Pay attention to the salary stick!This cost may change

Author:Changjiang Daily Time:2022.06.27

With the release of the upper and lower limits of the social security payment base in 2022, your social security payment may usher in new changes.

The upper and lower limit of the social insurance payment base increases in many places

The upper and lower limits of the annual social security payment base are determined according to the average salary data of the previous year. Recently, the average salary data of 2021 was released in 2021, and then the upper and lower limits of the social insurance payment base in 2022 also released the 2022 social security payment base. Due to the increase in the average salary in 2021, the upper and lower limits of the social security payment base have also increased.

Among them, the Sichuan Provincial Bureau of Statistics announced that the average salary of employment personnel in all units in the province in 2021 was 81,420 yuan. Subsequently, the Sichuan Human Resources and Social Security Department and other departments issued a notice that in 2022, the upper limit of the province's basic pension insurance payment base was 300%of the full -caliber salary, that is, 20355 yuan/month; the lower limit was 60%of the full -caliber salary, that is, 4071 yuan/ moon.

The average salary of employment personnel in full -caliber urban units in the province in 2021 was 91253 yuan/year (7604 yuan/month). Subsequently, Qinghai determined that the upper limit of the 2022 social insurance payment base was 22,812 yuan/month, and the lower limit of the payment base was 4562 yuan/month. Essence The upper limit rose 1743 yuan from the 2021 yuan/month in 2021, and the lower limit increased by 348 yuan from 4214 yuan/month in 2021.

Shanxi's average salary of employment personnel at all -caliber urban units in 2021 was 70,968 yuan, and the average monthly salary was 5914 yuan. Based on this, it was determined that the lower limit of the monthly payment base of the social insurance premiums in the province's participation in enterprises and institutions and institutions in 2022 was 3548 yuan, and the upper limit was 17,742 yuan. This rose 313 yuan and 1566 yuan from the lower limit of 2021 and the upper limit of 16176 yuan, respectively.

Who will have more social security payment?

In 2022, the upper and lower limit of the social insurance payment base increases. Who will have more social security payment? Is the social security payment of all insured persons become more?

In accordance with the "Interim Measures for the Management of Personal Accounts of Pension Insurance in Employees", the average monthly salary of the employees in the same year is the personal payment salary base. If the average monthly salary is lower than the average salary of 60%of the local employees, pay at 60%of the average monthly salary of the local employee; if the average salary of the local employee is 300%, the monthly average salary of the local employee will be paid. The basis of payment salary is not included in the base of pensions.

Therefore, for employees who work in the unit, the social security payment base is my average monthly salary of the previous year. If the average monthly salary of the previous year did not increase, and my monthly average salary level was between the upper and lower limits of the social security payment base, then then Social security payment will not become more.

However, for those with a salary level lower than the lower limit of the social security payment base, their social security payment base is not their average monthly salary of the previous year, but to pay according to the lower limit of the social security payment base. Therefore, with the lower limit of the local social insurance payment base, Rising, these people's social security payment will also become more.

The same is true for flexible employees who pay the payment according to the lower limit of social security payment. Individual industrial and commercial households and flexible employees who participate in the basic endowment insurance of enterprise employees can choose the appropriate payment base between the upper and lower limit of the payment base. However, if the flexible employees pay at the lower limit of the social security payment base, as the lower limit increases, the minimum payment will become more.

for example:

Assuming that the lower limit of the social insurance payment base in 2021 is 3500 yuan, and the lower limit of the social insurance payment base rose to 4,000 yuan in 2022, then if the employee who pays at the lower limit of the social security payment base, the proportion of personal payment for the endowment insurance is 8%, then the monthly payment is payment. It has increased by 40 yuan; if the flexible employees who pay at the lower limit of the social insurance payment base, the percentage of pension insurance payment is 20%, then the monthly payment will be increased by 100 yuan.

Therefore, not all insured persons will increase with the upper and lower limit of the payment base.

Flexible employees can apply for slow payment of social security

According to the notice of the implementation of the staged implementation of corporate social insurance premiums in the staged implementation of corporate social insurance premiums issued by the General Office of the Ministry of Human Resources and Social Security and the General Office of the State Taxation Administration, individual industrial and commercial households and various flexible employees who participate in the basic pension insurance of the enterprise employee are personal. If it is difficult to pay the payment in 2022, the payment can be relieved voluntarily. In 2022, the monthly payable payment can be paid before the end of 2023. The payment base is selected within the upper and lower limit of the local personal payment base in 2023, and the accumulated calculation of the payment period.

Among them, Beijing made it clear that the above -mentioned insured who paid basic pension insurance premiums in 2022 can log in to the "Personal Slow Payment of Pension Insurance Treasury" module of the "2022 phased payment of social insurance premiums" on the website of the Beijing Human Resources and Social Security Bureau. Choose "I want to temporarily pay the old -age care", and the period of voluntary payment of the paid fee is the monthly basic pension insurance premiums that apply for the month and later. You only need to choose once without the need to choose each month.

Therefore, if flexible employees are difficult to pay in 2022, they can be paid slowly, and they will be paid by 2023. This gives a buffer time for flexible employment.

(Source: CCTV News Client)

【Edit: Fu Sakura】

- END -

Huang Jianfa, deputy secretary of Zhejiang Provincial Party Committee, also served as Secretary of the Political and Legal Committee

China Economic Net Hangzhou July 3rd Comprehensive Report According to the Zhejiang Daily, on July 2, Huang Jianfa, deputy secretary of the Provincial Party Committee and Secretary of the Political

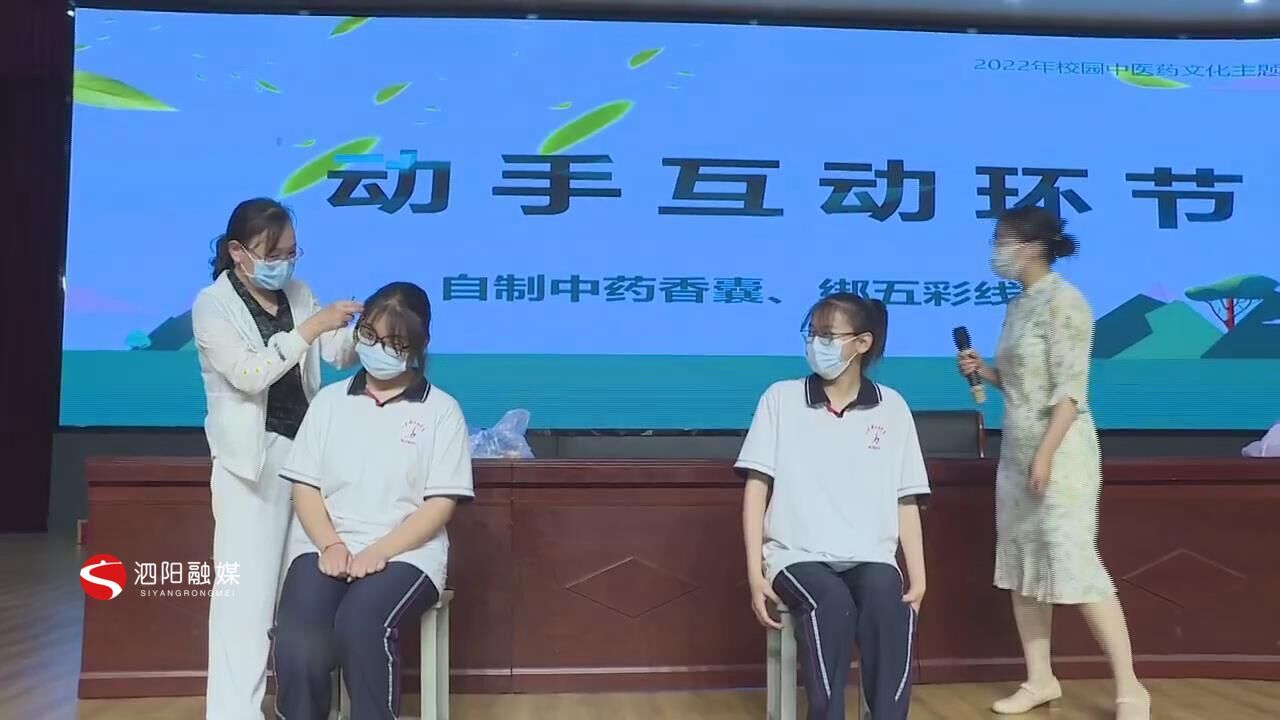

National Eye Love Day: Caring for students' eye health and Chinese medicine culture into campus

June 6th is the 27th national \Eye Eye Day\. The theme is \Following General E...