Jiuquan Subei: Multi -dimensional hair power towards the new journey of the "Four Essentials"

Author:Subei Published Time:2022.09.27

In recent years, the tax bureaus of the Subei County has strictly implemented the "four essence" requirements, further optimized tax law enforcement methods, standardized tax law enforcement behaviors, improved the level of tax rule of law, upgraded the concept of enforcement and renewal, and accurately implemented tax supervision, continued to deepen the expansion of tax co -governance governance Focus on the pattern, in -depth promotion of "precise law enforcement" and "fine services" in depth, promote the effective docking of "precision supervision" and "sincere co -governance", and continuously optimize the tax business environment. The tax law compliance and social satisfaction have improved significantly.

Innovate law enforcement methods and further promote accurate law enforcement. Focusing on the requirements of "accurate law enforcement", strictly implement the "Tax Administrative Penalty" First Violations "list and" Gansu Provincial Tax Administrative Penalty Corruption Standards "to solve the problems and standards of law enforcement in the process of law enforcement. Standardize the law enforcement behavior of tax personnel, and can better safeguard the legitimate rights and interests of the taxpayer's payment, so that law enforcement has both strength and temperature. At the same time, take the initiative to innovate law enforcement methods, advance the post -after -to -the -after reminder to protect the enthusiasm of the enterprise, resolutely prevent extensive, selective, "one -size -fits -all" law enforcement, and promote the transformation from empirical law enforcement to scientific law enforcement. Jurisprudence blends.

Practice service concept and strive to build fine services. Continue to expand the "non -contact" service category, strictly implement the operation process and tax service specifications of tax collection and management, realize the unified, standardized, and standardized tax and fees business, maximize the taxpayer's payment, maximize taxpayers, and increase taxes to increase taxes. At the same time as the efficiency of the fee collection management, the pain relief point, the dredging point, and the breakage point have improved the taxpayer's payment of the tax payment experience. Vigorously implement high -quality and efficient intelligent tax and feed services, achieve preferential tax and fees, and enjoy the preferential policies, effectively reduce the tax payment burden, comprehensively improve the tax payment method, and realize the transformation from non -differential services to refined, intelligent, and personalized services.

Promote the "culinary tax" in depth and comprehensively improve accurate supervision. In -depth revitalizing tax big data, actively exploring "taxation taxes", continuously improving the "credit+risk" regulatory mechanism, and relying on the tax big data platform to resolve the tax -related risk of the enterprise in time. Improve the law enforcement system, use the rule of law thinking, innovate administrative law enforcement methods, strictly standardize tax law enforcement behaviors, on the one hand, adhere to the tax fees in accordance with laws and regulations, and to be collected; The main body's funds "live", and the people's happiness "rises". Adhere to the risk management orientation, carry out tax inspections in a targeted manner, so as to be risky, no disturbance, violation of the law, and the whole process of strong intelligence control. The selection of retained tax refund enterprises will conduct key inspections to effectively promote the construction of credit systems in the taxation field, stimulate market entities vitality.

The joint governance pattern and focus on deepening the sincerity of co -governance. Focus on multi -department collaboration, establish a joint system, eliminate information barriers between housing construction, housing management and other departments, and actively promote the resolution of "registration difficulties". At the same time, the linkage between departments such as environmental protection, medical insurance, banking, public security and other departments continues to collect the taxes and fees to prevent tax evasion. Maximize efficiency, give full play to the basic, pillar, and affordable effects of taxation in national governance, help further build a superior business environment in the county, and provide strong support for promoting high -quality development. (Guo Hailiang, Taxation Bureau of Subei County)

- END -

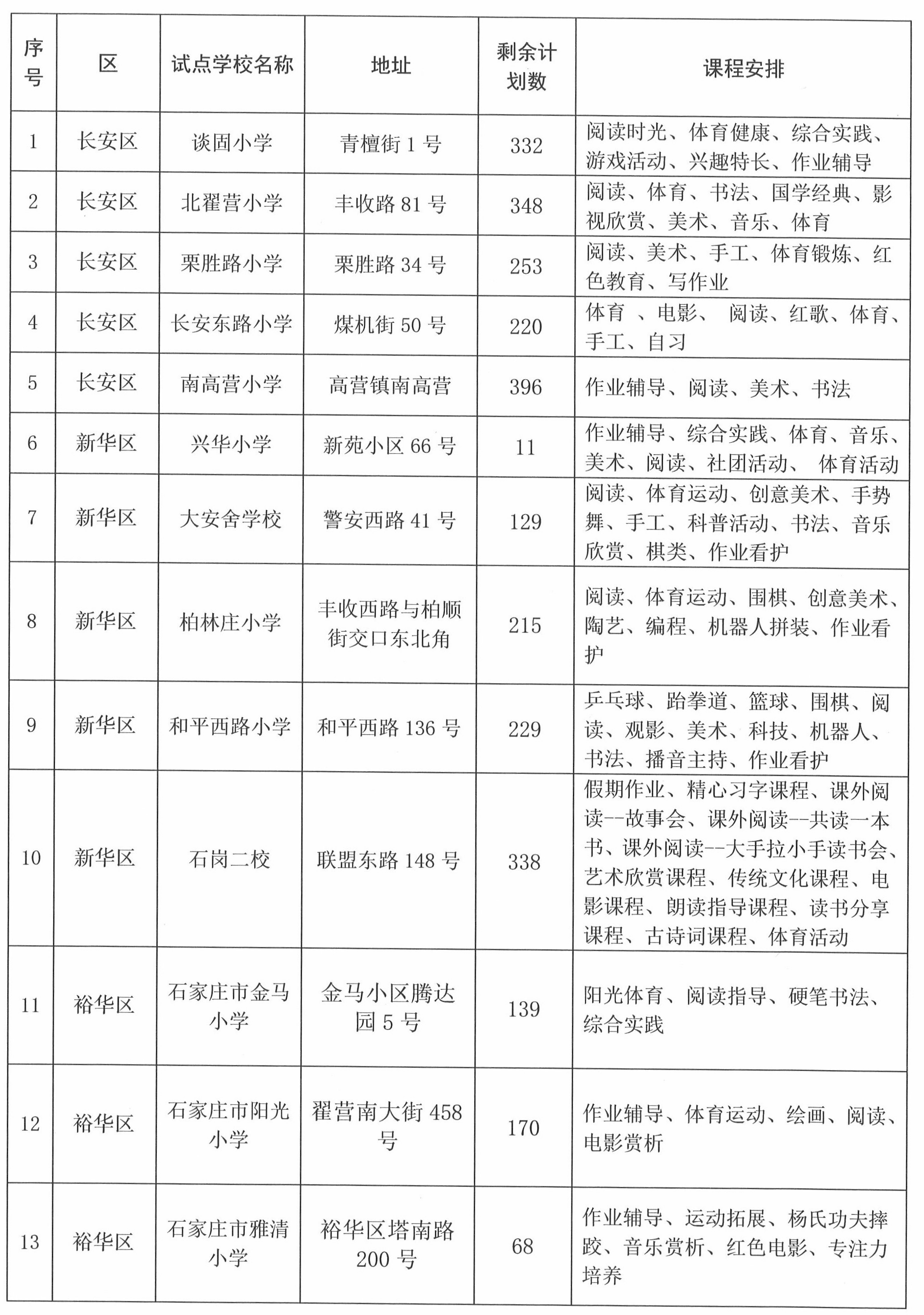

good news!Primary school students summer vacation free hosting service pilot school can register again

Great Wall Network · Jiyun Client News (Reporter Zhang Chao) In order to effectiv...

Let the sun full of wanderers go home -Anqiu Jingzhi "Sunshine Civil Affairs"

Recently, the staff of the Civil Affairs Office of Jingzhi Town received a call fr...