collect!One article understands the manufacturing small, medium and micro enterprises to delay payment of taxes and fees

Author:Chinese government network Time:2022.09.27

Source: China Tax News WeChat

In order to help enterprises' difficulties in rescue, the General Administration of Taxation and the Ministry of Finance recently issued the "Announcement on Continuing the Payment of Part of the Tax and Fees" (2022 No. 17, hereinafter referred to as the "Announcement"), which clearly issued it. From September 1st, in accordance with the "Announcement of the Ministry of Finance of the State Administration of Taxation on continuing the implementation of the implementation of small, medium and micro enterprises to delay the payment of some taxes and fees related to the manufacturing industry" (2022 No. 2), it has enjoyed the manufacturing industry that delays 50%of the tax and fees Small and micro enterprises that delay 100%of the tax payment and fees, which have delayed taxes and fees, have continued to extend 4 months after the expiration of the slow payment period of tax payment. How to enjoy the slow payment policy? Does the impact of the impact of the impact of the tax slowing policy shall be settled in the personal income tax of the business income? Come and learn together.

1. How does manufacturing small and medium -sized enterprises enjoy continuing to delay the payment policy?

For small and medium -sized enterprises in the manufacturing industry, if they have enjoyed the delay in the delay in paying taxes and fees in accordance with the announcement of the 2022 announcement, after delaying the expiration of the payment period, no taxpayer operation is required, and the slow payment period is automatically extended for 4 months.

Example 1: The taxpayer A belongs to the manufacturing small and medium -sized enterprises stipulated in the announcement of the 2022 announcement, and the relevant taxes and fees are declared on a monthly basis. The period is 9 months, and the original policy will be paid before the application period in September 2022. After the "Announcement" was released, the relevant tax payment period in November 2021 was automatically extended for 4 months, and the declaration and payment of the relevant taxes and fees in December 2022 can be paid during the reporting period of January 2023.

If the taxpayer A declares and pays related taxes on a quarterly, the relevant taxes and fees in the fourth quarter of 2021 have been paid in accordance with the regulations, and the period of slow payment is 9 months. According to the original policy, it will be paid before the end of the application period in October 2022. After the "Announcement" was released, the relevant tax payment period in the fourth quarter of 2021 was automatically extended for 4 months, which could be paid during the reporting period in February 2023.

Example 2: Taxpayer B is an individual industrial and commercial households that meet the tax slowing conditions. It implements a simple declaration and pays for quarterly. For the relevant taxes and fees that have been slowly paid in the fourth quarter of 2021, the taxpayer does not need to operate to confirm the relevant tax of the relevant tax. In the expense, the tax authorities will not deduct their personal income tax, VAT tax, consumption tax and cities that have been slowed in the fourth quarter of 2021 in the fourth quarter of 2021 in the fourth quarter of 2021. Related taxes and fees continue to be extended for 4 months, and the tax authorities are deducted into the warehouse in February 2023.

2. Does enjoying the tax slowing policy affect the personal income tax of the business income?

If the taxpayer who enjoys the tax slowing policy shall handle the personal income tax settlement of the personal income tax, and continue to implement the processing rules stipulated in the preliminary tax slowdown policy, that is, the taxable tax paid by the taxpayer shall be deemed to be "pre -paid tax", which will participate in the operation normally. Calculation of personal income tax settlement calculations. At the same time, the taxpayer shall pay the corresponding slow taxes and fees in accordance with the law after the expiration of the "announcement" stipulated in the "Announcement".

Example: Taxpayer E is an individual industrial and commercial households with an annual sales of 1 million yuan. It implements the personal income tax of the account inspection and declare the personal income tax according to the quarterly taxation policy. The personal income tax that should be paid in the second quarter was delayed until the application period of the January 2023. After the "Announcement" was released, the above -mentioned tax payment period continued to be extended within 4 months to May 2023's application period. When the taxpayer applied for the personal income tax settlement of the personal income tax in 2022 before March 31, 2023, the taxable tax paid was deemed to be "pre -paid taxes", and the personal income tax refund of the personal income tax was settled normally. The calculation of taxation shall be applied for taxation before March 31, 2023. If the tax refund is required, the tax refund may be applied normally and will not be affected by the tax policy of the second quarter of 2022. At the same time, the taxpayer's previously paid taxes shall be paid during the application period in May 2023.

3. The delayed taxes paid in November 2021 and February 2022 were paid to the warehouse before the announcement of the "Announcement" after September 1, 2022.

For small and medium -sized enterprises in the manufacturing industry in November 2021 and February 2022, the tax and fees paid paid in February 2022 will be paid before the announcement after the announcement will be applied for a tax refund (fee) and enjoy the continuation of the continuation of the continuation of the continuation of the tax refund (fee) voluntarily. policy.

Example: Taxpayer C delays taxes and fees that have paid the affiliated period in February 2022 in accordance with the provisions of the 2022 Announcement of 2022, and have been paid in the warehouse on September 5, 2022. For this part of taxes, you can voluntarily choose to apply for tax refund (fee) and enjoy the continuation and slow payment policy.

4. Taxpayers who have slowed corporate income tax in the fourth quarter of 20121 can continue to be extended for 4 months according to the "Announcement".

According to the announcement of the 2022 Announcement, a small and medium -sized enterprise for manufacturing in the fourth quarter of 2021, the manufacturing industry, which has been slowed in corporate income tax policies, its 2021 corporate income tax settlement payable tax should be repaid with the fourth quarter of 2021. The tax paid paid was delayed and the paid was delayed. The tax could continue to be delayed for 4 months in accordance with the provisions of this "Announcement".

Example: taxpayer D, the quarterly pre -paid corporate income tax, the corporate income tax of 100,000 yuan in the fourth quarter of 2021, according to the announcement of the 2022 announcement, the tax can be delayed until October 2022 and the library was paid.After the "Announcement" was released, its slow payment period continued to be extended for 4 months, and it could be paid in the warehouse in February 2023.In addition, if the taxpayer's 2021 corporate income tax settlement is settled, the tax payable will be paid 200,000 yuan, and it can be paid in the warehouse in October 2022 according to the previous retractable policy.After the "Announcement" is released, it can continue to delay the entry into the library with the fourth quarter of 2021 in the fourth quarter of 2021 to February 2023.

- END -

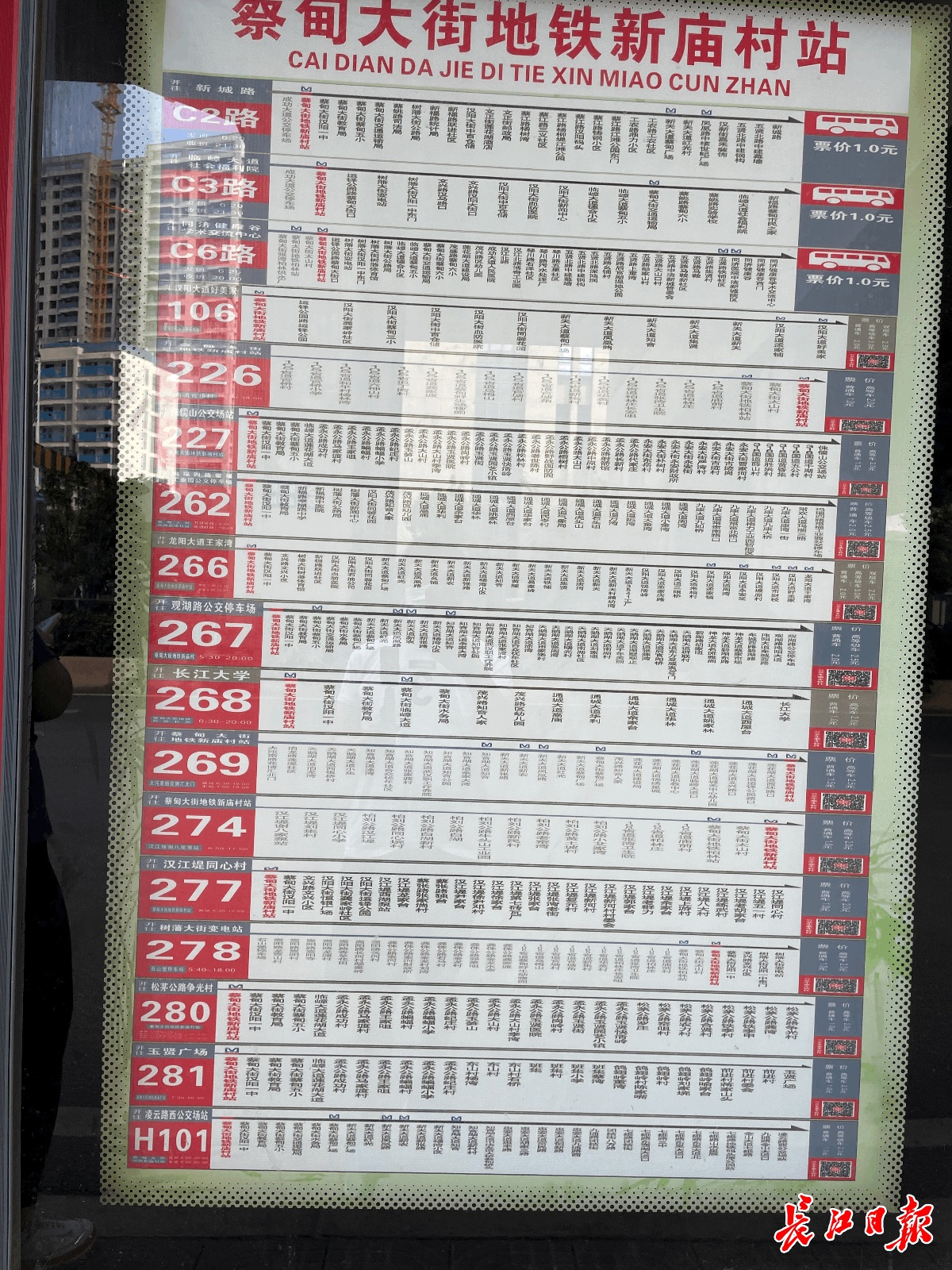

This has become the "Transfer King" station in Caidian District, and 17 bus lines are gathered here.

The Yangtze River Daily Da Wuhan Client September 11th (Reporter Yin Qinbing) 13 b...

Zhengzhou Traffic Police issued important reminders

Henan Legal System Henan Legal System Daily was founded in 1984 and was sponsored ...