The price of battery -grade lithium carbonate exceeded 510,000 yuan/ton a record high, and the upstream lithium ore earned up

Author:First financial Time:2022.09.24

24.09.2022

Number of this text: 2188, the reading time is about 5 minutes older

Guide: A new round of price increases for battery -level lithium carbonate?

Author | First Finance Xiao Yisi

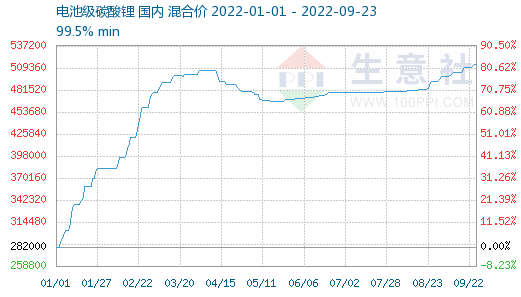

On September 23, the First Financial Reporter learned from the Shanghai Ganglian Department that the average price of lithium battery -grade lithium carbonate rose by RMB 1.15 million/ton to 511,500 yuan/ton, which continued to reach a record high. Yesterday, the price of lithium carbonate of battery -level rose by 0.25 million yuan/ton, and the average price reached 510,000 yuan/ton for the first time. At the same time, the quotes of industrial -grade lithium carbonate and lithium hydroxide have also risen.

After mid -to -late June this year, the price of battery -grade lithium carbonate has maintained the stability of more than two months, about 470,000 yuan/ton to 480,000 yuan/ton. However, in the past month, the price of lithium carbonate of battery -class rose rapidly, the price increased by 30,000 yuan/ton to 40,000 yuan/ton, and the monthly increase was up to 8.5%.

Regarding the reason for the price increase of lithium carbonate, lithium carbonate analysts in business clubs said that in terms of supply, the Qinghai area was affected by the epidemic and transport control and control of transportation control, which made lithium carbonate shipments slower. The supply is impacted, but demand is still increasing. The fourth quarter is coming. The downstream enterprises are rushing at the end of the year, increasing the preparation of lithium salt raw materials, and the procurement performance is positive.

The first financial reporter learned from the relevant people who are familiar with the matter that the current rising trend of the price of lithium carbonate at battery -level is still continuing, and some traders quoted up to 530,000 yuan/ton. However, after exceeding 500,000 yuan/ton, the price of lithium carbonate at battery -level was high, and the quotation of some enterprises began to maintain stability.

A new round of lithium salt rises in price increases

Since last year, the price of lithium salts headed by battery -grade lithium carbonate has risen rapidly, making many downstream companies miserable. Since this year, this situation has not only eased, but has intensified.

The reporter learned from the business club that the price of battery -level lithium carbonate at the beginning of this year was 282,000 yuan/ton. By mid -late February this year, the value had exceeded 400,000 yuan/ton. As many people in the industry think that the inflection point is approaching, the price of battery -level lithium carbonate has exceeded 500,000 yuan/ton in April this year.

However, with the repeated influence of many places across the country, 500,000 yuan/ton on the battery -level lithium carbonate price stations did not last long, and it was lowered at the end of May. It returned to more than 46 yuan/ton at the end of May. As the epidemic is alleviated, the price of lithium carbonate of battery class returns to the rising channel.

This round of lithium carbonate increased sharply from mid -to -late August, first affected by the supply. Since then, it is more dominated by demand. Qu Yinfei, Shandong Longzhong Lithium Analyst, told the First Financial reporter. In mid -to -late August this year, due to the prevention and control of electricity restrictions and Qinghai epidemic, the production of lithium carbonate decreased, but at the same time, demand is still increasing, mainly concentrated in new energy vehicles and energy storage.

According to the China Automobile Association data, in August this year, the production and sales of new energy vehicles in my country completed 691,000 and 666,000, respectively, an increase of 1.2 times and doubled year -on -year. According to data from the China Automotive Power Battery Industry Innovation Alliance, in August, my country ’s power battery output was 50.1GWh, an increase of 157%year -on -year.

With the advent of the traditional peak season "Gold, Nine Silver Ten", downstream car companies have the willingness to rush work in the peak season. Qu Yinfei said that from September to the end of the year, the price increase logic of lithium carbonate will be dominated by demand. It does not rule out the possibility of lithium carbonate prices in the peak season preparation during the fourth quarter and the first quarter of next year.

The rise in the price of lithium carbonate in this round also has lithium concentrate prices as support. The Australian Perbala Mining Company, which is supported by the industry's wind direction, held the sixth time of the savory concentrate auction during the year on September 20. The final transaction price was $ 6988/ton. The transaction price rose by $ 638/ton, an increase of 10%. Lithium carbonate corresponding to lithium concentrates in this auction is about 510,000 yuan/ton.

However, the price of battery -level lithium carbonate encountered obvious rising pressure after exceeding 500,000 yuan/ton. Lithium carbonate analysts of business club pointed out to reporters that the price of battery -grade lithium carbonate has slowed down this week, and some companies quoted the quotation to maintain stability. It is expected that the price of short -term lithium lithium carbonate is mainly compiled.

Earlier, the industry generally reported that 500,000 yuan/ton of battery -grade lithium carbonate has reached the highest price that downstream power battery manufacturers can accept. Some batteries and material manufacturers represented by leading enterprises have discussed that carbonate that exceeds this price exceeds this price Lithium does not buy.

This statement was confirmed by insiders from a second -tier power battery company. The person once told reporters that the company will "stock up" when the price is slightly lower. If the price exceeds 500,000 yuan/ton, it will definitely not consider buying it.

Price increase and accelerate industrial profits upward movement

With the price increase of lithium carbonate in raw materials, the profits of enterprises in the middle and lower reaches of the new energy industry are constantly being eaten. As a result, the downstream car company's "Tucao" midstream battery manufacturer "Black Heart", and the battery manufacturer turned to "complain" the upstream material is too expensive.

Not long ago, at the World New Energy Automobile Conference, Chen Hong, chairman of SAIC Group, pointed out that in the past year, lithium carbonate has skyrocketed nearly 10 times. Mine main work.

For companies with lithium resources, the higher the price of lithium salt, the higher their gross profit margin.

In the first half of this year, the operating income of "Lithium King" Tianqi Lithium was 14.29 billion yuan, and the net profit attributable to the mother reached 10.3 billion yuan, a year -on -year increase of more than 119 times, the net profit margin was 72.24%, and the gross profit margin was as high as 84.26%. First Financial reporter learned that the cost of battery -level lithium carbonate in Tianqi Lithium is 65,000 yuan/ton ~ 70,000 yuan/ton, while the average price of lithium carbonate in the first half of the year is 453,000 yuan/ton, which means Tianqi The lithium industry sells a ton of battery -grade lithium carbonate gross profit of up to 380,000 yuan. If in the second half of this year, the average price of lithium carbonate in battery -level can be maintained at 500,000 yuan/ton. The gross profit of Tianqi lithium industry to sell a ton of battery -grade lithium carbonate can be further increased to 430,000 yuan, and the gross profit margin will be increased to 86%. Regarding the midstream power battery companies and downstream car companies, unless they continue to transfer the pressure on downstream to the downstream transfer cost, they can only be further eaten.

In the first quarter of this year, because the price increased in time, the gross profit margin of Ningde Times suddenly fell to 14.48%, a record low of record. In the first half of this year, with the basic landing of power batteries, the gross profit margin of Ningde Times returned to 18.68%, but it still decreased by 8.58 percentage points year -on -year.

For the entire vehicle, the ability to make money has been further weakened relative to midstream battery companies. According to Data from Oriental Wealth Network, in the first half of this year, the average gross profit margin of the vehicle industry was 10.27%, while the average gross profit margin of the battery industry was 19.54%, which was 9.27 percentage points higher than the former.

The continuous increase in lithium carbonate has undoubtedly intensified the "contradiction" of upstream and downstream of new energy. Qu Yinfei also told reporters: "We expect the price of lithium salt to have an inflection point between the fourth quarter of next year to 2024. The specific time depends on the release of the supply side. If it is released well, the inflection point will be advanced in advance, and the opposite will be postponed. "

- END -

A regiment of the Xinjiang Military Region organized artillery teams to fight quickly

Video/Snapshot, T_100, F_JPG, M_fast Controls = Controls data-version/ueditor/video/mp4/20220709/1657381103497293.mp4 transcoding = 1 style = width: 400px; Recently, a new type of arti

Wang Lixia inspected the cultural tourism industry in Shaanxi

From August 14th to 15th, Wang Lixia, deputy secretary of the party committee of t...