Rongqi Technology, nearly 80 % of revenue is related to Apple, cross -border new energy is obstructive | IPO observation

Author:City world Time:2022.06.22

On June 17, Rongqi Technology started the meeting and successfully passed. According to Rongqi Technology disclosed the prospectus, the company is a supplier of quality testing and production assembly equipment. Intelligent testing equipment is the company's largest product, accounting for 80.19%of operating income in 2021. This product is mainly used for wireless charging module detection.

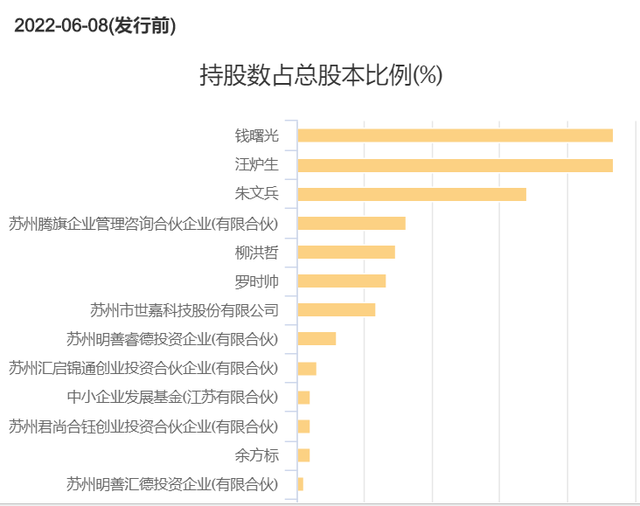

Rongqi Technology was established in 2011 and was restructured to a company Co., Ltd. in 2018. The company's actual control was Qian Shuguang, Wang Fosheng, and Zhu Wenbing, and the three were acting in unison. Before the issuance of stocks, the three held 23.4%, 23.4%, and 17.95%of the company, respectively, occupying the company's absolute control equity. Qian Shuguang is the company's chairman and general manager, Wang Fosheng is the company's director and deputy general manager, and Zhu Wenbing is the company's director and deputy general manager.

1. Focus on the field of wireless charging

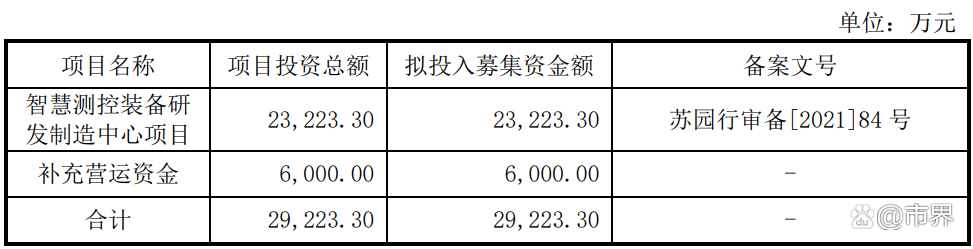

The Rongqi Science and Technology Prospectus shows that the plan to issue no more than 13.34 million shares and plan to raise 292 million yuan. Among them, 232 million yuan was used for the development and manufacturing of intelligent testing equipment, and 60 million yuan was used to supplement daily operating funds.

From the perspective of corporate revenue, 80.19%of Rongqi Technology's revenue in 2021 comes from intelligent testing equipment. This product is mainly used in the field of wireless charging, and unlimited charging is generally used in electronic products such as mobile phones and watches. According to data disclosed by Rongqi Technology's prospectus, from 2019-2021, the product's revenue in the field of wireless charging accounts for 41.13%, 68.54%, and 48.22%of the company's total revenue.

In response to the IPO of Rongqi Technology, the CSRC also made inquiries. One of them requires Rongqi Technology to explain related EMS manufacturers to whether there is a continuous procurement demand for wireless charging detection modules and whether related businesses are sustainable.

As for the inquiry of the CSRC, as of June 22, Rongqi Technology did not respond. However, in the Rongqi Technology Prospectus, it can be seen that the first large -scale application time of wireless charging was 2017. At that time, the iPhone8 series launched by Apple was equipped with wireless charging function for the first time.

From the perspective of the industry, wireless charging sets have the characteristics of portable and high efficiency, and there are no shortcomings such as wired charging line wear, aging, and unsafe. Therefore, mobile phone manufacturers such as Xiaomi and OPPO are also using wireless charging. According to IDC data, the scale of mobile phone wireless charging markets from 2015-2021 rose from 1.05 billion to 6.87 billion yuan, and there will be further increase in the future. Wireless charging is also regarded as the main trend of future charging by science and technology people.

Thanks to the large-scale application of wireless charging, Rongqi technology revenue has risen sharply in the past few years. From 2019-2021, the company's revenue was 102 million yuan, 243 million yuan, and 291 million yuan, respectively. Due to the advantages of intelligent detection product technology, Rongqi Technology has 4 links to detect equipment Rongqi Technology in the five links of Apple Infinite Charging Module detection.

2. Cross -border new energy lowers the gross profit margin

Although the company has technical advantages in the field of wireless charging. However, there are still risks in the operation of Rongqi technology.

First of all, in terms of customer concentration, Rongqi Technology customers are too high. From 2019 to 2021, the company's top 5 customers' revenue accounted for 72.93%, 82.73%, and 59.85%, respectively.

Most of the customers of Rongqi Technology are Apple's supplier, so Rongqi Technology is also a proper "fruit chain" enterprise. Data show that from 2019 to 2021, Apple's direct and indirect revenue of Rongqi Technology accounted for 52.11%, 91.85%, and 79.44%, respectively.

Although the proportion of revenue from Apple in 2021 has declined, the risk of Apple dependence still exists. After all, in the context of today, there is a great risk of relying on Apple's large scale. For example, Ophi Guang, because technology could not keep up with Apple's development, was kicked out of the Apple industry chain in 2020. The profit of the year lost a significant loss of 1.945 billion yuan. In 2021, the loss was 2.625 billion yuan. 28%.

Affected by Apple's cutting order in 2021, the net profit of existing fruit chain companies also declined sharply. The net profit of Lan Si Technology fell 57.72%in 2021, while Changying Precision lost 604 million yuan, a year -on -year decrease of 62.05%.

Although Apple is a great company, it is obviously not wise to put eggs in the same basket for companies in the supply chain.

Excessive business concentration has also actively transformed Rongqi Technology. In terms of business transformation, Rongqi Technology has aimed at the field of new energy power batteries. But in the early days of the transformation, the effect was not ideal.

According to Rongqi Technology, there are certain differences from old businesses in the technical requirements and detection environment in the new business field. The company is facing insufficient research and development experience and difficulty in market development. Rongqi Technology launched the new energy battery fully automatic visual detection equipment for sales. In 2021, the revenue in the new energy vehicle field was only 1.43 million yuan, accounting for 4.92%of the company's total revenue.

The sluggish business has further lowered the company's gross profit margin. From 2019-2021, the company's gross profit margin was 53.50%, 46.80%, and 45.75%, respectively.

From the perspective of financial indicators, due to the decline in the prosperity of the industry and the increasingly fierce competition in the same industry, the financial indicators of Rongqi Technology have declined to varying degrees.However, from the perspective of market prospects, Rongqi Technology is also in the two major "Yangyang industries" of wireless charging and new energy vehicles.A great man once said that there are two sides of everything, and good or bad depends on his eyes.The same is true for investors who purchase Rongqi Technology in the future.(Author | Editor Duan Nannan | Lang Ming)

- END -

[When the village is in progress] Create three beautiful towns and villages, and Huadu acts!Come and see how beautiful Huadu Township is ~

Huadu District will represent Guangzhou 代Participate in the 3rd Rural Revitalizat...

Implement the "double carbon" action to build a beautiful home, Jinan City holds national low -carbon daily publicity activities

New Yellow River Reporter: Luo XiaofeiOn June 15, the national low -carbon day pro...