The female anchor and the poster "Judging two people", netizens were shocked

Author:Global Times Time:2022.09.23

On the evening of the 21st, the two "Green Fund Live Comparison Maps" spread widely in the circle of friends. The pictures showed that the two female anchors in the live promotional picture were huge differences from the two female anchors at the live broadcast scene. Some investors shouted "deceived", and some netizens ridiculed: one was the fund before buying, and the other was a fund after buying. On the 22nd, Green Fund responded to the upstream journalist that the anchor's appearance and poster were caused by pregnancy.

Live publicity poster and live broadcast scene picture comparison

In response to the "live broadcast poster and real gap between real people", on the 22nd, a customer service staff from Green Fund acknowledged that the above live broadcast was broadcast on July 22, 2022, and explained that "Live broadcast is us and investment For the main ways of communicating, the company attaches great importance to the content and quality of the live broadcast. All employees who have rich work experience are sent as an anchors. At that time, a employee was at pregnancy, resulting in a certain gap between the external and the image on the poster. "

The customer service staff further stated: "The image of the live broadcast and the poster will be different. With some beautification treatment, this situation occurs."

As for the netizens' questioning, "Even the female anchor deceives people and never buy this company fund again", the customer service staff said: "This does have special circumstances in it, I hope to give our colleagues more understanding and tolerance. We I also conducted emotional guidance and soothing of the anchor of the live broadcast on the day. Out of the care of employees during pregnancy, we adjusted her work and hoped to give us more understanding. "

The upstream journalist saw from the official video of the Green Fund that an anchor Axia in the disputed live broadcast also frequently appeared in the official short video of Green Fund. In multiple Green Fund self -made short videos, "Popular anchor Axia" appeared on the cover map, and its pictures were exactly the same as the "Green anchor Axia" in the live publicity page.

However, in the Green Fund video number, no other related videos of an anchor Zhao Chenguang were found.

The reporter noticed that in June 2022, the State Administration of Radio and Television and the Ministry of Culture and Tourism jointly formulated the "Network anchor Behavior" Specifications "(hereinafter referred to as" new regulations "). The new rules are for live broadcast content (such as medical and health, financial and finance, law, and education) for high professional levels, and anchors shall obtain corresponding practice qualifications.

Does the female anchor of Green Fund have related qualifications? The above -mentioned customer service staff said that it has already begun to execute: "The fund industry's requirements for employees are to have a fund qualification certificate. These two employees (anchors) do not engage in investment research positions. Fund qualifications, which also meet the requirements of corresponding laws and regulations. "

Green Fund Ranking Public Fund 109

The upstream news learned from the Tianyan check app that Green Fund Management Co., Ltd. was established in 2016. It is a company that is mainly engaged in capital market services. The company's registered capital is 20 million yuan. The company is a wholly -owned subsidiary of Anrong Real Estate Development Co., Ltd., Henan Province. The company's actual control is Wang Shuanhong. He is also a legal representative of Green Express Brokers Co., Ltd. and Henan Green Insurance Brokerage Co., Ltd.

Figure: Tianyancha

According to the Shenzhen Commercial Daily in November 2021, in the ranking of the public fund that year, the Green Fund's mixed funds were "overwhelmed by the whole army". The yields of six hybrid funds were negative during the year. Fund; several debt -based returns are ranked out of 3,000; the scale of multiple products under the company has shrunk.

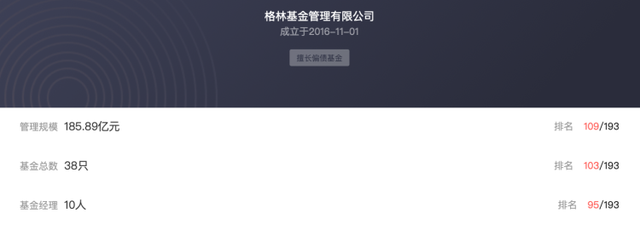

The upstream journalist saw from Flush Shun data that the latest asset management scale of Green Fund was 18.589 billion yuan, ranking 109th among all public offerings; there were 38 funds, including 18 bonds and hybrid funds, and 2 were 2, and 2 were 2. Only currency funds.

Figure: Same Flower Shun

From the perspective of performance, Green Fund's bond products have better performance. Of the 18 bond funds, only two of the nearly a year of income are negative; and only two of the 18 mixed funds are positive in the past year.

According to the performance rankings released by Haitong Securities on July 1, as of the end of June 2022, 132 of the 153 public fund managers, 132 investment in solidaries since this year has received positive returns. Among them, there were 14 yields exceeding 2%in the first half of the year. Green Fund fixed income yields have been 2.45%this year, ranking fourth.

Fund company live broadcast is cooling down

It is understood that the fund company's densely invested live broadcast began in 2020. According to the statistics of the Daole Research Institute, in June 2020, the Fund Company's live broadcast of more than 250 live broadcasts on each platform means that there are more than 10 fund companies live a day.

In May 2021, the China Securities Investment Fund Industry Association issued the "Minutes of the Symposium on Public Fund Live Business", which sorted out issues such as live broadcast forms, red envelopes, and compliance internal control, and put forward relevant suggestions. Fund company live broadcast began to cool down slowly.

According to the statistics of Daole Research Institute, in September 2021, a total of 117 institutions opened 1,445 live broadcasts in the Alipay Wealth Management Live Fund, with an average of 12 live broadcasts per month. The quantity is lower than the level of July and August.

A person from a fund company's marketing department analyzes that a fund company is an important demand for a live broadcast to increase the scale.In the early days of live broadcast, new customers will indeed increase the scale, but after a period of operation, new users on the same platform will become weak.In addition, the fund's overall money -making effect is weakened. Investors' enthusiasm for the fund is not as good as the previous years, and it is also an important reason for the decline in the live broadcast of the fund company.However, some small and medium -sized fund companies trying to increase marketing channels through the Internet are still catching up in the live broadcast field.For example, Debon Fund recruited three Internet celebrity anchors, including the well -known beauty anchor "Hua Cai Sister", which was hired by heavy money.

Source: Upstream News, China Fund News, Shanghai Securities News, Shenzhen Commercial Daily, etc.

- END -

Qinghe listened to the rain original "The West of the Branch"

Loop of BranchText/Qinghe Listening to RainWow out of homeNatureHuman disasterI'm ...

The start

The picture shows the players from the men's elite group of the 2022 Ring Lalasa C...