Hurry up and refund the money!The end of this month

Author:Guizhou Daily Time:2022.06.21

According to the announcement of the State Administration of Taxation

From March 1, 2022 to June 30

Individual residents who meet relevant regulations

Need to apply for personal income tax of 2021

Comprehensive income settlement and settlement matters

According to the announcement, after the end of 2021, the residents need to summarize the income from four income obtained from the salary salary, labor remuneration, manuscript remuneration, and franchise fees from January 1, 2021 to December 31, 2021, and the expenses are reduced by 60,000 After the special deduction, special additional deduction, other deductions and eligible public welfare charities determined in accordance with the law, the personal income tax rate for comprehensive income is applicable and subtract the speed deduction. The tax amount has been paid in the year, and the amount of tax should be refunded or replenished, and the taxation or tax refund or taxation is applied to the tax authority.

1

Who needs to handle annual exchange calculations?

For one of the following circumstances, the taxpayer needs to handle annual exchange calculations:

(1) The pre -paid tax amount is greater than the taxable tax amount and the tax refund shall be applied for;

(2) The comprehensive income income obtained during the tax year exceeds 120,000 yuan and the amount of tax replenishment is more than 400 yuan.

The amount of tax should be refunded or the amount of tax supplies = [(comprehensive income income-60,000 yuan- "three insurances and one gold" and other special deductions-special additional deductions such as child education-other deductions determined in accordance with the law Tax rate-speed calculation deduction number] -The prepaid tax.

2

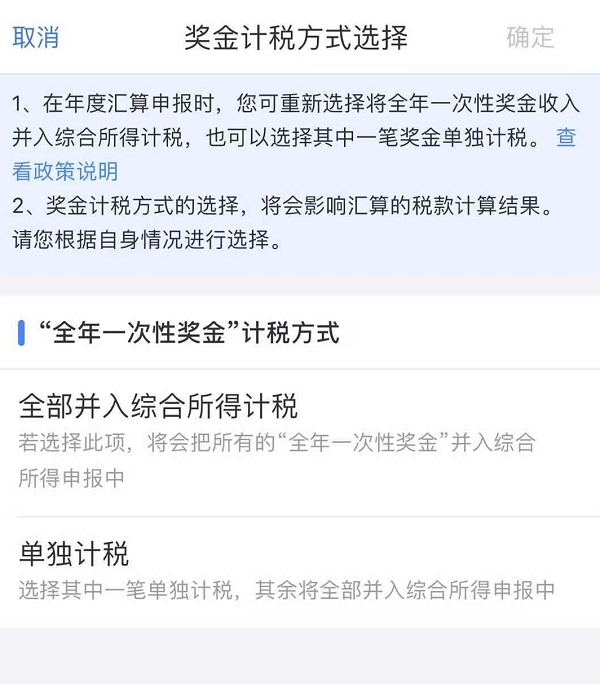

How to choose a bonus tax method?

The editor reminds everyone that the country has decided to not incorporate the annual one -time bonus to income in the monthly salary income and implement a monthly tax rate for taxation rates alone, which continues until the end of 2023. Therefore, when the tax exchange is performed this year, there will be a choice question for the year -end award: separate tax calculation or all income from comprehensive income tax.

Different tax calculation methods will affect the tax amount. Experts analyze that for those with relatively small salary and relatively many year -end prizes for the annual annual salary, they may choose to make the year -end award merged into the comprehensive income tax calculation method.

If you want to know which tax calculation method is more advantageous to yourself, a very simple way is to operate both tax calculation methods on individual tax apps, but don't confirm first, compare which tax calculation method is cost -effective. Just choose which one.

3

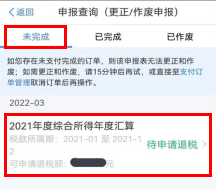

How to query whether the declaration has been completed?

After the declaration is completed, you can use the personal income tax app home Check the details of the report.

For example, the 2021 comprehensive income annual settlement report details show that the green "completed" label (as shown in the figure below) shows that you have completed the declaration.

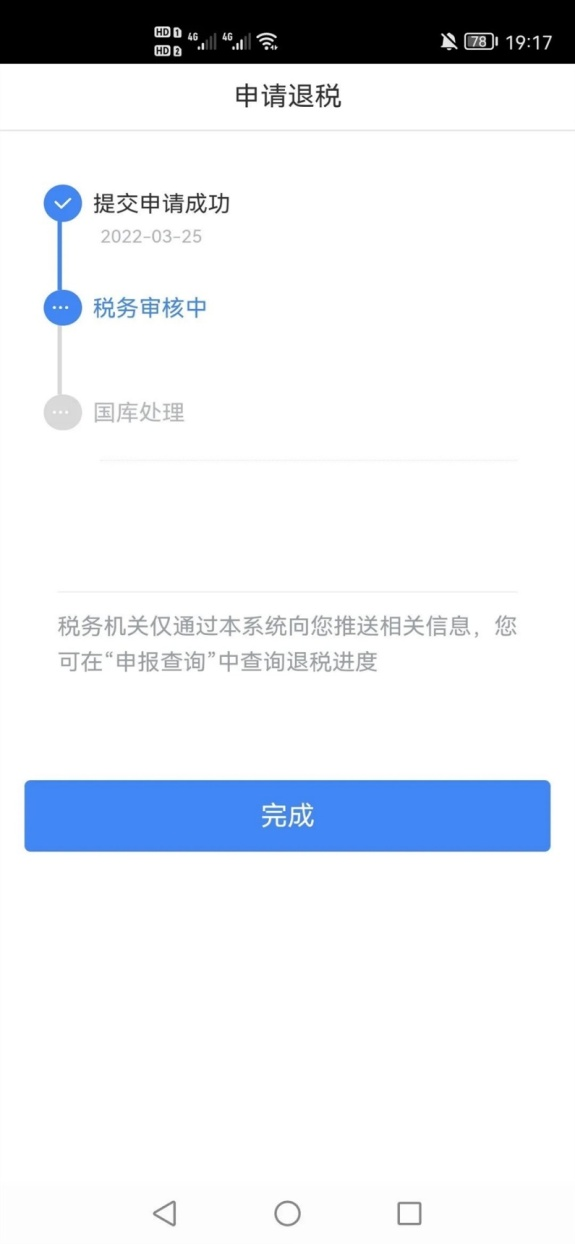

However, if the declaration record is shown in the "unfinished" label, and the word "tax refund to be applied for" (as shown below), it shows that you only submitted the annual tax refund declaration form, but did not apply for tax refund.

Application tax refund ≠ Apply for tax refund. This situation does not receive your tax refund application, so you will not receive tax refund. In response to this situation, you need to perform a "tax refund" operation.

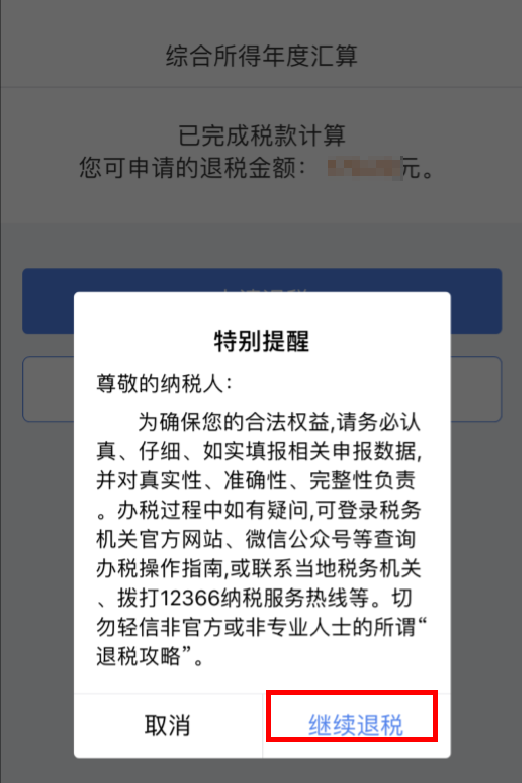

Click the report of "To Apply for Tax Return"

You can see the reported record details

Please click "Apply for tax refund" in the lower right corner

The system will pop up special reminders

After reading, click "Continue Tax Return"

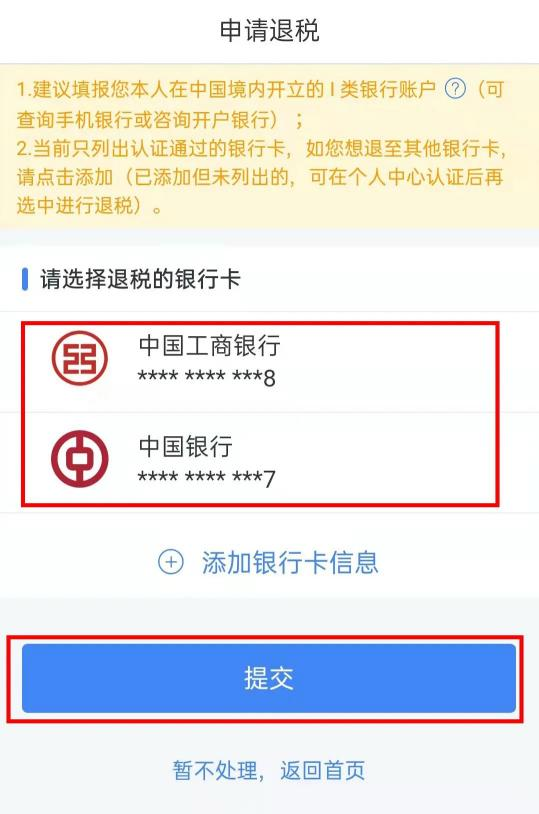

Choose a bank card that receives tax refund, click to submit

If you have already been in the APP "Personal Center" in the early stage

Add bank account information

The system will automatically bring out

If you need to add

Please click to add bank card information

It is recommended to fill in myself in China

Opened a class of bank accounts

And make sure you are in a normal state before receiving the tax refund

After the tax authorities and the State Treasury staff are reviewed and approved

You can receive the tax refund

4

False filling in income, deduction, etc. apply for tax refund

Multi -person investigations

14 taxpayers from a service management company in Loudi City, Hunan Province misunderstood the false filling video of the Internet. In the absence of medical expenditure expenses, the special medical treatment for major illnesses was submitted.

After the tax authority was found, the unit immediately visited the unit, interviewing the company's legal representatives and financial personnel, requiring the unit to strengthen policy propaganda and counseling, report to employees one by one, and correct them as soon as possible.

At present, all 14 taxpayers have been corrected. Considering that the above -mentioned taxpayers confessed their mistakes after the tax authority reminded the reminder and corrected errors in time, the tax department criticized it and educated it without punishment. (The principle of "first violation")

The relevant person in charge of the Taxation Bureau of Loudi City, Hunan Province reminds the vast number of taxpayers to handle the comprehensive income of personal income tax in accordance with laws and regulations, and to fill in information such as income, deduction and other information, and do not listen to various gossip information such as the network to avoid false reporting the impact on the impact of reporting reporting. Tax credit.

When the Xiamen Taxation Department in Fujian Province conducted a comprehensive tax refund review of the 2021 income of 2021, it was found that the taxpayer Liu had obtained only the internal training certificate of the unit and did not meet the special additional deductions of the continuing education of the continuing education of the vocational qualifications. Error filling in the special additional deduction of 3,600 yuan per year. The Xiamen Taxation Bureau further reviewed and found that the taxpayer still added his grandparents to the elderly to fill in the special additional additional deduction in the case of the special additional deduction conditions of the elderly.

After the tax authority reminded, Liu acknowledged the mistakes and had corrected the declaration in accordance with regulations. Considering that the taxpayer can correct the tax supplement after reminding the reminder, and recognize the mistakes, the tax department has criticized and educated it without punishment.

Remind everyone:

Those who apply for tax refund for false reporting income, deduction, etc., and tax reimbursement and paying taxes in accordance with the law will recover taxes and late fees in accordance with the law and include the list of tax supervision key personnel. If the review is strengthened, the circumstances will be punished according to law.

The tax department reminds:

The vast number of taxpayers shall handle personal income tax in accordance with laws and regulations, and carefully read the reminder information of the personal tax app, and the application items such as revenue and special additional deductions are truthfully reported. Do not trust all kinds of "tax refund secrets" on the Internet, let alone disseminate unofficial tax -related information on online social platforms, and be taxpayers who are honest and trustworthy according to law.

(Source: Xinhuanet, Workers Daily)

Edit: Hu Kaiyu

- END -

"Three strengthening" in the suburban power supply company in Changchun City tighten the party style and clean government

A few days ago, State Grid Changchun City Power Supply Company aims at the construction of the party's clean government and the work of anti -corruption, and conscientiously implement the decision -ma...

A magnitude 3.3 earthquake in Malcon City, Sichuan, Sichuan, Sichuan Province

China News Service, June 13th. China Earthquake Network officially determined: At ...