Signed a long list of 100 billion silicon procurement with Tongwei!180 billion global photovoltaic component leaders half a month "eat silicon" 720,000 tons

Author:Federation Time:2022.09.11

The global photovoltaic component leader crystal energy with a total market value of more than 180 billion yuan issued a major procurement contract announcement yesterday. About 382,800 tons.

For example, the average domestic single -crystal -to -chili tightly expenditure was announced on August 31, 2022 of the China Nonferrous Metal Industry Association's Silicon Industry Association. The average price of 305,100 yuan/ton was calculated, and the total amount of this contract was about 103.356 billion yuan. According to media reports, this is the largest polysilicon single order in the history of photovoltaic.

The announcement showed that when the contract was signed, the company signed with Tongwei in the early period of 2020-2023 "Polycrystalline Silicon Purchase Framework Agreement" automatically terminated. In early November 2020, Jingke Energy signed a contract with Tongwei Co., Ltd., agreed that from November 2020 to December 2023, Jingke Energy and its subsidiary Sichuan Jingke Xiangtongwei's subsidiaries purchased a total of polysilicon 9.3 9.3 9.3 10,000 tons.

Within half a month, Jingke Energy has signed a 100 billion purchase order for the second time. On August 26, the special transformation electrician announced that Jingke Energy signed the "Strategic Cooperation Sale Agreement" with the new special energy of the company's holding subsidiary. The procurement of native polysilicon to the new special energy is 336,000 tons, and the total amount of the agreement is expected to be about 90.333 billion yuan. The two orders were purchased for a total of 718,800 tons of polysilicon.

It is reported that the price of polysilicon has continued to rise since this year. The average transaction price of domestic single crystal tightly ingredients released (August 31st) of the Silicon Industry Branch was 305,100 yuan/ton. The price hit a 10 -year high.

Faced with the rise in raw materials, photovoltaic components have locked their supply in advance and issued large procurement contracts. Except for Crystal Energy, in March this year, Longji Green Energy and Tongwei shares signed a polycrystal silicon long single procurement agreement. It plans to purchase 203,600 tons of polysilicon products in the next two years, with a contract amount of 44.2 billion yuan.

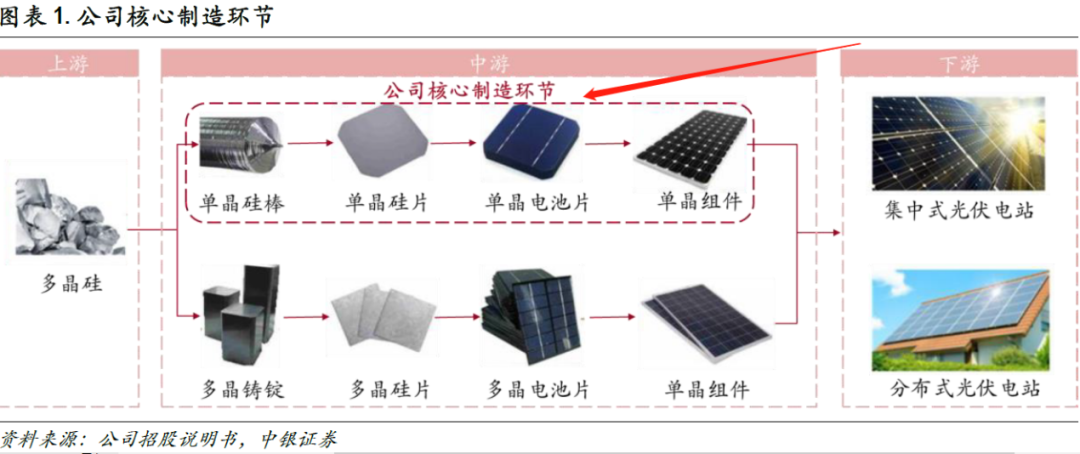

Public information shows that Jingke Energy is a global photovoltaic component leader. It has vertical integrated production capacity from pulling rod/cast ingots, silicon wafers, battery films to photovoltaic component production. The company's overseas revenue accounts for 75%, and component revenue accounts for more than 96%. The cumulative shipping volume exceeds 100GW. From 2016-2019, the company's component shipments ranked first in the world for 4 consecutive years. In the first half of 2022, Jingjing The science energy returned to the top with 18.21GW shipments.

Central Plains Securities Analyst Tang Junnan stated in a research report released on August 16 that according to the Paris Agreement 1.5 ° temperature control requirements, IPCC predicted that the usage of coal use globally by 2050 must be reduced by 95%. In 2050, renewable can be renewed. The proportion of energy and energy power generation is expected to increase to 86%, and the global photovoltaic installation capacity is expected to reach 8519GW.

Jingke Energy covers 61 countries and regions overseas, with a total of 353 channel vendors, and 1,392 cases installed. Compared with other companies in the same industry, the number is in the first echelon. In 2020, the company ranks first in major photovoltaic markets such as the United States, Vietnam, Japan, Germany, Australia, Brazil, India and the Netherlands, and its market share ranks first.

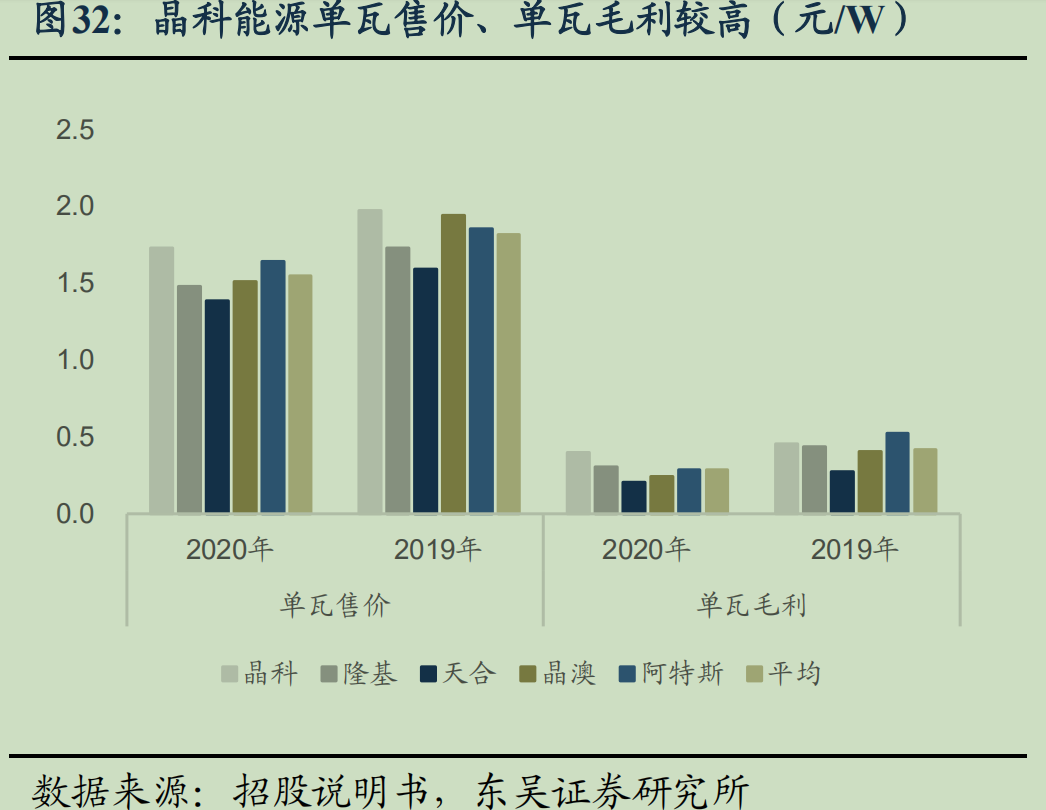

Soochow Securities Analyst Zeng Duohong said in the research report on May 3 that the European and American markets have higher gross margins in various sizes and components in Europe, USA, and stronger premiums. Highest.

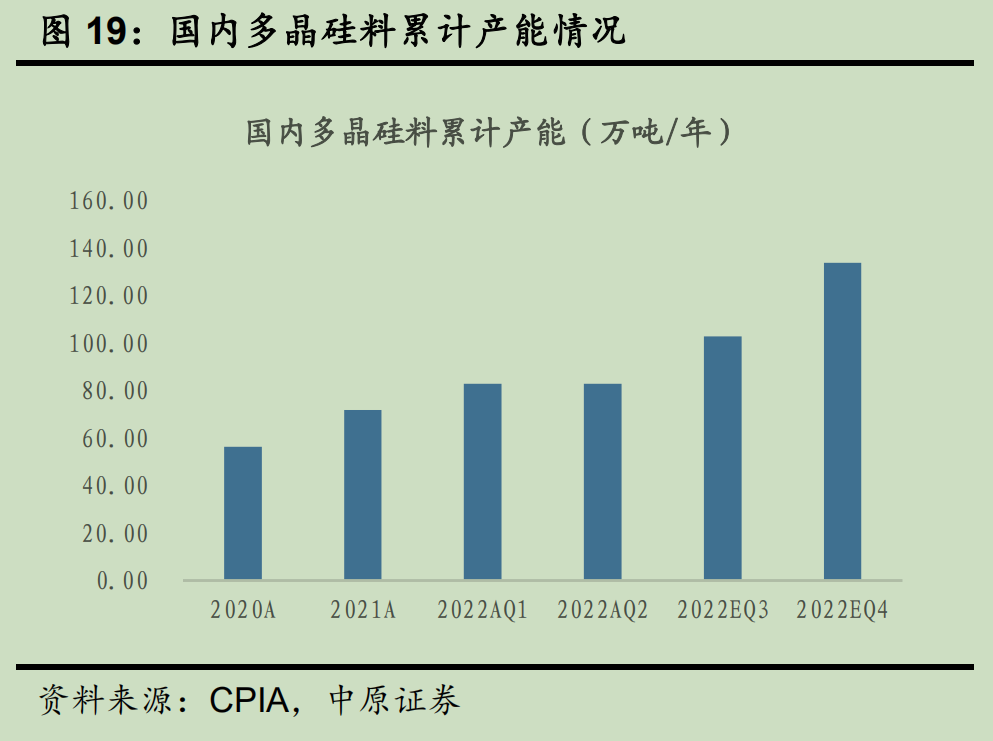

The cost end, with the release of the production capacity of the silicon -headed enterprise, the tight supply and demand of silicon materials is expected to alleviate. Tang Junnan pointed out that it is expected that at the end of 2022, my country's polycrystalline silicon material capacity will reach 1.338 million tons/year, especially in the third and fourth quarters of the main production capacity. In the first half of 2022, the gross profit margin of the integrated component plant was in a low position. The demand side of the photovoltaic installation machine in 2022H2 or 2023 decreased at the cost end.

In addition, in August 2021, Jingke Energy Union Jing'ao and Xindu Energy jointly capitalized the new Steel 100,000 tons of silicon material projects. It can ensure the effective supply of silicon materials.

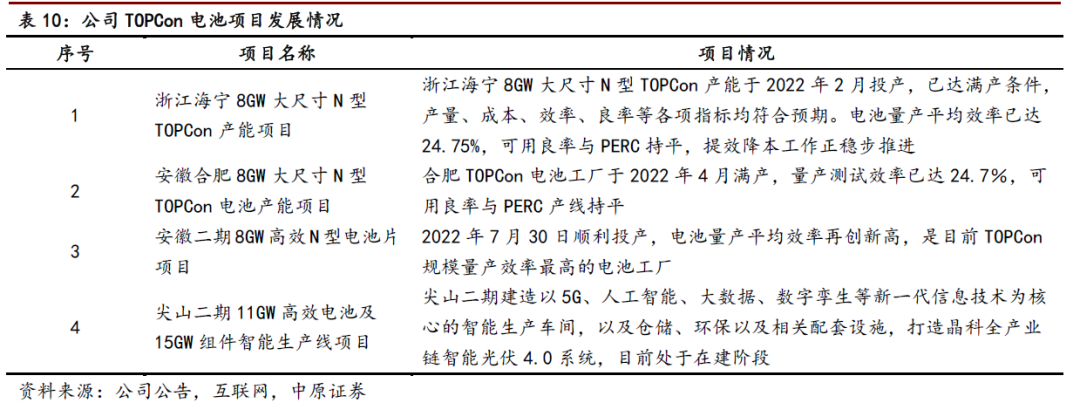

In the field of TOPCON batteries, Jingke's energy production capacity has a global leading. The company disclosed during the investigation of the agency in July that the production capacity of 16GW Topcon battery in the first phase has been completed. In the second half of the year, the production capacity of TOPCON battery in the second phase of the second phase was put into production. The average battery production average of the first phase of the battery is 24.7%, and the target of the second phase of production efficiency is expected to reach more than 25%. The production efficiency and production yield of mass production continue to lead the industry. At present, the company's TOPCON component order volume has exceeded 10GW, which is expected to become the industry's first component company to ship over 10GW annually in the industry.

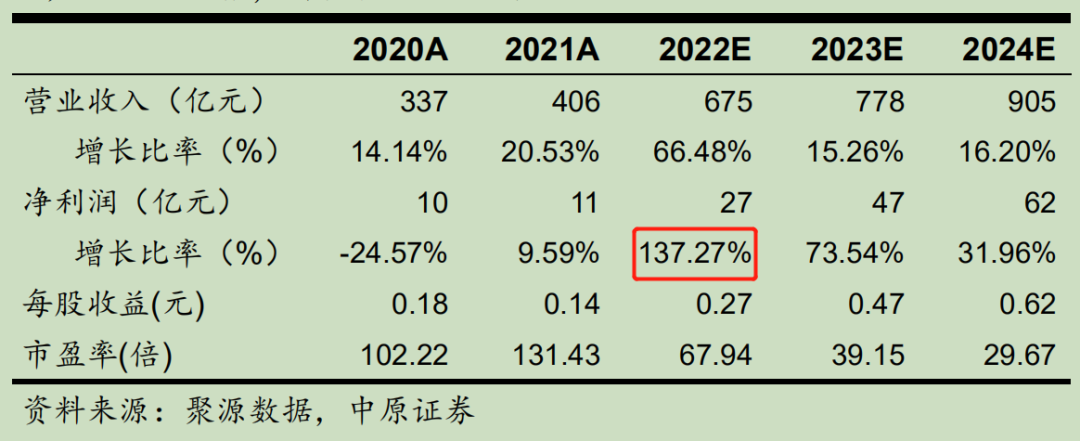

According to profit forecast and valuation budget, Tang Junnan's prediction of Jingke Energy's net profit in 2022 increased by 137.27%year -on -year.

However, it is worth noting that in order to keep energy security, the European Commission has previously stated that it will create a photovoltaic production line in Europe and "at all costs" for this goal. The return of the European industry chain may be a visible gray rhino for Chinese companies.

The amount of power battery installed in August has doubled year -on -year! "Ning Wang" for five consecutive months was less than 50 %, and the "Di Wang" chased the momentum fiercely

A -shareholders climbed to 209 million households, and the number of new households increased by more than 10%month -on -month."Hanjiang Monster" reproduction?What is the truth about the unknown "water monster" in the Hanjiang River in South Korea?

Is the lithium battery charging is expected to accelerate?New type of anode material can help lithium ions smoother transmission

Putin: It is also expected to increase the export of potassium fertilizers to developing countries

Buffett's continuous sweeping of Western oil holdings has exceeded one quarter

450739B0221B00B71ba72585EC9BD6EF-SZ_24868.png "Data-NickName =" Financial Association "Data-Alias =" Data-SIGNATURE = "Financial Association is hosted by Shanghai Newspaper Group.Authoritative, professional "as a guideline, provides 7x24 hours financial information services." Data-from = "2" data-is_biz_ban = "0" />

Click "watching

"Stocks make a lot of money

- END -

Public announcement of the "non -green code" personnel of "non -green code" personnel

Resident friends:Due to the need for the prevention and control of the epidemic, t...

The Russian Ministry of Foreign Affairs criticized the West at an attempt to exclude Russia outside the United Nations: obviously there is no future!

[Global Network Reporter Zhang Jiangping] The Russian Ministry of Foreign Affairs ...