Control the new energy industry chain?"Beauty" is hard to come true

Author:Global Times Time:2022.09.05

Editor's words: On August 16, local time, as the US President Biden signed the signature, the total value of $ 750 billion was officially effective. Among the legislation that relieves the high inflation economic environment of the United States, more than half of the amount is used to cope with climate change and ensure energy safety. Special subsidies for new energy vehicles have become the main points. It is worth noting that although China does not clearly mention China in the relevant provisions of the bill, in the conditions that can be obtained by the subsidy model, the United States has set up a series of "extra" clauses to protect and create a new "partner of the United States and its partners The new energy vehicle industry chain system of the country, suppressing and excluding China and other "foreign attention entities" with the first advantage of the industrial chain. At present, China has leading the world in the fields of new energy vehicle markets, vehicle and power battery capacity, and key raw material production and processing. Can the "Act of Inflation in 2022" help the United States get rid of the dependence on China's new energy vehicle industry chain? Will the global new energy vehicle industry chain migrate to the United States due to these restrictions? Will the comparative advantages established in China weaken? The Global Times reporter conducted an interview and investigation.

"Without Chinese raw materials, the United States cannot create a battery"

In order to achieve Bayon's target of half of the new vehicles in the United States by 2030, the "2022 Inflation Act" was unprecedented to drive the development of the US local new energy vehicle industry through fiscal subsidies. The Global Times reporter sorted out the clause of the bill, and found that the bill's stimulus policy on the new energy industry chain of the United States focused on three major aspects: one is to expand the scale of subsidies; the other is to stimulate low -income people to buy cars; third, at high globalization In the new energy vehicle industry chain of division of labor, the United States once again came up with protective clauses, and wanted to promote the return of the automobile manufacturing industry in a "row" manner and accelerate the establishment of the local industrial chain.

The bill clearly mentioned that subsidies are limited to new energy models assembled in North America, which means that all imported new energy vehicles no longer enjoy any subsidies.不仅如此,法案对可获得补贴新能源车型使用的部件及原材料有明确要求,比如动力电池部件及其关键矿物(生产动力电池所必须的电芯、模组、电解液、隔膜及锂、镍、 Cobalt, graphite positive and negative materials, etc.) must have a certain percentage from the United States or countries that have a free trade agreement (Canada, Mexico, Australia, South Korea, Chile, etc.), and the proportion is increasing year by year.

Although the "extracurricular" clause in the bill has not explicitly pointed to China, from the current structure of the new energy vehicle industry chain in the United States, Chinese companies have become an important part of its. China's power battery industry chain "unbind".

"As the third largest new energy vehicle market in the world after China and Europe, the United States does not have the autonomy of the supply of new energy vehicle power batteries and their raw materials, and relies on China and South Korea." People told the Global Times reporter that the United States hopes that through these "inequality subsidies" clauses, they will attract companies to invest in the United States and establish a new energy vehicle supply chain belonging to the United States and its "allies" to get rid of "key components and raw materials for China and raw materials. Serious dependence. "

However, from the current industrial situation, it may be difficult for the United States to achieve "hard decoupling" with China's power batteries and their raw materials in the short term. According to Bloomberg New Energy Finance Data, at present, only Tesla companies have the ability to commercialize the mass production capacity of power batteries and other battery factories with large -scale production capacity. Head battery manufacturers joint venture (including 4 GM, 3 Ford, Stellandis2), or vita by British Vasolt in the UK, IM3NY and other battery companies in Australia.

According to the statistics of Bloomberg New Energy Finance, the top ten companies in US power battery capacity (including complete enabled, under construction and announced battery capacity) are currently from the above -mentioned "foreign" joint ventures or wholly -owned companies. After calculating the Global Times reporter, it was found that the production capacity of a single Korean battery manufacturer accounted for 59.7%of them. It can be seen that the power battery of the American local new energy vehicle is highly dependent on South Korea, but more than 80%of the battery mineral raw materials used by Korean battery manufacturers last year were imported from China.

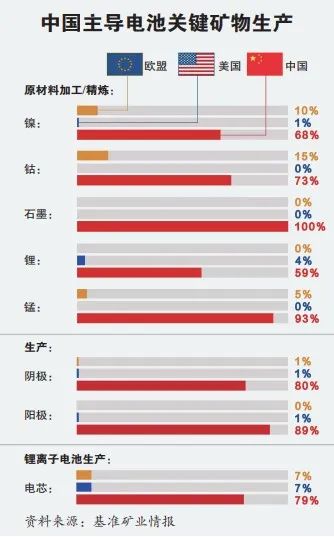

In terms of processing, refining, production and recycling of the main raw materials required for production power batteries, China has absolute dominance. According to the data of the benchmark mining intelligence company that tracks the global battery supply chain, 59%of the world ’s lithium, 68%nickel, 73%cobalt, 93%manganese and other positive poles are supplied by China. In terms of negative materials, China also has an irreplaceable advantage, and nearly 100%of graphite is produced by China. "Bloomberg Business Week" quoted UBS analyst Tim Bush, saying that graphite is an essential component for battery negative electrodes, but both natural graphite or synthetic graphite, China has absolute dominant advantages. In addition, more than 80 % of materials such as lithium battery electrolytes and diaphragms were also from China last year.

The American technology website The Verge reports that China is not on the list of "friendly trading partners" in the United States, but most of the US electric vehicles still depend on China's power batteries and raw materials.

"It is difficult to obtain power battery raw materials and components that have reached tax -free thresholds from the American industrial chain." Bloomberg New Energy Financial Energy Reserve Analyst Evina Stoluku said, "The production capacity of new batteries and components is the most capable It takes 3 years to long. "Bloomberg also stated in an article that it is difficult for the United States to achieve" hard decoupling "with China in the field of power battery raw materials, because mining usually takes 7 years or longer to complete exploration, mining and processing Production. According to the information provided by the US Geological Survey, although the US lithium proven reserves ranks fourth in the world, there are only one active lithium mine. Cleantechnica, a global electric vehicle and battery analysis agency, even directly stated that if there is no raw materials from China, the United States cannot create batteries.

"Allies" are also difficult to get subsidies

Judging from the current reaction of the new energy vehicles and major car companies, all parties are not optimistic about the prospects of the bill, and believe that the restrictions of its use components and materials are too expensive.

It is reported that the bill has clear requirements for components and materials used for subsidy models. For example, battery components must come from the United States or countries with free trade agreements with its free trade agreement, accounting for 50%before 2024 to 100%in 2029 in 2029 Essence The key mineral raw materials in the battery must be extracted or processed in countries or regions with a free trade agreement with the United States, or recycled in North America, accounting for at least 40%before 2024 to 80%in 2029. Moreover, battery components and key mineral raw materials shall not come from "sensitive entities" since 2024 and 2025, respectively. Reuters quoted the analysis of the American Lobbying Organization Automobile Innovation Alliance, which represents Volkswagen, Toyota, GM, etc., saying that there are currently 72 electric vehicles on sale in the United States, but only 30% of the electric vehicle subsidies came into effect on January 1, 2023, only 30% The models are eligible to enjoy tax credit. If the additional battery production is limited, no model is qualified to get full subsidies.

Reuters reports that this clause has been strongly opposed by car companies, saying that the percentage target of key minerals and components procurement is too high, and the growth is too fast to meet the subsidy requirements. In addition, the United States' disregard of the interests of allies also dissatisfied all parties. The bill requires new energy models to obtain subsidies in North America, and the modern Kia models in the United States that are second only to Tesla in the United States still rely on imports. To this end, the South Korean delegation, including Zheng Yixuan, president of Hyundai Automobile Group, recently visited the United States in the near future, hoping that the effective time can be postponed for 2-3 years to win the time for its first electric vehicle and battery factory in the United States. The European Union and other main export areas have also stated that the regulations violate the free trade regulations of the World Trade Organization and make it difficult for it to get subsidies.

China's advantage is difficult to be shaken

Although the bill has tried to switch the global new energy vehicle industry chain to the United States and its "allies", from the current situation in the United States, this "migration tide" may be difficult to achieve in the short term.

"Because the United States does not have key mineral mining, processing capabilities, and processing and refining technology of key raw materials. In the next 3-5 years, it is still difficult for the United States to form a mature local industrial chain system to get rid of dependence on China." Chinese Chemistry Liu Yanlong, Secretary -General of the Physical Power Association, told the Global Times reporter.

Zhou Xiaoliang, the partner of the Chinese supply chain and network operations in Deloitte, also believes that it is difficult for the United States to establish power batteries and its related complete local industrial chains in the short term. Because the competitive pattern of global power batteries has been formed, the advantages of China, Japan and South Korea's industry chain are obvious. The current supply chain pattern is the result of market -oriented selection. It is made by many factors such as raw materials, artificial factory costs, and market demand. The United States does not have advantages in these aspects. The time and cost pressure of the United States as a post -developed country to establish an industrial chain are greater.

"In the past 40 years, the globalization direction of the new energy vehicle industry chain mainly relies on economic laws. Because China has the world's most cost -effective labor, funds, transportation and other conditions, the global supply chain has shifted to China, making China a global new energy vehicle industry The center of the chain. "Xu Haidong, deputy chief engineer of the China Automobile Industry Association, told the Global Times reporter that under the influence of US trade protectionism, the judgment standards of the globalization of the industrial chain are mixed with more political considerations." The United States hopes to transfer the supply chain transfer To a partnership country with the same values, this is also the direction of the supply chain layout of Western countries such as the United States in the future, and controls important strategic materials in its own 'circle of friends'. "

Xu Haidong believes that these "extra" clauses of the "Inflation Act 2022" will be forced to a certain extent to transfer relevant companies to the United States and countries with free trade relations, but China itself is still the world's largest new energy vehicle market. The upstream and downstream industrial chain is enough to support the development of its own supply chain. The US self -built new energy vehicle supply chain will not shake China's leading advantage.

"Although the 2022 Chip and Science and Technology Acts recently issued in the United States and the" Activity Act of 2022 "are trying to guide the manufacturing industry through industrial subsidies and tax reductions, especially high -end manufacturing, but they have not systematically resolved the manufacturing industry.The problem of 'hollowing'. "Zhou Xiaoliang said that in contrast, China's new energy vehicle industry chain has a strong first -mover advantage, the supply chain is mature, and the cost advantage is outstanding.The United States "cannot eliminate China's advantages in scale economy, labor and energy costs" through tax credits. China's share of supply chains such as batteries and positive and negative materials "difficulty to be completely replaced" in the short term will "maintain the world's leading leading worldwide leading worldwide.status".The screenshot is the Global Times September 3 B7 version

Global Times reporter Tao Zhen

- END -

Xiamen Tong'an: The total investment of 7 total investment in the completion project was 19.8 billion yuan

The iron arm waved, the mechanical roar, the construction vehicles were arranged i...

"The World of Huahua" is a bit good -looking in the garden of this community in the community in the community.

Red Star News Network (Reporter but Tang Wen) reported on June 20 that the environ...