Fengkou Think Tank | The central bank is heavy!Decline the foreign exchange deposit reserve ratio and release three major signals

Author:Peninsula Metropolis Daily Time:2022.09.05

Fengkou Finance reporter Liu Xiao

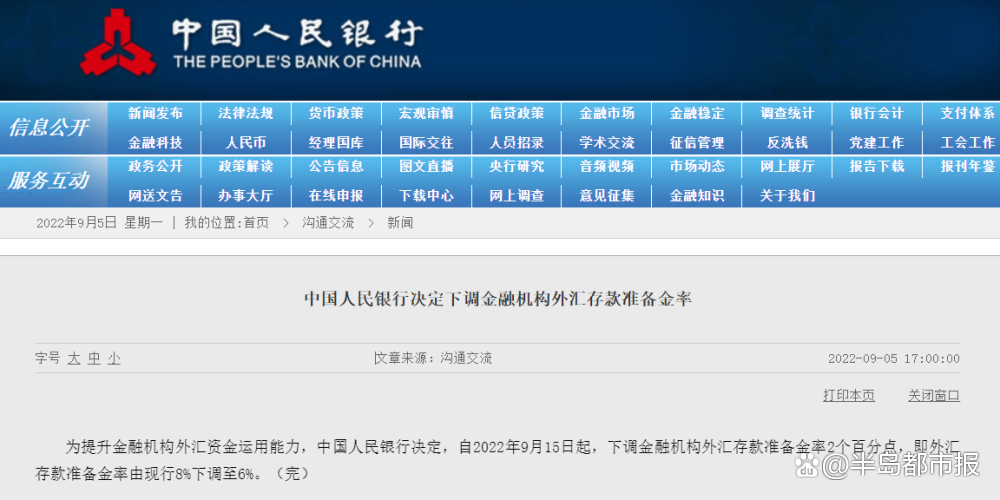

According to the website of the People's Bank of China, in order to enhance the ability of foreign exchange funds for financial institutions, the People's Bank of China has decided that starting from September 15, 2022, the foreign exchange deposit reserve ratio of financial institutions has been reduced by 2 percentage points, that is, the foreign exchange deposit reserve ratio will be by the current current. 8%down to 6%.

A number of experts from Fengkou Financial interviews said that the low -end financial institution's foreign exchange deposit reserve ratio means a reduction in reserves paid by domestic financial institutions for foreign exchange deposits. Ability is conducive to the stability of the RMB exchange rate.

There is no comprehensive depreciation of the renminbi

Recently, the continuous depreciation of the renminbi has caused market attention. Since mid -August, the value of the RMB against the US dollar has fallen as a whole. Especially on August 29, the value of the RMB against the US dollar fell below 6.9 on the shore, and the corresponding US dollar index exceeded 109, a new high in the past 20 years. On September 5th, the US dollar index rushed to stabilize the 110 mark and continued to consolidate the 20 -year high above 109.00. During the same period, the offshore RMB fell below 6.95 against the US dollar, depreciating nearly 400 points within the day. The RMB in the shore fell below 6.93.

It is worth noting that on the afternoon of September 5th, the State Council's News Office held a routine briefing meeting of the State Council to introduce the continuation policies and measures to introduce a policy of stabilizing the economy, and answered reporters. According to Liu Guoqiang, Vice President of the People's Bank of China, recently, the renminbi depreciation is mainly adjusted by the US dollar currency policy. The US dollar has appreciated by 14.6%since this year. In the context of the appreciation of the US dollar, other reserve currencies in the SDR basket have depreciated sharply. About 8%, but compared with other non -US dollar currencies, the depreciation is the smallest. For example, from January to August, the euro depreciated by 12%, the pound depreciated by 14%, the yen depreciated 17%, and the renminbi depreciated by 8%. The depreciation of the renminbi is relatively small, and in the SDR basket, in addition to the depreciation of the US dollar, the RMB is appreciated with non -US dollar currency. In the SDR currency basket, a basic situation is that the US dollar appreciates and the RMB has also appreciated, but the appreciation of the US dollar appreciation is greater. Therefore, the renminbi did not have a comprehensive depreciation.

Liu Guoqiang pointed out that the recognition of the RMB in the future will continue to increase, which is a long -term trend. However, this should be like this in the short term. Both directional fluctuations are normal, with two -way fluctuations, and there will be no "unilateral cities", but the point of the exchange rate is not allowed. Do not bet on a certain point. Reasonable and balanced, basic stability is well -known, with strength support.

Liu Guoqiang said that in the next step, he will adhere to a stable monetary policy, effectively and effective use of policy tools, take into account the relationship between stable growth, employment and stability, and cope with various risks and challenges.

Dongfang Jincheng chief macro analyst Wang Qing told Fengkou Finance that recently the RMB exchange rate against the US dollar has fallen, but there are two reasons behind the non -US currency. Low. Since August 15th, the US dollar index has risen from a strong statement of the monetary policy of several Federal Reserve officials.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, told Fengkou Finance that the Fed has continuously released the eagle signal, and the market is expected to heat up the Fed's radical interest rate hike. In addition, the European energy crisis has been upgraded recently. As a result, non -US currencies such as RMB weakened.

The central bank releases three -point signal

Wen Bin, chief economist of Minsheng Bank and dean of the Institute of Research, said in an interview with the wind and economic interviews that the reduction of foreign exchange deposit reserve ratio of financial institutions means that the reserve for domestic financial institutions for foreign exchange deposits is reduced, which will help increase the market The liquidity of the US dollar and improve the ability of foreign exchange funds for financial institutions, which is conducive to the stability of the RMB exchange rate. Affected by the Federal Reserve's accelerated tightening of monetary policy, the US dollar index once broke through the 110 mark, causing the devaluation of RMB passiveness to the US dollar. The central bank's move to release a positive signal to the market is conducive to stabilizing RMB exchange rate expectations and avoiding irrational overruns.

"The central bank announced that the foreign exchange deposit reserve ratio will be reduced from 8%to 6%from September 15th. We believe that this measure releases three -point signal." Chang Ran, a senior researcher at Zhixin Investment Research Institute, told Fengkou Finance.

The first is to increase the liquidity of foreign exchange to regulate the supply and demand relationship of the foreign exchange market, which will help stabilize the RMB exchange rate. Chang Ran said that the most direct effect of lowered foreign exchange deposit reserve rate is to increase the amount of foreign exchange capital available for commercial banks, thereby increasing the supply of foreign exchange on the market. At the end of July 2022, the balance of foreign exchange deposits was 953.7 billion US dollars. This time the foreign exchange deposit reserve ratio was reduced by 2 percentage points, which meant to release about $ 19.1 billion in foreign exchange liquidity to the market. Proper reverse adjustment will help to reduce the recent depreciation of the RMB.

The second is to compare 1%by 1%in April. This time, the 2%increase has increased, but the release scale is more reasonable. Chang Ran told Fengkou Finance that in April, the Fed had just started to raise interest rates, and the 25bP increased for the first time, and the US dollar index had a limited impact on the RMB exchange rate trend. However, at present, the Fed has accumulated a total of 225bp, the US dollar has maintained a strong pressure, which has put a lot of pressure on the RMB exchange rate. The adjustment of foreign exchange deposit reserve ratios should also be improved accordingly. The balance of foreign exchange deposits of financial institutions in August decreased by 96.3 billion US dollars from April. The base of foreign exchange deposits reserve rates decreased, and the scale of the US dollar released by the proportion of 2%was reasonable. "Third, this helps to reduce the depreciation of the RMB exchange rate, and it is intended to release policy signals to manage exchange rate expectations." Chang Ran said that this time the participants who bet on the unilateral renminbi depreciated participants released clear policy signals. It shows that the authorities will take corresponding measures to keep the RMB exchange rate basically stable. On the issue of regulating the excessive depreciation of the RMB, the currency authorities have ample management tools, such as foreign exchange deposit reserve ratio, foreign exchange risk reserve ratio, counter -cyclical factors, and foreign exchange swap transactions.

Zhou Maohua told Fengkou Finance that the central bank was intended to avoid irrational fluctuations in the RMB foreign exchange market and interfere with the normal allocation of market resources. The central bank's preparation rate of foreign exchange deposits is on the one hand, on the one hand, through the release of the foreign exchange liquidity of the banking system, it will increase the supply of market foreign exchange and promote market balance. On the other hand, the central bank's release of a stable signal to the market will help stabilize market expectations. "As of July, the foreign exchange deposits of financial institutions were US $ 953.7 billion. The central bank had reduced two percentage points, roughly estimated that the foreign exchange liquidity of $ 19.1 billion was released." Zhou Maohua said.

Will not form substantial constraints on macro policies

Previously, in view of the proportion of the world's trade in the RMB, how the People's People's Central Bank managed the RMB exchange rate is crucial to the global financial market. The market is also observing whether the decline in the RMB will have a impact on the economic central bank to further relax the policy to support the slowdown.

"Decreased foreign exchange deposit reserve ratio will increase the liquidity in the shore market, and alleviate the pressure of the depreciation of the RMB against the US dollar in the current exchange market's supply and demand balance." Wang Qing said to the Creale Finance that the depreciation of this round of RMB was mainly treated sharply by the US dollar index significantly. Triging that the three major RMB exchange rate index runs steadily, which means that the regulatory market's exchange market regulation will be mild and will not pay too much attention to specific points. The RMB exchange rate will fluctuate with the US dollar index. "This also means that this measure may drive a short -term rebound of the RMB against the US dollar. It will tend to be mild, and a basket exchange rate index will continue to be strong.

Wang Qing believes that in the context of the overall restoration of the domestic economy, my country's international revenue and expenditure will maintain a large surplus, and it is difficult to effectively gather the RMB depreciation expectations. Equipment.

Zhou Maohua believes that the short -term strong dollar still puts some pressure on the renminbi, but it is expected that the RMB is expected to run near the equilibrium level, and the two -way fluctuations are normalized. The main domestic scattered epidemic is controllable, maintaining the support of stable prices, relief to help enterprises and stable growth policies, and the domestic economy has steadily recovered. This is the world's largest certainty. At the same time, my country's supply chain industry chain has resumed smoothly, foreign trade structure is optimized, foreign trade enterprises have improved quality and efficiency, foreign trade toughness is sufficient, and the value of RMB assets has been prominent in long -term allocation. The international revenue and expenditure will remain basically balanced, and the elasticity of the RMB exchange rate has also significantly enhanced.

Zhou Maohua said that from the long -term perspective, the RMB exchange rate will maintain a smooth operation and slowly appreciate trend. The exchange rate in the medium and long term will eventually return to the fundamental aspect. my country continues to deepen reform and opening up, accelerate the construction of a new development pattern of dual -cycle, promote industrial upgrading, improve economic efficiency, and release huge market potential. Domestic has become global investment, asset allocation, wealth management hot soils; From the perspective, the global economy is facing deep -seated structural problems and non -traditional problems. The financial and monetary policy of major European and American economies and the impact of potential sequelae are prominent.

(This article is for reference only, does not constitute investment suggestions, investment is risky, and you need to be cautious when entering the market!)

- END -

"Zero" obstacle "zero" resistance "zero" is from Kezhou full service to open work

Tianshan.com reporter Song Weiguo correspondent Yang PengOn June 23, in Abutus, th...

Liaoyang Meteorological Bureau issued a lightning yellow warning [Class III/heavier]

Lightning yellow warning signal: It is expected to have lightning weather such as short -term wind, hail, short -term heavy precipitation and other strong convective weather such as short -term wind,