The anti -phase effect of the sanctions highlights European inflation and worsening

Author:Xinhuanet Time:2022.09.05

Xinhua News Agency, Brussels, September 5th (International Observation) Sanctions reverse effects highlighting European inflation and worsening

Xinhua News Agency reporter Kang Yi Shan Weiyi

Affected by the multiple factors such as energy crisis, extreme weather, and the Fed's continuous radical interest rate hike effects, the energy and food prices of the euro zone have continued to soar in the near future, the inflation rate has reached a record high, and the prospect of economic growth is even more dim. Analysts believe that the European geopolitical crisis is delayed, and the EU blindly follows the anti -phase effects of the United States' economic sanctions on Russia, which has gradually appeared, which worsen the severe inflation situation in Europe.

Inflation towards the two -digit era

According to the latest data from the EU Statistics Bureau, the inflation rate of the euro area in August was 9.1%at annual rate, exceeding market expectations, and hitting a record high. The inflation rate of nine countries in the 19 member states of the euro zone reached two digits at an annual rate, of which the inflation rate of the three Baltic countries exceeded 20%.

House seemingly endless rain. This year's European encountered severe drought, about 47%of the regions faced the risk of drought, and another 17%of the region was in a more serious alarm state. Belt Colene, a senior economist at the Euro Zone of the Netherlands, pointed out that the energy crisis and drought weather will continue to put pressure on prices in the next few months, and inflation can hardly see signs of relief in the short term.

In addition, the current market's concerns about the level of natural gas inventory in winter and the surge in the cost of imported LNG from the United States, which also promotes the price of natural gas in Europe, making the inflation rate of the euro area possible to double digits.

Affected by this, the actual salary of the euro zone has severely shrunk, the purchasing power of the public has declined, the family consumption is far lower than the pre -epidemic level, retail sales have declined, and consumer confidence is at a historical low. At the same time, the surge in cost has also affected the production field, leading to a decline in industrial output and more adverse effects on the European economy.

The risk of economic recession has increased sharply

Recently, the Fed's continuous radical interest rate hike brought a negative spillover effect to Europe. The euro continued to weaken, fell below the price of the US dollar several times, further intensified European inflation, and the difficulty of adjusting the monetary policy of the European Central Bank.

The German "South Germany will" published a comment that the European Central Bank has been brought into the rhythm of interest rate hikes by the Federal Reserve. The depreciation of the euro on the US dollar has made the European situation more difficult. Europe imports from the United States at a higher price, pays higher amounts of raw materials and semi -finished products for the US dollar at a higher price, and raises the cost of European raw materials to further increase inflation. The euro zone has fallen into a high inflation dilemma, and it must also bear the inflation pressure from other countries. The European Central Bank has to increase interest rates to respond to inflation, and its risk of economic recession has increased sharply.

Market analysts predict that in response to high inflation, the European Central Bank raised interest rates at least 50 base points in September without suspense, while the Eagle School strived to raise interest rates 75 basis points.

Jane Ting, the global director of the currency strategy department of the Brown Brown Brown Brown, said that a sharp interest rate hike may cause great damage to the struggling euro area economy.

Casten Bugski, an economist at the Netherlands International Group, also believes that the European Central Bank's interest rate hike helps to normalize the currency policy and control inflation expectations, but it cannot achieve high inflation at the same time and does not cause economic recession.

Sanctioning against Russia's anti -blessing itself

Analysts believe that the EU, which highly rely on Russian energy supply, has a huge reflux effect on Russia's sanctions, which leads to Europe in the dilemma of energy supply, and then continuously pushes European natural gas and electricity prices.

On August 26, the Dutch ownership transfer centers (TTF) natural gas futures closing price of the Dutch ownership of natural gas at the benchmark price of the European natural gas below $ 100 per million British thermal units hit a record high, which was also more than ten times the price of the same period last year.

In contrast, the natural gas benchmark price in the US market is much lower than the European price. Today, many US traders are constantly selling liquefied natural gas to Europe and earning high profits.

Hagan Lyin, a member of the German House of German House, doubts the results of sanctioning Russia. He said that Western sanctions did not bring benefits except to bring a shortage of natural gas and the power crisis to Germany. This is the consensus of many German business people.

Hungarian Prime Minister's Office of the Prime Minister Guysh Gargie believes that the EU will expand sanctions on Russia to the energy field is "fundamental errors."

Herbert Kirkel, a member of the Austrian Parliament and the Liberal Party leader, said that if sanctions harm to the sanctions, sanctions will not make sense. This is the current situation of the EU sanctions on Russia.

- END -

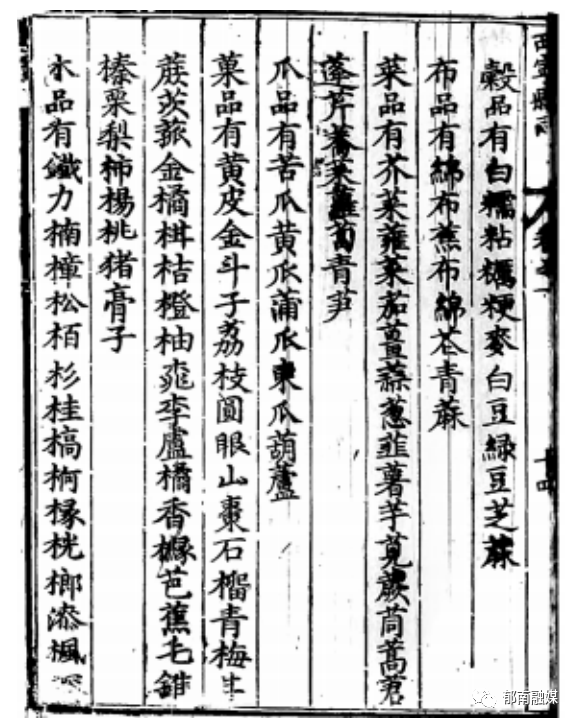

[You know the county's words] Yu Nan Huangpi Development

In the midsummer in July, it was the season to eat yellow skin.据明万历二十年《西...

[First -line fax] Ronggui Police Camp Dialogue -Xiamen Railway Public Security launched retired veteran comrades to return to police camp activities

Every festival is thoughtful. The Xiamen Railway Public Security Department of ...