To solve the problem of "urgent and sorrowful hopes", 90 in Shanghai's private tax payment measures have been implemented

Author:Report Time:2022.09.05

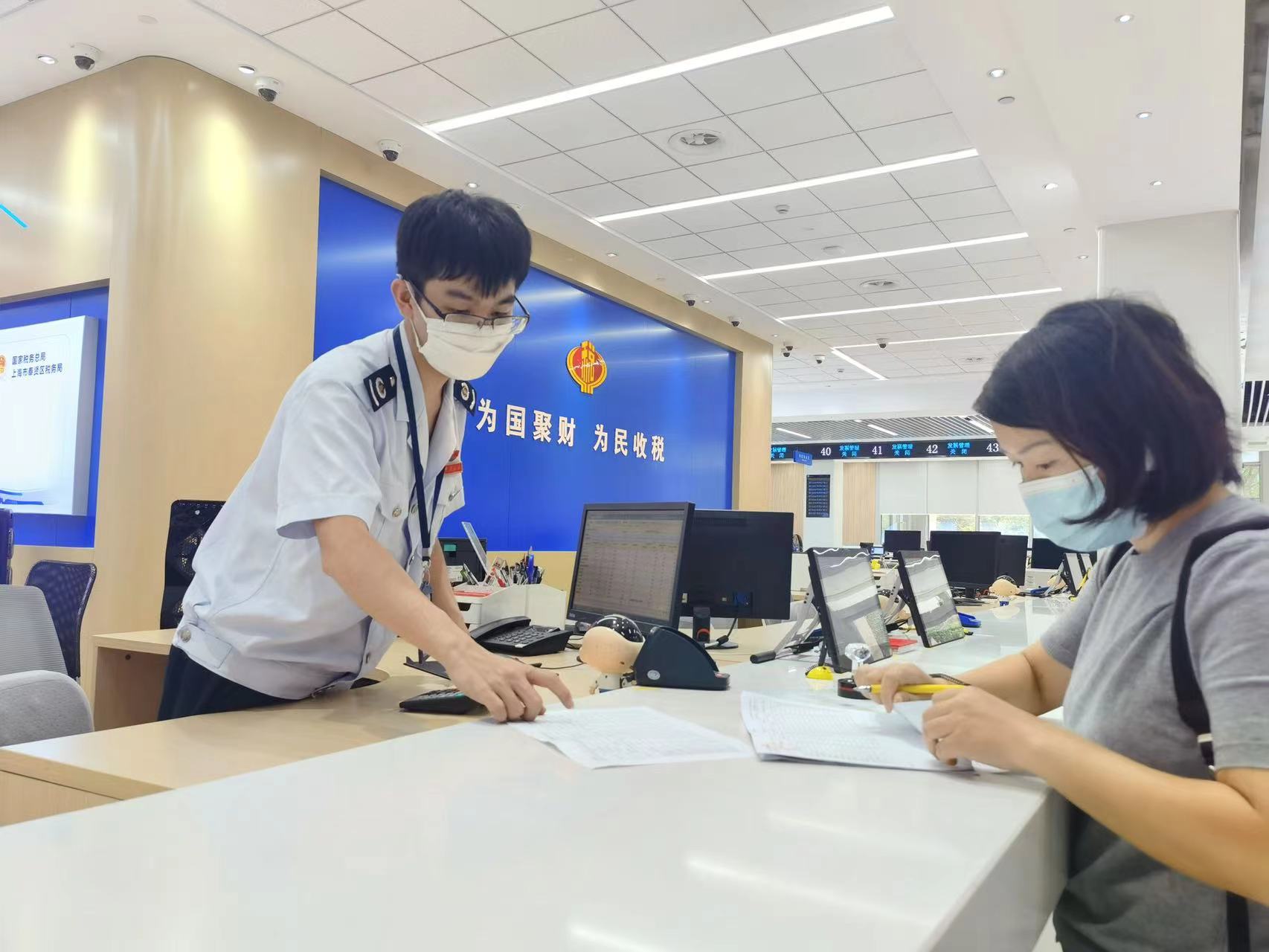

Since the beginning of this year, the Shanghai Taxation Department has conducted in -depth in the 2022 "I run practical affairs for the taxpayer and the private tax spring breeze" on the theme of "Smart Taxation Development, benefiting the stability of the people and the people", and the launch of 5 categories 20 categories 20 Article 121 of the private tax payment measures. At present, 90 measures have been implemented, and the taxpayer's sense of payment has been further improved.

Smart services "multi -dimensional", tax and fees are more convenient

"From the on -site office of filling in paper data, to the online handling of platforms such as the Electronics Taxation Bureau, and then reminding the Intelligent Office online, the tax experience is constantly optimizing." The value -added tax declaration comparison function, not only the data is automatically pre -filled and automatically compared, but the wrongdoing will also pop up the window reminder in real time.

In recent years, the Shanghai tax department has continuously expanded smart tax services, and "taking the Internet and handling on the cloud" has become the first choice for taxpayers' daily taxes. At the same time, many tax departments have penetrated the parks, buildings, community service centers and other areas to create several social co -governance points to provide the optimal solution for taxpayers "nearby".

In the smart tax co -governance point of the Shibei High -tech Park, Cao Yanfei, the Finance of Shanghai Diqin Intelligent Technology Co., Ltd., has just received the invoice of the agency: "As an enterprise in the park, walking in less than 10 minutes at the co -governance point, applying for online application, applying for it online. Receive, it can be completed on the spot, which is very convenient. "

It is understood that the co -governance point can also achieve online processing of more than 300 tax -related services, as well as more extensive government services such as employment and entrepreneurship and certificate processing.

The policy is delivered to the "zero time difference", and the tax -related demand quickly responds

"During the epidemic, the operation of corporate funds was difficult. The taxation department insisted on sending the preferential policies to the door to the door with online ways such as intelligent voice and WeChat. Cao Yiwei, Co., Ltd. said.

In order to make policy delivery more timely and accurate, the Shanghai Taxation Department optimizes the preferential push mechanism for tax and fees, and rely on the online channels such as the Electronic Taxation Bureau and the application side to push the policy of 2.9 million households. At the same time, online and offline publicity is carried out through telephone, cloud class, and big visit to ensure that the policy should be known and enjoyed.

In Fengxian, the "live broadcast on Wednesday" has become a fixed "program" of the District Taxation Bureau. The experts of various lines of business are in the form of "one period, one hot spot", and surround the new combined tax support policy and hot spots. The issue is carried out on a special preaching. In addition, the bureau also integrates intelligent voice technology into the policy promotion and launched the "tax AI assistant". At present, 58 batches of 96,000 voice telephone reminders have been implemented. Policies, service measures and other tax -related information.

Ask for "zero distance", personal service solution problem problem

In order to better solve the personalized problem of taxpayers, the Shanghai Taxation Department launched the "Integration Integration" service model, relying on the 12366 tax payment service hotline to create a "two question and one answer" service system, provide online instant consultation services, accumulate tax refund cumulative tax refund More than 9,700 tax reduction consultations.

"Not only can you send information in real time, but also the screenshot and video connection consultation of the question, just like with the exclusive tax customer service, the business is smoother." Huang Liang, the financial leader of Shanghai Youli Pharmaceutical Technology Co., Ltd. After the interactive platform, I said with emotion.

Li Zhigen, the head of Shenzheng Hardware Business Department, Chedun Town, Songjiang District, Shanghai, also has a deep understanding of this. As an individual household, he usually does not have many tax -related business, and the electronic tax bureau is unskilled. Under the video connection counseling of tax personnel, less than half an hour, 50 general VAT electronic invoices are approved. "I did not expect to handle taxes now. It can handle various tax -related business without leaving home, which is easy to use." Li Zhigen said.

Data empower the "card breaking point", and the chain is strong and the chain stabilizes the business of the enterprise

"Seeing that the delivery period is coming soon, the straw materials have been on the red light." Li Qiujia, Finance Li Qiujia, Shanghai Hanyu Environmental Materials Co., Ltd., said, "After learning about our demand, the tax department immediately passed through the big data of the tax '. I found the suppliers of Hunan for us, which contributed to a contract of 600,000 yuan, and helped us solve the urgent need. "

In order to support the development of small and medium -sized enterprises, the Shanghai tax department gives full play to the advantages of tax big data, and in vertical, through the "national taxpayer supply chain query" function matching potential suppliers to ensure the rapid and effective supply and demand docking; horizontal upward, rely on "silver tax interaction" The mechanism has a comprehensive linkage with the Banking Regulatory Supervision Department. Through shared tax data, it has provided credit support for 12,000 companies, and a total of 26.7 billion yuan in loans will be issued.

Shanghai Anhui Automobile Sales Co., Ltd. mainly sells Jianghuai Xingrui Automobile. After learning that the enterprise had the problem of capital transfer, the in charge of the tax authority guided the enterprise to obtain a tax credit loan of 1 million yuan through the "silver tax interaction" platform. "With sufficient funds, we can ensure the supply of upstream suppliers and speed up the normal sales of the car," said Wang Zheng, the company's person in charge.

The relevant person in charge of the Shanghai Municipal Taxation Bureau of the State Administration of Taxation said that in the next step, the Shanghai Taxation Department will intensify the in -depth intensive reform of the private tax spring breeze operation with fine service pilots, optimizing the business environment and other important reforms, and continue to collect the needs of taxpayers.Strengthen the internal and external coordination, up and down linkage, solve the problem of "urgency and sorrow" of the taxpayer's payment, and effectively open up the "last mile" of the taxpayer payment.

Author: Zhou Yuan

Edit: Zhang Yan

Editor in charge: Rongbing

- END -

"Find the most beautiful Xiang police" on the "sharp knife blade" on the Changsha Public Security front

There is such a team in Changsha Public Security. They are brave, experienced, and...

Important reminder!Suspension from 18:00 tomorrow

August 31: Yin temperature 20 ~ 26 ℃Newspaper Tel: 0715-8128787Fresh things, stra...