The game of "nickel": Huayou Cobalt has planned to raise a funds of 17.7 billion yuan. Among them, the layout of 12.2 billion plus nickel industry chain

Author:Daily Economic News Time:2022.06.19

On the evening of June 19, Huayou Cobalt (SH603799, stock price of 91.49 yuan, and a market value of 145.3 billion yuan) disclosed the latest fixed increase announcement, which intends to raise 17.7 billion yuan, of which 12.2 billion yuan wants to invest in Huashan Nickel Cobalt (Indonesia) Co., Ltd. Referred to as Huashan Nickel Cobalt) an annual output of 120,000 tons of nickel metal metal meter hydroxide cobalt wetting project.

Huashan Nickel Cobalt System 2021 Huayou Cobalt and Qingshan Group's Qingshan Technology Co., Ltd., such as Qingshan Technology Co., Ltd., established in Indonesia, registered $ 1 million, and Huayou Cobalt Industry indirectly holds 68%of Huashan Nickel and Cobalt.

Why do you put most funds to the project? Huayou Cobalt revealed that the company jointly constructed 120,000 tons (nickel metal quantity) nickel hydroxide cobalt wetting projects in Indonesia, which is conducive to ensuring the stable supply of nickel resources, improved and consolidated the company's industrial chain layout, fits downstream customers downstream customers For the urgent demand for stable supply chains, at the same time, it is obtained by obtaining nickel ore to reduce production costs, and builds cost competition advantages.

From the nickel futures incident of Qingshan Group, to the turmoil of Lun Nickel Futures, and then to this time, Huayou Cobalt wants to raise huge funds to lay out the nickel industry chain. On the asly on the new energy industry, the game of "nickel" resources around the key raw materials of the upstream is surging. Where will the "nickel" war go in the future?

It is intended to invest 12.2 billion yuan to invest in Nickel and Cobalt, Indonesia

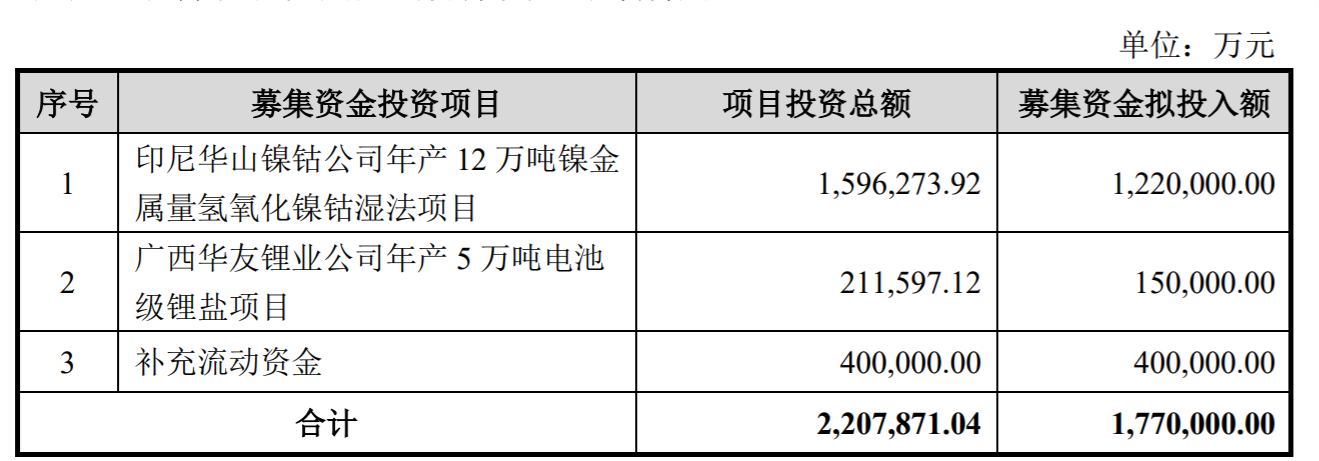

According to the fixed -increase announcement disclosed by Huayou Cobalt, the issuance target of non -public issuance shares is Huayou Holdings, the company's controlling shareholder, and no more than 34 specific objects. From the perspective of the use of funds, the total amount of raised funds for this time does not exceed 17.7 billion yuan. The projects that are intended to be invested after deducting the issuance fee include three aspects.

First, Huashan Nickel Cobalt produces 120,000 tons of nickel metal metal metal hydroxide cobalt wet wetting project, which is intended to invest 12.2 billion yuan; followed by Guangxi Huayou Lithium Company's annual output of 50,000 tons of battery -level lithium salt projects, it is intended to invest The fundraising funds were 1.5 billion yuan, and finally it was intended to invest 4 billion yuan to supplement liquidity.

From the perspective of the proposed projects for fundraising funds, Huashan Nickel and Cobalt produced 120,000 tons of nickel metal metal metal metal hydroxide cobalt wet wetting projects per year, and the total investment of the project was 15.963 billion yuan.

Image source: Announcement Screenshot

On the same day, Huayou Cobalt disclosed the foreign investment announcement and introduced the company's three targets to invest, namely Huashan Nickel Cobalt, Prospect Lithium Zimbabwe (PVT) LTD (Prospect Lithium Mine) and Guangxi Huayou Lithium Co., Ltd..

Among them, Huayou Cobalt intends to jointly build a wholly -owned subsidiary Huatuo International and GLAUCOUS to jointly build Huashan Nickel and Cobalt to produce 120,000 tons of nickel metal metal hydroxide cobalt wet wetting project. According to preliminary estimates, Huashan Nickel Cobalt's total investment was US $ 260,191,100 (including full -diagram of funds of US $ 157.159 million, of which 47.148 million US dollars were paved). Huashan Nickel's authorized capital is $ 1 million, of which the company should pay $ 680,000 in actual capital, holding 68%of the shareholding; Glaucous should pay $ 320,000, and the shareholding ratio is 32%.

It is understood that the project construction cycle is 3 years, and the project funds are resolved by the company's own funds and self -raised funds. At the same time, Huayou Cobalt Industry reminded that the project still needs to be submitted to the company's shareholders' meeting for approval, and this foreign investment project must handle the government's approval/filing and/or other administrative procedures for China, Indonesia and Zimbabwe government. sex.

Plus nickel industry chain layout

Why do listed companies have a huge sum of money to invest in Huashan Nickel Cobalt?

The reason given by Huayou Cobalt is that the popularity of new energy vehicles and the trend of high nickelization to rapidly drive nickel resources, and it is imperative to accelerate the situation of nickel industry chain cloth. The ternary power battery is one of the main development directions of new energy vehicle battery technology, while high nickel triple materials have significant advantages in the aspects of endurance mileage, energy density and material cost. High -nickelization has become the future development of ternary power batteries Trend; as the key links and core components of the value chain of new energy vehicles, the lithium battery and lithium battery materials industry will accompany the rapid popularization of new energy vehicles to continuously expand the market capacity accordingly.

Secondly, the global nickel resources are unevenly distributed, and "going global" to improve the layout of resource layout is inevitable. Indonesia, Australia, Brazil, Russia, Cuba, and the Philippines accounted for 78.01%, and nickel resources concentrated. Among them, Indonesia is one of the most abundant countries in the world's red earth nickel ore resources, accounting for more than 10%of the world's red earth nickel ore reserves.

Huayou Cobalt said that the company jointly constructed 120,000 tons (nickel metal quantity) nickel hydroxide cobalt wet wetting project in Indonesia, which is conducive to ensuring the stable supply of nickel resources, improved and consolidated the company's industrial chain layout, fits downstream customers for downstream customers. The urgent demand for stable supply chains, at the same time, obtains nickel ore to reduce production costs, and build cost competition advantages.

The Research Report released by Guoxin Futures recently wrote that before the demand for new energy batteries increased, the nickel mine was in the state of two lines of supply, that is, nickel -sulfide ore produced refined nickel through fire and smelting, mainly used to produce nickel nickel Alloys and high -end stainless steel are used for a small amount of nickel salt. Red earth nickel ore has been used to produce nickel -ray iron (NPI) and nickel iron, and the terminal is mainly used to produce stainless steel; a small number of red earth nickel ore produces cobalt hydroxide nickel or nickel nickel or nickel nickel or nickel. Nickel sulfide cobalt, then use to produce nickel salt. Nickel sulfide ore and red earth nickel ore have no cross in the smelting link, mainly due to the crossstream demand links, and the main terminal requirements of the two are stainless steel. After the demand for new energy batteries began to explode in 2020, the demand for nickel sulfate increased significantly. Nickel sulfate increased significantly on pure nickel and nickel iron price differences. On the other hand, on the other hand, in the red earth nickel mining industry chain, enterprises have begun to increase the production capacity of moisture smelting to produce nickel intermediate products. In terms of fire method, Chinese enterprises Qingshan Industry has opened up nickel -raw iron -high ice nickel -sulfuric acid Nickel's industrial chain, which makes the supply of nickel sulfide ore and red earth nickel ore crossing the high ice nickel link.

Regarding the technology of nickel hydroxide cobalt (MHP), Guoxin Futures analysis states that the production of nickel hydroxide cobalt uses high -pressure acid immersion technology (HPAL), which is characterized by the high cost of fixed investment in the early stage and high technology. Before 2022, the production capacity of wetfare has not changed much for many years. It was driven by profit and was driven by 2022 Nickel hydroxide cobalt. The new output of nickel hydroxide cobalt was about 100,000 metal tons, and about 60,000 tons of metal tons in 2023. Given that the MHP project has been completed for a long time, the peak period of production capacity release may be after 2023.

And Huayou Cobalt's fixed increase is intended to invest in Huashan Nickel and Cobalt to produce 120,000 tons of nickel metal metal metal hydroxide cobalt wetting project. If it is approved, according to the project progress, it is expected to be released in 2025. After the project is completed, the output of nickel hydroxide cobalt will further increase.

Daily Economic News

- END -

Is it difficult for job hunting and employment?Four enhanced measures to help you!

On June 17, the State Council's Journalism Office held a routine briefing meeting ...

Anti -epidemic in Qingdao!See what the street nucleic acid stickers look like

The Qingdao epidemic prevention and control headquarters opened the prelude to the...