Buffett presses the old and new energy conversion keys to reduce the holding BYD and buy Western oil

Author:City world Time:2022.09.02

When domestic institutions bought BYD crazy, Buffett, who had held 14 years, chose to quietly reduce his holdings, and the stock god pressed the new and old energy conversion keys.

Many investors are familiar with the myth that Buffett made in BYD, and many investors are familiar with. In 2008, Buffett bought 225 million BYD H shares at a price of 8 Hong Kong dollars per share. By the first half of 2022, he never reduced its holdings. Based on BYD Peak's stock price, the stock god once earned up to 40 times on BYD's body. Income.

In BYD's investment, Buffett, like Dinghai God needle, adds the confidence when investors face the huge stock price fluctuations. "The stock god is with me!" Before Buffett moved, this was the "power of faith" of investors.

But now, the "power of faith" has shaken.

On August 30, the Hong Kong Stock Exchange disclosed that Berkshire Hathaway sold 1.33 million BYD H shares on August 24, with an average price of 277.1 HK $/share, and cash about 60 million US dollars.

After sale this time, Berkshire Hathaway's number of BYD has fallen to 219 million shares, that is, in two months, Berkshire Hathaway has reduced its holdings of 6.281 million shares.

Buffett's suddenly shot and hit BYD investors caught off guard. When not understanding the stockings of the stock, many people chose to sell their own stocks.

Although BYD responded to this that investors did not need to "over -interpret" to reduce their holdings, and recently BYD has not disclosed major issues, and the company's operations are normal, but the company's stock price has fluctuated significantly.

Beginning on August 30, BYD's stock price began to fall endlessly. By September 1st, it closed for three consecutive days. The company's A shares fell 8.56%, and Hong Kong stocks fell 11.96%.

However, the stock god sold BYD is not groundless. On July 9, BYD's total number of shares circulating in Hong Kong's central settlement system increased by 20.49%, corresponding to Citibank's sudden increase in BYD 225 million shares, which was regarded as Buffett's sale of BYD's precursor.

Since then, Buffett has continued to lighten up until it was disclosed for the first time on August 30.

It is worth mentioning that before the reduction of BYD, the stock god was not idle. In the first half of the year, he continued to increase its holding of oil companies.

Just half a month ago, Berkshire Hathaway had just obtained the approval of the US energy regulatory agency and could purchase up to 50%of Western oil companies.

Earlier, the company frequently shot and bought traditional energy companies such as Western Petroleum and Chevron. At the end of February this year, after reading the record of Western Petroleum Corporation in the fourth quarter of February 25, Buffett bought nearly 10%of the company's shares of the company in 5 days;

Buffett emphasized: "For Western oil, we can buy as much as we can buy."

In the next five months, Buffett practiced his words. From June 17th to July 6th, Berkshire Hathaway took four shots and bought more than 30 million Western oil, which also means that Buffett already owns 175 million Western oil shares and about 18.7%of the shares. In addition, Berkshire also owns 100,000 Western oil priority shares, 84 million shares recognized equity certificates. In addition, it has an option of buying another 83.9 million shares. Buffett's shareholding ratio reached about 28%.

At this year's shareholders' meeting, Buffett was asked why heavy warehouse held oil stocks. Buffett said that there are many strategic petroleum reserves in the US government, and now everyone may think that there are so many oil reserves in the United States.

"But think about it, the current reserves are still not enough. It may be gone in three to five years. You don’t know what will happen in three or five years."

In addition, Buffett recently explained that the ESG problem and investors' general indifference to the traditional energy industry have led to a sharp fluctuation in the industry in the past few decades, which directly affects the market value of the company's company and creates an opportunity to buy.

Looking at the operation of Buffett in the first half of the year, it may be that the converting key was pressed between the old and new energy sources.

Coincidentally, Elon Musk CEO Elon Musk sold approximately 7.92 million Tesla shares from August 5th to 9th to cash about about $ 6.9 billion in Tesla shares. $ 32 billion.

The new and old richest people have cash out in the field of new energy vehicles, adding a trace of uncertainty to the market.

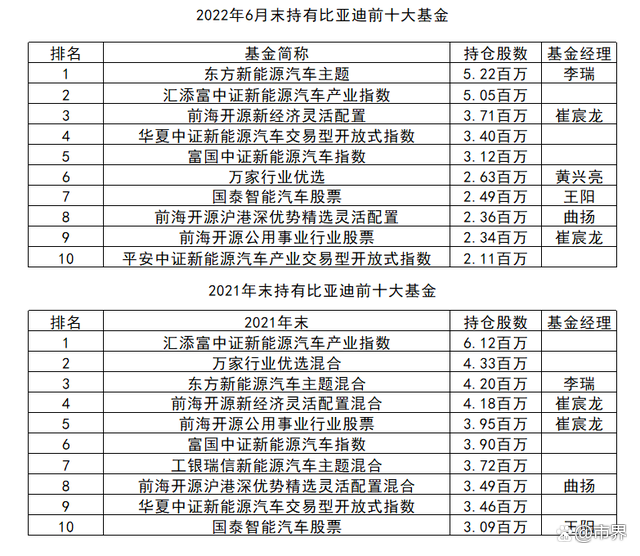

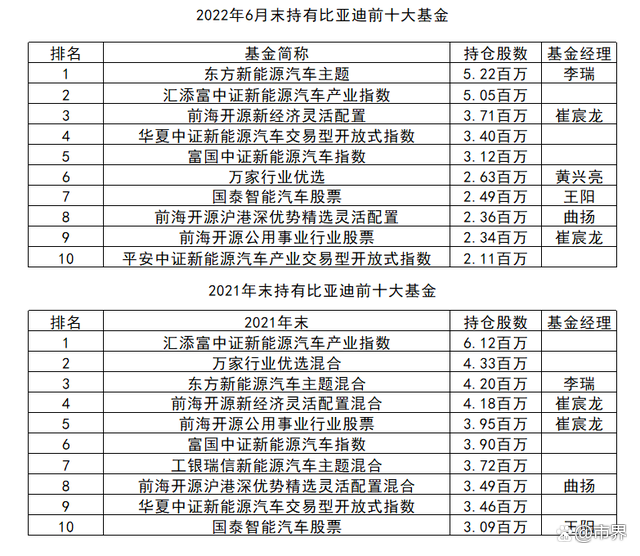

However, contrary to the stock god, more domestic institutional investors are involved in BYD. Choice data shows that at the end of 2021, a total of 1,228 funds in BYD A shares participated in the investment, with the number of stocks of 171 million yuan; this number rose to 1523 and 180 million shares at the end of June 2022.

As of the end of June, the fund holding BYD's most position was the Oriental New Energy Vehicle -themed Fund managed by Li Rui, holding 5.21 million shares, accounting for 0.28%of circulating shares, an increase of 1.01 million shares from the end of 2021. In addition, Cui Yilong, Huang Xingliang, Qu Yang, and Wang Yang, the well -known star fund manager of the market, are also among the best, but these are reduced to varying degrees.

The sought after by so many fund managers has nothing to do with BYD's excellent operation and bright performance.

The night before the results of Buffett's reduction, on August 29th, BYD just announced the most dazzling semi -annual report over the years.

Data show that BYD achieved operating income of 150.607 billion yuan in the first half of the year, an increase of 65.71%year -on -year; net profit was 3.595 billion yuan, an increase of 206.35%year -on -year, and non -net profit of deduction reached 3.029 billion yuan, an increase of 721.72%year -on -year. Among them, net profit and revenue set a new high in the same period, and the net profit has exceeded the whole year of last year. The important contributor to BYD's revenue during the car business. In the financial report, the revenue of BYD automobiles, automobile -related products and other products in the first half of the year was 109.267 billion yuan, an increase of 130.31%year -on -year. This means that the total income of the automobile business has exceeded 70%, while the same period last year was 52.2%, an increase of more than 20%

From January to June 2022, BYD sold more than 640,000 units, leading Tesla nearly 80,000 vehicles, winning the global new energy vehicle sales championship. According to the China Automobile Association data, in the first half of 2022, BYD's new energy vehicle market share was 24.7%, an increase of 7.5 percentage points from 2021.

Buffett's reduction may disturb the emotions and stock prices in the short term, but what really determines BYD's future trend is whether the operation can continue to grow steadily.

But now, BYD has not exhausted.

(Author | Li Yan)

- END -

The face and the people!Berlin Park "micro -transformation" realizes "micro -improvement"

Parks are not only a good place for urban residents to recover, but also an import...

I am in the Mid -Autumn Festival, and the safe moon is rounder

Folding XiangguiyuanMid -Man -Mid -Autumn FestivalIn the family's reunion daysTher...