"Black Swan" is here?Buffett sells logical puzzles behind BYD, whether the new energy sector has "risen to the head"

Author:Huaxia Times Time:2022.08.31

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

On August 31, BYD rushed on Weibo hot search, causing more than 400,000 netizens to pay attention. The reason is that a news from the Hong Kong Stock Exchange's reduction from Buffett's company has caused a stir in the stock market.

On the evening of August 30, data from the Hong Kong Stock Exchange showed that Buffett's Berkshire Company reduced its holdings of 1.33 million shares (01211.HK) on August 24, and the reduction price was HK $ 277.1016 300 million Hong Kong dollars. The number of shares held by Berkshire Hathaway fell to 219 million shares, and the proportion of shares with the right to vote was reduced to 19.92%.

It is worth noting that on the evening of August 29, BYD shares released a semi -annual report. According to data from the semi -annual report, as of the end of June 2022, Buffett's BYD shares have not changed. In other words, the reduction of holdings was carried out in the past two months.

The reporter of the Huaxia Times called the concurrent interview letter to BYD's secretary office. As of the press time, no reply was received. However, relevant persons in BYD responded to the media that BYD has not disclosed in major matters in the near future, and the company's operation is normal. Regarding market guessing, do not need to interpret it.

BYD's stock price is hit hard

It is reported that Buffett subscribed for 225 million shares in BYD in 2008 for the price of HK $ 8/share. After calculation, as of now, Buffett's investment in BYD has exceeded 30 times. If the average price of HK $ 277.1016/share is estimated, its profit is more than 34 times.

Chen Fengzhu, manager of Hong Kong Anri Asset Management Investment Group, told the reporter of the Huaxia Times that Buffett's holdings were likely to lock some profits.

As of the close of Hong Kong stocks on August 31, BYD shares reported at HK $ 242.2/share, a decrease of 7.909%, a transaction volume of 27.9958 million shares, and a transaction value of HK $ 6.659 billion.

A -share BYD (002594.SZ) is also implicated. On August 31, BYD closed at 287.98 yuan/share, compared with the closing price of 310.85 yuan/share on August 30, a decrease of 7.36%. Roughly estimated that BYD's market value fell over 66 billion yuan within a day.

He Li, the chief investment consultant of Guotai Junan Securities, analyzed the reporter of the Huaxia Times that Buffett's reduction in the psychology of secondary market investors will have a certain negative impact, and the stock price also reflects this.

He Li pointed out that the scale of Buffett's holdings is very limited, which is not enough to mean that he is not optimistic about BYD in the future. Of course, you need to pay attention to whether Buffett will continue to reduce his holdings. It is necessary to judge that in the end, it is only to reduce the holdings, or to clear all the positions, because the two are completely different.

He Li believes that because Buffett holds a large stock volume, the whole world is paying attention to his actions. In theory, he can only reduce his holdings in the fundamentals of the stocks he invested. Otherwise, everyone "runs" It is faster than Buffett, then he can't sell a good price. Therefore, it is understood that at this time, Buffett's reduction at this time just shows that BYD's fundamentals are in a upward and good development cycle.

Half -annual report performance is innovative

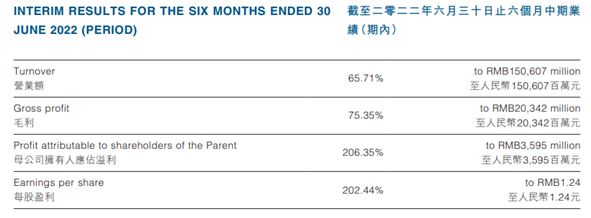

比亚迪H股半年报显示,公司在2022年上半年实现营收1506.07亿元(人民币,下同),同比增长65.71%;毛利203.41亿元,同比增长75.35%;归母净利润35.95亿元,同比The increase of 206.35%; the net profit of the mother after deduction was 3.029 billion yuan, an increase of 721.72%year -on -year; the profit per share was 1.24 yuan, an increase of 202.44%year -on -year; the net cash flow of business activities was 43.185 billion yuan, a year -on -year increase of 346.27%.

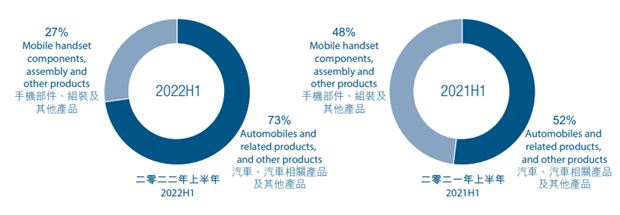

Among them, the revenue of automobiles, automobile -related products and other product business was 109.267 billion yuan, an increase of 130.31%year -on -year; the revenue of mobile phone components, assembly and other product business was 41.07 billion yuan, a year -on -year decrease of 4.78%; the proportion of the total revenue of the Group was 72.55, respectively. %And 27.27%.

A senior brokerage person told the China Times reporter that Buffett's reduction may have passed the outbreak of performance and income because BYD has increased the short -term valuation too fast, and the growth rate of income may not support high market value. In addition, the competitive landscape of BYD's core technology may not be clear in the short term. Whether BYD's blade battery technology leads or the battery technology of the Ningde era is ultimately breakthrough. The short -term may be uncertain factor.

Expert: New energy market is not over

A senior new energy sector fund manager told the reporter of the Huaxia Times that the short -term Buffett reduction incident or had an impact on the new energy sector. In the long run, the market's market is not over.

Chen Fengzhu pointed out that although BYD's current price is high, but because of the rapid growth of future profitability and increase in market share, it can support stock prices.

Regarding the market outlook for the new energy sector, Chen Fengzhu said that it will continue to be optimistic about the market outlook for the new energy vehicle sector. In addition to policy support, the technological improvement of mainland car companies has increased in except for penetration in the Mainland and exports. Affirmation.

He Li believes that the valuation of some stocks in the new energy sector is indeed relatively high.But overall, because the industry's prosperity this year is very high, the performance is actually better.Compared with the end of last year, the overall valuation of the industry (new energy vehicles, batteries, photovoltaic, and wind power) is not high.At present, the market is afraid of some stock prices, and the concentration of chips is relatively high. The track is relatively crowded. Therefore, the sharp fluctuation of the stock price is easy to understand.He Li said that from the long -term perspective, the prosperity of these new energy tracks in the future still maintains long -term maintenance, so the new energy sector is not rising, and the probability is just a significant adjustment.Make overestima worth digestion.

Editor: Editor Yan Hui: Xia Shencha

- END -

Damei Shuanghu is picturesque

Modern herdsmen on the western Sichuan PlateauUnder the high temperature, the face...

"Let's open, I'm here!" The guy kneels on his knees to save people, and he has another identity

Recently, Chaoyang District, Beijing A 4-year-old boy is unconscious , he lay his...