Buffett Buffett's first reduction in BYD for the first time in 14 years, earning 33 times!Better affects geometry?

Author:Jinan Times Time:2022.08.31

The stock god Buffett sells 1.33 million BYD shares H shares. This time it was Buffett's first sales of BYD in 14 years. Even at the average price of HK $ 277, the profit was more than 33 times. As the leader of the new energy vehicle sector, BYD, known as the "Di Wang", what impact will be reduced by Buffett's holdings this time?

On August 30, the Hong Kong Stock Exchange website showed that Buffett's Berkshire Hathaway sold 1.33 million BYD H shares on August 24, with an average price of HK $ 277.1016, cash out 369 million Hong Kong dollars, and still held 2.18 100 million shares, the proportion of voting rights that has been issued to 19.92%.

As early as July 12, there were market rumors that Buffett had reduced its holdings of 225 million shares of Hong Kong stocks, and BYD Hong Kong stocks closed more than 11%that day.

Buffett and BYD have accompanied the 14 -year earnings over 30 times

Buffett signed an agreement with BYD in September 2008 to subscribe to 225 million BYD shares at a price of 8 yuan per share, accounting for about 10%of its shares after sale, with a total amount of about 1.8 billion Hong Kong dollars. According to the 263 Hong Kong dollars/shareholding of BYD's closing on August 30, Buffett's overall value of BYD's stock applied by about 31 times, worth nearly 60 billion Hong Kong dollars.

BYD AH shares have increased in the past two years. There is no doubt that it is the hottest stock of the hottest new energy sector, and the market value is also the number one Chinese car company. Therefore, investors are also called "Di Wang".

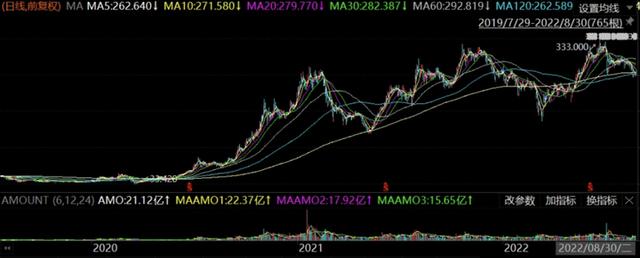

Among them, BYD A -shares minimum on March 24, 2020, 47.32 yuan, and June 13, 2022, a maximum of 358.75 yuan, a maximum increase of more than 6 times.

In terms of Hong Kong stocks, BYD shares were HK $ 33.42 on March 23, 2020, and the highest report of HK $ 330 on June 28, 2022, a maximum increase of nearly 9 times.

Therefore, BYD's first reduction by Buffett will be psychologically influenced by investors holding new energy vehicle stocks.

Analysts: Buffett will continue to reduce the holding BYD follow -up investors may follow

Yan Zhaojun, a China -Thailand International Strategy Analyst, told the Finance News Agency that Berkshire's shareholding of BYD's shareholding in July of this year was transferred from physical stocks to CCASS (Hong Kong Central Settlement and Harment System). Essence He predicts that Buffett's holdings will continue, and this position that is held from Citi can also be seen. This news puts pressure on BYD's stock price, mainly because investors in the market may also reduce their holdings due to the actions of the stock god.

On September 29, 2008, Buffett's Berkshire Hathaway spent HK $ 1.8 billion in Hong Kong dollars at a price of 8 Hong Kong dollars, subscribing to BYD 225 million shares in Hong Kong stocks. Since then, Buffett has been warehousing BYD, and has also attended BYD's new car release and other activities to platform for BYD.

The old partner of Buffett Buffett, Charlie Munger, Vice Chairman of Berkshire Hathaway, has been hailed as "mutual achievements" with BYD. Wang Chuanfu: "It is simply a mixture of Edison and Welch. He can solve technical problems like Edison, and at the same time, he can solve the problem of corporate management like Welch. I have never seen such a thing."

As of the closing of August 30, BYD A shares fell 0.86%, closed at 310.85 yuan/share, H shares fell 0.45%, and closed at 263 Hong Kong dollars/share.

BYD becomes a global new energy vehicle sales crown

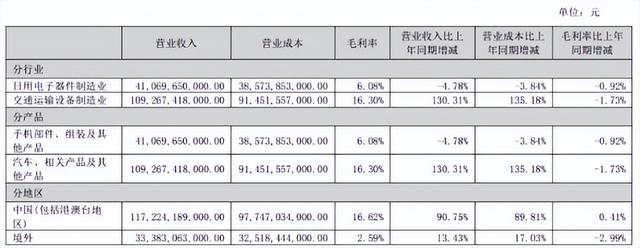

BYD, who has just sent the semi -annual report, from the fundamentals, the data is better.

The money made by BYD in the first half of 2022 was over 2021.

BYD's 2022 semi -annual report shows that BYD achieved operating income of 150.607 billion yuan in the first half of the year, an increase of 65.71%year -on -year;

The net profit attributable to the mother was 3.595 billion yuan, an increase of 206.35%year -on -year, and the net profit of returning mother was 3.045 billion yuan in 2021.

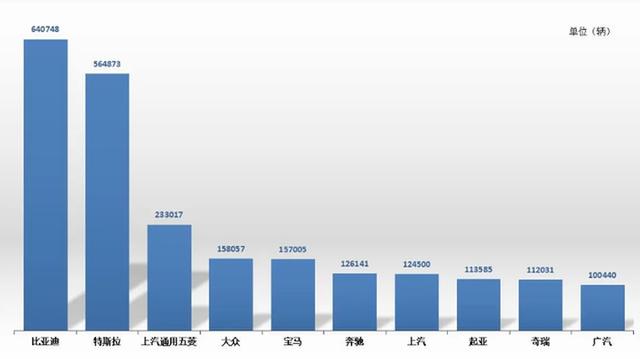

Moreover, in the first half of 2022, global new energy vehicle sales rankings, BYD defeated Tesla, cumulative sales in the world.

BYD sold 640748 units in the first half of the year, with a market share of 15.4%, Tesla's cumulative sales of 56,4873 units, a market share of 13.6%.

(Comprehensive Surging News, Finance Association, Sohu Finance) Editor: Zheng Chuqiao

- END -

Our city has built 2636 pension service facilities from 2636 to 2025, and the proportion of nursing beds of pension institutions is not less than 60%

On the 28th, Li Pingwei, the director of the Civil Affairs Bureau, was commissione...

Extraordinary ten years | "Three efforts" running out of innovation leads the acceleration of revitalization and development