Newcomers join the job, please pay attention to special tax deductions for individual taxes

Author:Chinese government network Time:2022.08.29

Source: China Tax News WeChat

How to operate the special income tax deduction of personal income tax, do you need to save the relevant information? Let's take a look at the relevant hot Q & A.

1. What should be operated by enjoying the special tax deduction of individual taxes?

Answer: (1) If the taxpayer chooses to apply for a special additional deduction by the deduction obligation within the year of the taxpayer, it shall be handled in accordance with the following regulations:

(1) If the taxpayer selects the deduction of the deduction obligations and submits the special additional deduction information through the remote tax terminal, the deduction obligor shall be deducted according to the receiving information.

(2) If the taxpayer directly submits the electronic or paper "Deduction Information Form", the deduction obligor will import the relevant information or enter the deduction software, and submit it when the withdrawal of the withdrawal of the withdrawal is submitted the following month. Give the tax authority in charge. The "Deduction Information Form" should be in two copies, and the taxpayer and the deduction obligor signs (chapters) and retain them for inspection.

(2) If the taxpayer choose to apply for a special additional deduction when you apply for a remittance and settlement declaration of the year, you can submit the special additional deduction information through the remote tax handling side, or the electronic or paper "deduction information form" (one formula "(one formula" Two) submitted to the tax authority of the remittance land.

If you submit the electronic "Deduction of the Information Form", the tax authority in charge of the tax authority is accepted and printed. After the taxpayer is signed, one shall be reserved by the taxpayer, and the other shall be reserved by the tax authority; After the signing and confirmation of the person in charge of the tax authority accepted the signing, a refund of the taxpayer was retained for investigation, and one was retained by the tax authority.

2. What should I do if the deduction obligations do not accept the special additional deduction information submitted by the taxpayer?

Answer: If the taxpayer provides a special additional deduction information to the deduction obligor, the deduction obligor shall be deducted in accordance with regulations and shall not refuse. The deduction obligations shall be confidentially confidentially submitted by the taxpayer.

3. Does the company deduct the information of the special income tax of employees?

Answer: If the taxpayer is filled in the electronic or paper "Deduction Information Form", the deduction obligor will be submitted to the deduction obligations, and the deduction obligor will import the relevant information or enter the deduction software, and submit it to the withdrawal of the withdrawal of the withdrawal of the deduction of the next month to the deduction declaration. Tax authorities. The "Deduction Information Form" should be in two copies, and the taxpayer and the deduction obligor signs (chapters) and retain them for inspection.

4. What are the methods of special additional deduction information collection?

Answer: Taxpayers can submit personal special additional deduction information to the withdrawal obligor or in charge of tax authorities through the method of remote taxation, electronics or paper statements, etc.

Policy basis:

"The State Administration of Taxation on the Revision and release of the - END -

The city's first Volunteer Association Women's Federation was established

On June 26, the Women's Federation of the Colorful Delivery Volunteer Association of Liaocheng City was established.This is the first women's federation established in our city to establish in the Vol...

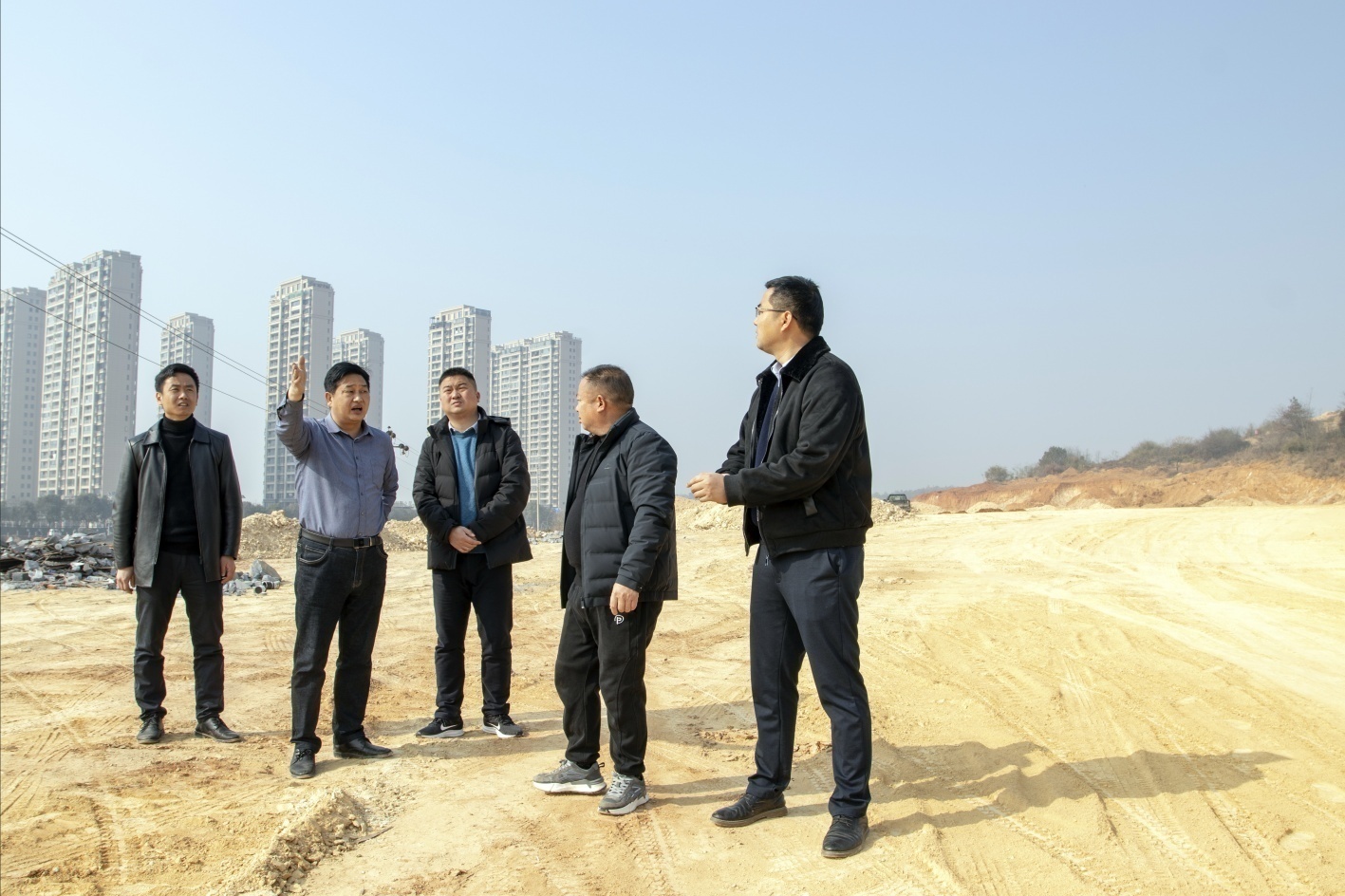

Poyang Raozhou Street: Beautiful window to build the central city of the east bank of Poyang Lake

In the first half of 2022, the target positioning of the Five Subsidies and Five B...