Zhao Wei: Inflation or long -term risk under European energy transformation

Author:Zhongxin Jingwei Time:2022.08.25

Zhongxin Jingwei August 25th.

Author Zhao Weiguo Guojin Securities Chief Economist

The energy increase caused by the Russian -Ukraine conflict has stimulated the vulnerability of the inherently vulnerability of the European energy system. In the context of European energy transformation, we need to be alert to long -term risks.

European energy high depends on imports

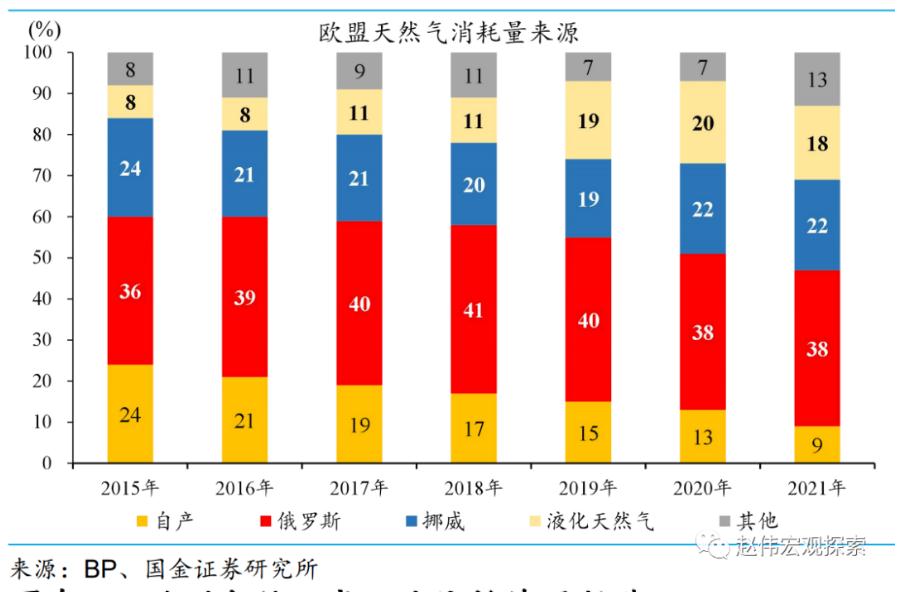

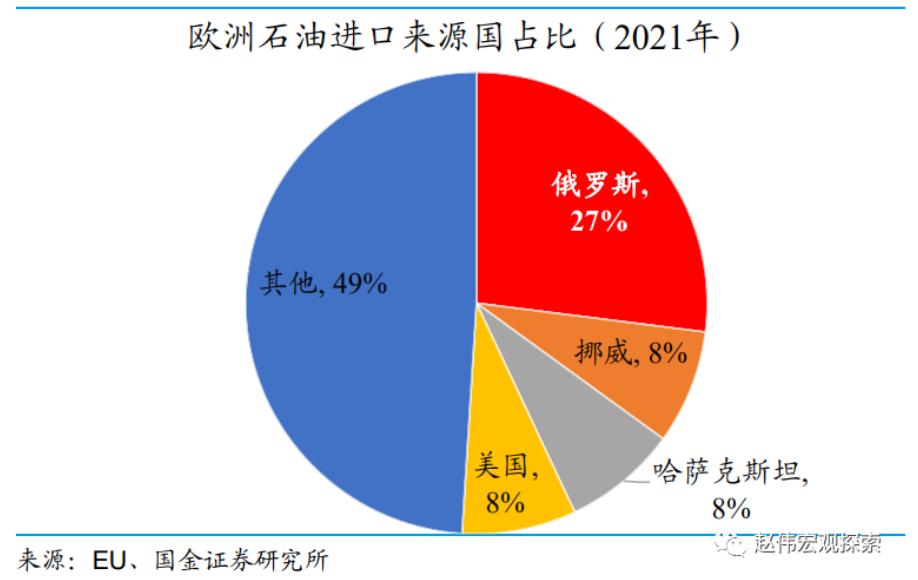

The European energy system has natural vulnerability, extremely low self -sufficiency, and high dependence on imports. Despite the huge consumption, European natural gas, petroleum, coal and other traditional energy output are low, and the external dependence is extremely high. In European energy imports, about 40 % of natural gas, 30 % of crude oil, and 50 % of coal are supplied from Russia.

Figure 1 European about 40 % of natural gas relies on Russia imports

Figure 2 about 30 % of European crude oil imported from Russia

Figure 3 European imports of about 50 % of coal Russia

In the context of the increasingly exhausted traditional energy production capacity, in order to reduce the dependence of energy, the European layout has transformed into green energy. For example, Europe continues to increase investment in wind power and photovoltaic investment. In recent years, under the advancement of the carbon emission reduction movement, Europe has restricted traditional energy investment, which has continued to reduce the power generation of "non -clean" energy such as coal. It is worth noting that, as a transitional energy under the carbon neutralization path, the proportion of natural gas power generation has also risen.

Figure 4 Europe continues to increase investment in wind power and photovoltaic equipment

Due to the "radical" and green energy fluctuations of energy transformation, EU energy supply and demand has been relatively fragile in recent years. For example, its dependence on Russia has further increased, and the price of natural gas has been greatly increased. At the same time, European electricity prices are also "rising." Since the outbreak of the Russian -Ukraine conflict, many economies such as the United States and Europe have continued to sanction in Russia, which has worsened the situation of Russia and Ukraine. The continuous restriction of energy supply under geopolitical conflict has further highlighted the pressure on European energy price increases, which has intensified the vulnerability of the inherent vulnerability of the European energy system.

Figure 5 Electricity prices in major European economies are "rising and high"

The fragile energy system increases the European economy constraints

The recent surge in energy prices has led to a sharp rise in production costs in some upstream companies in Europe, severely eroding profits and suppressing production prosperity. Including some upstream industries, including electrolytic aluminum, refined zinc, and chemical fertilizers, energy costs account for a high proportion of total production costs. For these middle and upstream industries, in the context of soaring energy prices, related companies can only be forced to reduce or even discontinue production. Compared with the corporate sector, the European residential sector has a significant impact on energy increases. At the same time, the electricity prices of European residents have also been significantly higher than industrial electricity prices.

European inflation or evolution to long -term risk

In the context of trying to get rid of Russia's energy dependence, European energy problems may continue in 2022. On the one hand, photovoltaics and wind power, including restarted nuclear power, need to take a long time, and it is difficult to ensure the effectiveness of the year. At the same time, the contradiction between supply and demand for alternative energy such as coal is no less than natural gas, and the price increase is even better. In terms of gas storage, due to the significant dependence of different European economies to Russia's natural gas, the prospect of gas storage investment is unknown. In summary, in the context of lack of Russian energy supply, European energy issues may still be more severe in 2022.

For policy authorities, the risk of inflation under European energy transformation is likely to evolve into long -term issues. In the long run, under the "general trend" of carbon neutralization and policy to promote the continuous decline of traditional energy capacity, the unstable supply of green energy supply may easily enlarge the supply and demand of energy supply and demand in stages. At the same time, the rise in the price of carbon emission rights may mean that in the transitional transition period, high energy prices will evolve into a new normal. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Zhang Yan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Shijiazhuang ordinary primary and secondary schools of summer illegal supplementary courses and reporting telephones and mailbox announcements

In order to thoroughly implement the double reduction policy, effectively reduce t...

Xiaogan Meteorological Observatory lifted lightning yellow warning [III level/heavier]

Xiaogan Meteorological Observatory June 08 07.41 was lifted at 16:29 on June 07th at 16:29.