"Fengkou Research Report · Company" LNG+Hydrogen+Glutiny+its own fleet transportation. This company has a comprehensive layout of clean energy and has the advantages of gas source+transportation. Analysts estimated that this year's net profit is close to double.

Author:Federation Time:2022.08.22

This company takes the liquefied natural gas LNG business as its core and has the advantages of its own fleet transportation. At present, the layout of clean energy industry chain is formed by cutting into other fields such as hydrogen+sorcene. The current PE is only 10 times.

Company essence:

① The company's main products include clean energy such as liquefied petroleum gas (LPG) and liquefied natural gas (LNG). With the advantages of its own dock and its own fleet, the cost will be reduced. It is expected to double;

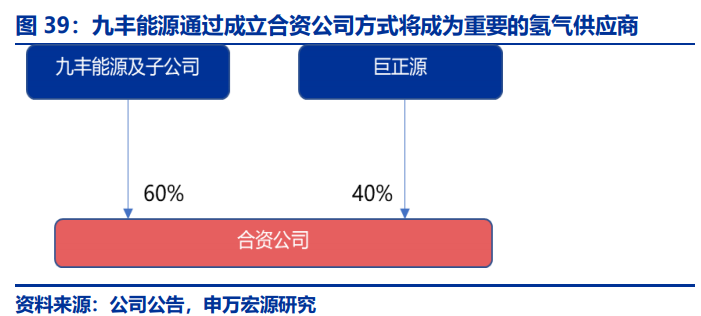

② The company has newly cut into the hydrogen and sorbe business to build a new growth point. At present, the hydrogen of 25,000 tons of by -products has been put into production through the joint venture company.

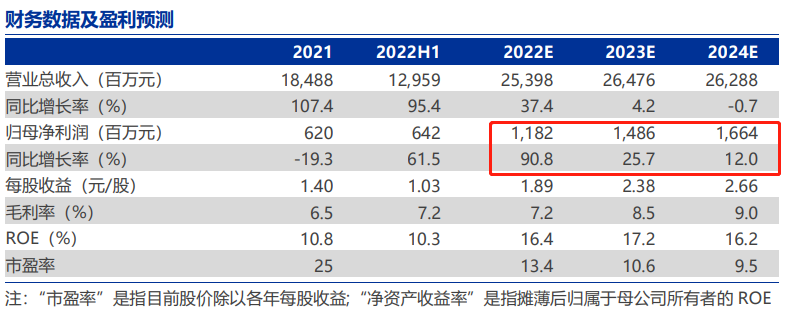

③ Shen Wanhongyuan Securities Wang Lu is expected to return to the company's net profit from 2022-2024 to 11.82/14.86/1.664 billion yuan, an increase of 90.8%/25.7%/12%year-on-year. X, the first coverage is given to "buy" rating;

④ Risk reminder: Overseas natural gas prices fluctuate, and the construction cycle of docks and transport vessels does not meet expectations.

Last year and this year's electricity limit incident highlight the importance of traditional energy, Shen Wanhongyuan Securities Wang Lu's latest covering a layout of Jiufeng Energy (605090), which has a layout of natural gas LNG as its core and expanded to hydrogen and sorbe business. The company It has formed a double -gas pattern of sea and land. The traditional business has strong growth in the future, and the development direction is in line with the background of low -carbon and clean energy revolution.

Wang Lu expects that the company's net profit from the company from 2022-2024 is 11.82/14.86/1.664 billion yuan, an increase of 90.8%/25.7%/12%year-on-year. Give "buy" rating.

Comprehensive supplier of clean energy industry in South China, the stable development of LNG and LPG business

The company has been cultivating in South China for 30 years. The main products include clean energy such as liquefied petroleum gas (LPG), liquefied natural gas (LNG), as well as chemical products such as methanol and di methalulthars (DME).

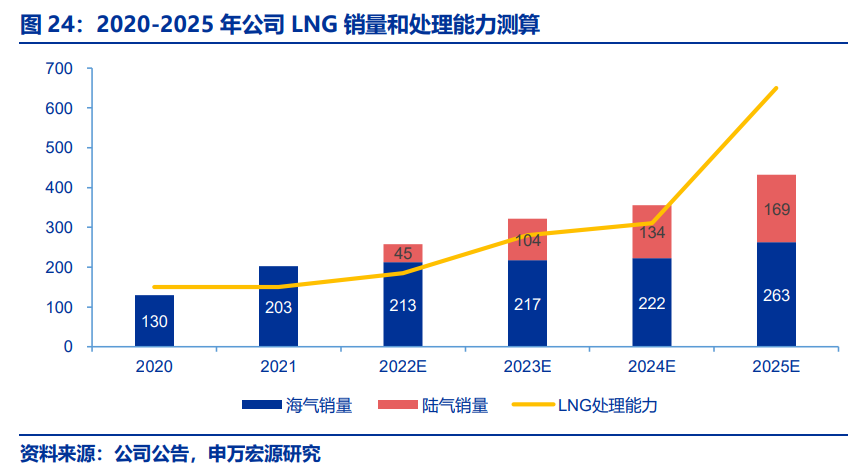

In 2021, the company's LNG and LPG business accounted for 53.43%and 42.22%, respectively. With its own dock advantage, the capacity of LNG and LPG can reach 1.5 million tons/

In the year, the transportation cost was reduced through its own fleet.

In 2022, with the improvement of the company's industrial chain and the increase in overseas air sales, the company's performance improved significantly, and operating income was 12.959 billion yuan, an increase of 95.36%year -on -year; net profit of home mother was 642 million yuan, an increase of 61.54%year -on -year.

At present, a new LNG ship and LPG ship are built, and the Guanghai Bay LNG Wharf, which has a capacity of 3 million tons/year, and the Huizhou LPG terminal of 1.5 million tons/year. It is expected to be put into use in 2024-2025. At that time, the sales volume of LNG and LPG imports from the company is expected to double.

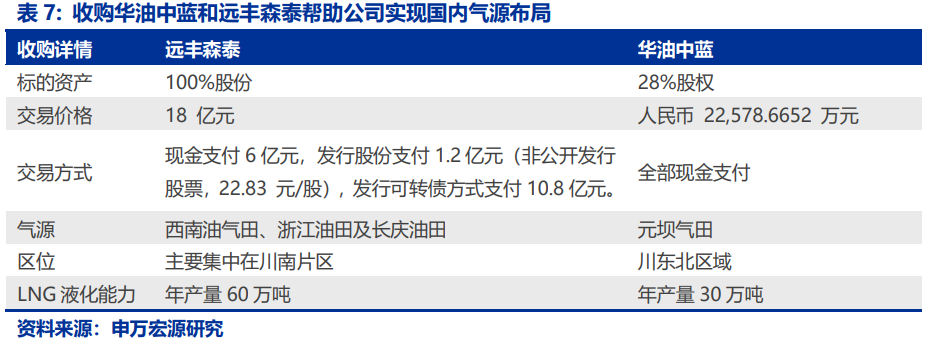

The market believes that international natural gas prices in 2022 are worried that rising sea gas costs will affect the company's gross profit level. However, nearly half of the company's sea gas resources are relatively small and relatively small, and with the formation of the company's sea and land dual gas pattern, domestic gas sources will optimize the company's intake costs. At the same time, the company can use its own advantages of capacity, flexibly selling overseas natural gas, and reducing the import price of natural gas in the domestic market on the inversion of the domestic LNG factory price.

Cut into the hydrogen and sorbe business to build a new growth point

The company has a cost advantage. It has LNG terminal resources in Dongguan and has a low cost of overseas gas. It has a unique cost advantage to carry out natural gas reconstruction of hydrogenation in Guangdong Province.

At present, through strategic cooperation with Juzhengyuan and mergers and acquisitions, the company has cut into hydrogen and athletic tracks at the same time this year. The first phase of the Jizhengyuan PDH device has been put into production. The annual output of 25,000 tons of glyphs through the propane dehydrogenation device has entered the plan of the second phase of the PDH device. The annual output of hydrogen is expected to be 25,000 tons.

After the company acquired Yuanfeng Sentai, he obtained high -purity radon resources. Yuanfeng Sentai has achieved gas production, and the purity has reached a level 5N level. Expand the advantages of the ingenuity industry.

Shen Wanhongyuan calculated that the company's hydrogen business: 2023-2024 sales were 1/20,000 tons, and gross profit margin was 29%/33%.

Glipper business: 2022-2024 sales 18/20/26 million cubic meters, gross profit margin is 89%/87%/86%, respectively.

Recently in this column clean energy series:

On August 17th, "Light thermal Power Generation+Heating Power Supply+thermal Power flexibility renovation, analyst Qiang Call, a new type of heat storage application scenario, is the potential route of the long -term energy storage track, the scale is expected to achieve leapfrog growth"On August 16th, "New Technology Demonstration Project in the field of energy storage was put into commercial operations within the year, and this company has been exclusively authorized by the world's leading leadership, accelerated with the signing of cooperation with the Electric Power Group" on August 16 "" Power Grid Interconnection+adjustment "is expected to become power supplyImportant supplements, this field can be aggregated and coordinated for distributed energy sources. Analysts are optimistic about it as one of the most economical power supply means. "On August 11," Energy Storage+Power Generation Integrated Technology solves the current new energy access to the Internet.Pain point, the scale of this project under construction is 4 times the scale of the project under construction, analysts sort out the beneficiary company "

- END -

More than 100 tons, 20,000 loving vegetable bags!@, Pick the vegetables

In the early morning of the 29th, the Xinguang Pneumonia Epidemic Institute of Che...

Longconggouzheng: The Internet celebrity punching place burst into tragedy, sounding the "wild scenic spot" safety alarm clock

New Yellow River Reporter: Sun MinYu Hong (pseudonym) did not think that the origi...