Financial services help the Shanxi market subject double

Author:Shanxi Economic Daily Time:2022.08.15

New products for corporate reduction rates, timely retain tax refund, and physical development ... Since this year, all departments of our province have made positive efforts for market entities. Among them, the inclusive financial service department has continued to implement a policy and put a funds to help market entities running out of "acceleration".

Window guidance has power

"As of the end of June, the province's banking financial institutions and non -bank payment institutions made a total of 175 million yuan to the real economy, and the cumulative market entities were benefited from 960,000 households." Recently, relevant persons from the Taiyuan Center of the People's Bank of China introduced to reporters.

In order to ensure that payment services are reduced to make the profit policy effectively benefiting market entities, the central branch has established a "small and micro enterprise dynamic identification mechanism" and "fee refund mechanism" to accurately deliver preferential policies to the eligible market entities. Those who cannot accurately define the identity of the enterprise shall be "depleted"; in response to the situation of multiple fees and errors, simplify the refund processing process and procedures, and ensure that the refund policy should be "enjoyed." At the same time, the central branch has strengthened normalized inspections and dynamic return to prevent the incidental rate of rebound; strengthening the leadership of state -owned banks, creating a good atmosphere of paying the payment industry to reduce the expenses; Good use. In the next step, the central branch will also organize the province's financial services subjects to continuously dig in depth and reduce the cost reduction, ensure that the policy bonuses are effective, and benefit the people's livelihood.

All branches under the Shanxi Regulatory Bureau of the China Banking Regulatory Commission have successively issued a series of measures to support the local market subject, and guide financial institutions to do financial services. The Yuncheng Banking Insurance Regulatory Bureau issued the main points of financial services in Yuncheng Banking Bank and Insurance Insurance, focusing on guiding the return of the banking insurance industry financial institutions to return to the main business, promoting the annual annual activities of market players' multiplier engineering and market entity, accurately connecting financing Demand, deepen small and micro financial services, expand the financial coverage of individual industrial and commercial households, and promote the stable operation and strong vitality of market entities. As of the end of June, the loan of small and micro enterprises in Yuncheng City was 52.8 billion yuan, an increase of 21.1%; the average interest rate of the newly issued inclusive small and micro enterprise loans was 6.62%, a decrease of 0.42 percentage points from the average interest rate last year.

Financial institutions

"We take the entrepreneurial guarantee loan as the starting point, support ten types of personnel such as returning to entrepreneurial migrant workers, independent entrepreneurial farmers to realize their entrepreneurial dreams." The person in charge of the Postal Savings Bank Shanxi Branch told reporters.

It is understood that the branch actively launched financial products and service models suitable for individual industrial and commercial households and start -ups to meet the financing needs of new market entities.

Our provincial banks, including postal savings banks Shanxi Branch, actively relieve their worries for private enterprises, small and micro enterprises, and individual industrial and commercial households.

Postal Savings Bank Shanxi Branch has launched a loan of 815 million yuan this year to help more than 4,100 people start a business. At the same time, 24,600 households were issued to 14,600 individual industrial and commercial households with a loan of 2.23 billion yuan, and a loan of 3.874 billion yuan was issued to small and micro enterprises.

Pudong Development Bank Taiyuan Branch is close to market demand, taking "Rongzhi+financing" as its main line. By building a special inclusive financial product system, it will focus on promoting the increase in market entities. As of the end of June, the bank supported 132 small and micro enterprises with a amount of 110 million yuan.

ICBC Shanxi Branch is 8654 small and micro customers who have invested 12.7 billion yuan in inclusive small and micro loans, and 718 new small and micro enterprises have been added. The "incremental expansion" effect of inclusive loans has continued to increase.

The Taiyuan Branch of Bohai Bank has set up green channels for small and medium -sized enterprises, simplifying the account opening process of customers and enhanced customer experience. At the same time, the establishment of the list of inclusive credit customers and active credit to increase the public account 819 households.

CCB Luliang Branch has invested 2.5 billion yuan in inclusive financial loans for more than 3,200 small and micro customers this year, with a balance of 1 billion yuan.

Native

Market subjects survive

Shanxi New Elephant Breeding Co., Ltd. is an important agricultural enterprise in our province. The upstream customers are 1181 pig farmers including individuals, individual industrial and commercial households, cooperatives, etc., which are distributed in 50 counties and surrounding Inner Mongolia in our province. Hebei and other places. The "New Elephant Pig Model Model" loan products developed by CCB Wenshui Branch make farmers "no need to worry about pig -raising roads, guarantee technical security, and funding channels." "Elephant Loan" officially landed in mid -March, with a total amount of 700 million yuan, which enhanced the vitality of the agricultural market entity.

The farmhouse business households in Kunshan Village, Lingchuan County want to improve their tourism reception capacity, but the construction cost of hundreds of thousands of yuan makes them worry. After the staff of the Agricultural Bank of China Shanxi Jincheng Branch learned of this, they formulated a financial service plan for "Huinong E Loan" as the main product. After the implementation, the plan was implemented, so that more than 20 farmhouse operators received more than 3,100 million yuan in credit.

In order to allow new energy enterprises, casting enterprises, domestic waste incineration power generation and dining kitchen waste treatment projects, medical device enterprises, agricultural production cooperatives, logistics companies, and even chain convenience stores in the provincial capital, they all enjoy the financial services that improve quality increase, each Focusing on the inclusive financial business, financial institutions should take the mission to support market entities, and do their best to serve the majority of market entities such as small and micro, "agriculture, rural areas", and individual industrial and commercial households.

Each financial institution has continued to make efforts to serve market players with effective action, fully promote the continuous development of market players, injecting strong motivation and vitality into the province's all -round promotion of high -quality development, and laid a solid financial foundation for market players to multiply.EssenceShanxi Economic Daily reporter Li Ruonan

- END -

Zhumadian: Features of characteristic planting

Reporter Ding JipoRecently, the reporter walked into the Fengqiu Ecological Gourd ...

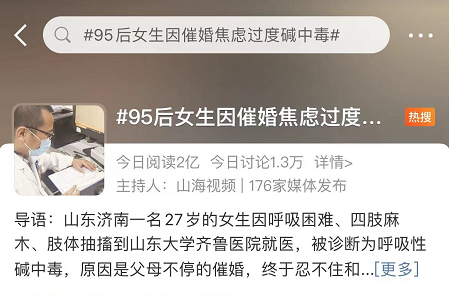

After the 95th, girls were diagnosed as respiratory alkali poisoning, but because they were urged to marry ...

China Business DailyJuly 19thThe post -95 girls are over -alkali poisoning due to ...