Qinghai Taxation: "First Leader" processing process promotion service is more accurate

Author:Qinghai Tax Time:2022.08.15

"We declare that the increase in tax refund is more than 30,000 yuan, and the last time we refunded more than 60,000 yuan. The company's operation was affected by the epidemic this year. The support for tax refund funds was very critical. We will use the tax refund to buy fuel. Continue to organize production activities. "Li Jinxia, a tax personnel of Qinghai Tong'an Transportation Co., Ltd., said when the Secretary of the Party Committee and Director of the State Administration of Taxation's Qinghai Provincial Taxation Bureau, Van Zhagen said when the process of" walking the process "to help him apply for tax refund declaration.

Pictured: Director of the Qinghai Provincial Taxation Bureau Fan Zhagen's processing process is more accurate (Li Xianyuan shooting)

In the past few days, the Qinghai Provincial Tax System has conducted a “first -hander” process work in accordance with the deployment of the State Administration of Taxation and the Qinghai Provincial Party Committee. , Promote the implementation of combined tax support policies. On the morning of June 2nd, Vanza went into the Tax Service Office of the Chengzhong District of Xining City to experience the tax payment service process as a taxpayer or taxpayer. Implement the reinstatement, the process of processing the process, and the improvement of service quality. At present, 60 people at all levels of tax authorities at all levels in the province have achieved 100%of the first -line to the front desk to experience the business processes of service windows such as tax payment and business review, and solve the problem of the problems in practice.

Do the matter of every taxpayer

In the experience area of the Electronic Taxation Bureau on the first floor of the Taxation Service Hall in the urban area of Xining, modernized taxation facilities are arranged in an orderly manner.

Pictured: Fan Zhagen Experience Social Security fee payment business processing process (filmed by Li Xianyuan)

Fanza randomly walked to a crowd who handled the business, asked about the situation and accompanied the counseling to handle taxes and fees. "I applied for the unit to pay some social security premiums in the Human Resources Department in June. Now I come to the tax department to pay the social security premiums that need to be paid by the individual.

Log in to the management client of the social insurance premium unit, fill in the taxpayer identification number and login password, review and submit the application application, complete the personal payment part of the application and pay, print the "Taxation Certificate of Taxation of the People's Republic of China", and complete all the processes for about 2 minutes. Fan Zhagen's opinion and suggestion of the payment of the funders, Ma Hailan said: "Now the social security medical insurance payment channel is very rich, the operation is simple, and it is particularly convenient. It is no online self -service fee function. It is helpful to affect the operation of the special period, and it is helpful to spend the difficulties now. "

"The responsibility of social security premiums is transferred to the taxation department, and the two lines of the income and expenditure are clearer. In order to safeguard the rights and interests of each payment person and ensure the security of social security funds, there is no online refund function." Fan Zhagen patiently and meticulously and meticulously and meticulously. Explain the payment of the payment, and ask the relevant business departments to do a good job, further strengthen the communication and coordination of the department, finely serve the reasonable needs of each taxpayer's payment, and solve the problems for the masses.

Pay attention to each tax refund processing link

The new taxpayer package area on the first floor of the taxation hall is crowded, and the people who receive invoices in the tax area of self -service offices are endless. Fanza's attention to the implementation of the epidemic prevention and control measures on the front line, understand the convenience of tax payment for more procedures, and study specific measures for the deployment of overall epidemic prevention and control and key taxation work.

In the special window of personal income tax settlement business, Vanza and the taxpayer Liu Gang experienced the personal income tax annual settlement process. Liu Gang said that there is no difficulty for individual tax banks, the amount of tax refund is not large, and the tax director helps to handle it very warm.

Pictured: Fanza's experience individual tax calculation process (shooting Li Xianyuan)

"There are a large number of taxpayers in individual taxes, which directly involves the interests of the masses. We must focus on promotion, implement in place, and ensure progress." Fan Zhagen said that he is also a taxpayer and has already handled the settlement of settlement and completed the corresponding tax supplement. Payment.

Remembering the timely approval of Li Jinxia's tax refund, Vanza came to window No. 10 on the second floor, and the "walking process" went to the taxation department for tax refund for tax refund. He logged in to the core collection and management system as a tax personnel approved job, received the inquiry of taxpayers' reserved tax refund declaration, inspecting intelligent approval, risk prevention and control prompts, reviewing data items, comparison policies matching situations, enterprises classified and existing data, etc. Confirm and pass the tax refund review.

During this period, Fan Zhagen and the tax cadres of the approval post fully exchanged it to understand the tax refund, tax reduction, fee reduction, etc. at the grassroots level. The types of import and sales characteristics and risk, and the recognition measures of risk points, in particular should strengthen the integration of tax business, policies, regulations, and big data and information systems, condense joint efforts, ensure accurate services, policy implementation, and ensure that tax fraud is zero to zero tax fraud. Tolerance, tax is absolutely safe.

Fanza also experienced the "first violation" declaration and handling process, and told tax personnel to pay special attention to protecting the legitimate rights and interests of taxpayers.

Optimize each set of taxes and fees business processes

In the secondary 12366 tax payment hotline, Vanza experience the process of reporting (remote handling) process (remote handling) process of cross -regional tax -related matters, and communicate with online taxpayers. "Now you can communicate with video, and you can handle a lot of business remote," said Li Dan, a taxpayer who is connected.

Pictured: Fan Zhagen Experience Remote Counseling and Cross -regional Tax Report Report (Shooting of Han Shifeng) The "First Leader" of the Qinghai Provincial Taxation Bureau finally, the relevant business department of the Provincial Bureau, the Xining Taxation Bureau, and the Taxation Bureau of the Main Urban District , Window personnel, etc. conduct discussions, answer doubts on the spot, and dredge the difficulties in the work.

In response to the situation changes in the process of grass -roots personnel, and the pressure of risk data review should be stressful, the "first -hand" walking process work group made timely feedback at the symposium. The province's tax system must adhere to the leadership of party building, promote business integration, form a joint force to solve problems, work together to promote the continuous optimization of each process, reflect the "four essences" with the process, promote the reform of the management service, and promote services more accurate; in the early stage of work On the basis, further strengthen publicity and counseling, and further improve risk recognition and prevention capabilities. In particular, in response to large enterprises and special industries and individual situations, we will implement measures such as "one enterprise, one policy" classification and classification counseling, so as to achieve both bold work, rigorous and prudent, and promote the accurate release of policy dividends.

The reporter asked Director Fan Zharagang, did he do related homework before the "first -hander" process? Fan Zhagen said with a smile that this homework was relatively solid. Not only itself, the members of the Party Committee of the Provincial Bureau, the first time the policy was introduced, repeatedly studied the implementation measures, put forward the "nine precision" work requirements, and continuously improved and improved the key tax work tasks to achieve tax refund and tax reduction and reduction. The policy is quickly implemented, facilitating taxpayers to the greatest extent, and the most intentional measures to do practical things for the masses. This time, the taxpayer and the taxpayer experience the tax payment of different identities and experience the work process of the grass -roots window business. Based on the problems of the "first -hander" process of finding the problem, we will focus on promoting the actual problems of front -line research. The Provincial Bureau will promote leading cadres at all levels to further approach taxpayers and taxpayers, and to promote taxes and fees more accurate and better serve the people.

Author Han Shifeng Correspondent Yang Bo

- END -

Anhui establishment of a long -term mechanism to ensure the payment of wages of migrant workers

On June 15th, in order to effectively prevent housing construction and municipal i...

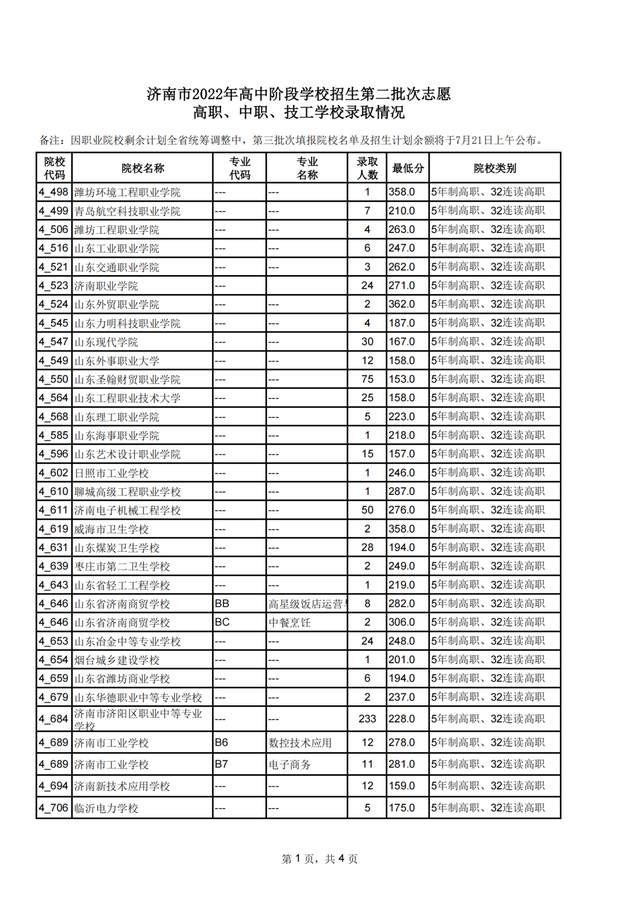

The second batch of volunteers to fill in the admission situation in Jinan High School (excluding Laiwu, Steel City)

At 15:00 pm on July 20, the Jinan Education Bureau Zhongzhong held the second batc...