Buy 20%of Western oil shares to meet the "measuring" standard. Buffett is not afraid of the decline in oil prices?

Author:Kanjie Finance Time:2022.08.14

Buffett's heart would bring Western oil to Majesty.

According to a document disclosure submitted to the SEC by Buffett, from August 4th to August 8th, Berkshire bought about 6.68 million Western oil stocks, costing about $ 400 million After the completion of the holding of this time, Berkshire's holding of Western oil has reached 20.2%.

It is worth noting that Berkshire currently holds the standard of "measuring" Western oil. Moreover, Berkshire has become the largest shareholder of Western oil.

It can be seen that Buffett's ultimate purpose may be to acquire Western oil, not simple financial investment.

So why did Buffette dare to re -bet on petroleum stocks? Why did he start adjusting his strategy and take the initiative to increase investment to reduce the proportion of cash holdings?

On August 6, Berkshire released the second quarter of 2022 financial reports and semi -annual reports. The financial report showed that Berkshire's revenue in the second quarter of this year was US $ 76.18 billion, a year -on -year increase of 10.2%; A $ 100 million, a year -on -year increase of 38.7%; but the net loss attributable to shareholders in the second quarter was US $ 43.755 billion, while the same period last year was $ 28.094 billion.

For the loss of the quarter, Berkshire explained that in the second quarter, a loss of US $ 66.919 billion in investment and derivatives. In fact, the cause of losses is the loss of heavy stocks in the second quarter.

Judging from the positioning data of Berkshire in the second quarter, the top five companies held by Berkshire accounted for 69%of the total investment, namely:

First, Apple. The proportion of holdings is nearly half, and the market value of the position is $ 125.1 billion (calculated on the day of the issuance of the financial report);

Second, Bank of America. The market value of the position is $ 32.2 billion;

Third, Coca -Cola. The market value of the position is 25.2 billion US dollars;

Fourth, Chevron. The market value of the position is 23.7 billion US dollars;

Fifth, the US Express has a market value of $ 21 billion.

It can be seen that although Berkshire made a large proportion of investment in one and two quarters, its proportion of Apple exceeded the sum of the second to fifth largest positions. It is reported that the overall stock price of Apple in the second quarter of this year fell 21.63%, which means that Apple's loss occupies a big head of losses. But it is worth noting that as of now, Apple's stock price has risen by 26%in the third quarter of this year, which has almost recovered all the declines. The loss items will also make up for it.

In addition, why Berkshire dares to heavy warehouse oil stocks because of the low proportion of oil stocks in Buffett's position. Although since last year, Buffett has continued to buy Western oil until it enters the top ten stocks, but from the current situation, the proportion of still holds a low share. Based on the market value of 61.2 billion The stock market value is about $ 12.4 billion. Even if the investment in Western oil has a large proportion of losses, it is not great on Buffett's positioning.

Since the third quarter of this year, international oil prices have fallen a certain percentage. At present, the price of Brent crude oil is $ 98.01, and the price of Nymex crude oil is $ 91.88, which has a decline of $ 30 or forty. I believe Buffett will not perceive the changes in oil prices.

So, since you understand the changes in international oil prices, why does Buffett continue to buy Western oil without hesitation? The answer may be that he saw something else. In fact, Western oil is no longer a traditional oil company. In addition to traditional energy, it is a new environmental protection enterprise.

It is reported that in the second half of this year, Western Petroleum plans to build a global top -level direct air capture technical facilities in Texas. After being put into operation, the facility can extract 1 million tons of carbon dioxide from the atmosphere each year, which is currently more than 100 times the total global carbon capture.

Not only that, Western Petroleum also signed a five -year agreement with South Korea's SK International Trade, which will provide 200,000 barrels of net zero carbon emissions each year. That is to say, if Western oil is successfully transformed in the future, the company will be Re -valuation, then Buffett can continue to "lying".

Therefore, Buffett will continue to increase western oil in the future until Western oil is completely acquired.

- END -

Multi -village community in Cangnan County, Cangnan County, Wenzhou City, and multiple forms of garbage classification popularization promotional service activities

Volunteers' promotion, on -site explanation of the launching point, the theme acti...

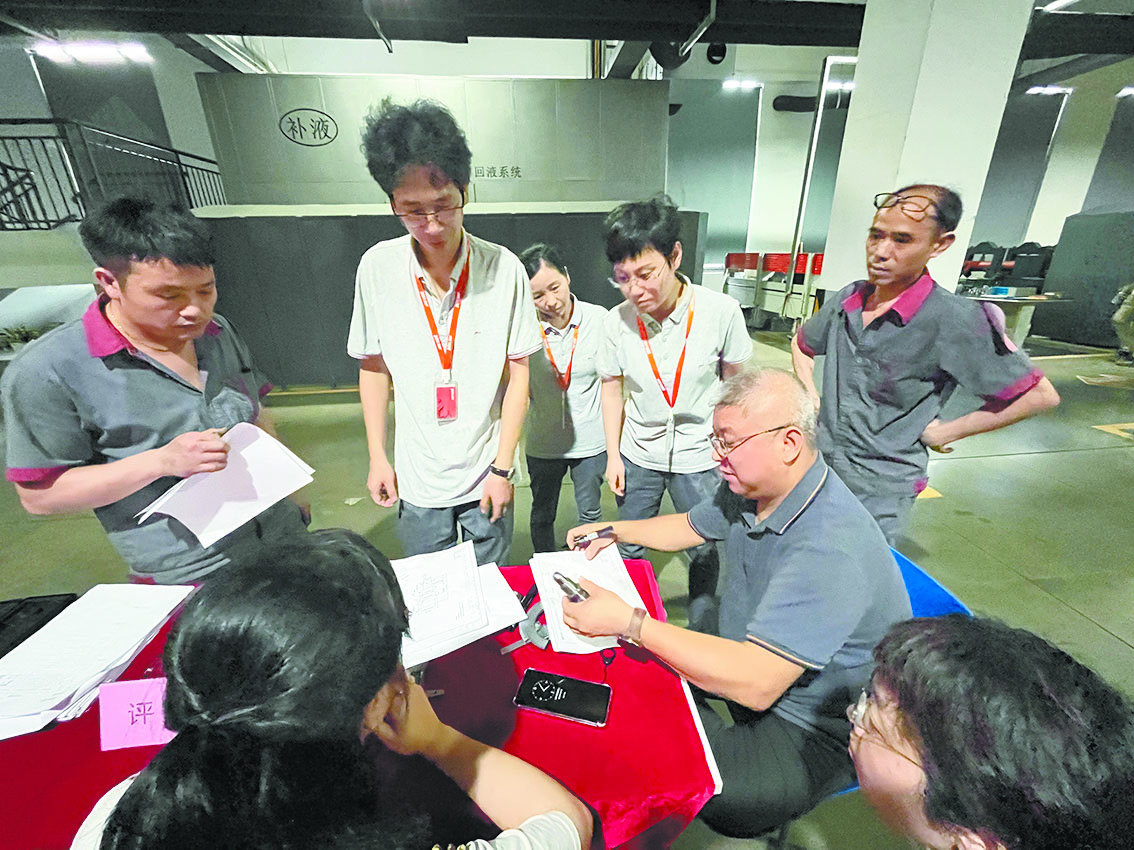

Skills professional competition, carefully guide the model!Zhejiang Federation of Trade Unions grass -roots squatting dot group to polish and cultivate skills talents "tested gold stones"

Xu Bin commented on the works of the contestants one by one. Reporter Jin Junxun P...