The new power system+photovoltaic+wind power+energy storage of "Fengkou Research Report · Company", the company has become the second in the industry, but analysts still believe that the market's growth in the company's growth and the quality of reporting

Author:Federation Time:2022.08.09

① New power system+photovoltaic+wind power+energy storage, the company has achieved the second in the industry, but analysts still believe that the market has insufficient awareness of the company's growth and report quality; The cycle calculation still has 2 billion+profitable base, and has begun to transform new energy business.

"Fengkou Research Report" Today Introduction

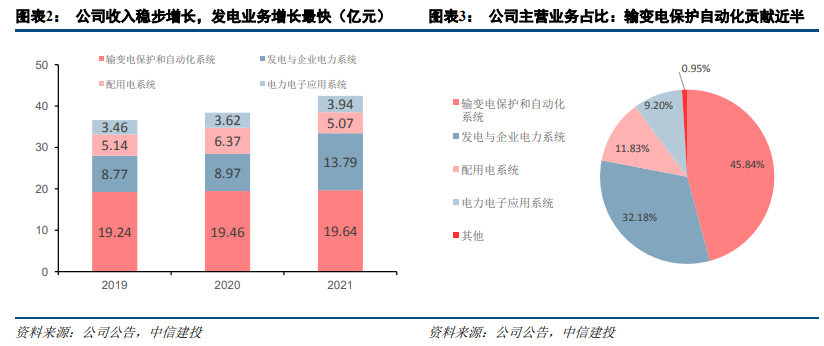

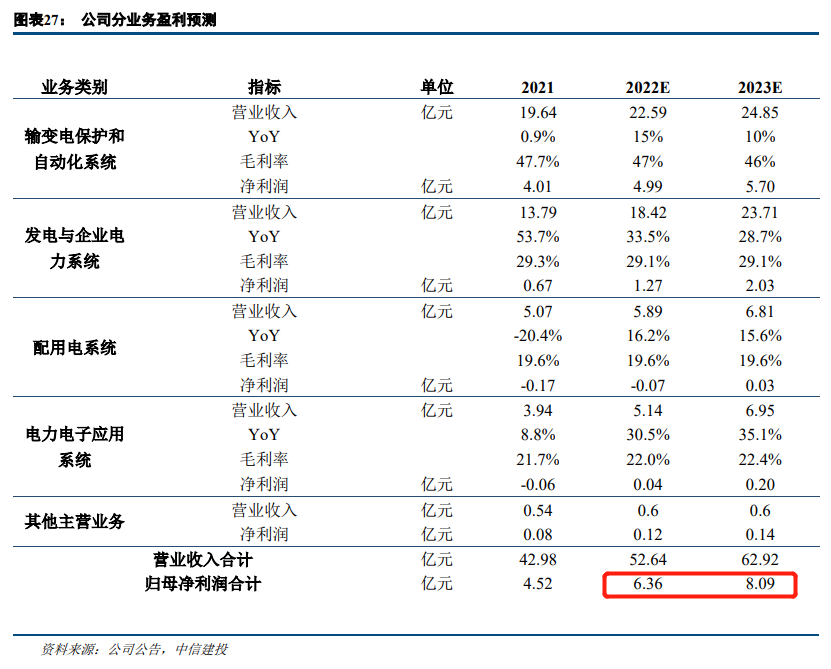

1. Company 1: ① The company is a domestic relay protection and secondary equipment leading enterprise. In recent years, the market share in the National Power Grid and Southern Power Grid relay protection automation concentrated bidding is stable between 16%-20%, second only to the second only to the second only to the second only to 16%-20%. Guodian Nanrui ranked second; ②China CITIC Securities Zhu Xi believes that this year is the year of landing of the new power system. The State Grid Grid investment will exceed 500 billion yuan. As of now, the company's winning bid shall have reached 18.21%. System construction; ③ The company's horizontal extension of the new energy voltage stations, large industrial enterprise user substations, thermal power transformation, park power consumption and other fields, and set up a distributed energy business department to enter the distributed photovoltaic and energy storage business to open the road of growth; ④ Zhu Xi believes that the market has insufficient awareness of the company's growth and the quality of reporting. The expected difference is large. It is expected that the net profit attributable to the mother to the mother is 6.36/809 million yuan, respectively. ; ⑤ Risk factor: The growth rate of power grid is less than expected, and the growth rate of new energy installation is less than expected.

2. Company 2: ① The completion of the real estate will be greatly improved in the second half of the year. The reason is that the completion will become the source of funds, and the future completion cycle will be shortened to 2 years; ② the demand for floating glass is closely related to the completion of the real estate. Bao Yanxin believes that both ends of the current glass supply and demand are gradually repairing from the worst situation; ③ Neutral perspectives at this round of floating glass demand elastic or limited, opportunities are not in the sector, companies with reliable new business incrementally include: Qibin Group, Xinyi Glass, and South Glass A; ④ Risk reminder: Cliff -type decline in completion demand; raw materials such as energy and soda sodae increased prices exceeding expectations.

Theme one

The new power system+photovoltaic+wind power+energy storage, the company has achieved the second in the industry, but analysts still believe that the market has insufficient awareness of the company's growth and report quality

Today, CITIC Construction Investment Securities Zhu Ye deeply covered Sifang Co., Ltd. (601126). The company is a domestic relay protection and secondary equipment leading enterprise. Entering the power field to open the road of growth for the company.

Sifang Shares Protection Automation's market share in the industry is second in the industry, and the construction of new power systems continues to benefit

The company's core business is the protection and automation system of transmission and transformation, which is one of the six people in the domestic relay protection.

In recent years, the company's market share in the National Power Grid and Southern Power Grid Reexia Protection Automation Automation Electricity Bidding has stabilized between 16%-20%, second only to the second only to the National Electric Nanyu position.

Zhu Xi believes that this year is the year of the new type of power system. The State Grid Grid investment will invest over 500 billion yuan.

As of now, the first and second batch of concentrated bidding for relay protection of State Grid reached 1.595 billion yuan, an increase of 23.4%year -on -year, and the company's winning bidding share reached 18.21%, a year -on -year increase of 1.6 percentage points.

New energy, energy storage, and power distribution business are the road to grow in Sifang shares

The company exerts its technical advantages. The vertical extension and cutting into the field of intelligent terminal equipment is integrated for one or two times. Entering distributed photovoltaic and energy storage business.

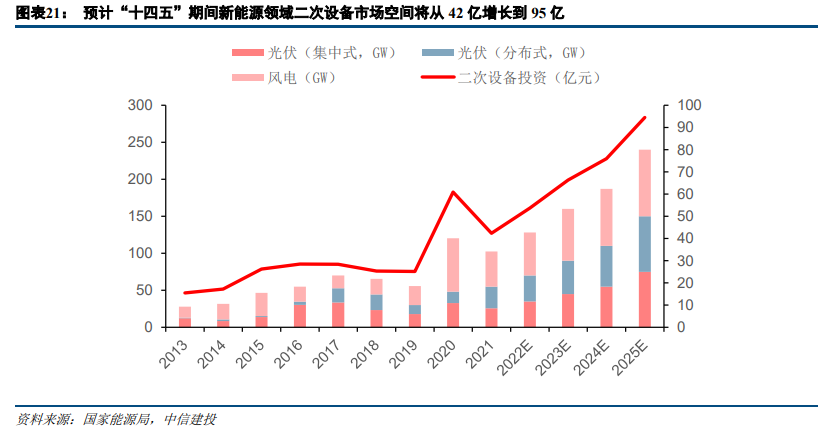

(1) In terms of new energy: In the context of the main development model of wind power photovoltaic bases, the number of new energy boost stations increases and the voltage level increases.

After Zhu Ye's calculations, the secondary equipment market space in the new energy field is expected to increase from approximately 4.2 billion in 2021 to about 9.5 billion in 2025, with a compound growth rate of 22.6%.

(2) The use of electricity: At present, the fusion of one or two has become the technical development trend of distribution equipment, with an penetration rate of more than 80%.

The company can provide products with complete power distribution automation, prefabricated substations, power distribution terminals, and one or two fusion switches. It is expected that the company will have a larger space under the background of the power grid investment towards the distribution grid.

(3) In terms of energy storage: The company's project is rich in experience and has a strong ability to take the single. At present, it is mainly integrated projects, but it pursues scale expansion.

The market has insufficient awareness of the growth of Sifang shares and the improvement of report quality.

In the context of my country's New Energy with Wind Power Photovoltaic Base as the main model, the company's large system integration capabilities formed by the company's deepening power grid relay protection will be more valued. New energy business is expected to maintain a growth rate of more than 35%.

In addition, under the situation of the concept of the new power system this year and the high investment of power grid investment, Reex Power Protection is expected to achieve an increase of about 15%as the company's traditional advantageous business.

Zhu Xi believes that the market has insufficient awareness of the company's growth and the quality of reporting. The expected difference is expected. It is estimated that the net profit of the mother-in-law will be 6.36/809 million yuan in 2022-23, and the corresponding market value PE is 20.5/16.1 times.

Recently in this column clean energy series:

On June 28th, "The first large -scale" full -scale liquid stream battery "energy storage power station is about to be commercially available in the battery. The battery has a accurate positioning of the energy storage storage field of 16,000 cycle life in 30 years. "Welcome to the Wind" on June 21 "After the introduction of the wind power segmentation leader was introduced into the state, the scarcity" anti -shrinkage "link was also followed. Incrementing space will be 6 times the total income last year. "Trend" on June 20 "The commodity decline, analysts are optimistic that the industry will be directly benefited from the decline in raw material costs, the cost of company materials accounts for nearly 90%, and short -term stock price elasticity Reads 120GW Dahaong expectations! Analyst's "Fighting" in the second half of the year is expected to double the growth of the shipment. At the same time, the prices of the main raw materials of the upstream at the same time have dropped significantly by 20%+the "quantitative interest double rise" "on June 17" distributed photovoltaic+energy storage+charging Pile+Internet of Things, this power segment industry will usher in the "price increase+replacement" cycle, the total bidding amount of the South China network has risen by 60%, the number of qualifications under the implementation of new standards has been significantly reduced "June 13 "Sea wind power prosperity is in the early stages of launch, and the second half of the year and next year are expected to usher in high -month increase. This company has a scarce production capacity in many places, and it is expected to double the performance next year."

Do not miss the real estate recovery. The limit periodic calculation still has 2 billion+profitable base. It has begun to transform new energy business

Recently, the real estate industry has received great attention. Vanke Yu Liang believes that the real estate market has bottomed out, but the recovery process will be slow and mild. Guotai Junan Xie Haoyu believes that since the supervision of pre -sale funds in 2021, the completion of real estate has begun to decline significantly, but the completion of the real estate will be greatly improved and accelerated in the second half of the year. It will be shortened to 2 years.

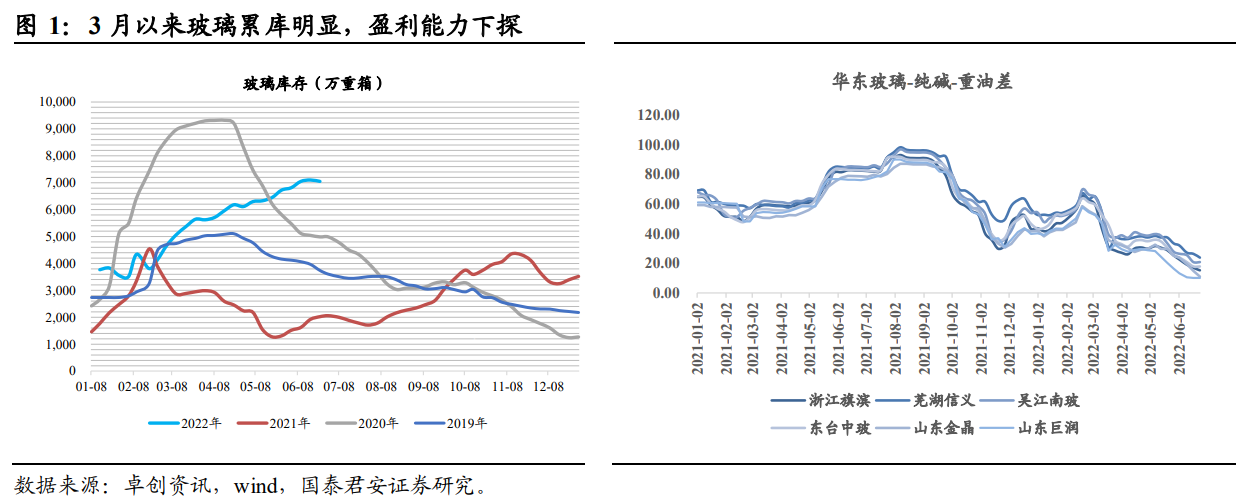

The demand for floating method is closely related to the completion of the real estate. Guotai Junan Baoyanxin today covers the floating glass industry and believes that the two ends of the current glass supply and demand are gradually repairing from the worst case. Under the premise of a reasonable floating method profit center, the focus is on the focus. Companies are recommended to have a strong profitable texture and contribute to the performance of diversified business in 2023, including Qibin Group, Xinyi Glass, and South Glass A.

The worst situation at both ends of supply and demand has occurred in profitability.

Since the beginning of the year, the tightness and continuity of downstream real estate funds in the glass have exceeded expectations. Since the Q2 quarter, glass production and sales have shown a peak season. The average price of 5mm white glass nationwide has fallen from 2400 yuan/ton to the current 1,800 yuan/ton. The current glass inventory has reached a new high in recent years.

At the same time, due to the unanimous optimistic glass of the market outlook, the cold repairs were delayed, and the glass began to accelerate the accumulated library since March. At the same time, the price of glass has been exploring all the way. Some low -cost areas have entered a current stage.

In the later stage of the industrial game, from the cold repair to the exfoliation repair

Since June, positive repair signals have appeared:

1) Cold repair gradually started: Last enterprises have fallen to 10 yuan/weight box in June. Historically, when the profit of the headpiece of the header was shrinking to 10 yuan, a large -scale cold repair appeared in the following quarter.

With the accumulation of inventory, the pressure of high -cost small lines rose sharply. In the second half of June, the production lines in East China and the north began to release cold repair. Cold repair showed that the industrial expectation game began to loosen compared with the previous height.

2) Increased real estate sales to the bottom of the real estate sales: In May, the sales area of new houses in a single month in May narrowed year -on -year, and the month -on -month increase was increased. It further clarified the restoration trend of the destination rate. Prerequisites for power enhancement.

Opportunities are not in the sector.

Looking at this round of floating method in a neutral perspective, the current supply is 10%higher than that of 2020, and the demand for the completion of this round requires real estate endogenous leverage repair. It is a relatively slow variable, which brings the entire completion demand to stable and smooth in 2023.

Therefore, starting with caution and conservative angle, maintaining the "limited elasticity" assumption of floating glass "limited elasticity". After 2020, the sector sexual market of glass is difficult to copy, but even under the hypothesis of the price elasticity of the limited floating method, the head company has already shown better Valuation Safety. Outdoor Floating Method's profitable texture and diversified business can effectively contribute incremental performance.

Qibin Group: The bottom of the risk is clear, the new business is excellent. In the second half of 2022, Qibin Energy -saving/photovoltaic glass will contribute profit increases. Electronic/pharmaceutical glass will accelerate the scale, and the profit and valuation will be flexible.

Calculation needs to return to the level of 2018-2019. According to the business structure of 2023, the price of the floating method/photovoltaic glass is not considered. It is expected that the company's overall profit bottom is about 2.5 billion yuan, corresponding to the current PE13 times, and the security margin is sufficient.

Xinyi Glass: The decline in the semi-annual report performance is 35-50%, the decline is significantly better than the industry, showing a good leading risk ability. The profit of Xinyi in 2023 is 8 billion Hong Kong dollars, corresponding to the previous market value of only 9 times PE, and the 50%dividend rate assumes that the dividend rate is 6%.

Company 1: Sifang Co., Ltd. (601126)

Company 2: Floating Method Glass (Qibin Group, South Glass A)

Recent cycle series of this column:

On June 28th, "Enjoy the era of energy rising in 2022, the company's single -quarter performance reached a record high, the net profit in the first half of the year is expected to catch up with the whole year of last year, and there is still 1.9 billion payables to accelerate the recovery" June 27 "The demand for the downstream wind power of this chemical product accounts for 60%, and the investment logic electrolyte PVDF is for lithium batteries. Only 3 listed companies in China have 10,000 tons of production capacity. "The second echelon leader also has quartz sand resources, this company's current valuation and expectation are located at the bottom. "On June 15th," The newly connected orders in the industry in the first May of the industry, the newly connected orders exceeded 80 billion yuan, and the analyst Qiang CALL 20 -year big cycle has beenRe -start, and the new regulations of the EU "carbon neutral" will be forced to implement or improve the replacement needs in 2023 "

- END -

Don't wait!Just in Lizhou!Come to this ancient village to experience the cool summer

With summer breezeStepping on the cool stream beside the small bridgeLet's go to t...

Luo Yonghao Fa Changwen Farewell to the social platform: will still live and bring goods in the futu

[Dahecai Cube News] On June 13, Luo Yonghao officially announced that he left to m...