In the first half of the year, the Shandong Taxation Department handled a total of 511.16 billion yuan in export tax refund for 37,051 export enterprises in the province

Author:Published in Shandong Time:2022.08.05

This morning, the Provincial Government News Office held a press conference to introduce the relevant situation of "Implementing the New Combined Tax and Fee Support Policy" and answered questions from reporters.

Shandong Comprehensive Broadcast Reporter:

As the "last ring" of the Treasury of the People's Bank of China, as the "last ring" of the transmission of fiscal and taxation policies, what measures have been taken to ensure that the tax refund funds are directly enjoyed to the market entity?

Wang Jinghui: The new "combined" tax support policy implemented this time is an important measure to help market entities relieve difficulties and reduce burden on the real economy. During the implementation of the policy, the national treasury departments at all levels of the People's Bank of China Jinan Branch firmly took the political responsibility of paying the tax refund funds directly to the taxpayer's "last mile". In the first seven months of this year, the treasury treasury at all levels in the province handled a total of 7.827 million tax refund business and 265.7 billion yuan, which were 1.3 times and 1.2 times of the whole year last year; of which the value -added tax retained tax refund business volume and amount were last year. The year of the year is 28.5 times and 2.8 times, and the tax refund funds are delivered to the market entity with precise services. To this end, we focus on the following two measures:

On the one hand, strengthen responsibility for responsibility and compact tax refund security responsibilities. The People's Bank of China Jinan Branch firmly establishes the concept of "people's supremacy", and has taken tax refund work as the "first leader" project. Provincial, municipal, and county -level treasury linkages, organize hard work, coordinate the resources of all parties, do a good job in the maintenance of various parameters of the national treasury system in advance, and jointly carry out the full -chain business training with the fiscal and taxation departments to strengthen human, material resources, and capabilities. Take the initiative to extend the business day of the working day, abandon the holidays such as May Day and weekends, work overtime, and make every effort to ensure the timing of tax refund. Especially during the peak of the tax refund in April, it was also a severe period of the province's epidemic situation. Cadres and workers at all levels of the province's treasury at all levels in the province eat and live in the job, stick to their posts, and ensure that the treasury services continue to file. The guarantee of tax refund funds will be allocated to the taxpayer's bank account as soon as possible, and the "hard index" of the Treasury people in exchange for the "happiness index" of the taxpayer.

On the other hand, optimize the tax refund mechanism and process, and improve service quality. Facing the pressure of double tax refund business, the state treasury department has faced the difficulties, and conscientiously studied the difficulty of tax refund work with the fiscal and tax departments, opened the green channel of the Treasury, promoted the tax refund business classification and processing mechanism, and rely on the advanced national treasury business system to fully implement Non -contact tax refund, "tolerance" for non -critical elements, can effectively achieve "getting, reviewing, and doing". Pay close attention to changes in the stock treasury inventory, adhere to the traction and result orientation of the problem. According to the demand for tax refund funds and the situation of the treasury funds, balanced scientific and rational scheduling and use of the library to ensure that the tax refund is "done one time" and the market entity is safely reached.

New Yellow River client reporter:

In the first half of the year, what policies and measures did the Shandong taxation department implemented, what effectiveness did the Shandong taxation department implement?

Wang Baoming: In the first half of 2022, the Shandong Taxation Department handled 511.6 billion yuan in export tax refund for 37,051 export enterprises in the province, an increase of 12.1%year -on -year.

Since 2022, the State Administration of Taxation has successively introduced a number of preferential convenience measures to increase support for export tax refund. The Provincial Taxation Bureau continues to implement the following three policies in accordance with the requirements of higher -level deployment.

First, if the enterprise obtains the export credit insurance compensation because it cannot collect foreign exchange, the export credit insurance compensation compensation is listed as a foreign exchange collection, and the export tax refund is required. The Provincial Taxation Bureau actively coordinates the Shandong Branch of China Credit Insurance Co., Ltd. to promote its optimization of export credit insurance insurement insurance and claims, expand the coverage of export companies, especially small and micro enterprises, and help enterprises better prevent foreign exchange collection risks.

The second is to actively carry out the work of "not exempting and deducting tax deduction deductions" in processing trade enterprises. Since the introduction of this policy, the Provincial Taxation Bureau has figured out the province's export enterprises, and the point -to -point policy will be promoted to processing trading companies. It is expected to benefit more than 1,500 export enterprises in the province, reduce the burden of export enterprises 140 million yuan, and support the development of processing trade trade. Essence

Third, from June 20, 2022 to June 30, 2023, more than 40,000 export enterprises in the province will enjoy the average processing time of normal business to be shortened to convenient services within 3 work days. Realize the "day of the day", effectively improve the level of export tax refund facilitation, and create a high -quality foreign trade business environment.

(News Office of the People's Government of Shandong Province)

- END -

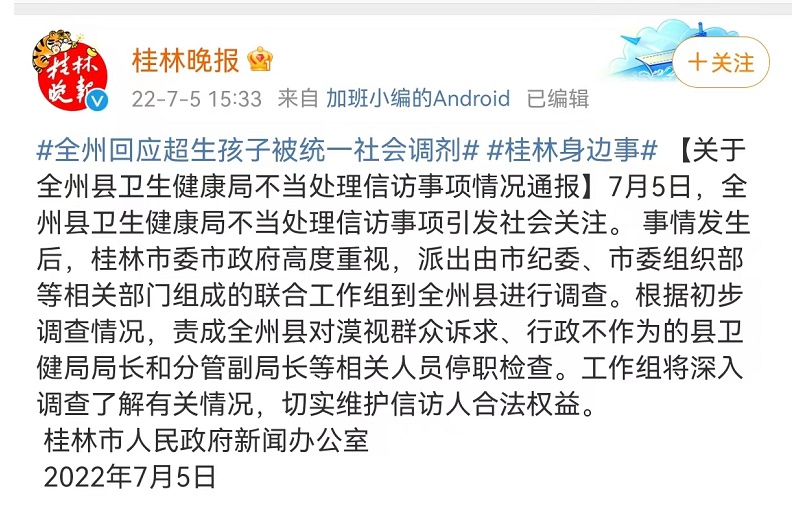

After being given a child, he was hugged for social adjustment?Local director was suspended!

According to the official Weibo news of the Guilin Evening News, on July 5, the im...

Pay attention!The management measures for cargo motor vehicle in Hangzhou Qiantang District have been adjusted

In order to strengthen road traffic management in Hangzhou Qiantang District and e...