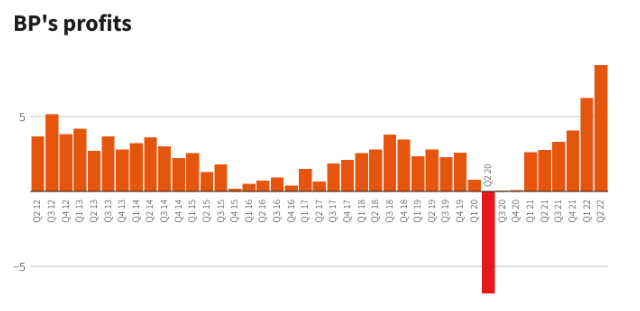

New high in about 14 years!In the second quarter of Britain, the British oil earned 57.1 billion yuan, and it also announced that the dividend was raised by 10%

Author:Daily Economic News Time:2022.08.02

On the afternoon of August 2nd, Beijing time, Energy Giant British Petroleum (NYSE: BP, a stock price of $ 29.06, a market value of $ 92.17 billion) announced the second quarter financial report. Benefiting from the rise in commodity prices during the reporting period, the British Petroleum's basic reset cost profit in the second quarter (Underlying Replacement Cost Profit) recorded 8.45 billion US dollars (about RMB 57.1 billion), a new high since 2008. Analyst estimates $ 6.73 billion. In the first quarter of this year, the net profit of British oil was $ 6.2 billion.

British oil quarterly profit trend (picture source: Reuters)

After the adjustment of Britain in the second quarter, the revenue per share was $ 0.4358, and the market was estimated to be $ 0.35; the revenue in the second quarter was US $ 69.51 billion. British Petroleum also announced that dividends raised the dividend from 5.46 US dollars per share by 10%to 6.006 cents, and planned to complete a $ 3.5 billion stock repurchase before the third quarter performance announcement.

CNBC reports that the performance of British oil has once again highlighted the rich profits of the petroleum giant. Affected by the multiple factors including the Russian and Ukraine conflict, energy prices such as oil and natural gas have been significantly increased since this year, and many international energy companies have made a lot of money. The latest financial report shows that the world's five major oil giants Exxon Mobil (XOM, the stock price of $ 94.48, a market value of US $ 393.8 billion), Chevron (CVX, a stock price of 160.51 US dollars, a market value of US $ 315.4 billion), Shell (Shel, a stock price of $ 52.36, a market value of market value, a market value 192.6 billion US dollars), TOTE (TTE, a stock price of $ 50.55, a market value of US $ 132.4 billion) and the total profit of the second quarter of this year's oil company reached approximately 51 billion US dollars (about RMB 340 billion), a record high.

Under excellent performance, many fossil fuel companies are returning to shareholders to return cash by repurchase.

Just last week, British oil competitors Shell announced a $ 6 billion stock repurchase plan. In the second quarter, the shell adjusted net profit recorded US $ 11.47 billion, exceeding the average estimated $ 11.22 billion of the previous analysts, and higher than the net profit of US $ 9.13 billion in the first quarter of this year. The shell broke the company's net profit record in the second quarter, and it still created a record of breaking records for two consecutive quarters. The trend was very strong.

In addition to shells, the financial reports of several other energy giants are also very dazzling. Some analysts pointed out in an interview with CNBC that a trend of profits such as petroleum giants will continue in the second half of this year. According to the analysis, the free cash flow of the global oil and gas industry is expected to reach a scale of $ 834 billion at the end of this year, an increase of 70%over last year.

"Daily Economic News" reporter also noticed that at the time of the soaring energy prices, the British government also gave a long time to political pressure from all parties, that is, high taxes on the super high profit of the petroleum giant fee. However, 25%of taxation (ie, energy profit tax) will not take effect until July 14 this year, so the second quarter of the second quarter of British oil or other petroleum companies will not be affected.

Daily Economic News

- END -

Three Great Balls Sichuan City League (volleyball project) Finals Chengdu Men's Volleyball Team Winning Opportunities

On July 16th, the three major balls of the Sports Cup China City League trial and ...

Sichuan Qingshen County Market Supervision Bureau Xilong Institute of Xilong Institute of Three Small Business Stores Food Safety Inspection Work

Recently, the Qingshen County Market Supervision Bureau Xilong Institute launched ...