The "swallowing beast" turned off, and the share of more than half a month has shrunk!A number of public fund managers of the public offerings sell new products

Author:China Fund News Time:2022.08.02

China Fund reporter Tianxin

The fund is here today. Let's look at the points first:

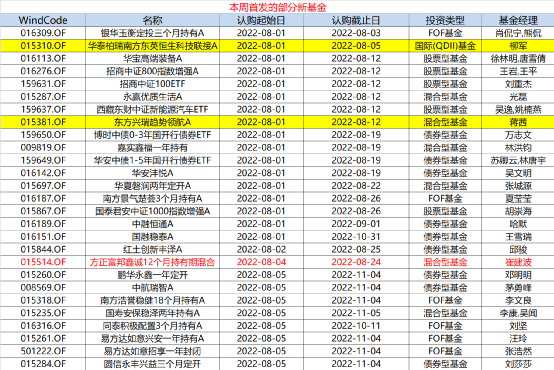

First of all, in terms of the issuance of new funds. First of all, in terms of Xinfa Fund, there are 30 new Fund this week, involving more than 20 fund companies including Yifangda, Huaxia, Wells, Southern, Boshie, Huayai Berry, China Merchants, Yinhua, Essence Among them, Jiang Qian, Liu Jun, Cui Jianbo and other senior performance fund managers have launched new products this week.

Secondly, in terms of ETF capital flow, the net purchase share of six ETFs in the first trading day exceeded 100 million, and the effect of attracting gold in securities firms, 5G and other sectors was significant. At the same time, CSI 1000ETF, which has been greatly attracted for more than half a month, suspended the net inflow of funds. Wide -based ETFs such as CSI 300, CSI 100, and Shanghai Composite 50 also had net outflow of funds.

Jiang Qian, Cui Jianbo, Liu Jun, etc.

Senior performance fund manager Xinfa Fund

According to Wind statistics, there are more than 30 new funds this week, involving more than 20 funds including Yifangda, Huaxia, Fuguo, Southern, Boshica, Hua An, Huatai Berry, China Merchants, Yinhua.

Among them, a number of senior fund managers also ushered in new products this week. For example, Jiang Qian managed the Oriental Xingrui Trends, Cui Jianbo managed Fang Zhengfang Xincheng's 12 -month holding period, and Liu Jun's Huatai Berry Southern Dongying Hang Seng Technology connection.

"Value Growth" is a very eye -catching label on Jiang Qian, Assistant to the General Manager of Oriental Fund and Deputy Director of Rights Investment. He has long adhered to value growth investment for a long time. Configure high -quality growth stocks, prefer technology and manufacturing.

At the end of the second quarter, Jiang Qian maintained a balanced configuration strategy in the selection of Oriental themes in charge. Oriental Innovation Technology focused on midstream manufacturing industries such as automobiles and intelligent driving, computers, photovoltaic, military and machinery manufacturing. Judging from the stock position, Jiang Qian's product positions are generally higher.

Looking forward to the market outlook, Jiang Qian has a cautious and optimistic attitude towards the future market. He believes that the second quarter should be the bottom of the Chinese economy, and the entire economic cycle has entered the bottom of the bottom in the third quarter. In the future, with the economic cycle, in a relatively friendly currency environment, the entire market center will also probably go up.

"From the current point of view, I tend to be a balanced market style in the second half of the year, and the value and growth will have the opportunity. The growth section generally reflects the industrial development trend. It is expected to get out of a good market when the face can be fulfilled. The value sector conforms to the development of the economic cycle. If the domestic economy's recovery process is stable, the value sector will be greatly promoted. With the stability of the domestic economy, the profitability of listed companies is also profitable. It will improve to varying degrees. Future value sectors may be preferred in stages, but the overall extension, the medium and long term is still more inclined to the growth sector. "Jiang Qian said.

Cui Jianbo, Vice President and Chief Investment Officer of Fang Zhengfang, is good at controlling retracement through positions. In his opinion, combined management is a process of continuous dynamic adjustment. He will increase the level of risk returns through the cost -effectiveness of different targets.

According to the Fund's second quarterly report, compared with the first quarter, in addition to individual funds, most of the fund positions managed by Cui Jianbo have been reduced, and the positioning structure has also been adjusted. Among its heavy positions, alcohol, chemical, medicine, brokerage and other sectors are sections. The main direction of the warehouse.

Cui Jianbo believes that the second quarter is the bottom of the year's economy, and the probability of the third and fourth quarters will be improved by quarter. Considering that the current market valuation level is relatively high, the overall reduction of positions at the end of the quarter has maintained a neutral level. Some high -level growth sections have been reduced, and some consumer sections are added.

Liu Jun, the director of the Investment Department of Huatai Berry Index, has a passive index product of more than 84 billion yuan. At present, it has a large advantage in the comparison of similar products in pipelines, including market liquidity and tracking errors.

Looking back at the recent global market performance, Liu Jun said that the recession was concerned about the heating up again and again to hit the US stock market again, which led to the performance of the same period in the first half of this year. The market has become an "shelter" for investors.

"From the perspective of A shares, from the perspective of market trading logic since the beginning of the year, the transaction logic of real estate and consumption is positively correlated, and it is trapped by" stable growth expectations "or" recovery expectations "; from the perspective of the main investment line, it is still optimistic about it The two main lines of the landing policy and the logic of recovery in the half -year growth policy. Affected by this, large -cap stocks may benefit even more. "Liu Jun said.

Looking forward, Liu Jun believes that Hong Kong stocks perform in the second half of the year. First of all, there has been major changes in the policy, that is, the "policy bottom" has appeared. The Hong Kong stock market is still expected to continue to present relatively toughness, which is essentially determined by the economic and policies of China and the United States. Considering the departure of China's and overseas cycles, it is still optimistic about the favorable policies and the low -valuation environment to support the prospects of the Hong Kong stock market.

ETFs such as brokers, 5G and other industries

CSI 1000ETF, CSI 300, CSI 100 and other wide -foundation shrink

On the first trading day of this week, and the first trading day in August, the A -share market was closed as a whole.

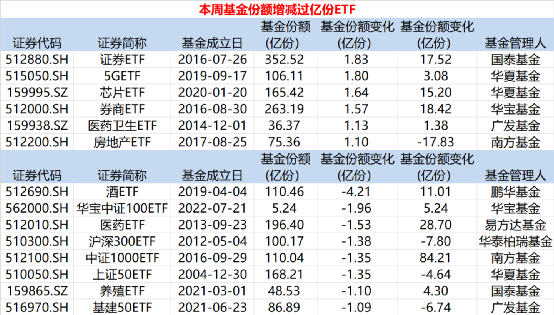

From the perspective of ETF funds, the share of 6 ETFs has a net purchase share of more than 100 million within the first trading day, and the performance of securities firms, 5G and other sectors is active. However, the CSI 1000ETF suspended the momentum of gold, and the broad -base ETFs such as CSI 300, CSI 100, and Shanghai CSI 50 also had net outflow of funds. Specifically, as of August 1, Cathay Fund's securities ETF received a total of 183 million net purchases from net purchase on one trading day to 35.252 billion yuan. Since July, the ETF net purchase was 1.752 billion yuan; the 5GETF net purchase of Huaxia Fund's 5GETF net purchase 180 million copies, to 10.61 billion copies, and 308 million copies of net purchase since July; 164 million copies of the chip ETF of Huaxia Fund, to 16.542 billion copies, and 1.52 billion yuan in net purchase since July; 157 million copies, to 26.319 billion copies, and net purchase have been purchased 1.842 billion since July.

In addition, the pharmaceutical and hygiene ETF of Guangfa Fund and the real estate ETF net purchase share of the real estate ETF of the Southern Fund have exceeded 100 million, of which Southern Real Estate ETF has redeemed 1.783 billion yuan since July.

At the same time, on August 1, the ETF of the wine ETF of Penghua Fund obtained a total of 421 million copies of net redemption on one trading day to 11.046 billion yuan, and 1.101 billion copies of net purchase since July; Hua established on July 21st Baozhong's 100ETF net redemption was 196 million, to 524 million copies; Huatai Berry 300ETF, 1000ETF of China Prescriptions, and Huaxia Fund's 50ETFs under the Southern Fund, all of which were redeemed by more than 100 million copies of 50ETF.

It is worth mentioning that this is the first net outflow of funds from Southern Fund CSI 1000ETF since July 14. The ETF has increased more than 8.4 billion yuan in July. CSI 1000ETF.

Huaxia CSI 1000ETF ended the net inflow of funds for more than half a month on July 29, and the fund share shrinkage exceeded 400 million copies. On August 1, the ETF share was converted to 2.237 billion copies.

In addition, more than 100 million copies of net redemptions in ETFs, Cathay Pacific Breeding ETFs, and 50ETFs of Cathay Pacific Breeding, and 50ETFs in Guangfa Infrastructure have also appeared. Among them, Huatai Berry 300ETF, Huaxia Shangzhi 50ETF, and 50ETF have shrunk since July.

Edit: Xiao Mo

- END -

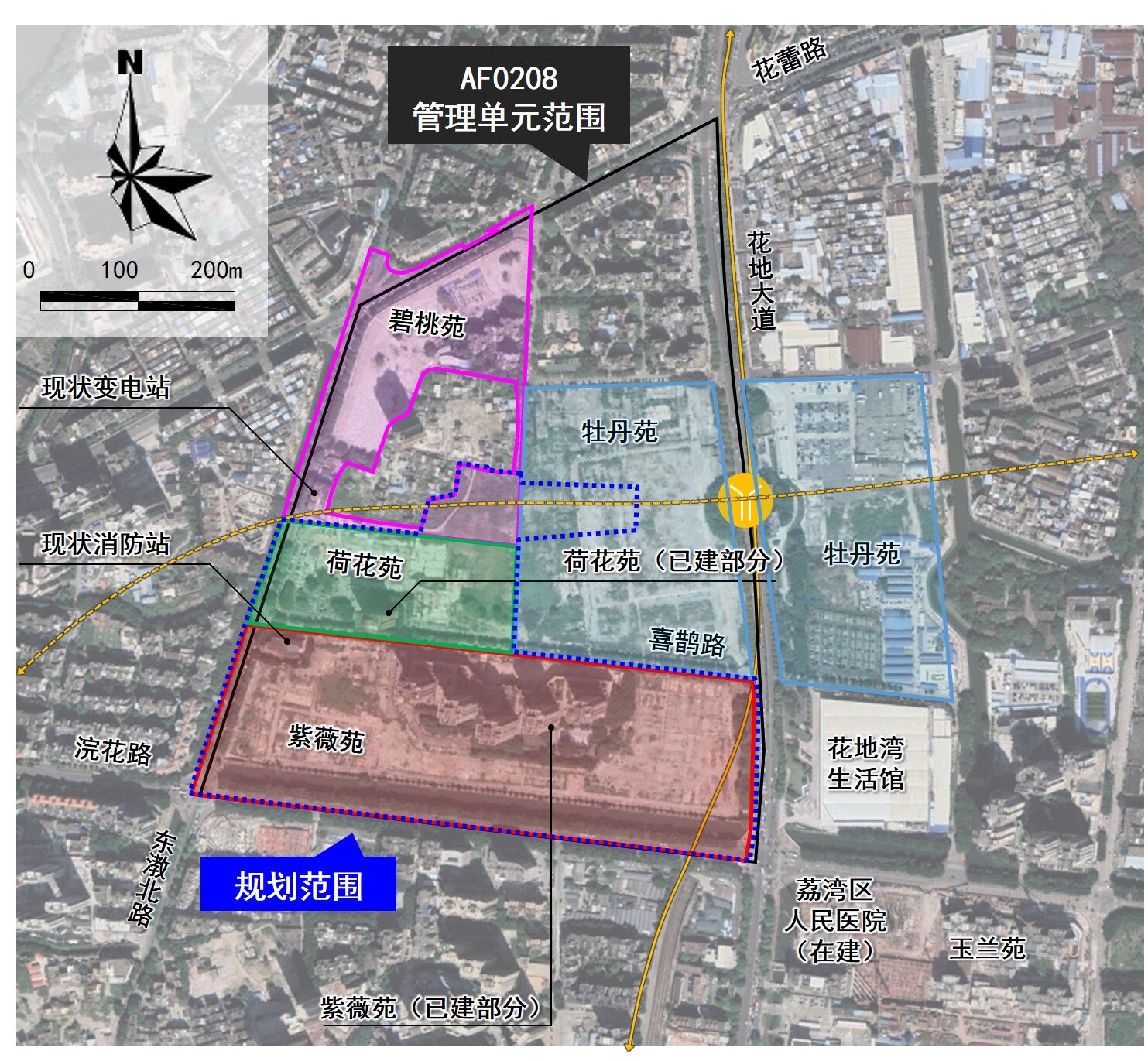

The planning of the southwestern area of Huadi Bay, Fangcun Hua, Birds, Fish and Cedu Markets will build business and residential buildings

The Fangcun, bird, birds and insect markets familiar to Guangzhou have been demoli...

Qinghai Province forms a red tourism resource system

Qinghai News Network · Damei Qinghai Client News On June 29th, the reporter learned from the Qinghai Provincial Red Tourism Work Symposium hosted by the Qinghai Provincial Department of Culture and T