Nearly a thousand active equity funds achieved positive returns in July

Author:Economic reference Time:2022.08.02

Affected by factors such as market performance, the overall differentiation of the fund's income in July was greater. Wind data shows that more than 4,000 funds have risen and the proportion of more than 50 % of the funds in the month, and there are nearly 1,000 active equity funds with rising net worth. For the distribution market, the impact of excluding the concentrated outbreak of the same industry deposit index fund, the issue of the fund in July and June are basically the same as in June. However, the issuance of equity funds has risen significantly. to make.

More than 3800 funds are rewarded in the year

In July, the market entered the shock pattern, and the net value of the fund was also affected. Wind data shows that the average performance of stock funds, hybrid funds, international (QDII) and FOFs will be excluded from the new funds established this year. He-5.86%, bond funds, currency market funds and alternative investment funds have closed, with an average performance of 1.35%, 1.10%and 0.48%, respectively.

As of July 31, there were 3815 funds rewarded during the year (Class A/C merging calculation, the same below), accounting for less than 40 %. 45%. As far as active equity funds are concerned, a total of 453 maintenance has been maintained within the year, and 978 increased in July, accounting for about 24.7%.

Specifically, due to the strong rise in commodity prices, although the net value of related theme funds fluctuated, the current increase is still the top. According to Wind data, as of July 31, Castrol crude oil, Cathay Pacific commodity, and Yinhua Zhongzhong's photovoltaic industry connected the first three fund income lists. %. In addition, many crude oil QDII, including Huabao S & P Oil Oil A RMB A, southern crude oil A, Yifangda crude oil A, etc. However, since July, the net value of crude oil QDII has declined as a whole. From the perspective of the whole year, the overall performance of QDII products has been different from each other. In the first seven months of this year, nearly 80 % of QDII products were negative.

As far as active equity funds are concerned, the performance performance of products in the fields of new energy and advanced manufacturing. Wind data shows that the first seven months of the first three active equity funds are the Macro -in -Macro -selected time -selection strategy, the Wanjia Xinli and the Tedda Manuro Smart Selection for 18 months. 42.63%, 37.05%and 34.96%. In addition, 21 products such as GF, CITIC construction, low -carbon growth, and Xinyuan clean energy exceeded 20%of the annual annual annual annual annual annual annual annual annual annual annual annual annual annual annual annual. Judging from the situation in July, the performance is still more prominent, but it is still fund products in the fields of new energy, advanced manufacturing, low -carbon, and automobiles. 39 active equity products such as the low -carbon economy, Huashang new energy vehicle, Huaxia advanced manufacturing leader It rose more than 10%in July.

Looking forward to the market outlook, "differentiation" has become a common point of view of multiple institutions. The China -EU Fund believes that some track stocks have returned to the high space of valuation after the rebound of this round, but industry innovation is still. With the announcement of the semi -annual performance, subsequent individual stock performance will be differentiated. Galaxy Securities also stated that the fundamentals of A -share are independent, and the market has entered a vibration pattern of accelerated differentiation. August is the dense period of disclosure of the interim performance disclosure of listed companies. The performance driver will still become the core leading factor of the market. Investor strategies should focus on the development of the industry core development, grasp the value of time, choose valuation and value, and stable performance direction. Good, high -profile circuit sector with certainty income. Anxin Securities believes that the current high -growth small and medium -sized disk is dominant at the current stage, and the core is formed around the global competitiveness of the automotive industry chain. Auto parts companies with small and medium -sized market value are the areas where the primary attention is paid. At the same time The service industry deserves focus.

In July, the fund issuance of "strong stocks weak debt"

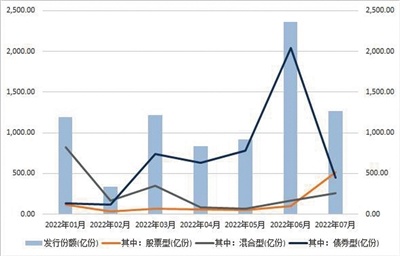

It is worth noting that the proportion of the issuance of equity funds in July returned to a high proportion. According to Wind statistics, with the fund establishment date as the statistical standard, as of July 31, the number of reporters in July, the number of newly issued funds in July was 109, and the total issue share was 126.898 billion. The decline of 21.58%and 46.19%, respectively. Despite the decline in the previous month, the fund issuance share in July was still at a high level in the first seven months of this year. In addition, the average issuance share of a single fund in July reached 1.164 billion, which was also a secondary level since this year, second only to 1.696 billion copies in June.

Some people in the industry said that the "big explosion" of the fund issuance in June was affected by factors such as a sharp rebound in the market, the approaching expiration of the approach, and the centralized establishment of the interbank deposit index fund. Essence If there is no statistical interbank deposit index fund, the total fundraising share of other funds in June was 132.451 billion yuan, which is equivalent to July.

CITIC Construction Investment predicts that due to the continued downturn of wealth management products, the trend of increasing the rights and interests of residents will continue, but subsequent new fund issuance will still be affected by the recent market performance, and it may not return to a high level for the time being.

From a structural perspective, the fund issuance market in July showed a "strong stock and weak debt" pattern. According to Wind data, among the newly established funds in July, the issuance share of stock, mixed, and bond funds was 512.27 billion, 25.501 billion, and 44.488 billion copies, respectively, with the share of 40.37%, 20.10%and 35.06%, respectively. ; QDII, public offering REITs and FOF products account for relatively small share. It is worth noting that the issuance of stock funds has increased by more than 400%from the previous month from 9.914 billion in June, and the issue share of mixed funds has increased by 55%compared to June. From the perspective of shareholding, the share of bond funds in June accounted for more than 80 %, while the total share of stock -type and hybrid funds in July exceeded 60 %. From the perspective of single products, in the newly established funds in July, the number one of the issuance share is the three -year holding of Yifangda Quality King (Class A/C merging calculation, the same below), and the issuance share reached 9.911 billion copies. Earlier, Yifangda issued an announcement of the raised raised in advance. As the fund's subscription funds exceeded 10 billion yuan, the upper limit of the raising scale will be distributed. The three -year holding of Yifangda's quality kinetic energy is also the first tens of billions of active equity funds this year.

In addition, many fund companies have stepped up the layout of broad -base ETFs. In July, the four CSI 1000ETF and eight carbon neutralized ETF became a highlight of the distribution market. Wind data shows that the issuance share of the GFC 1000ETF, the Fortune Card 1000ETF, and the Ichida 1000ETF issuance share ranked among the top five in July fund product issuance, and the issuance share was 7.997 billion, 7.95 billion, and 7.924 billion. In addition, the first fundraising share of the Shanghai EMB Carbon Zhonghe ETF, Southern China C Securities Shanghai EMB Carbon and ETF, Fortune Corporate Cover Shanghai EMC also exceeded 2 billion copies. The first raising of the newly established equity fund exceeded 2 billion copies.

- END -

Municipal working group guides the construction of the Health Station of the Integrated Building of Yunxiao Fang Card and Immigration Pioneer Park

This website (Zhu Qiaoyi) On the morning of July 14, at the invitation of the Epid...

Under the bell floor 丨 Construction enclosure, but not building citizens calling for returning to the people

Citizen reports:There is a construction enclosure on the sidewalks on the northwes...