It's about pension!Over places, plans

Author:Xinhuanet Time:2022.08.02

Basic pensions are raised by 4% of various places to ensure that they are issued in full on time

Just in July, many provinces were notified of the basic pension of retirees in many provinces. As of now, 31 provinces (autonomous regions, municipalities) and Xinjiang production and construction corps across the country have emerged. Will the pension insurance premium policy launched since April will affect the pension treatment of relevant personnel? In the next few years, how to ensure pension pensions and be issued in full on time?

The overall rising 4%will benefit more than 130 million retirees

In May of this year, the Ministry of Human Resources and Social Security and the Ministry of Finance jointly issued a notice to make clear that retirees have been completed in accordance with the regulations by the end of 2021 and received the basic pensions on the end of 2021 and received the basic pension on a monthly basis. The level of pension, the overall adjustment level is 4%of the basic pension per capita pension per capita in 2021.

"Xinhua View Point" reporter found that as of now, 31 provinces (autonomous regions, municipalities) and Xinjiang production and construction corps have been released. All localities are combined with fixed adjustment, hook adjustment, and appropriate tilt, and are required to be paid in place before the end of July.

It is understood that the fixed adjustment mainly reflects the principle of social fairness. The adjustments of different provinces ranging from 20 yuan to 60 yuan. Taking Guangdong as an example, retirees increased by 28 yuan per month.

The hook adjustment reflects the incentive mechanism of more and more payment and long payment. Taking Jiangxi as an example, if the adjustment of the payment period is adjusted, the payment period of 15 years or less will increase by 16.5 yuan per person per month. The monthly increase of 1.23%of the basic pensions in December 2021 per person.

The proper policies are tilted, which reflects the key care of elderly personnel, corporate retirement forces to cadres, and retirees in difficult and remote areas. For example, Heilongjiang increases an additional 30 yuan per month for the elderly at the age of 70 to 79; the elderly over 80 years of age are increased by an additional 40 yuan per month; those who retire for retired areas are increased according to the regional categories, respectively. 5 yuan, 10 yuan and 15 yuan.

"Improve the important measures for people's livelihood protection, which will benefit more than 130 million retirees." Said Zheng Gongcheng, president of the Chinese Society of Social Security.

Staged slow -payment social premium policy does not affect pensions and issued in full on time

In order to help enterprises relieve their difficulties and keep people's livelihood, this year my country has difficulty in small and medium -sized enterprises in difficult companies in 5 specialty industries, 17 other industries, and difficulty in difficulties affected by the epidemic. Individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of the enterprise employee are difficult to pay for the payment of the payment by the end of 2022.

Short -up -to -social premium policy reduces the current income of the endowment insurance fund. Will it affect the implementation of the pension policy in 2022?

"After careful and meticulous calculation, the fund can bear it and can ensure that the pension is issued in full and full." Said Tao, deputy director of the Ministry of Human Resources and Social Security, said that especially increased funding support for fund difficulties in funds. Established, the funds of more than 120 billion yuan have been completed in the first half of the year, which effectively balances the burden on the fund in inter -provincial.

From the account of the account, according to the data of the Ministry of Human Resources and Social Security, at the end of March, the annual income and expenditure scale of the National Basic Pension Insurance Fund reached 12.6 trillion yuan, and the cumulative deposits exceeded 6 trillion yuan. It is guaranteed to be distributed in full on time.

At the same time, the central government's financial subsidy has continued to increase, and it is specially used to ensure the distribution of basic pensions. According to Guo Yang, deputy director of the Ministry of Social Security of the Ministry of Finance, in 2021, the scale of the subsidy funds of the basic endowment insurance fund of the central government has reached approximately 900 billion yuan, which will increase further in the future.

Deepen reforms to promote the basic pension insurance system more sustainable

In the next few years, with the birth of the peak of childbearing in the 1960s, the number of retirement age will increase, and the number of pensions will increase. Some young people are worried about the sustainability of pensions and whether their own pension insurance benefits can be guaranteed in the future.

"The Social Insurance Law clearly stipulates that in accordance with the average salary of employees and the rise in prices, the level of basic endowment insurance benefits is raised in a timely manner." Zheng Gongcheng said that my country has established a rational adjustment mechanism for the basic pension of retirees. The general principle is to do our best to do their best, and build the level of improvement on the basis of economic and financial sustainable growth.

At the same time, my country continues to deepen reform and optimize the system to ensure that the basic pension insurance system is sustainable for a long time.

As of the end of 2021, the number of basic pension insurance for urban employees exceeded 480 million, an increase of 24.53 million from the end of the previous year. "my country is promoting the restrictions on the registration of flexible employees to participate in the household registration, allowing 200 million flexible employees to participate in the basic endowment insurance of employees at the employment place. The basic pension insurance system of enterprise employees expands its coverage." Zheng Gongcheng said.

Improving the level of overall planning is also accelerating. From January 1, 2022, the basic pension insurance of enterprise employees is officially implemented nationwide. As of now, the basic pension insurance information system in most provinces' employees in the country is launched.

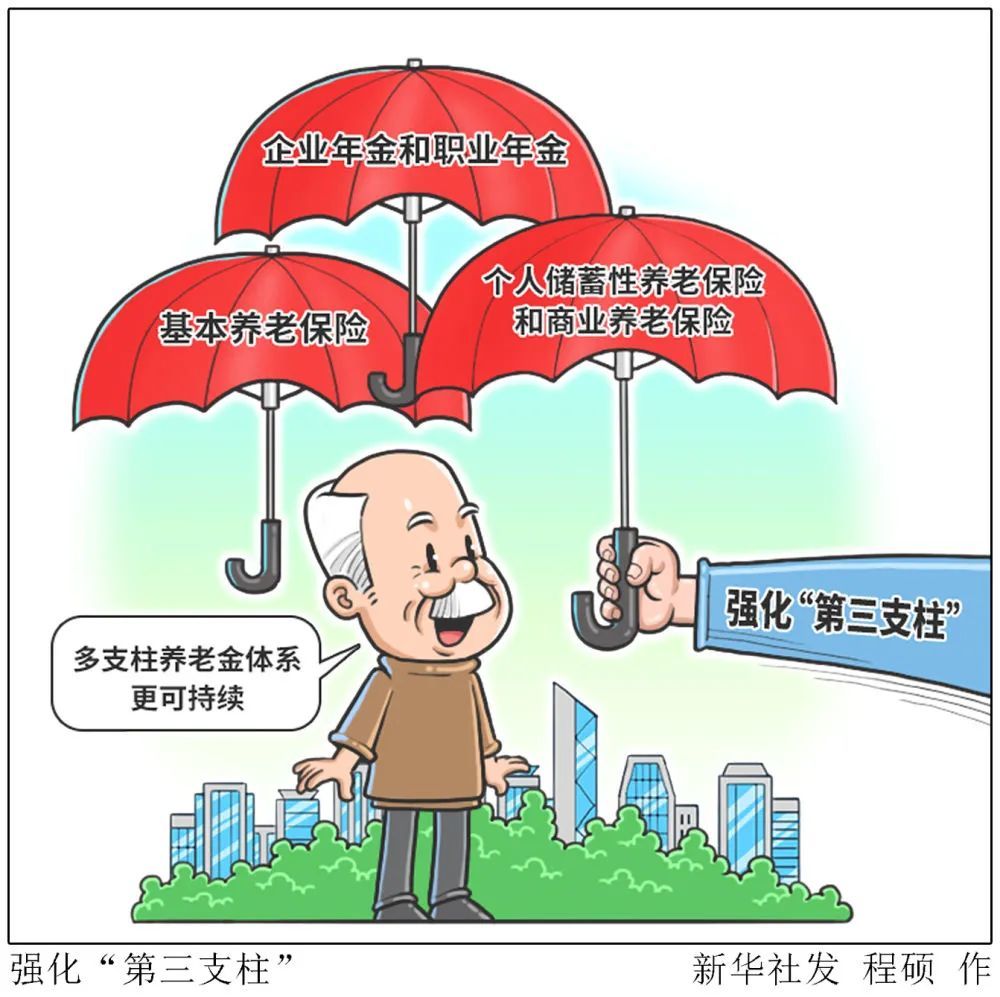

"The funds are lacking in each other across the country, which is conducive to the scale effect of the fund and enhancing support capabilities.More sustainable, "Saitao said.The personal pension system supplemented by basic pension insurance was also launched in April this year.The Ministry of Human Resources and Social Security is formulating supporting policies with relevant departments to determine the cities of the personal pension system.

"The endowment insurance fund is the 'raising money' entrusted by the people to manage the state. We will take multiple measures and take good care of the pension insurance funds and make hundreds of millions of elderly people support it." Said Tao said.

Source: Xinhua News Agency

Reporter: Jiang Lin, Huang Xing, Xie Ying

Produced: Liu Hong Cheng Miao

Edit: Yan Hai

School pair: Liu Yiran

Internship: Party one

- END -

Provincial Jiuquan Highway Business Development Center Suzhou Highway Section: Prevention and disposal of flood prevention

This newspaper Suzhou News In order to improve the flood prevention and disaster resistance of highways in the flood season, recently, the provincial Jiuquan Highway Business Development Center Suzhou

90 merchants "welfare" embrace the army!The first demonstration street of the Economic Development Zone is listed on the demonstration street

On July 29th, with the strong support of Urumqi City, Urumqi Retired Military Serv...