Heavy!The latest list of public funds is here

Author:China Fund News Time:2022.08.02

China Fund reporter Ruohui

In the first half of the year, the A -share market changed. After fierce competition, the "half champion" of the fund industry's business in the first half of the year was finally revealed.

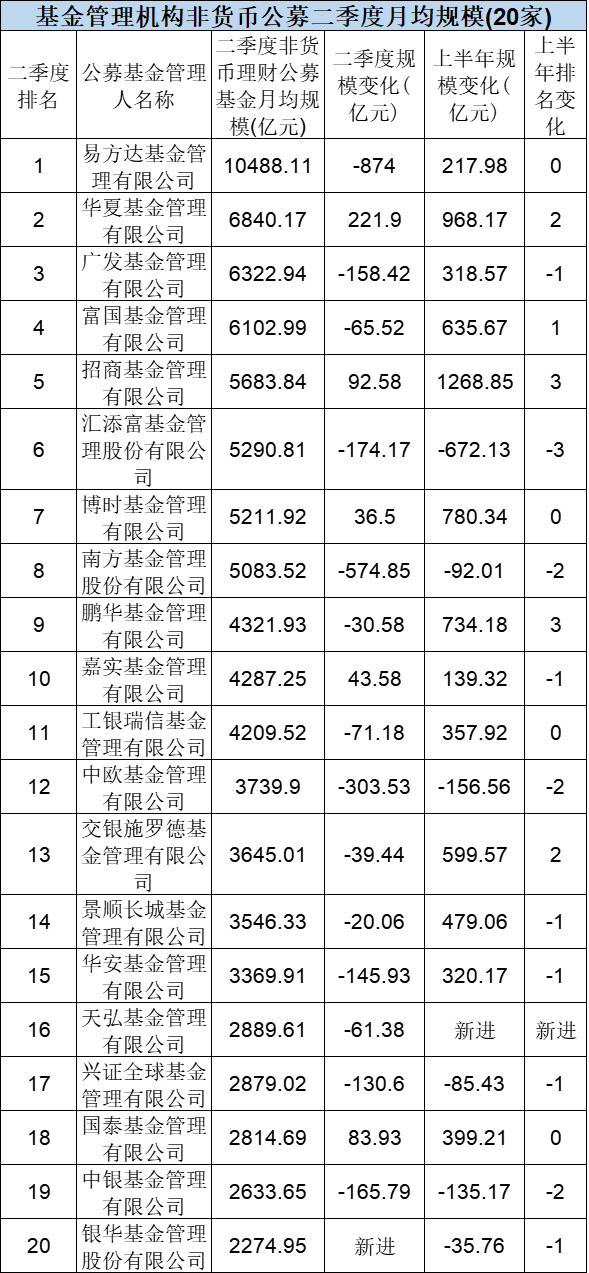

On the evening of August 1st, the average annual scale data of various asset management business announced by the Fund Industry Association in the second quarter of 2022 showed that the E Fund Fund continued to win the non -money -scale champion of the public fund at 1048.811 billion yuan. The ranks of the runner -up have increased by two rankings compared to the end of last year, and the gap between the two in the second quarter was reduced. The scale gap between the two was reduced from 474.384 billion yuan in the first quarter to 364.794 billion yuan.

The top -ranking of the fund's number of households is still occupied by Chuangjinhexin Fund, but the fund company's special account scale has shrunk by nearly 70 billion yuan compared to the first quarter, and Ping An Fund replaced the Huaxia Fund into the top five in the industry.

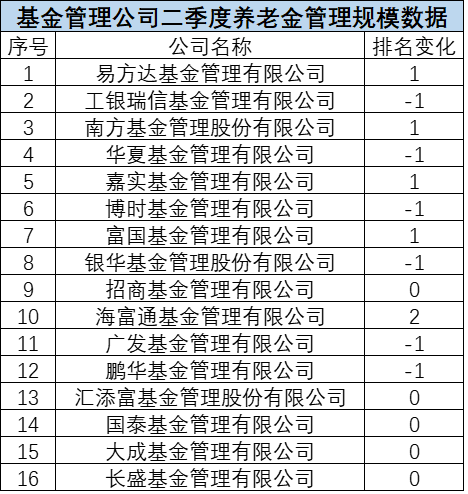

China Merchants Wealth replaced the assets of Agricultural Bank of China with the advantages of nearly 100 billion yuan, and promoted the scale of the fund subsidiary. In the list of pension lists, Easy Fang reached the credit and silver letter, becoming the first in the industry.

Yifangda, Huaxia, Guangfa

The top three of the non -goods scale list

Excluding the rushing effect at the end of the season, the average monthly non -monetary scale of the fund company can represent the true strength of the fund company.

On the evening of August 1, the Fund Industry Association announced the average monthly data of various asset management business in the second quarter of 2022. In the second quarter of this year, the non -monetary scale ranking of the fund company was also fresh.

Yifangda Fund continued to win the non -monetary scale champion of public fund -raising funds at 1048.81 billion yuan. Compared with the end of last year, the size of Yifangda's non -monetary scale increased by 21.798 billion yuan, an increase of 2.12%. The quarter -quarter decreased by 7.69%.

Huaxia Fund replaced the Guangfa Fund, and for two consecutive quarters, it has stabilized the public offer of non -monetary -scale runner -ups for two consecutive quarters. Data show that as of the end of the second quarter, the size of the Non -Monetary Fund of Huaxia Fund reached 684.017 billion yuan, an increase of 16.49%in the first half of the year. One of the company.

Since the beginning of this year, Huaxia Fund has developed a number of businesses such as REITs and ETFs at the same time, and the scale growth has obvious. Wind data shows that in the first half of this year, the scale of the bond funds of Huaxia Fund increased by more than 45 billion yuan. Yuan, the scale of public offerings also officially exceeded the tens of billions at the end of the second quarter.

From the perspective of single funds, the two funds of Huaxia Short Debt Debt and Huaxia Hang Seng Internet ETF have increased by more than 8 billion yuan in the first half of this year. In the first half of this year, the newly issued Huaxia Interperture Index Fund also "attracted gold" tens of billions.

The China Merchants Fund was also another "Dark Horse Player" in the public fund industry in the first half of the year. In the second quarter, it was promoted to the top five of the public funds with a monthly average month of 568.384 billion yuan. Among the ten fund companies, the only fund company with a scale of more than 100 billion yuan, the increase in the investment funds in the first half of the year reached 28.74%, and was the highest -scale fund company in the top 20 funds. In the first half of this year's tens of billions of new funds, China Merchants Fund occupied two seats. China Merchants Timan's one -year bond issuance and China Merchants Union Index held a 7 -day holding fund raising scale reached 15 billion yuan and 10 billion yuan, respectively. Among the old funds, China Merchants Zhaowang Pure Debt Fund increased by more than 10 billion yuan in the first half of this year.

In addition, the number of companies in the top 20 funds also retired. Shanghai Oriental Securities Asset Management withdrew from the top 20 non -goods scale, and Tianhong Fund was squeezed into the twentieth place.

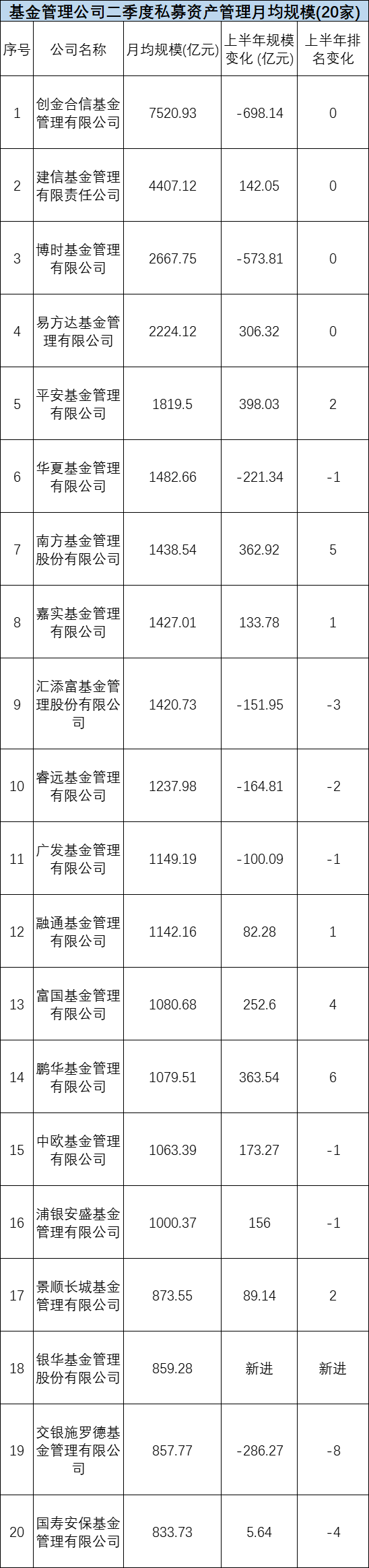

Chuangjin Hexin won the large -scale championship

Fund management companies in the second quarter of private equity management companies were also released in the top 20 of the average monthly scale. Chuangjinhexin, Jianxin, and Boshi Fund continued to rank among the top three in the industry, but the number of special accounts in Chuangjin Hexin Fund has shrunk from the end of last year. It was close to 70 billion yuan.

In addition, Yifangda and Ping An Fund are ranked fourth and fifth. Ping An Fund replaced the Huaxia Fund in the first half of the year, and the top five new industry.

From the perspective of scale changes, Ping An, Penghua, Southern, and Yifangda are four fund companies with private equity assets in the first 20 of the 20th year of the first half of the year.

The Yinhua Fund ranked in the top 20 in the second quarter with the average monthly scale of 859.28.

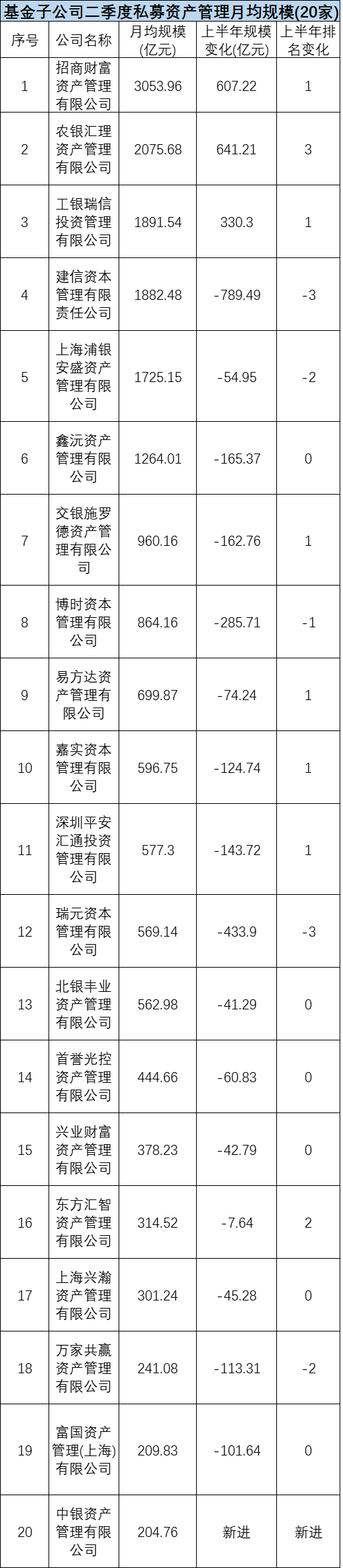

There are only 6 left 100 billion -level fund subsidiaries

The scale of the fund subsidiary has also changed a lot. In the second quarter of China Merchants Fortune, the average monthly scale of China Merchants exceeded 300 billion yuan, replacing CCB Capital, and reaching the fund subsidiary's scale champion.

However, in the first half of this year, the size of the head fund subsidiary has shrunk. In the first half of the year, the fund subsidiary with an average monthly scale of more than 100 billion yuan included investment wealth, RMB Huili Assets, ICBC Credit Capital, CCB Capital, Shanghai Pu Yinan Shengsheng There are 6 assets and Xinyu assets. At the end of last year, there were still 9 fund subsidiaries with a scale of more than 100 billion yuan.

The total management scale of the first 20 fund subsidiaries exceeded 1.88 trillion, compared with 6%compared to the end of last year.

The top of Yifangden's top pension scale top

The long -term personal pension system of all parties is about to be released, and the pension business has always been valued by various fund companies.

In the second quarter, Yifangda replaced the Gongbin Credit Council and promoted the list of pensions.ICBC Credit, Southern, Huaxia, and Castrol Fund ranked second to fifth.Edit: Xiao Mo

- END -

Except for Payment of DRG in Beijing, medicine recovers!Medical Devices ETF (159883) rose 1.63 % in early trading

On July 14, the three major indexes rose and declined. Affected by Beijing's trial...

Sri Lanka Prime Minister and Cabinet Minister swore

Xinhua News Agency, Colombo, July 22 (Reporter Che Hongliang) Sri Lanka Prime Minister and Cabinet Minister took an oath in Colombo on the 22nd.On the same day, Ghanvadner swore to the President Vikra