Another hundreds of billions of housing companies exploded!Thousands of housing companies merge the letter, and the two US dollar debts were "stumbled"

Author:Jiang Dongwen Time:2022.08.01

Ascend to the height!

China's real estate company, which was mixed with the wind a few years ago, the head of the heads of the heads made a lot of money;

However, the romantic is always blowing by the rain! In recent years, the state has become more and more tight in real estate policies. Real estate is no longer the highlight industry. The major real estate companies are deeply trapped in the quagmire. It is difficult to retreat throughout the body. Some small real estate companies are facing the risk of shuffling.

"Behind the king of the earth is a history of blood and tears." Under the tightening of the industry's environment, after the major real estate companies, Rongxin, the "King of the Earth King", was falling into the altar and everyone.

Recently, Rongxin has continued negative information, debt defaults, capital crisis ...

one

Another 100 billion housing company officials announced!

It used to be tens of billions of land, and now 188 million can't afford it. Once the scenery was infinite, and the leaders were the first, but the investors were messy in the wind.

Ou Zonghong, the founder of Rongxin, is the helm of 100 billion housing companies. He is a real estate black horse killed in oblique thorns. He is also a manufacturer of the "Earth King" in China's unit price. Today, it has become a member of the list of mines in housing companies.

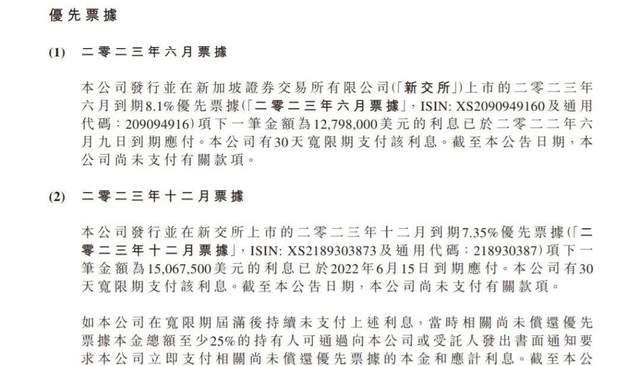

On the evening of July 10, Rongxin China disclosed a inside information that its company had two US dollar debts expired and failed to pay relevant funds.

Specifically, a 8.1%priority notes expired in June 2023. The interest of US $ 12.798 million should be paid on June 9 this year. 7.35%of the priority notes expired in December of the year, the amount of interest payable on June 15 this year was US $ 15.0675 million, and also failed to pay the interest on a 30 -day wide limit.

Rongxin China said that although the company has done its best to reduce the impact of various unfavorable factors on the company's operations, due to the long duration of the state, the group's operation and capital status have been significantly affected, and the future debt repayment capacity is facing a greater ability. Uncertainty.

However, it is worth mentioning that Rongxin China announced the exhibition period not long ago.

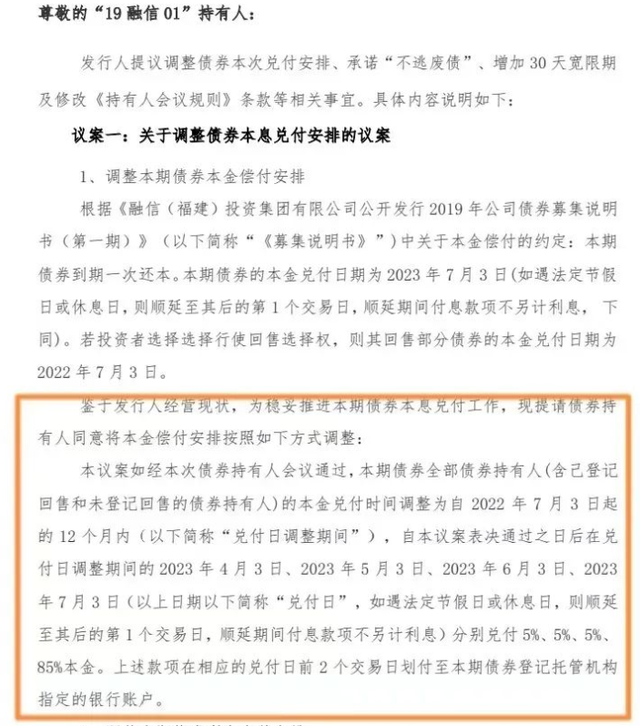

On July 4, Rongxin (Fujian) Investment Group Co., Ltd. issued an announcement on the Shanghai Stock Exchange that after passing the bond holders' meeting, "19 Rongxin 01" and "19 Rongxin 02" will conduct the exhibition period. Pay the interest on the two bonds on the first day, pay 5%of the principal in the 9th, 10th, and 11th months, and pay the remaining 85%in the 12th month.

It is reported that since mid -June, Rongxin has been seeking the support of bond holders, hoping to have a large number of holders, including one of the four major banks in China and two state -owned trust companies, and only 15% of the 15% of the holders held by the hand. Bonds to avoid the formal exhibition period of these two bonds because of the gap in funds. However, most of the holders finally decided to exercise the right to return.

The exhibition period of Rongxin is "difficult and correct decision". With the continued tight industry liquidity, in the middle of the due debt processing and stable operation, real estate companies must find a balance to have the opportunity to get out of winter.

two

In recent years, it is not unusual for real estate companies to explode, but it is still a bit surprised by Rongxin China's default.

It stands to reason that Rongxin China ’s debt repayment peak period was in 2023, and in 2021 reports, it has made it clear:“ As of the end of February 2012, the Group has repaid all the priority notes that expired in the first half of 2022 ” What is the two priority notes of today's breach of contract?

According to the 2021 annual report released on May 30, in 2021, the company's annual contract sales were about 155.52 billion yuan, a slight increase of 0.22%year -on -year; The interest rate was 10.90%, a year -on -year decrease of 0.91%; the asset -liability ratio was about 78.70%.

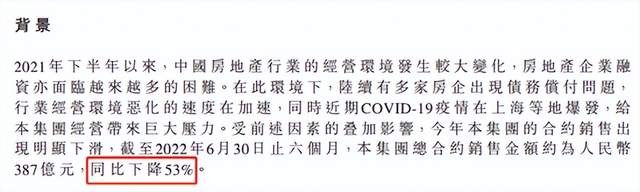

Affected by a variety of factors, Rongxin's contract sales have fallen significantly this year.

The company disclosed that as of June 30, 2022, the company's total contract sales amount was about 38.7 billion yuan, a year -on -year decrease of 53%. In June, its contract sales were about 9.102 billion yuan, a year -on -year decrease of 38.7%(unprecedented operating data).

According to statistics from the sales performance of housing enterprises in the China Finger Research Institute, the sales of Rongxin Group from January to July were 47.91 billion yuan, ranking 23rd in the month, a year-on-year decrease of 51.5%.

Before the US dollar bond interest payment was overdue, Rongxin accelerated the return of funds by transferring assets in the first half of the year.

In January this year, Rongxin China withdrew from the project company affiliated to Hangzhou Yawangju. Previously, it held 50%of the project company. One month later, Rongxin China will be sold to Zhejiang Beizer Group at 55%of the equity of 55%of Ningbo Hailiang Real Estate, which is cost 421 million yuan. The two assets of the two assets are used to return bank loans.

Although I did not lie down directly before and continued to pay the debt, Rongxin was still a debt default ...

And as early as the US dollar bond default, Rongxin China had already appeared in multiple domestic corporate bond defaults, with a total principal of more than 2 billion yuan. At the same time, the company has multiple business tickets overdue.

As of June 30, 2022, a total of 5 business tickets in Rongxin China appeared on the continuous overdue list of the Shanghai Ticketing Exchange.

Three

According to the announcement of Rongxin China, since the second half of 2021, the company has accumulated a total of nearly 30 billion yuan in net paid open bonds and various types of interest debt and related interest.

At present, Rongxin China has 6 US dollar bonds, with a total amount of 2.245 billion U.S. dollars and a total of RMB 15 billion. Three months later, Rongxin will have a $ 688 million bond principal due to expiration, and payment will undoubtedly be a greater test. There is no doubt that Rongxin's boss Ou Zonghong will face a big hurdle!

Rongxin rose rapidly and fell quickly, because of the "king of the earth", it also declined due to the "king of the earth". The Putian businessman composed a "history of blood and tears" in the ups and downs of real estate waves.

According to the official website of Rongxin Group, the company was established in 2003 and is headquartered in Shanghai. According to public information, Rongxin Group was established in 2003 and headquartered in Shanghai. It was listed on the Hong Kong Stock Exchange in January 2016.

As of the end of 2021, the company's registered capital was 4.025 billion yuan, which was wholly -owned by Fuzhou Yixin Investment Co., Ltd., and the actual controller Ou Zonghong indirectly held 66.69%of the company's shares through the Ou Family Trust to perform actual control of the company.

As the leader of the Fujian housing company, Rongxin won the land crazy from 2015 to 2017, and was nicknamed the "Kings Harvest Machine" by the industry.

With crazy landing, its sales have also risen rapidly. From 10 billion in 2015 to 121.8 billion in 2018, becoming a new "100 billion dark horse".

However, in recent years, Rongxin China ’s“ Earthwriting Calms ”has appeared, and the risk of high -priced land and high debt has begun to be released. The cost of ultra -high soil storage has greatly reduced the profit space of the project.

In the 2021 housing company sales ranking of Kerry, Rongxin's equity sales accounted for only 64.7%.

Unrestrained

Frozen three feet, not a day cold. In fact, 100 billion housing companies have now been Chu Ge, and the Domino brand effect caused by the capital crisis has affected the real estate in many places.

Through Rongxin China's operating debt scale and monetable assets, it was found that the capital gap at the end of 2021 reached about 57.7 billion yuan. It may need to reach more than 40%during the year to settle the debt crisis.

It is foreseeable that in the next six months, Rongxin's capital chain will be under heavy pressure!

The real estate industry is not good. This is a well -known thing. Who can know when to usher in the "last straw that crushes the camel"?

With the long -lasting regulatory policies, from the speed of poured hundreds of small and medium -sized real estate companies a few years ago, it gradually spread to head real estate companies such as Evergrande, Sunshine City, Blu -ray, and Aoyuan. winter.

For a long time, various problems caused by the quality of the house have caused developers to be involved in the vortex of the crisis of trust. Now, the problems of thunder and even continuous project shutdown of developers are constantly challenging the bottom line of the majority of home buyers. Essence

Fortunately, from the end of last year to the first half of this year, the good information of the property markets in various places was frequent, and it aims to help the real estate companies who once rushed to get rid of the predicament and give buyers a satisfactory and peaceful home, but whether the housing can be delivered smoothly and developing development. Whether a business can "live" is still the housing company itself;

No housing companies should be too optimistic about their financing capabilities now. "Survival of the broken arm, carefully fulfilling the spirit of the contract", the real sales repayment and the handling of high -quality assets in hand to get the cage of funds is the best way to spend the current industry.

So, in the context of recent thunder in the real estate market, can you think that the once -billion -dollar real estate company Rongxin can be carried?

Reference materials:

"One Generation King, Climb into ICU", market value observation

"Instantly plunge 31%! 100 billion Real Estate Giants Relief China Event ", China Fund Newspaper

"The Dowager Sales of Debt Overdue Sales Rongxin Crisis, Qingdao Project has been complained", China Real Estate Newspaper

"Official announcement! Rongxin China is deeply trapped in the debt crisis, and the Taiyuan construction site has been suspended for a long time! ", Leju.com

- END -

The Yellow River's hometown of 10,000 acres of lotus attracts customers

The unveiling of the AAA Scenic Area of the Huanghe Homent Road in Cao CountyO...

Caring for the "City Beauty Division", the "Sanfu Post" is set up to send health

The Yangtze River Daily Da Wuhan client July 20th I posted a three -volt post yest...