In the era of mobile payment, is there still a need for young people?

Author:Everyone is a product manager Time:2022.08.01

In recent years, the scanning payment has been rapidly popularized in my country. WeChat and Alipay have become an inseparable part of people's daily life. Many people have become accustomed to "a mobile phone walking the world."

While mobile payment becomes mainstream, banknotes seem to be farther and farther away from us. When the cash that can be turned into a string of numbers on the screen, the mobile phone has been successfully paid, and we may have all felt this: Where did the money spend?

Everyone knows rational consumers. If you don't want to spend money like flowing water, how can you clarify your income and expenditure?

Bookkeeping is definitely a good choice.

How do you get a bookkeeping now? Special APP or use the bookkeeping function with the payment software? What is the significance of the annual bills of major platforms? We started a discussion every day, let's take a look at what the friends said ~

[Daily Q: Selected every week] No. 197: Why are major platforms keen to launch annual bills? For example, the content of the annual Alipay annual bill of Alipay comes from @例 例 @ @ @_ _ @ @小 小 例 @例 前 前 @啊 Autumn Autumn.

1. How do you get a bookkeeping? Three main ways of bookkeeping

With the development of the Internet, our life is inseparable from mobile phones. The bookkeeping has also slowly changed from paper pen to various online bookkeeping tools to see what is the mainstream bookkeeping method.

1. Paper notes

Many friends may have experienced their parents when they were young.

Prepare a small book, simply write how much money it costs to eat today, what snacks you buy, etc. These are expenditures, and then write a small income that continues to be 0. Finally, there is a balance.

Pen pen and pen can be said to be the most traditional way of bookkeeping, but now some people persist again.

2. Special accounting app

There are many hot accounts on the market. If you search in the application market, you will jump out a lot of options. There are still a lot of installation times, and some are even hundreds of millions of times. Accounts, meow meow booking ...

Let ’s take a record and shark account as an example.

There are many templates that are recorded, divided into four categories: family, individuals, business, and hobbies. There are many small templates. It is friendly to users with separation requirements for different accounts. The specific classification is also very detailed, and the function is extremely powerful, but novice users need time to explore.

The page of shark bookkeeping is relatively simple, which can meet basic needs. The classification of bookkeeping is very detailed, the functional operation is simple, and the budget function of reciprocating bookkeeping and anti -chopping hands is also regularly reminded.

There are large and small accounting software evaluations on Zhihu and Xiaohongshu on various platforms.

Nine most popular bookkeeping app evaluates anyone, no one knows this accounting app, will I be sad! The best bookkeeper app! none of them! Amway! Just the right minimalist accounting software! … 3. The bookkeeping function comes with the software

WeChat and Alipay themselves also bring their own bills, which is convenient for friends who focus on a platform.

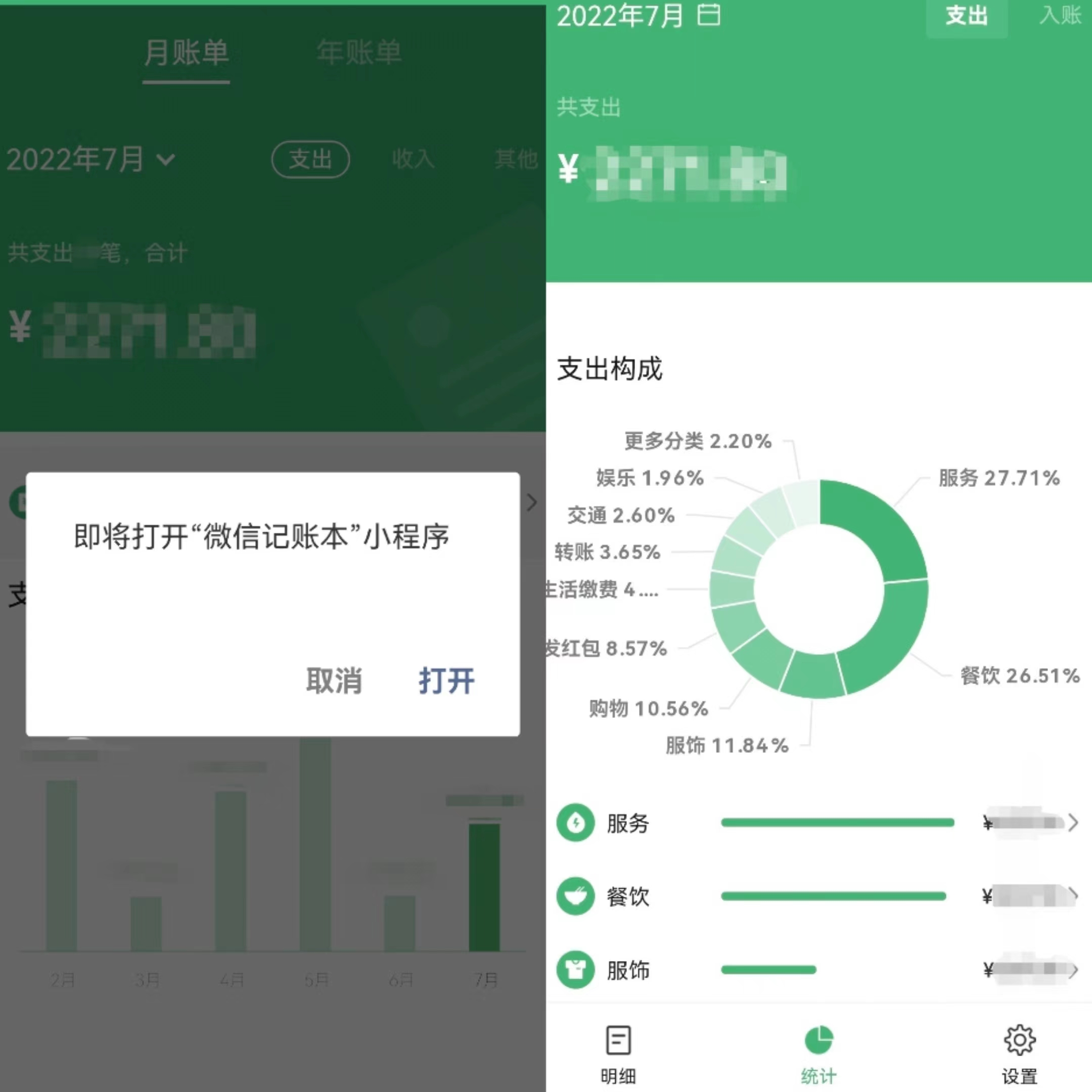

Taking WeChat as an example, as long as it is a record of using WeChat, the bill in the upper right corner of the wallet will be displayed. At the same time, there is a supporting applet "WeChat accounting book", which detailed the composition of this month's expenditure, as well as daily comparison, monthly comparison, and so on.

2. Why are major platforms keen to launch annual bills?

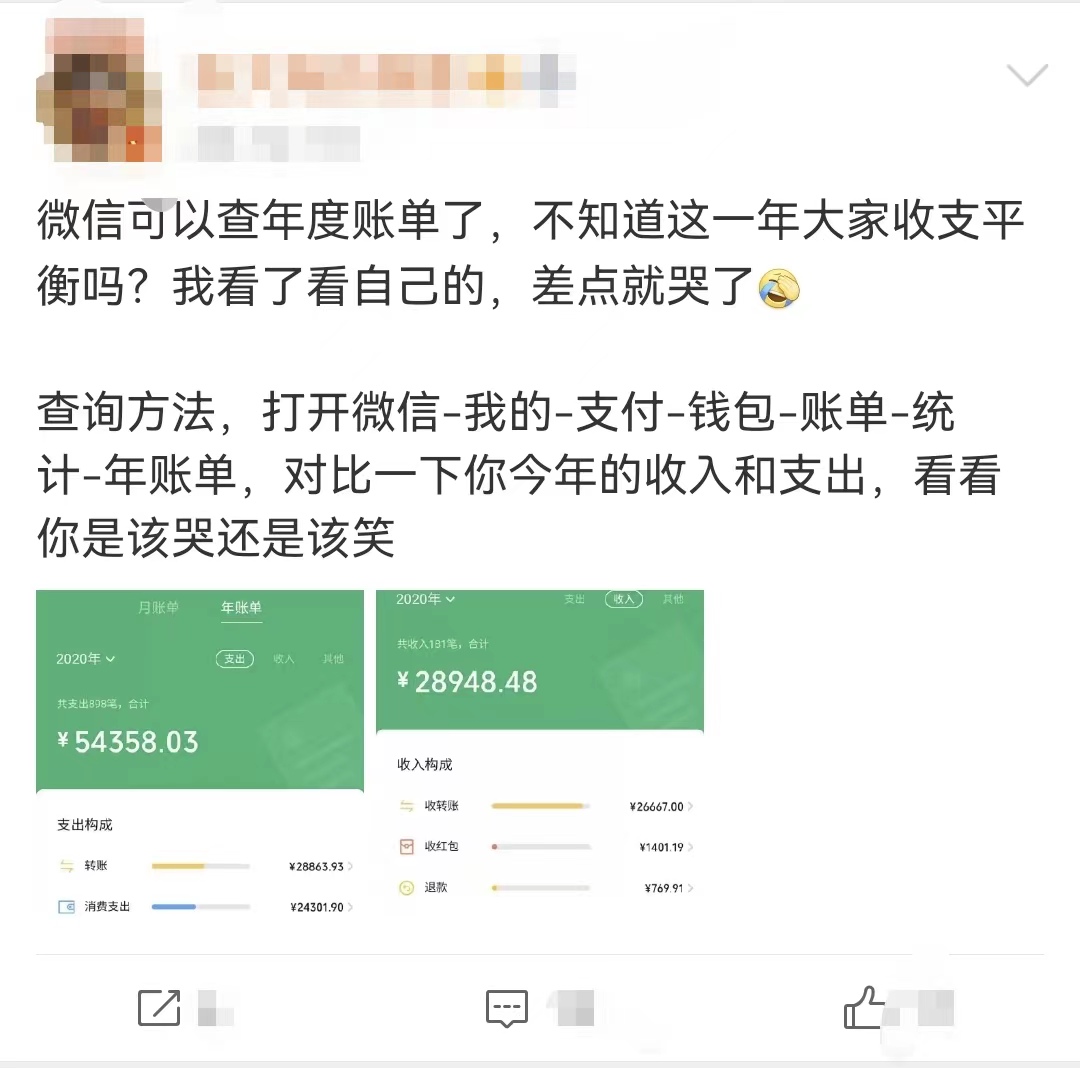

In addition to daily bookkeeping, at the end of each year, major apps will also launch annual bills, and they always have a whirlwind sharing in the circle of friends.

Although the bill function of non -accounting products is more hidden than special APPs, after all, it is real gold and silver.

As long as there is a need, there will be expenses. Everyone pays attention to how much money they have spent in the past year. Mowing

In the annual bill of 2021, you can see the number of physical stores consumed this year, and the cost of movies and performances. Data such as green energy produced by ant forests. In the end, you can enter the highlight of the annual general bill, and obtain a detailed analysis of the annual expenditure and income.

The annual bill of 2021 is very frequent in the circle of friends and major social software. Why does the "annual bill" set off such a degree of discussion? Why are major platforms keen to launch annual bills? This should be talked about from both users and platforms.

From the perspective of users, the annual bill is the manifestation of the past life and the outlook and prediction of future life.

1) Looking back and summarizing the past consumption situation

You may send the ultimate three questions when you see the bill:

What is money? Where did the money come from? Where to go? Through the bills, users can intuitively understand the consumption distribution of the past year. The introduction of the annual bills gives users an intimate summary experience, and all aspects such as eating, drinking, fun, food, food, food, and transportation will be involved.

2) Optimize future consumption expenditure

The user's financial status is well reflected in the one -year bill, which can make more reference income and expenditure plans for the future, instead of spending a year and after a year and after a year.

The year's revenue and expenditure is far greater than the one -day record, which can be said to be the most important reference data in personal financial management. What are unnecessary expenditures? Which piece of expenditure can be further optimized? Continue to age or make appropriate savings? All this is based on the understanding of your financial situation. In addition to the usual accounting, the emergence of annual bills is also essential. With the help of past experience to optimize future consumption, by the way, predict the expenses and income directions that may exist in the future.

3) Meet the needs of self -expression and sharing

On the Internet, people are used to sharing bits and pieces of life, and the annual bill of stock is naturally an expression of an expression, and it can even be said to be a good material to show themselves.

The annual bill of modeling, intuitive, and digital summary methods In addition to showing the user's consumption situation with the help of data, it also summarized the one -year life trajectory of users, and also helped the circle of friends to become a "Versailles" scene for some netizens.

The needs of sharing and expression are well satisfied in the annual bills.

From the perspective of the platform, the annual bill has the following aspects.

1) Find new business opportunities according to the new features of consumer data.

The personal bill showed by the platform is only part of the data, but standing on the standpoint of big data, you can analyze a lot of content, including: consumption behavior habits in different ages, consumption trends in different regions, sales of special festivals products The direction and so on.

The distant big data is actually closely related to every individual. From the user, the platform can dig the behavior behind the data and get the most direct market trend.

2) Help users return to the revenue and expenditure for one year, increase user stickiness

The bill can be said to be a intersection hub between the platform and the user.

Through the introduction of annual bills to interact with users, while helping users to re -inventory one year's revenue and expenditure, they also obtained a wave of users' favorability and enhanced the stickiness of users.

Annual bills can help the platform reduce user loss. This year, the individual "I" left these data stamps on a particular platform. The screening of data may bring users a special memory of a certain moment.

3) Promote the topic sharing of customers on social platforms and increase platform exposure

The user's own sharing as the main cut -off port, creating related topics on major social media, not only meets the needs of the user, but also brings a wave of expected publicity to the platform.

The annual bill of annual bills is intuitively highlighting the personal consumption situation and grasping the user's psychology. It is a large -scale marketing activity that can participate in all people and see it on the platform.

3. What kind of bookkeeping products do users like?

The demand for accounting has always existed. Now the appearance of mobile phones has replaced paper and pen, so what kind of bookkeeping products will users download?

1) Clear and accurate account classification

Account classification is a very important area in the bookkeeping app.

Good classification needs to include daily needs for eating, drinking, playing, clothing, food, food,, and transportation. There are clear boundaries between various categories to avoid vague intersections that both sides can choose to meet, and they are likely to meet the needs of users' "one -click selection".

At the same time, if you support customized modifications, you can better lock "personalization". The secondary classification is also a must -have function for some specific users. For example, it is best to set up breakfast, lunch and dinner. For some accounting apps, the "label" under a specific classification will have the same effect as the second classification.

2) Introduction to the interface clean

The accounting app itself belongs to the tool APP. The attributes of this type of app are efficient and fast, and need to solve the actual problem of users. Simply put, it is easy to get started and easy to use.

These are not without good interface operations. The logic is simple. Without complicated process steps, you can locate the required functions at a glance and save time for users.

The profile of the accounting product interface is very important for users who really need it. Whether it can quickly meet the acting of bookkeeping is the core factors that developers need to consider. The additional attributes of Hua's whistle will only become a stumbling block for the difficulty of growth in the later period.

3) Data analysis is instructive

Most of the accounting apps have chart analysis functions, which can record expenses in each category in detail.

A good bookkeeping product needs to accurately and intuitively reflect the expenditure and income proportion. You can query the daily, monthly, every quarter, and every year data. In order to better achieve the significance of data analysis for users.

4) Little advertisements and private security

The page does not start advertisements. It is naturally the best experience for users, but combined with actual considerations, it is difficult to avoid opening screen ads in free software. Therefore, developers can only try to avoid advertisements that may be popped up at any time during use, and inexplicable and frequent pop -ups will gradually dispel the user's favorability.

At the same time, because the accounting app comes with some finance or financial management attributes, users will definitely have a certain degree of concern for privacy leakage. Good bookkeeping apps must not obtain users' personal information illegally during the operation and ensure complete private letter. In addition, it is best to choose whether to set the login password according to the needs of the user.

5) Cross -platform data synchronization

Although currently the consideration of various factors such as data security, no bookkeeping product can synchronize WeChat, Alipay or bank bills. Most users can only remember it here, where the payment records are many and the platforms are scattered. When it is troublesome to operate. However, you can consider the possibility of screenshots uploading, automatic intelligent identification, or to import the expenditure bills of related platforms in one click, which can attract more needable users.

Fourth, conclusion

Is it really necessary to book accounts? The answer is naturally yes.

The current mobile payment is popular, and the possibility of impulse consumption is much higher than the previous cash consumption. In addition to allowing individuals to consume more rationally, accounting can also allow people to understand their financial conditions, etc., which is an indispensable part of personal financial management.

The annual bills launched by major platforms are also an annual summary of accounting. From large and small bills, we can see the epitome of past life, and the past and the future are displayed here at the same time.

Material Source: Tiantian Ask Topics Selection

"Daily Questions" is a mutual aid Q & A module under the product manager community, and is committed to learning and exchanges between knowledge, operation, marketing and other fields.

This column was edited and edited by @ivy. Welcome everyone to ask questions and communicate together.

The question map is from UNSPLASH, based on the CC0 protocol.

- END -

Tengxian Meteorological Observatory lifted the yellow warning signal [III level/heavier]

The Fujian County Meteorological Observatory lifted the heavy rain yellow warning signal at 22:49 on June 08, 2022.

There is a connotation!Open free!

Nanguan District LibraryPay attention to friends who love readingFrom July 6thNang...