Ebison's half -year net profit of 80 million but dividend 500 million actual controller takes one -third of more than a third

Author:Cover news Time:2022.08.01

Cover Journalist Zhu Ning

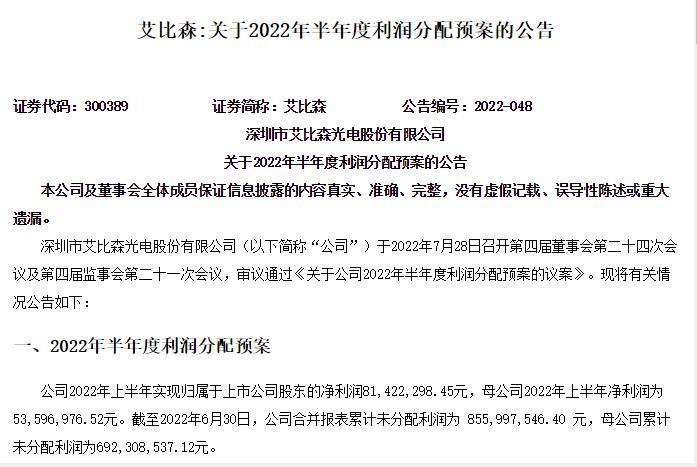

On the evening of July 31, Ebison issued a semi -annual report to distribute a cash dividend of 15 yuan (including tax) to all shareholders for every 10 shares, with a total cash dividend of over 500 million yuan. It is worth noting that Ebison has not divided dividends for many years, but this year's sixth annual report has a lot of dividends, and the dividend of the unproofed profits accumulated for many years has been divided.

According to the financial report, in the first half of 2022, Ebison's revenue was 1.1 billion yuan, an increase of 30.42%year -on -year; net profit was 81.4223 million yuan, a year -on -year losses; it was planned to use about 358 million shares as the base to distribute cash bonus for every 10 shares to all shareholders. Yuan (including tax), a total of about 537 million yuan (including tax).

It is worth noting that the top ten shareholders of the company's top ten shareholders reached 72.25%. In the second quarter of this year, the Swiss Bank, Bodhishay Growth Zhihang Stock Investment Fund, CITIC Securities and other newly became the top ten shareholders of the company. The company's actual controller Ding Yanhui this year In the second quarter, the shares increased by 41 million shares, and the shareholding ratio increased from 25.86%at the end of the first quarter to 34.31%. Therefore, Ding Yanhui, the actual controller, will take more than one -third of the dividend, which is about 184 million yuan.

The company said that the profit distribution plan fully considers the interests of small and medium investors, the company's short -term operating capital needs, and the company's future development plan, which is conducive to shareholders to share the company's operating results. However, the profit distribution plan must also be submitted to the company's shareholders' meeting to review and approve the implementation, and there are uncertainty.

As a domestic LED display application and service provider, after experiencing the growth of high -speed performance in the early stage, Ebison suffered a loss of performance due to the epidemic in 2020. From the perspective of 2021, the company's net profit of that year was only 29.941 million yuan, and the non-net profit was -14.695 million yuan.

Ebissen pointed out in the half -year report of 2022 that during the reporting period, the operating income of the Chinese market declined in 2021; however, the overseas market recovered rapidly with the easing of the epidemic prevention policy, an increase of more than 100%year -on -year. In addition, through the advancement of comprehensive channels, by the middle of 2022, the company has expanded more than 4,000 global channel merchants, forming a relatively complete channel system.

Since 2022, Edison's profitability has shown signs of the bottom. In terms of secondary market performance, Ebison came out of the "V" market during the year. As of press time, the company's stock price reported at 12.85 yuan/share, the lower point has rebounded nearly 70%, but it still fell more than 15%over the beginning of the year.

- END -

Entering the community in the free clinic and getting home healthy

During the early visits, social workers on Jackie Chan Road Street found that some...

Rotating the pile pile side flipping one person being trapped in Haikou fire to quickly break the rescue

Commercial Daily All -Media (Coconut Network/Altitude journalist Li Xingmin Corres...