The Army Festival in August 1st, please accept these policies

Author:Yangtze Cloud Time:2022.08.01

Building the Army Day today,

I wish the Chinese People's Liberation Army a happy birthday!

The reporter sorted out retired soldiers,

Military transfer cadres and family members of the army

Entrepreneurship and employment can enjoy tax discounts,

Let's take a look together

Retired soldiers' entrepreneurial tax deduction

Enjoy the subject

Retired soldiers who are employed

Content

From January 1, 2019 to December 31, 2023, if an independent employment retired soldiers engage in individual operations, they will handle the monthly (36 months, the same below) of 12,000 per household. The quota is deducted from the actual value -added tax, urban maintenance and construction tax, educational costs, local education additional and personal income taxes that the actual value -added tax, urban maintenance and construction taxes, and personal income tax. The limit standard can float up to 20%, and the people's governments of all provinces, autonomous regions, and municipalities may determine the specific limit standards within this extent according to the actual situation of the region.

Enjoy condition

1. Autonomous employment retired soldiers refers to retired soldiers who withdraw from active and place them in accordance with the provisions of the "Regulations on the Receiving Soldiers' resettlement" (the State Council Central Military Commission No. 608).

2. If the taxpayer pays less than the above -mentioned deduction limit, the tax deduction amount is limited to the tax and exemption amount is limited to the actual tax; if it is larger than the above deduction limit, the above deduction limit is limited.

3. The basis for the taxation basis for urban maintenance and construction tax, educational surcharge, and local education additional value -added tax should be taxable before enjoying the preferential tax policy.

Policy basis

1. "Notice of the Ministry of Taxation of the General Administration of Finance on Further Supporting the Research Taxation Policies of Employment and Employment of Employment of Employment of Employment" (Cai Tax [2019] No. 21)

2. "Announcement of the General Administration of Taxation of the Ministry of Finance on extending some tax preferential policies" (2022 No. 4)

Removal of retired soldiers' employment tax deduction

Enjoy the subject

Recruit enterprises that recruit independent employment retired soldiers and sign a labor contract for more than 1 year and pay social insurance premiums in accordance with the law

Content

From January 1, 2019 to December 31, 2023, recruiting independent employment retired soldiers, with it signed a labor contract for more than one year and paying social insurance premiums in accordance with the law, signed a labor contract and paid social insurance in the month. During the year, the number of people enrolled was deducted in turn, deducting VAT, urban maintenance and construction tax, educational surcharge, local education additional and corporate income tax in turn. The quota standard is 6,000 yuan per person per year, and up to 50%of the maximum rises. The people's governments of all provinces, autonomous regions, and municipalities may determine the specific quota standards within this range in accordance with the actual situation of the region.

Enjoy condition

1. Autonomous employment retired soldiers refers to retired soldiers who withdraw from active and place them in accordance with the provisions of the "Regulations on the Receiving Soldiers' resettlement" (the State Council Central Military Commission No. 608).

2. Enterprises in the above policies refer to enterprises such as VAT taxpayers or corporate income taxpayers.

3. Enterprise and recruitment of independent employment retired soldiers signed a labor contract for more than one year and paid social insurance premiums in accordance with the law.

4. Enterprises can apply the above -mentioned tax preferential policies and other special tax policies for support for employment. They can choose to apply the best preferential policies, but they must not be enjoyed repeatedly.

5. Enterprises calculate the total tax exemption and exemptions of the enterprise according to the number of recruits and the time signed, and deduct the value -added tax, urban maintenance and construction tax, educational costs, and local education additions within the total amount of accounts and exemptions. If the value -added tax, urban maintenance construction tax, educational costs, and local education attachments are less than the total amount of accounting and exemption tax, the actual value -added tax, urban maintenance construction tax, education and local education additional additional value -added tax, urban maintenance construction tax, urban maintenance construction tax, urban maintenance construction tax, urban maintenance construction tax, urban maintenance construction tax If the actual value -added tax, urban maintenance and construction tax, educational costs, and local education additional and local education are greater than the total amount of accounting and exemption tax, the total amount of tax reduction and exemption is limited.

At the end of the tax year, if the actual value -added tax, urban maintenance and construction tax, educational costs, and local education additional tax reduction tax and exemption tax are less than the total amount of accounting and exemption, the enterprise reserves the corporate income tax at the difference when the corporate income tax is settled. If the deduction of that year will not be reduced, the annual deduction will be deducted after the transfer.

6. The basis for the taxation basis for urban maintenance and construction tax, educational surcharge, and local education is to enjoy the value -added tax should be taxable before enjoying the preferential tax policy.

Policy basis

1. "Notice of the Ministry of Taxation of the General Administration of Finance on Further Supporting the Research Taxation Policies of Employment and Employment of Employment of Employment of Employment" (Cai Tax [2019] No. 21)

2. "Announcement of the General Administration of Taxation of the Ministry of Finance on extending some tax preferential policies" (2022 No. 4)

Family family members of the army are exempt from VAT for entrepreneurship

Enjoy the subject

Family members engaged in individual operations

Content

From the date of handling tax registration matters, the taxable services provided by it are exempted from value -added taxes within 3 years.

Enjoy condition

A certificate issued by the political organs above the or more of the division may show that each family member can enjoy a tax exemption policy.

Policy basis

"Notice of the State Administration of Taxation of the Ministry of Finance on the Pilot Pilot of Comprehensive Pushing for the VAT of Operation Tax Reform" (Cai tax [2016] No. 36) Appendix 3 "Regulations on the Transition Policy of the VAT Pilot Pilot Pilot VAT" (39) item

Personal income tax for the family members of the army

Enjoy the subject

Family members engaged in individual operations

Content

Family members of the army are engaged in individual operations. From the date of receiving tax registration certificates, personal income tax is exempted from three years. Enjoy condition

1. Family members of the army are engaged in individual operations, and there must be proof issued by political organs or above that can show their identity.

2. Each family member can only enjoy a tax exemption policy in accordance with the above provisions.

Policy basis

"Notice of the State Administration of Taxation of the Ministry of Finance on the Employment of Family Family Council" (Cai tax [2000] No. 84)

Enterprises that reset their families with their families are exempt from VAT tax

Enjoy the subject

New companies newly opened to resettle their families of the army

Content

For the newly issued enterprises to resettle the employment of the family members of the army, the taxable services provided by the tax registration certificate will be exempted from VAT within 3 years from the date of receiving the tax registration certificate.

Enjoy condition

The settlement of the settlement of the army must account for 60%(inclusive) of the total number of enterprises, and there are certificates issued by political and logistics agencies above the military (inclusive).

Policy basis

"Notice of the State Administration of Taxation of the Ministry of Finance on the Pilot Pilot of Comprehensive Pushing for the VAT of Operation Tax Reform" (Cai tax [2016] No. 36) Appendix 3 "Regulations on the Transition Policy of the VAT Pilot Pilot Pilot VAT" (39) item

Military transfer cadre entrepreneurial exemption VAT tax

Enjoy the subject

Military transfer cadres engaged in individual operations

Content

From the date of receiving the tax registration certificate, the taxable services provided by it are exempt from VAT within 3 years.

Enjoy condition

The self -employed military transfer cadres must hold the transfer certificate issued by the troops above the or more.

Policy basis

"Notice of the State Administration of Taxation of the Ministry of Finance on the Pilot Pilot of Comprehensive Pushing for the VAT of the VAT" (Cai tax [2016] No. 36) Appendix 3 "Regulations on the Transition Policy of the VAT Pilot Pilot Pilot of Business Tax Reform" (40)

The self -employed military transfer cadres exempt personal income tax

Enjoy the subject

Military transfer cadres engaged in individual operations

Content

The self -employed military transfer cadres are engaged in individual operations. From the date of receiving tax registration certificates, personal income tax is exempted from three years.

Enjoy condition

The self -employed military transfer cadres must hold the transfer certificate issued by the troops above the or more.

Policy basis

"Notice of the State Administration of Taxation of the Ministry of Finance on the Taxation Policy of the Army to Transfer Cadres of the Army of the Ministry of Finance" (Cai Tax [2003] No. 26)

Enterprises that reset the army to employment cadres are exempt from VAT tax

Enjoy the subject

New companies that are newly opened to resettle their own jobs to transfer their jobs

Content

In order to resettle the employment of military -transferred cadres who have selected their own jobs, the newly opened enterprises, from the date of receiving the tax registration certificate, the taxable services provided by it are exempt from value -added taxes within 3 years.

Enjoy condition

1. The resettlement independent selection army transfer cadres account for 60%(inclusive).

2. Army -transferred cadres must hold a transfer certificate issued by the troops above or above.

Policy basis

Notice of the State Administration of Taxation on the State Taxation of the Ministry of Finance on the Pilot Pilot of Comprehensive Promoting the VAT of Business Tax Reform (Cai Tax [2016] No. 36) Appendix 3 "Regulations on the Transition Policy of the VAT Tax Tax Tax Taxation Taxation Tax" (40)

- END -

Guowang Yantaihai Yang City Power Supply Company: Emergency increase to help enterprises open full horsepower production

Yesterday, the staff of the Guoyang Power Supply Company of the Guoying Yanyang Ci...

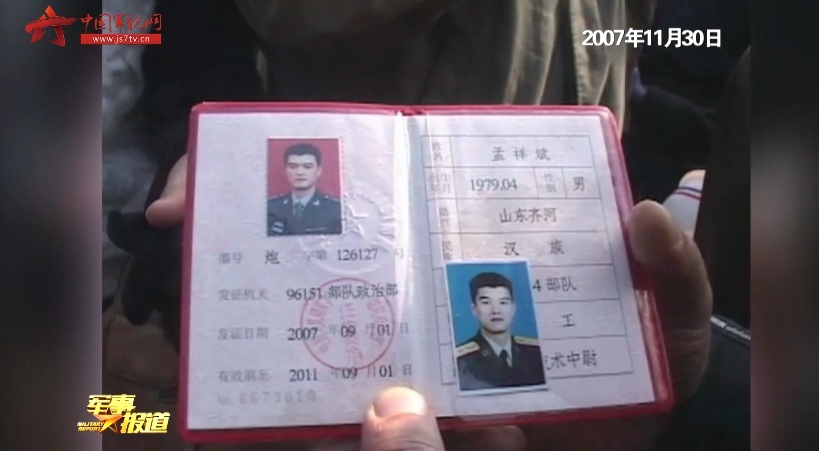

The martyr Meng Xiangbin's daughter to apply for her father's alma mater is the continuation of love, and it is also the heroic inheritance of the hero.

Recently, Meng Shiyan, the daughter of the martyr Meng Xiangbin, was moved to the ...