There are counts | National 279 banks' wealth management capabilities rankings (2022 222)

Author:Cover news Time:2022.08.01

The bank's wealth management capacity ranking is based on the second quarter of 2022. The bank wealth management institution included in the ranking in this quarter, a total of 279, an increase of 2 more than the previous period; including 18 national financial management institutions (6 state -owned financial management companies, 6, Twelve shares and shareholders' wealth management companies), 112 financial institutions in urban business, and 149 rural financial financial management institutions.

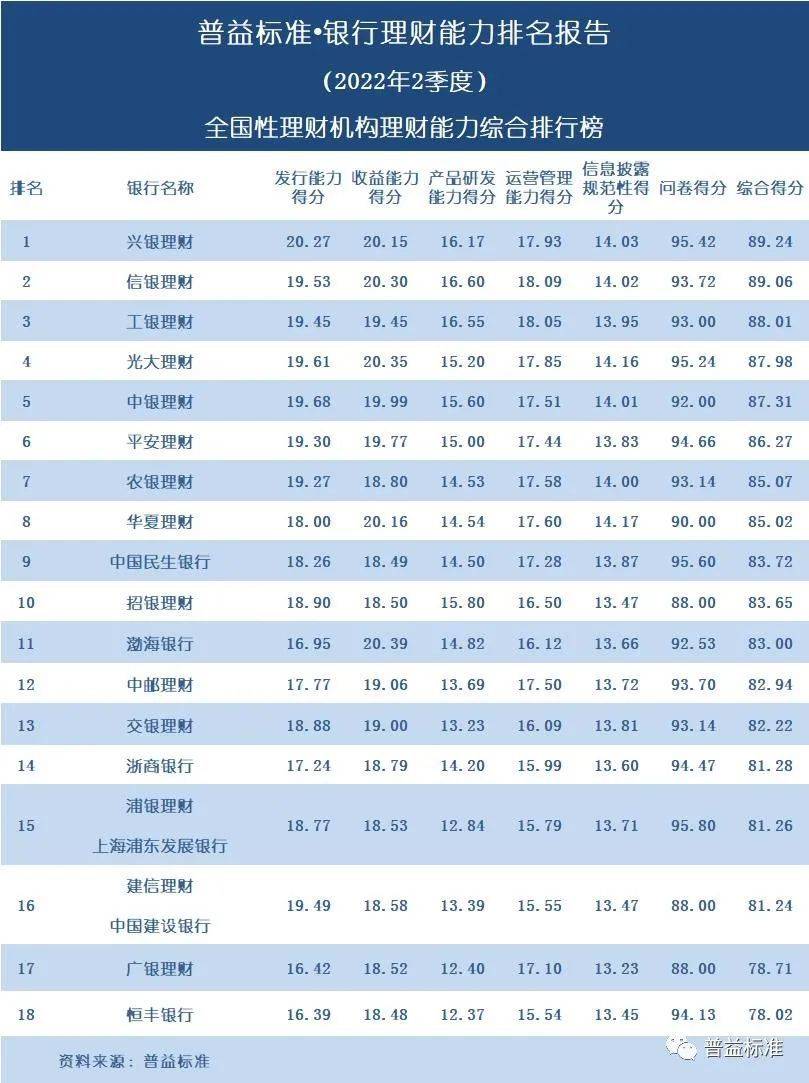

Comprehensive financial management capabilities ranking

The top five national wealth management institutions are the top five for Xingyin Financial Management, Bank of Wealth Management, ICBC Financial Management, Everbright Finance, and BOC Financial Management;

The top ten of the financial management institutions of the urban business department are Su Yin Financial Management, Nanyin Finance, Ningyin Finance, Shangyin Finance, Huiyin Financial Management, Qingyin Financial Management, Bank of Beijing, Hangzhou Bank Finance, Hankou Bank, Tianjin Bank;

The top ten rural financial management institutions are the Chongqing Rural Commercial Finance, Shanghai Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Qingdao Rural Commercial Bank, Jiangsu Suzhou Agriculture Commercial Bank, Dongguan Rural Commercial Bank, Beijing Rural Commercial Bank.

In the second quarter of 2022, Xingyin's financial management performance was outstanding, the distribution capacity score ranked first, and product research and development capabilities, operation management capabilities, and standardized information disclosure scores were all third in national financial management institutions. Its comprehensive wealth management capabilities ranks first in national financial management institutions; the average score of the research and development capabilities and operation management capabilities of Xinyin Bank of Wealth Management products ranks first in national financial management institutions. It is also among the top five to help them rank second in the second quarter of the national financial management institution's financial management capabilities; ICBC wealth management product research and development capabilities and operating management capabilities are ranked second in national financial management institutions, and other rankings It is also among the best, so its comprehensive ranking ranks third in national financial management institutions.

Table 1: Comprehensive list of banking wealth management capabilities (2022 222)

Ranking

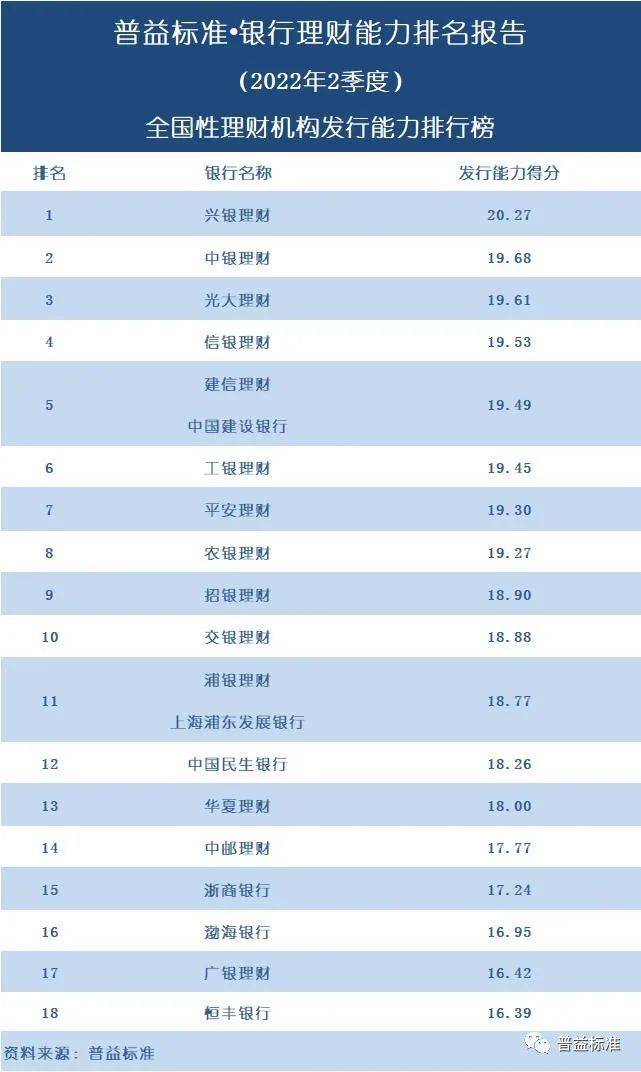

The top five national wealth management institutions are Xingyin Financial Management, BOC Financial Management, Everbright Financial Management, Xinyin Financial Management, CCB Financial/China Construction Bank;

The top ten of the financial management institutions of the urban business department are Ningyin Financial Management, Hangyin Financial Management, Su Yin Financial Management, Nangxin Finance, Shangyin Financial Management, Huiyin Financial Management, Qingyin Financial Management, Bank of Central Plains, Bank of Beijing, Hankou Bank;

The top ten rural financial management institutions are the Chongqing Rural Commercial Management, Shanghai Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Beijing Rural Commercial Bank, Qingdao Rural Commercial Commercial Commercial Commercial Commercial Commercial Commercial Commercial Commerce Bank, Dongguan Rural Commercial Bank, Zhejiang Xiaoshan Rural Commercial Bank.

According to the statistics of the Puyi Standard Standard, the net worth of the national financial institution (including state -owned banks and its wealth management companies and joint -stock banks and its wealth management companies in 2022 in the second quarter of 2022 was 14,327, with a duration of about 2.070 trillion yuan Essence Among them, state -owned banks and their wealth management companies have a net value -type wealth management product for 6090 models, with a duration scale of about 9.63 trillion yuan. Trillion yuan.

In the second quarter of 2022, national financial management institutions performed well, with an average score of 18.57 points, an increase of 0.13 points from the first quarter. Among the top ten institutions in this indicator, the proportion of state -owned banks and their wealth management companies and joint -stock banks and their wealth management companies is 3: 7, and the overall performance of joint -stock banks and their wealth management companies this quarter is relatively good. In terms of net worth products, most institutions have achieved the scale of net worth wealth management products, and the cumulative scale of 18 financial management institutions increases by more than 350 billion yuan.

Table 2: Listing of Issuance Capability (2022)

Ranking

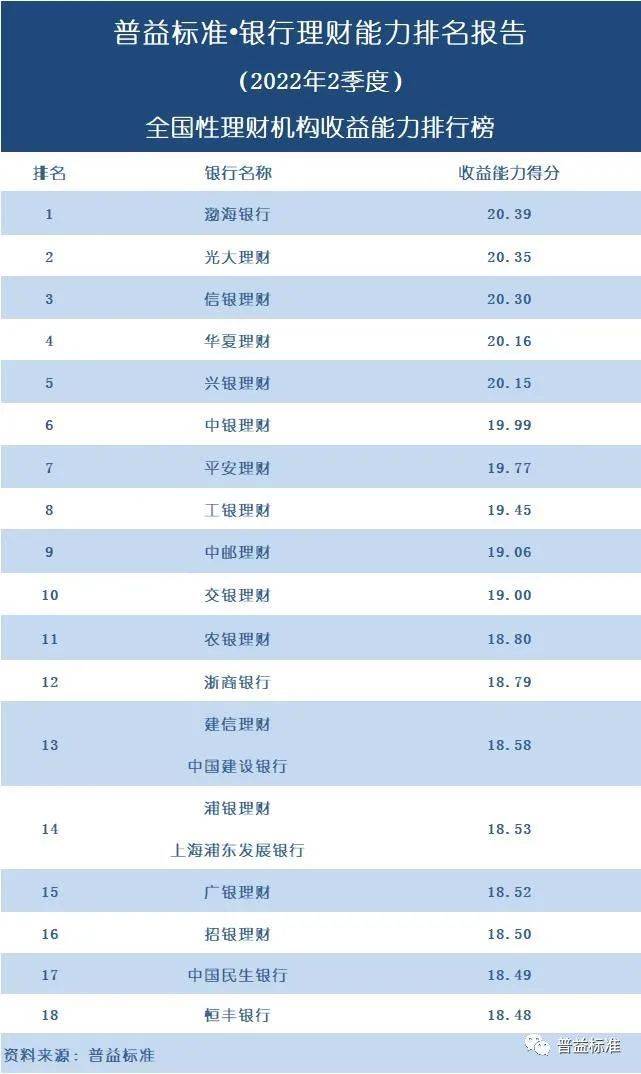

The top five national financial management institutions are Bohai Bank, Everbright Finance, Bank of China Finance, Huaxia Finance and Xingyin Financial Management;

The top ten of the financial management institutions of the urban business department are Nangong Financial Management, Su Yin Finance, Ningyin Finance, Shanghai Bank of Finance, Huiyin Financial Management, Qingyin Financial Management, Bank of Tianjin Bank, Bank of Guangzhou, Changsha Bank and Huarong Xiangjiang Bank;

The top ten rural financial management institutions are Shanghai Rural Commercial Bank, Jiangsu Jiangnan Rural Commercial Bank, Chongqing Rural Commercial Finance, Chengdu Rural Commercial Bank, Qingdao Rural Commercial Bank, Guangzhou Rural Commercial Bank, Jiangsu Suzhou Rural Commercial Bank, Guiyang Rural Commercial Commerce Banks, Hangzhou United Rural Commercial Bank and Ningbo Yinzhou Rural Commercial Bank.

In the bank's wealth management capacity ranking indicator system, the revenue capacity is mainly inspected for cash management, fixed income, mixed, and equity products (the financial derivative category is not considered for the time being). Among them, cash management products and fixed income products mainly examine the absolute income of products (seven -day annualized income and recent income performance); hybrid products and equity products mainly examine the risk adjustment of products. In addition, according to the product rating model developed by Puyi Standard, the revenue capacity score also includes the investigation of the number of star products of each financial institution, and pays attention to the status of the star products of each institution.

Table 3: Ranking of Revenue Capability (2022)

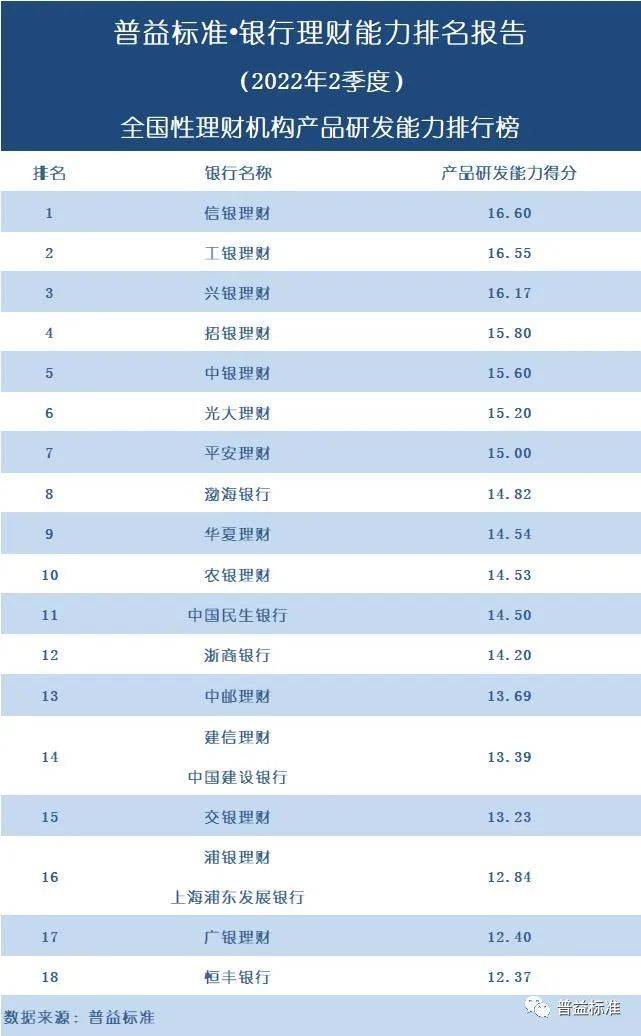

Product research and development capabilities ranking

The top five national wealth management institutions are the top five for faith, financial management, ICBC Finance, Xingyin Financial Management, China Merchants Financial Management, and BOC Financial Management;

The top ten of the city and business management institutions are Ningyin Financial Management, Nanyin Financial Management, Su Yin Finance, Shangyin Financial Management, Huiyin Financial Management, Hangzhou Bank Finance, Bank of Beijing, Changsha Bank, Huarong Xiangjiang Bank, Hankou Bank;

The top ten rural financial management institutions are Guangzhou Rural Commercial Bank, Shanghai Rural Commercial Bank, Chongqing Rural Commercial Finance, Jiangsu Jiangnan Rural Commercial Bank, Chengdu Rural Commercial Bank, Qingdao Rural Commercial Bank, Hangzhou United Rural Commercial Bank, Jiangsu Suzhou AgricultureCommercial Bank, Beijing Rural Commercial Bank, Dongguan Rural Commercial Bank.From the perspective of product research and development capabilities in the second quarter, the product research and development capabilities of national wealth management institutions were strong, with an average score of 14.52, an increase of 0.53 points from the first quarter.Among the top ten institutions in this indicator, the proportion of state -owned banks and their wealth management companies and their shareholders and their wealth management companies is 3: 7, and the performance of shares and wealth management companies is more dazzling.With the personalization and diversification of investors' wealth management needs, the development capacity of national financial management institutions has continued to increase. On the one hand, it continues to enrich product types and increase the distribution of mixed and equity products. On the other hand, product innovation is continuousESG, pension, cross -border financial management and other products.

Table 4: Product R & D capacity rankings (2022 222)

Cover reporter Dong Tiangang

- END -

The large -scale precipitation process will open tomorrow

Today's Tongliao Meteorological Observatory continuesWeather forecast during the r...

Aboriginal people in the United States described the Black History of the Black History of the Black History of the School of Black History, sexually assaulted, and mental abuse

The American Aboriginal Parade protests racial discrimination and abuse (data map)...