The securities management subsidiary's subsidiaries have accelerated the landing, wealth management has risen, and the "East Character" fell collectively."Brokerage Ranking"

Author:Huaxia Times Time:2022.07.31

China Times (chinatimes.net.cn) reporter Wang Zhaohuan Beijing report

At the end of July, with the performance of listed companies' interim reports, brokers also submitted their transcripts for half a year, but they were not ideal. Recently, the brokerage officials represented by Great Wall Securities have established asset management subsidiaries. In the second half of the year, the wealth management warfare wolves, and the old -fashioned asset management households face huge challenges.

According to the statistics of the same flower Shunshun, in the past week (July 25th to July 29th), the overall performance of the brokerage sector has a general performance, and the red tower securities that encounters the double -resistance of personnel earthquakes and performance are ranked first in the list, and the stock price has fallen 3.7%; "East East "The character Oriental Wealth, Dongxing Securities, and Dongfang Securities fell more than 3%, reaching the top five of the decline; in July, Oriental Securities fell 15.2%, Oriental Wealth fell 12.4%, and Dongxing Securities fell 7.75%.

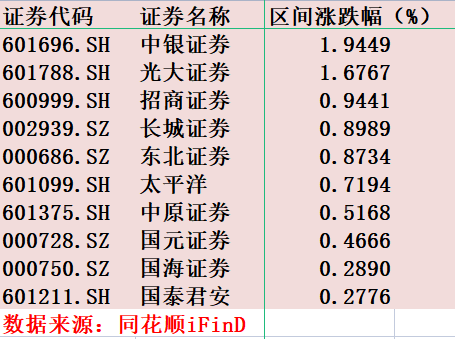

On this week's increase list, BOC Securities rose 1.9%, Everbright Securities rose 1.6%, and China Merchants Securities rose 0.9%.

Wealth Management Horseing Circle

On the evening of July 27, Great Wall Securities issued an announcement saying that in order to accelerate the development of the asset management business and meet the current supervision policy of the asset management industry, it is planned to contribute to RMB 1 billion to establish a wholly -owned subsidiary Great Wall Securities Asset Management Co., Ltd. Securities asset management business and change the company's business scope accordingly.

It is worth noting that Great Wall Securities also revealed in the announcement that as the asset management subsidiary applied for the management business of public fundraising securities investment funds after meeting the conditions stipulated in relevant laws and regulations.

Great Wall Securities stated in the announcement that the establishment of asset management subsidiaries is conducive to the company's development of asset management business, conforms to the current supervision policy of the asset management industry, accelerate the transformation of wealth management, improve the capacity of comprehensive wealth management services, and then realize that the "asset management business has become a connection to connect The waist force of the company's capital and assets, based on active management transformation results, has become an important internal support for wealth management business and an important customer center for the company.

According to statistics, since 2020, more than 10 securities firms including Shenwan Hongyuan Securities, CICC, Huachuang Securities, and CITIC Construction Investment have applied for the establishment of asset management subsidiaries. Since the beginning of this year, Guolian Securities, Guoxin Securities and Hua'an Securities have issued an announcement stating that they are planning to establish asset management subsidiaries. In July of this year, the CSRC has approved the establishment of asset management subsidiaries.

On May 20, the Securities Regulatory Commission issued the "Measures for Supervision and Management of Public Funding Securities Investment Fund Managers". The "Measures" modified in the "Administrative Measures for the Management of Securities Investment Fund Management Company" in the original fund industry. Business chain standards fund company business development.

The "Measures" relaxed the "one ginseng and one control" to "one ginseng, one control one card", and cleared the institutional obstacles for the securities asset management. According to Xu Fengyu, an analyst of Huabao Securities, it is expected that more securities management management will apply for public offering licenses in the future and enters the public funds in the Red Sea field.

"For high -strength medium -sized securities firms, obtaining public offerings is that the business can be more diversified and further improve the comprehensive strength and profitability. The field of wealth management has made its own brand, and related investment, research, services, management and other soft power challenges are not small. "A Beijing brokerage chief non -bank industry analyst said in an interview with the China Times reporter.

Performance continues to be under pressure

In the first half of the year, A -shares continued to be weak, and the performance of the brokers in the first half of the year was obvious, and the rebound of investors' minds did not arrive as expected.

According to reporters based on the statistics of the same flower Shunshun, as of the end of July, nearly 14 listed brokers in A shares disclosed the performance express report and performance forecast.

In the forecast, there are 7 pre -minus, and there are two first losses. The Pacific has declined more than doubled, and SMEs such as Southwest Securities, Dongxing Securities, Hongta Securities, and West China Securities have a pre -decrease of more than 50%.

A few days ago, Zhejiang Business Securities and Guotai Junan issued performance express reports. Zhejiang Business Securities announced that from January to June 2022, Zhejiang Commercial Securities achieved total operating income of 7.459 billion yuan, an increase of 4.64%year-on-year; net profit attributable to shareholders of listed companies was 727 million yuan, a year-on-year decrease of 17.26%; The company's shareholders' deduction of non -recurring profit and loss was 711 million yuan, a year -on -year decrease of 15.74%.

Guotai Junan released a performance fast report that the company achieved operating income of 19.534 billion yuan in the first half of the year, a year -on -year decrease of 10.88%; net profit was 6.373 billion yuan, a year -on -year decrease of 20.46%.

In addition, Guoyuan Securities announced that in the first half of this year, operating income was 2.474 billion yuan, an increase of 8.73%year -on -year; net profit attributable to shareholders of listed companies was 749 million yuan, a year -on -year decrease of 11.5%.

It can be seen that the explanation of securities firms in performance forecast tends to be consistent, mainly due to the downturn market of A shares affected investment income, and some brokerage companies also provide credit impairment losses due to the company's stock pledge.

In contrast, the performance of Oriental Wealth is unique. The securities subsidiary released in the semi -annual unreasonable financial statements in 2022 shows that the company's current revenue achieves 4.177 billion yuan, an increase of 34.14%year -on -year; A year -on -year increase of 37.52%. Fund slightly increased

Compared with the helplessness of the first half of the year, the fund's slightly increasing distribution of the securities company's stocks has made investors a little gratitude.

Tianfeng Securities released a research report stating that in the second quarter of 2022, the non -banking industry had rebounded in the positions of the fund, but the configuration and valuation were at a historical low. Among them, the brokerage sector has increased from the previous month, and the proportion of Oriental Wealth has rebounded sharply. CITIC Securities has steadily increased since 2021.

Statistics from Tianfeng Securities showed that in the second quarter, the brokerage sector index rose 2.6%, of which Oriental wealth rose 20.7%; the proportion of active rights fund heavy warehouse brokers was 1.58%, an increase of 0.26%month -on -month; The market value of the stock circulation is standard, the brokerage sector is equipped with 3.42%, and the low -ending ratio of the active equity fund is 1.84%.

At the same time, the addition of stocks is mainly concentrated in Oriental Wealth, and the proportion of heavy positions increased by 0.37%to 1.17%month -on -month. It is the only super -allocated stock of the brokerage sector. The scale is in the upward interval, and the increase in wealth management prosperity is the main cause.

In addition, CITIC Securities has steadily increased since 2021. The proportion of heavy positions in the second quarter of 2022 was 0.19%. It reflects strong toughness in market fluctuations. The profitability of institutional business formed is the main cause.

Open source securities analysts are superbly believed that the comprehensive registration system and fund net purchase are important catalysis in the second half of the year. Among them, the logic of the Great Wealth Management remains unchanged, and the improvement of the fund's net purchase will catalyze the track market. In April and May of 2022, a net redemption of partial stock funds appeared. The rebound in the first quarter of 2019, from January to March 2019, a single monthly rebound was 3.8%, 11.3%, and 5.7%, respectively. The fund shares are -1.6%, -1.6%, and-0.3%month-on-month. If a three-month net redemption is used as a neutral hypothesis, it is expected that it is expected to return to net for the third quarter of 2022. Stock ETFs and partial stock funds have improved the margin of new data. It is expected that partial stocks in the second quarter of 2022 will have an inflection point year -on -year. It is expected to drive large wealth line profitability and market valuation. The track is expected to usher in Davis double -click.

At the same time, from the perspective of superb, a package of policies with a comprehensive registration system is good for securities firms. It is expected that the probability of landing within the year is expected to have a high probability of landing in the year, and the main board registration system is directly favored by the investment banking business. The capital market reform policies that are fully rolled out from the assets and funds will fully benefit the various businesses of securities firms, and the head brokers may benefit more.

In addition, the comprehensive registration system may introduce the supporting facilities into long -term funds. In the future, it is expected to launch the long beef and slow cow market, which is conducive to attracting residents' wealth to the migration of equity financial assets and facilitating wealth management lines.

Editor: Editor Yan Hui: Xia Shencha

- END -

From "one horse and one certificate" to "one car and one certificate"!Guangdong -Hong Kong cross -border horse racing fast customs clearance

The brilliant pearls on the back of the north -Guangzhou Conghua, the Ruixi River,...

The party building leads the "sunset red" of happiness

Sanbanqiao Township, Lianhua County, Jiangxi Province takes Party Construction+ as the lead, integrates party building work into the cause of people's livelihood, comprehensively implements the par...