July Public Fund Investment Monthly News 丨 July runs, the strongest products have risen nearly 70%in the past March!Fu Pengbo and other "Double Ten Fund Managers" performance fell now

Author:Daily Economic News Time:2022.07.31

Just in July, the A -share market index performance was not strong. The Shanghai Index, Shenzhen Index, GEM Index, and Science and Technology 50 Index were adjusted.

However, individual stock markets are very lively. Energy storage, robots, cultivation of diamonds, automotive parts and other sectors have become the protagonist of the market. In the recent market, a number of public offering products have soared. The strongest products have increased by more than 70%in the past March, and the number of products with an increase of more than 40%have also increased significantly.

So, since the second quarter, which fund managers have become the hardest players? Which products are walking forward?

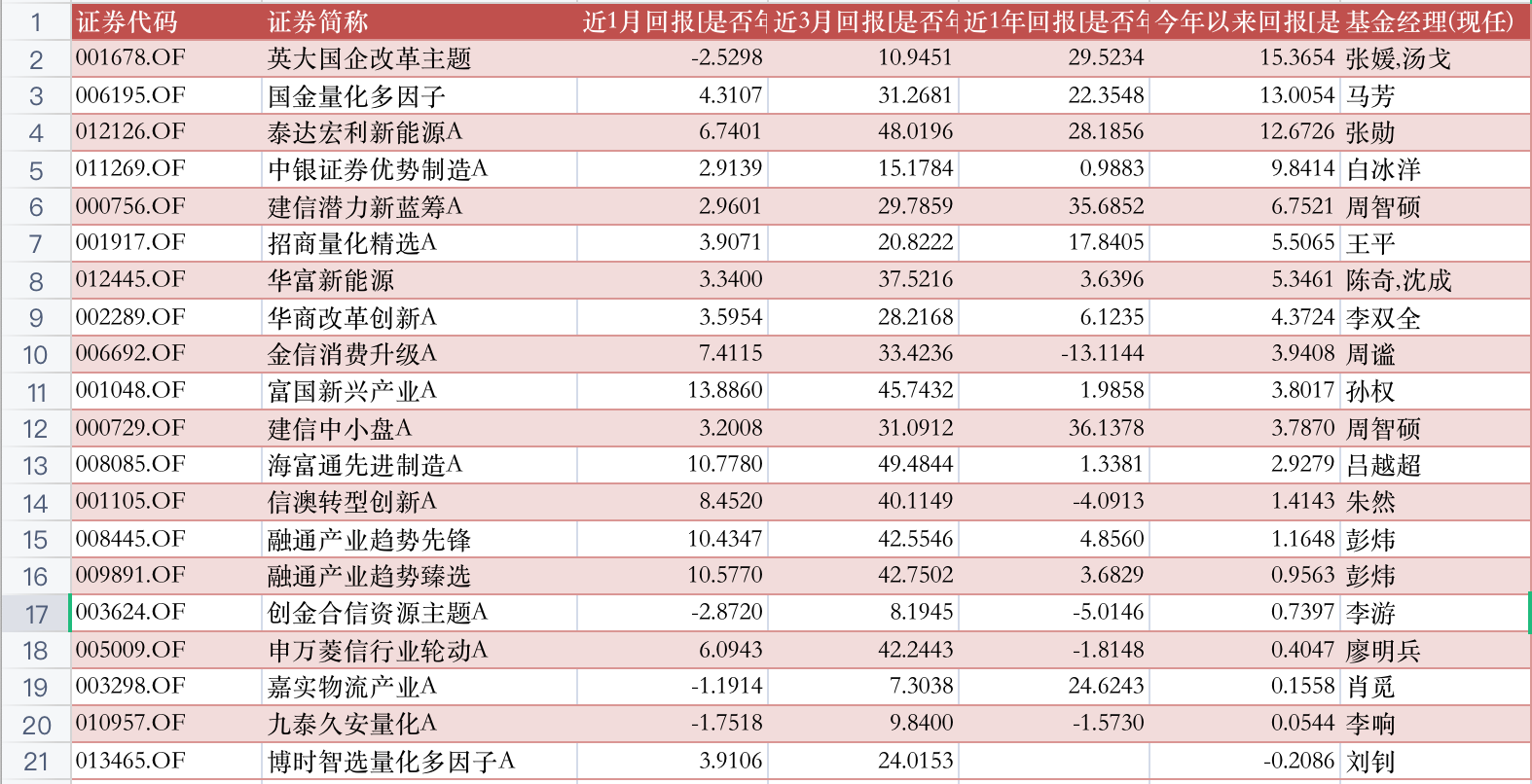

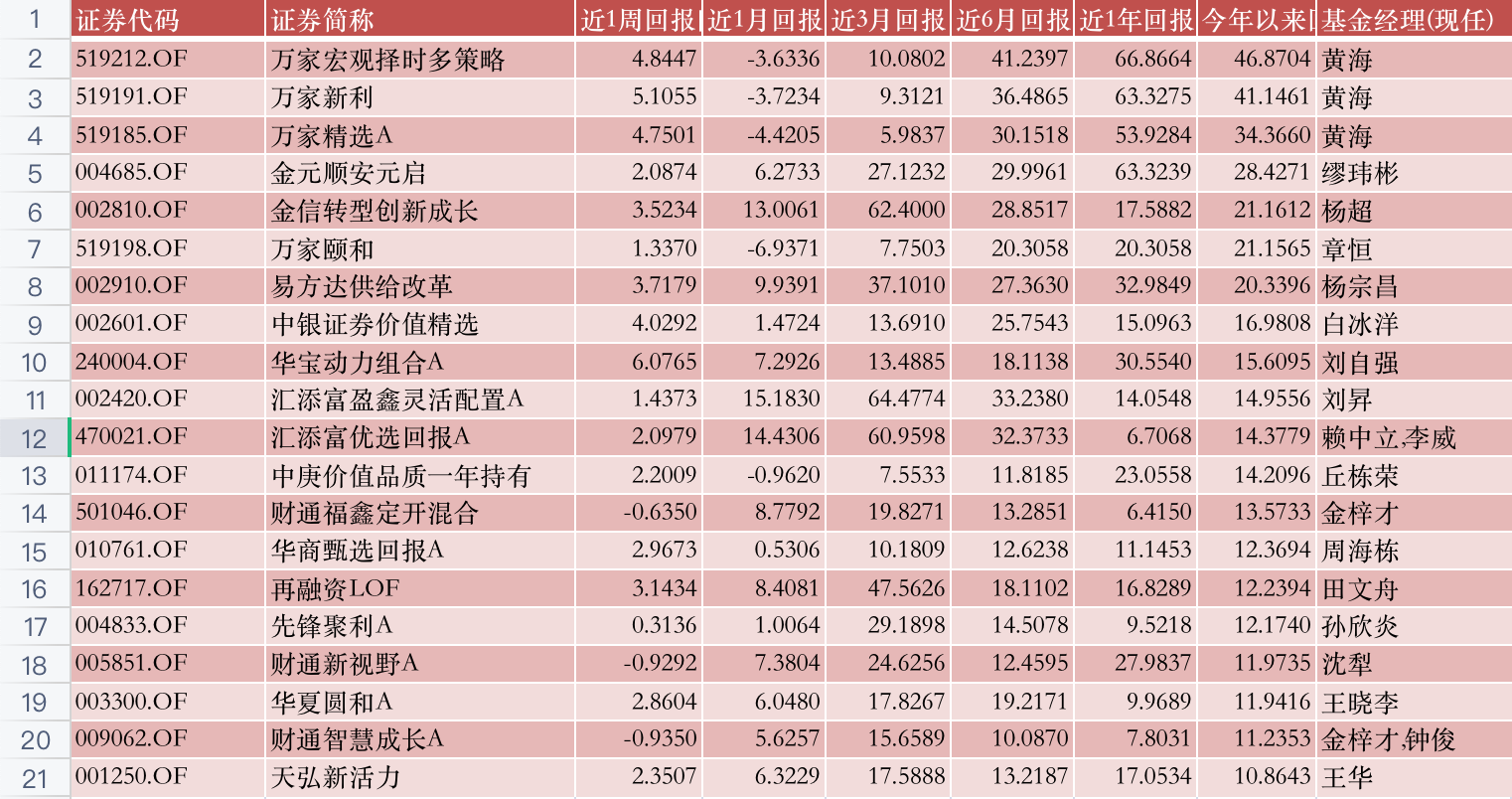

Stock "Niu Ji" TOP20 list: The performance battle battle is staged fiercely, and the three members will perform well

In the first half of this year, active stock funds had almost lost money at a time. As of the end of April, only two products achieved positive returns. However, with the recovery of the market in May and June, the performance of active stock funds has gradually recovered. After the adjustment of the market in July, the performance ranking of these funds has begun to become more and more intense.

As of July 28, active stock funds ranked first in Britain's state -owned enterprise reform (the first half of the year's share champion), but its return this year has declined slightly, and the net value has increased by 15.36%. Quantitative multi -factor, Tedda Manuro New Energy A, both rewarded more than 10%during the year.

Interestingly, among the top four products in July, Zhang Yuan, the manager of the British State -owned Enterprise Reform Fund, Ma Fang, the manager of Guojin Multi -factor Fund, and Bai Bingyang, the Manager of BOC Securities, all of them are female fund Manager, this is still very rare in recent years.

In addition, it is worth mentioning that the net value of the share foundation has risen significantly in the past three months. For example, Hai Futong's advanced manufacturing, the net value increase in the past three months reached 52%, which also made the product the first in the past March in the past March. Lu Yuechao, the manager of this product fund, currently manages three hybrid funds and a stock -type fund, with a total management scale of 4.1 billion yuan, and these products have increased by more than 50%in the past three months. The direction of its layout is mainly in the new energy industry chain.

In addition, products such as TEDA Manuro New Energy, Xin'ao's transformation and innovation, integration of industrial trends, and rotation of Shenwan Lingxin Industry have also achieved more than 40%of positive returns in the past March.

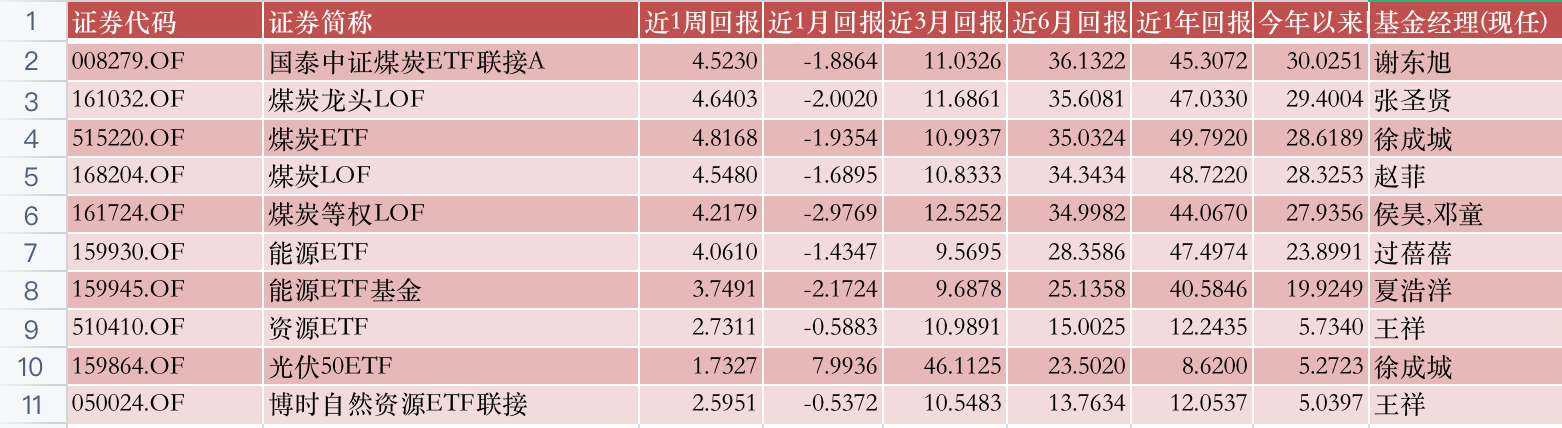

Take a look at the TOP10 list of passive index funds. It is still mainly based on resource products such as coal and oil. Instead, it is a photovoltaic index fund, such as photovoltaic 50ETF, 46%of the recent March income, and has obtained more than 5%this year. The income is also as high as 45%, but because the product is a new product established this year, there is no statistics within the list.

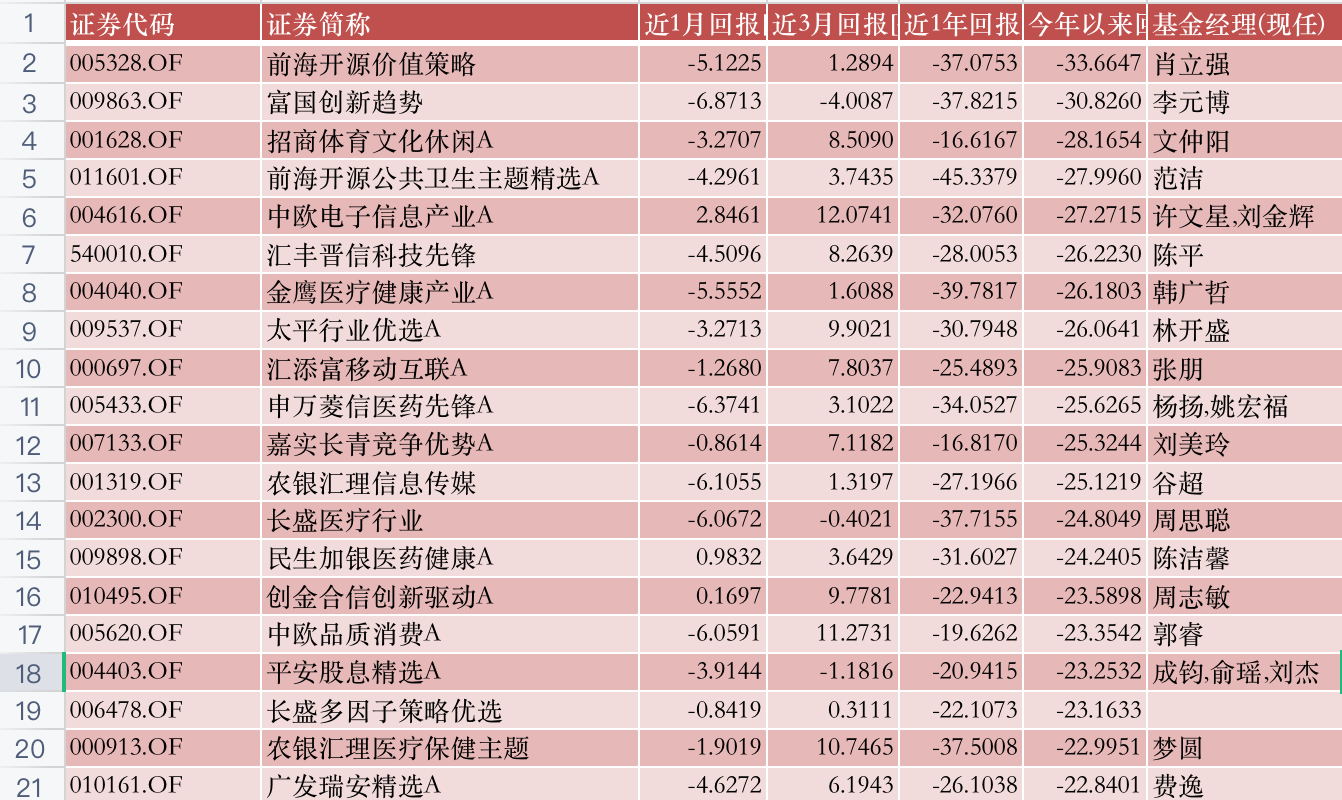

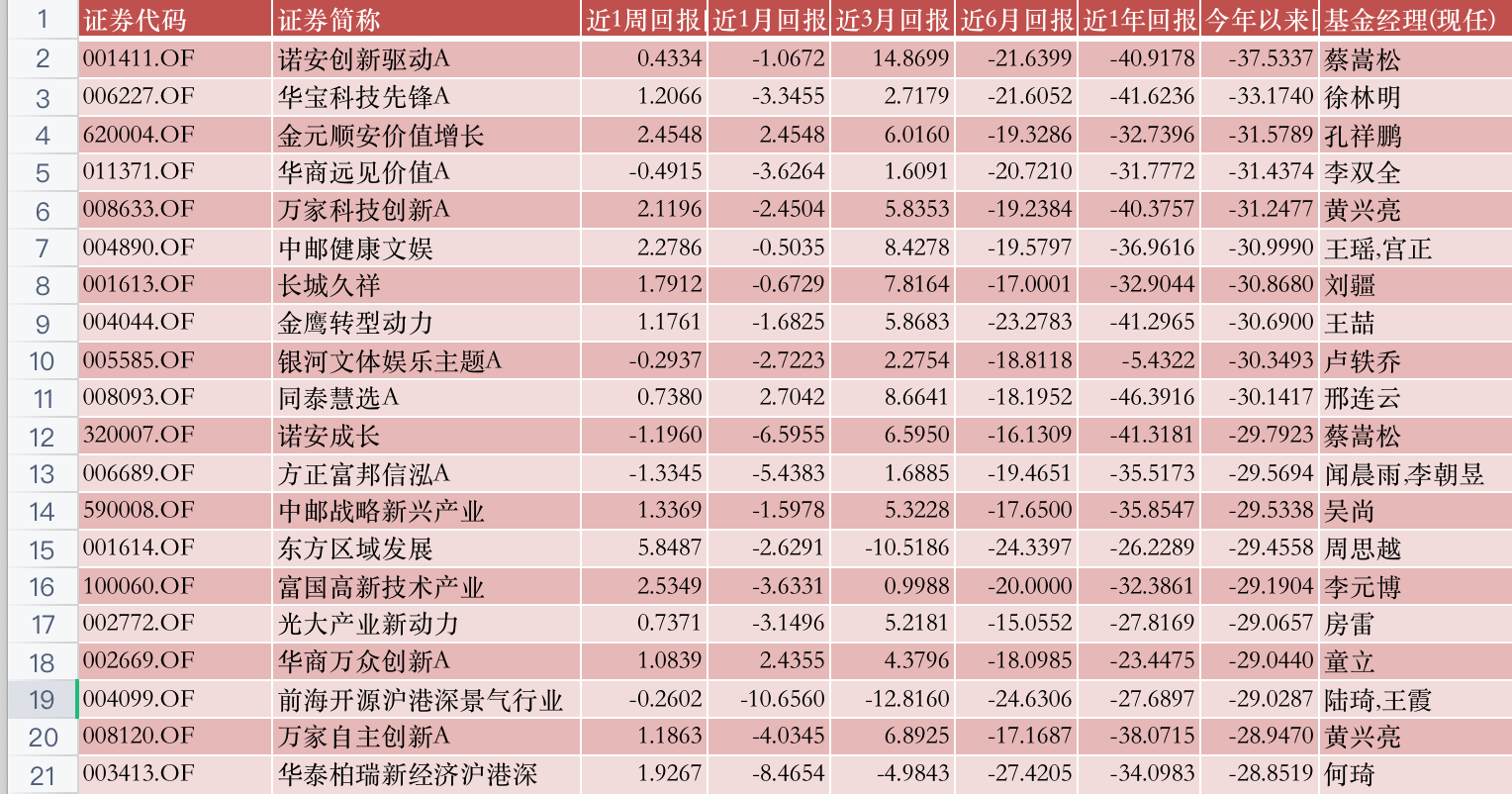

Stock "weak base" TOP20 list: The loss is further increased, and some products have encountered liquidation

Last month, we mentioned that in the half -year report of the statistical public fund investments that in May and June this year, as the market rebounded, many funds's performance had obviously rebounded, but some products still "could not afford to fall to the ground." After the market adjustment in July, these after -ranking products not only did not improve significantly, but also increased their losses.

Among them, Qianhai's open source value strategy and the innovation trend of rich countries exceeded 30%of the year, and the losses were further increased. Every reporter noticed that these products on the list of "weak bases" of the list of stocks are mainly based on tracks such as medicine and consumption. Among them, many well -known fund managers are in charge of funds. For example, the Golden Eagle Fund Han Guangzhe, who performed brightly last year, lost 36%this year's Golden Eagle Medical and Health Industry. The theme loss is 23%; Guangfa Rui'an, which is managed by the Guangfa Fund, has a loss of 22.84%, and Fei Yi's wife is the "100 billion stream" China -EU Fund Gram, but Gran's performance this year is also poor -Central EU The medical and health mixed year lost 18%during the year.

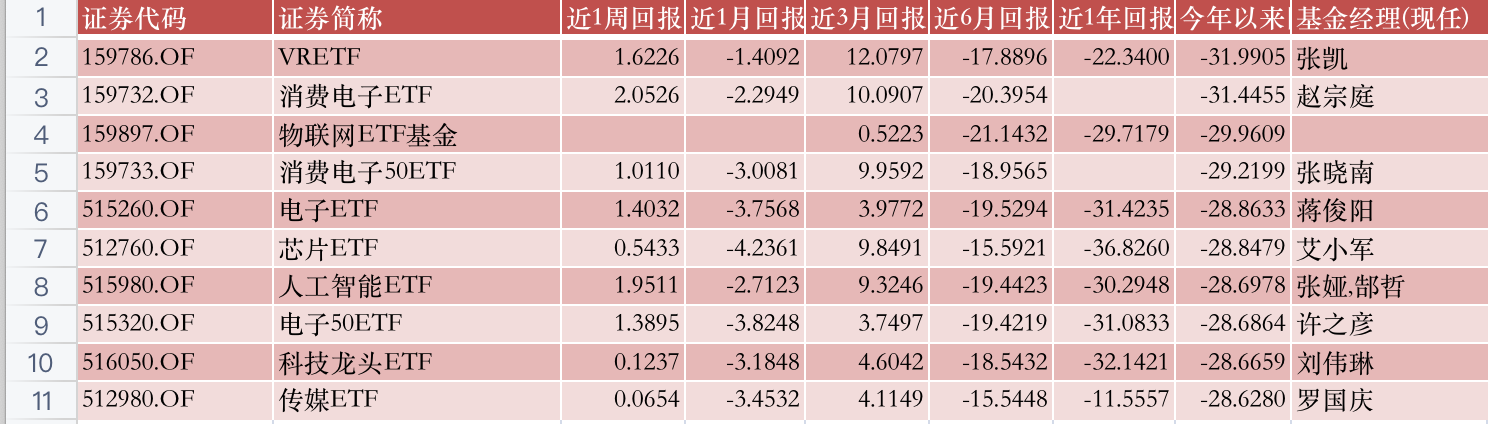

Take a look at the "weak base" TOP10 list of passive index funds. Compared with the list of last month, VR, consumer electronics, artificial intelligence, software, big data, computer, cloud computing, etc. are still the "severe disaster", but the loss is expanded than at the end of June. Only the products have reached a loss of 30%.

It is worth mentioning that whether it is an active stock fund or a passive index fund, each product has been liquidated in July. Among them, the Changdoro factor strategy is preferably liquidated on July 14, and the CCB IoT ETF has been terminated. The net asset value of the daily fund assets is less than 50 million yuan. If the end of July 19, 2022, the net asset value of the fund assets is less than 50 million yuan for 50 consecutive working days. It should be terminated that the fund manager will liquidate the fund in accordance with relevant laws and regulations and the "Fund Contract" and other provisions. Investors are requested to pay attention to relevant risks.

Mixed "Niu Ji" TOP20 list: trading players began to work hard

Continue to pay attention to the performance rankings of hybrid funds. As of the end of July, the three products managed by Wanjia Fund Huanghai continued to win the top three of the mixed foundation, but the income since this year has begun to fall, all in the past month, a decrease of more than 3%.

In addition, the Caitong Fund's heavy positions of pork and aviation stocks have a good performance in the near future, and continue to sit in the TOP20 list of "Niuji". It is worth noting that during the market adjustment process in July, trading fund managers relied on flexible operations to seize the opportunity of stocks during the index adjustment process, and achieved rapid performance. For example, the transformation and innovation of Jinxin managed by Yang Chao has increased by nearly 15%in the past month, and has risen by more than 60%in the past three months. Since this year, it has achieved more than 21%of the income, which is a typical dark horse.

In addition, Liu Sheng's management of Huitian Fuyingxin was mixed, with a return of 15%in the past January, and the income has been 15%since this year, and it has also entered the list. And Huitianfu's other product, Huitianfu's preferred return also achieved an increase of over 10%in January, and recorded 14%of the income this year.

Mixed Fund "weak base" TOP20 list: Cai Songsong continues to the bottom

As of the end of July, Cai Songsong's performance continued to be sluggish. The Nuoan innovation driver's loss of 37.53%of the Nuoan innovation continued to top the list in the mixed "weak base" list. The growth of Noon he managed was nearly 30%of this year.

In addition, Wanjia Fund Huang Xingliang's management of Wanjia scientific and technological innovation and independent innovation of Wanjia have lost 31%and 29%since this year.

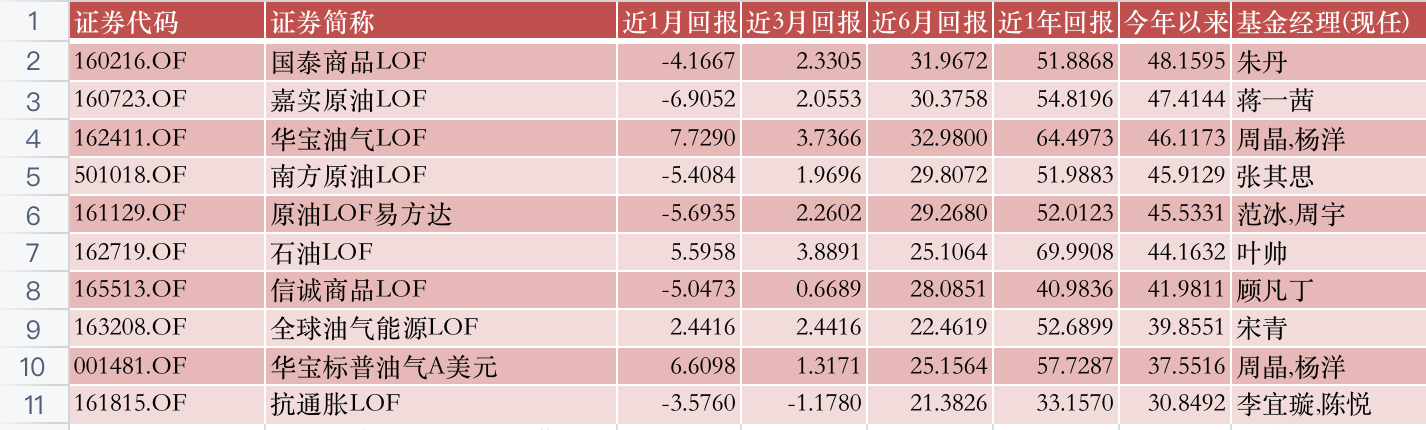

Qdii "Niu Ji" TOP10: Petroleum products fell across the board

Look at the "Niuji" TOP10 list of QDII products. With the significant decline in international oil prices, although the QDII products of petroleum have maintained a good income, the income range has narrowed significantly compared with the end of June, and the net worth has fallen in the past month. In the first half of the year, many products with more than 50%of the income were adjusted after July, and the income range returned below 50%.

QDII "weak base" TOP10 list: Back -cut products have appeared

Last year, Education ETF performed the worst in QDII products, but after June this year, educational ETFs significantly recovered, and the net value rose sharply.

However, as of the end of July, another net value -worthless product appeared -Cathay Pacific's high income overseas, which has lost 47%since this year.

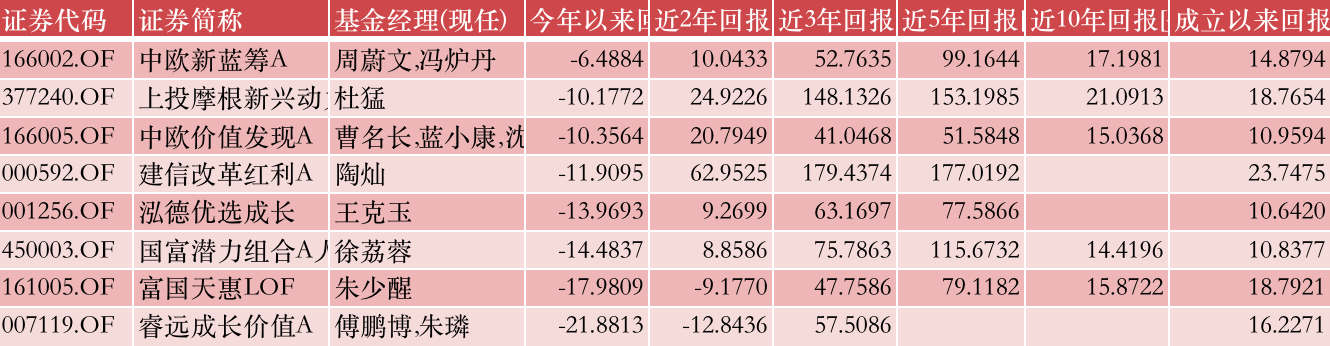

Ten Ten Fund Manager follow -up: Fu Pengbo is "lying flat" completely?

As of the end of June, the performance of the 8 "Double Ten Fund Managers" we tracked has rebounded, but after the market decline in July, their performance has fallen significantly again. Except for the loss of 6.5%of the China -Europe Blue Chips managed by Zhou Weiwen and Feng Guandan, several other double fund managers have lost more than 10%this year.

In particular, Ruiyuan's growth value managed by Fu Pengbo and Zhu Xi has lost 21.88%this year, and at the end of last month, his performance was 15.93%. At present, Ruiyuan's growth value is as high as 28.992 billion. At the same time, its stock allocation is also very complicated. It does not see too obvious style. It still feels that it is still available to buy it. For example, Sanan Optoelectronics, China Mobile, Lixun Precision, Oriental Yuhong, Wanhua Chemistry, Tongwei, Geely Automobile, Watson Biology, Mai Weiche and Guo Porcelain Materials have hardly found the same industry in the same industry. company.

In addition, in recent years, the layout of Fu Pengbo has not changed much, and it is basically those of the company that previously held. In the second quarter of this year, only Tongwei shares have not been bought in the past. But in fact, Fu Pengbo did not have much configuration in the new energy field that has risen in the second quarter of this year. You can think that he does not hold a certain track, but in fact he does waste a lot of time and opportunities.

Start market: Follow this "newcomer" who is easy to be ignored

In the monthly report of last month, we focused on sharing the new economy managed by Qianhai Managed by the champion Cui Yilong last year, and in July, the product has obtained 3%of the income, and the income has reached 33.56 in the past 3 months. %, Still good.

In this month's monthly report, we shared a public offering "newcomer" that is easy to be ignored by everyone. He only had two years of experience, Lu Feng, Hui'an Fund Manager Lu Feng. Although there are only two years of fund management experience, Lu Feng is already an investment and research veteran of securities firms. At present, two products have been managed, and the total management scale is 772 million yuan. Among them, the scale of 347 million Hui'an Fengli mixed, with a revenue of 27%in the past 3 months, and has lost 7%since this year. Although from the perspective of performance, Lu Feng was not the most pointed. The style was both balanced and growing. He bought a big white horse like Maotai and bought a bunch of new energy bull stocks.

It is worth noting that the reason why Lu Feng pays attention to him is that he is different from many other fund managers' "lying" attitude. Although before May this year, Hui'an Fengli's mixed performance also lost nearly 30%for a while, and severely lost the Shanghai and Shenzhen 300 index and similar products. However, Lu Feng actively adjusted the position and dared to take the shot. He seized the super big bull stock of quartz shares this year, which also made his product performance significantly improved. In addition to quartz, Lu Feng also bought China Mining Resources. It has also performed very well since the second quarter of this year.

In the second quarterly report recently announced, Lu Feng's point of view is relatively simple and unpretentious. He has not worked as a soul chicken soup like many other people to write small compositions.

Lu Feng said that objectively speaking, since this year, the new energy industry has overcome the unfavorable factors of upstream prices and epidemic conditions. The downstream demand continues to exceed expectations. Compared with other industries, the market performance has truthfully reflected the prosperity of the above industry. During the reporting period, Lu Feng's product holding structure was biased towards advanced manufacturing with comparative advantages, and a good return was obtained in the rebound.

In addition, from the perspective of global perspective, we are in a long decline cycle. On the one hand, the upstream resource products have restricted the supply due to the improvement of the competitive pattern and the slowly rising capital expenditure.On the other hand, since long -term liquidity is loose, the proportion of debt in major global economies has continued to increase, and at the same time, global scientific and technological innovation has also entered a bottleneck period, and economic growth lacks new impetus.During this cycle, the resource products with good supply and demand patterns are worthy of our focus and tracking whether it is traditional or emerging.Lu Feng also said that the new energy revolution represented by lithium battery and landscape has brought about major incremental and changes in the consumer and production side. Its industrial chain interpretation is wonderful, and it is still worthy of our continued positions.

Daily Economic News

- END -

The stadium that spends 1.2 billion, this is the first day of use

According to Taiwan media reports on the 23rd, the Hsinchu Baseball Stadium rebuil...

The Meteorological Orange Evaluation of the Meteorological Orange of Stidian County [Class II/Severe]

Stidian County Meteorological Observatory issued a heavy rain orange warning signal at 04:18 on July 24, 2022: The rainfall in our county in the past 1 hour has exceeded 40 mm.Township precipitation w