Loss of 3.7 billion yuan!Well -known giants announced that it will be completely shut down

Author:Voice of Hangzhou Time:2022.07.30

U.S. stocks are still in a dense disclosure period of financial reports, and the market focuses on the second quarter of science and technology leaders. Following Apple, the trillion chip leader and the largest chip producer Intel in the United States also handed over the transcript, which was a loss of profit.

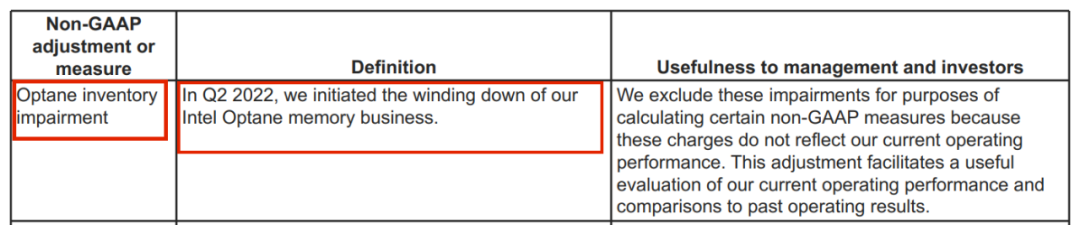

It is worth noting that Intel officially announced in this financial report that Wind Down will have been in a losing state of Optane technology -related business. Intel officially launched the high -speed storage technology in 2015. Once launched, it was hailed as "the law of Moore's Law". This shutdown is regrettable.

Lost in the year! Audon business will be completely shut down

While surrendering a second quarter financial report, Intel finally confirmed at the corner position of the financial report, it will gradually shut down the Aoteng business and no longer develop future new products. At the telephone meeting after the financial report, Intel said that the shutdown of Audite's business will generate an impairment of US $ 559 million (about 3.7 billion yuan).

Earlier reports said that the losses of Aoteng's business in 2020 have reached $ 576 million, and it is estimated that the loss in 2021 may also be about 529 million US dollars.

(Source: Intel 2022Q2 Financial Report)

Aoteng technology is composed of 3D XPOINT memory medium, Intel memory and storage controller, Intel interconnection IP and Intel software. Among them, the 3D XPOINT memory medium is the cornerstone of Ao Teng technology. And Avoton's revolutionary memory business/SSD, which has been given by Intel, will be gradually shut down, only seven years.

(Source: Tomshardware)

In fact, the shutdown of Audite's business has long been a sign, and Intel seems to be "forced" to shut down.

Since IMFT (IM Flash Temnology, Intel Micron's Semiconductor Corporation) dissolves, Micron has become the only production factory with 3D XPOINT, but Micron abandoned his 3D Xpoint program and sold the factory to Texas at the end of 2021 to Texas. Instruments, this makes Intel have no way to produce the 3D XPOINT chip required by Ao Teng, which means that Intel may also stop further exploration of 3D Xpoint technology in the future.

According to foreign media reports, there are many products under Intel ’s Aotezi brand, including Aoteng Memory, Ao Teng's lasting memory, and Audon SSD, but before the company divided all products into the scope of" Ao Teng's memory business ", so It may be the entire Audite department that is gradually closed this time, not just Aoton memory products.

It is worth noting that according to foreign media statistics, this is already the sixth non -core business of Intel CEO Pat Gelsinger. Other services sold include recently sold the drone business to Elon Musk's brothers, and the sale of the solid -state hard disk storage department (NANA and SSD) to SK Hynix. According to statistics, these transactions allow Intel to obtain $ 1.5 billion and use it to invest in its core business areas.

According to financial reports, Intel has now focused on the future focus of CXL -based products. Compute EXpress Link(CXL)是一种开放性的互联协议,能够让CPU与GPU、FPGA或其他加速器之间实现高速高效的互联,满足现今高性能异构计算的要求,并且提供更高的带宽及Better memory consistency.

Kissinger said that turning to the CXL architecture in the industry is a cruel reality that Ao Teng has to face.

Financial report "Blast Thunder

The stock price after the market once fell more than 10%

The market is expected to decline significantly in the second quarter of Intel, but failed to predict that the decline can be so large, and the performance guidance in the third quarter is even worse.

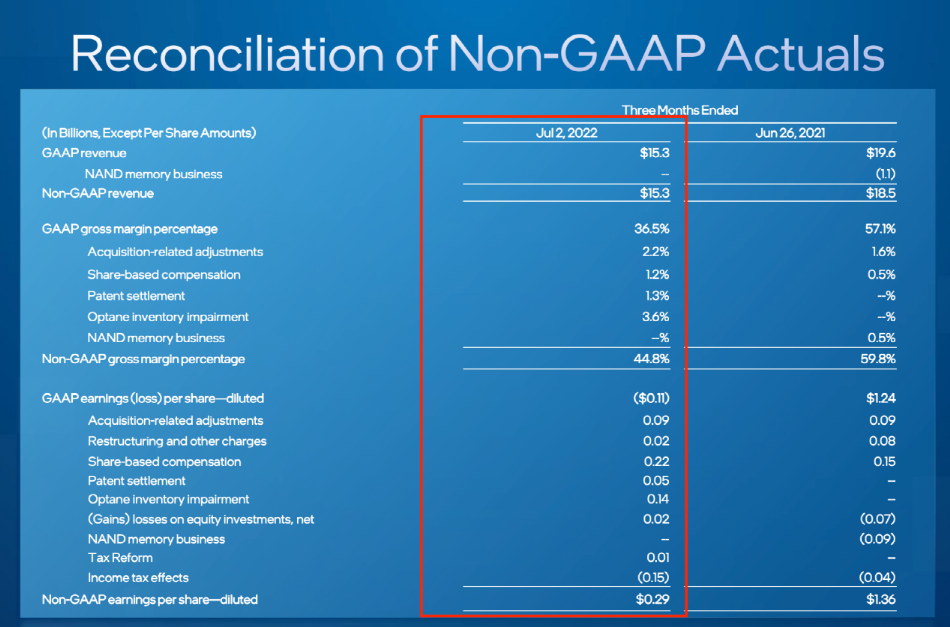

According to the financial report released after the US stock market on July 28, its second quarter revenue was US $ 15.321 billion, a decrease of 22%compared with the US $ 19.631 billion in the same period last year, far lower than the average expected $ 18 billion in analysts; the company The net loss was US $ 454 million, and the net profit of the same period last year was US $ 5.061 billion; the diluted loss per share was $ 0.11, and the diluted income per share of the same period last year was $ 1.24.

The financial report data shows that in the quarter of July 2, Intel's revenue decreased by about 22%year -on -year. Judging from the data of Refinitiv, Intel's quarterly revenue was 14%lower than expected, which was the worst quarterly income since 1999.

(Source: Intel 2022Q2 Financial Report)

At the same time, the company gave the latest performance guidelines, which greatly reduced the guidelines for the adjustment of the operating income throughout the year this year, from $ 76 billion to 65 billion to $ 68 billion, a decrease of 10.5%to 14.5%. Below of US $ 74.76 billion in market expectations.

The market has previously expected that the decline in personal computer sales will drag Intel's performance, but the company's server chip revenue unexpectedly dropped by 16%, further dragging the overall sales and profits. CEO Kissinger said that most of the company's losses were caused by the slowdown of the economy, but failure to produce better products on time is also the cause of losses.

Kissinger believes that Intel's current order level is lower than the end market's consumption of Intel chip device, which means that once the inventory is exhausted, the sales volume will rebound.He also said that the company would not give up a plan to invest in manufacturing technology, develop new products, and enter new markets to chase future opportunities.The decline in economic and performance will help the company more strategic underground bets, and at the same time cut investment in unimportant fields.But Intel's chief financial officer, Zinsner, said at the telephone meeting: "We think we have reached the bottom (Bottom)." He expects that the seasonal improvement of prices and fourth quarters should help Intel's gross profit margin to rise to 51% to 51%To 53%.

After the performance was "exploded", Intel's stock price fell more than 10%after the market. As of the receipt, the decline still declined exceeded 8%. If the decline was calculated, Intel's market value will fall more than $ 13 billion (about 87 billion yuan).

Source: China Fund News

Copyright belongs to the original author

Edit: Zhang Jie

- END -

More than 1.2 billion people have been completed

The State Council's joint control mechanism held a press conference at 3 pm on Jun...

Top ten innovations look at Weihai | "I will do everything (annoying), all‘ scriptures' do ”a window bring a business environment butterfly change

Video/Snapshot, T_100, F_JPG, M_fast Controls = Controls data-version/ueditor/vide...