The four departments of Hebei jointly issued a post!Related to medical insurance

Author:Hebei Radio and Television Sta Time:2022.07.30

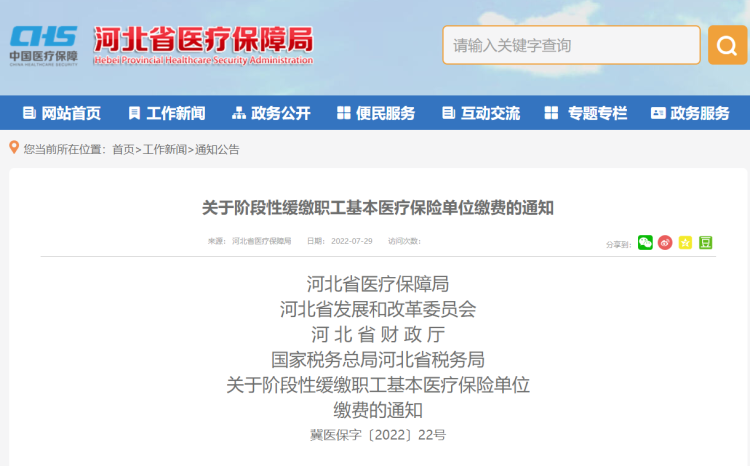

In order to effectively protect the basic people's livelihood and help enterprises to relieve difficulties, recently, the Hebei Provincial Medical Security Bureau, the Hebei Provincial Development and Reform Commission, the Hebei Provincial Department of Finance, and the State Taxation Bureau Hebei Provincial Taxation Bureau jointly issued the "About the basic medical care of the employees in staged slowly pays employees Notice of Insurance Unit Payment ".

The medical security bureaus of various cities (including Dingzhou, Xinji City), the Development and Reform Commission (Bureau), the Finance Bureau, and Taxation Bureau, the Public Service Bureau of the Xiong'an New District Management Committee, and the Reform Development Bureau:

In accordance with the requirements of the State Administration of Taxation of the State Administration of Medical Insurance Bureau of the Ministry of Finance of the Ministry of Finance of the Ministry of Finance of the State Department of Development and Reform, the State Administration of Taxation of the State Taxation of the State Administration of Medical Insurance , Subsidies to slow down the work notice of the work of the basic medical insurance (hereinafter referred to as employee medical insurance) units in our province. The work notice is as follows.

I. Purchase -level payment policy for employee medical insurance units. As of the end of June 2022, the accumulated fund deposit of the Fund's cumulative deposit can be paid more than 6 months. Since July 2022, individual industrial and commercial households who participate in small and medium -sized enterprises and units have slowly paid for 3 months of employee medical insurance for employee medical insurance (Including maternity insurance) unit payment, exempting late fees during the slow payment period. Enterprises that have been paid in July 2022 can be paid slowly from August. The redemption month will be postponed for one month accordingly. You can also apply for a return fee. part. Social organizations, foundation, social service agencies, law firms, accounting firms and other social organizations are implemented with reference.

2. Comprehensively implement the "exemption and enjoy" passage model. Eligible small and medium -sized enterprises can enjoy the payment policy of slow payment units without submitting applications. Specific standards for small and medium -sized enterprises refer to the "Notice on Printing and Distributing the Planning Standards for SMEs" (the Ministry of Industry and Information Technology Union Enterprise [2011] No. 300) and other strokes. Under the leadership of the local government, the medical security and tax departments are established in conjunction with relevant departments to participate in the participation The strokes are responsible for determining the small and medium -sized enterprises that have been paid in the area and the list of individual industrial and commercial households that are insured by the unit. Insurance enterprises can be implemented in accordance with the implementation of the social insurance premium policy in the 2020 implementation of the implementation of the social insurance premium policy in 2020. If the enterprise has objection to the planning results or the existing information cannot meet the needs of the type of enterprise, the promise system is adopted. Supplement the basis of the process in accordance with the prescribed process, and make written commitments, the unit assumes corresponding legal responsibilities to the promise information. It is necessary to strengthen departmental collaboration, optimize working links, innovate service methods, reduce corporate affairs, and do a good job of personal rights and interests to ensure that the rights and interests of the insured are not affected.

3. Ensure that the treatment of the insured during the slow payment period should be enjoyed. Small and medium -sized enterprises pay for the payment of employee medical insurance units, which will not affect the company's participants in the medical expenses for medical treatment normally. During the slow payment period, the medical expenses that are in accordance with the insured of the relevant enterprises shall be reimbursed in a timely manner, and the due report shall be reimbursed in a timely manner to ensure that the level of basic medical insurance reimbursement shall remain stable and not decreased.

Fourth, effectively protect the legitimate rights and interests of relevant enterprises. During the slow payment period, small and medium -sized enterprises shall fulfill the obligation to withdraw the personal payment of employees in accordance with the law, apply for information on medical insurance premiums for employees normally, ensure that employees continue to participate in insurance, and continue to record personal rights and interests. If the insured has a resignation, the treatment of the retirees of the employee's medical insurance, and the transfer of relationship transfer, the enterprise shall pay for the employee medical insurance unit that will be paid slowly. If a company has a cancellation, it shall pay the slow payment before canceling. Payment and maternity insurance premiums for employee medical insurance units that enterprises should be paid at the latest should be paid in place at the latest in June 2023.

Fifth, do a good job of scheduling statistical analysis to ensure the smooth implementation of the slow payment policy. All localities should strengthen the scheduling of slow payment of information, and will be submitted to the provincial medical security and tax departments to the provincial medical security and tax departments of the region before the 5th of each month. It is necessary to effectively strengthen fund management, strengthen fund operation analysis, control the risk of operation and control, and ensure the security of the fund. To establish an information communication and sharing mechanism, medical security, taxation and other departments at all levels must do a good job of sharing basic business information such as enterprises and employees' insurance payment, enterprise slow payment, etc. The medical insurance agency will slowly pay the name of the enterprise and unify the social credit code on a monthly basis. , Enterprise Type, Slow Payment Period, Slow Payment Period, Slow Payment amount, Slow Payment, and other information transfer tax departments.

6. Work requirements. Medical security, development and reform, finance, taxation and other departments at all levels should improve their political standing, strengthen organizational leadership, effectively perform their duties, strengthen communication and cooperation, improve the working mechanism, and do a good job of policies. To do a good job of policy propaganda in combination with the actual situation, clarify the operation process, and actively disclose to the society. The specific implementation plan is formulated and reported to the provincial medical security, development and reform, finance, and taxation departments for the record before July 20. When there are situations and problems in the implementation of various places, it is necessary to report it in time.

Hebei Provincial Medical Security Bureau

Hebei Province Development and Reform Commission

Hebei Provincial Department of Finance

The State Administration of Taxation Hebei Provincial Taxation Bureau

July 15, 2022

• Recommended video •

- END -

Sang Zhi, the hometown of rural rejuvenation | Peng Keke: a "new mission" of a piece of rice leaves

From extended opening time to open all day -24 -hour museum, new landmarks in the city nightlife

On May 18, 2021, the audience participated in the Wonderful Night series of activi...