Eat nails in the product?Fuling mustard just issued a half -year report, and the net profit increased by 37.24% in the first half of the year

Author:Daily Economic News Time:2022.07.29

Fuling mustard (SZ002507, the stock price of 29.8 yuan, a total market value of 26.451 billion yuan), known as the "mustard", was accused of product quality problems.

According to reports from the Shanghai Securities Journal on July 29, consumers recently broke the news that the Wujiang mustard produced in Fuling mustnon eats nails. In this regard, the relevant person in charge of Fuling mustard said that the company has arranged personnel to contact the consumer of the personnel this afternoon, and the company has launched an investigation.

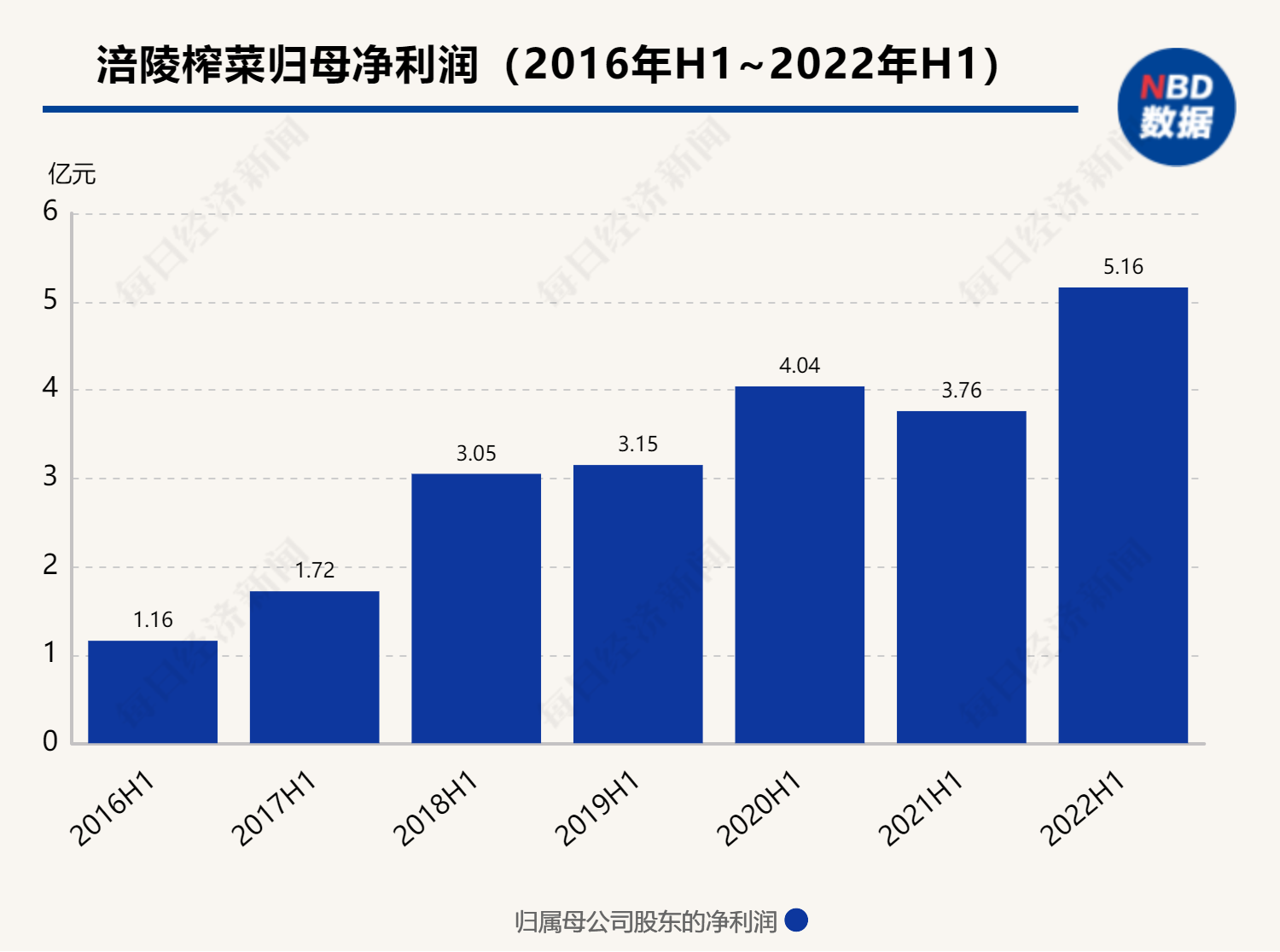

It is worth mentioning that Fuling mustard was released on the evening of July 29. The net profit attributable to shareholders of listed companies in the first half of the year was 516 million yuan, an increase of 37.24%year -on -year. However, Fuling mustard, which seemed good for performance, has declined in the gross profit margin in the first half of the year. In addition, the company's stock price has fallen by more than 20%since this year.

The company responded that it had launched an investigation

Fuling mustard is mainly engaged in the development, production and sales of convenience foods such as mustard and other foods, and in the segment of mustard in the industry.

Specifically, Fuling mustard has two main brands, "Wujiang" and "Huitong", and reserves a brand of "Qiu's Caifang". Among them, Wujiang mustard is the main product of Fuling mustard.

However, it is this main product that recently pointed out the quality of the product. According to the Shanghai Securities Journal, consumers have recently broke the news that the Wujiang mustard produced in Fuling mustnon eats nails.

On the evening of July 29, the reporter saw on the latest Weibo released by the official Weibo of Wujiang muston brand. Many netizens called on the company to respond to the nail incident as soon as possible.

In the evening of July 29, the reporter of "Daily Economic News" called the Fuling mustard securities department, or it may be because the time was late and the phone could not be connected.

According to the Shanghai Securities Journal, the relevant person in charge of Fuling mustard said that the company has arranged personnel to contact the consumer of the personnel this afternoon, and the company has launched an investigation. The person in charge said that from the perspective of production technology, the company's production line is relatively high, and foreign bodies such as nails will not occur in the product.

The reporter noticed that in terms of food safety and product quality problems of Fuling mustard, investors have repeatedly asked questions on the interactive platform of investor relations. On May 24 this year, the company once responded that the company has always adhered to the quality strategy and excels in product quality. In the future, it will also strictly control the quality of the product to bring consumers a better consumer experience.

Earlier in November 2019, Fuling mustard once responded that the company has always put food safety and quality standards first, and establishes foods from raw materials procurement, material inspection, pickling processing process, to foods that are out of the finished product. Safety and quality standards and management systems to ensure safety and quality, and provide consumers with green, healthy, safe and delicious foods.

Chinese food industry analyst Zhu Danpeng said in an interview with a reporter WeChat that from the perspective of consumption, the incident must have a certain impact, but the impact may not be great. Because of the mustard industry, the difficulty of food safety control itself is relatively large.

The stock price has fallen by more than 20% this year

What is the truth of the nail incident, it still needs further response to the squeeze of the edge. Coincidentally, on the evening of July 29, 2022, the company just announced the semi -annual report.

In the first half of 2022, the operating income of Muling's crushing vegetables was 1.422 billion yuan, an increase of 5.58%year -on -year, and the net profit attributable to shareholders of listed companies was 516 million yuan, an increase of 37.24%year -on -year.

Although the net profit of Fuling mustard in the first half of the year increased, the gross profit margin of the main products declined. Specifically, in the first half of 2022, Fuling mustard's main product mustard gross margin was 57.57%, a decrease of 3.82 percentage points compared to the same period in 2021. In addition, the gross profit margin of the company's radish and kimchi products also fell 12.31 percentage points and 2.53 percentage points. Essence

Why is the gross profit margin of the company's main products in the first half of the year? The reporter noticed that the company had estimated in the 2021 annual report that the company's main raw materials and semi -finished products were affected by market supply and demand. The prices increased by about 80%and 42%year -on -year in 2021, resulting in the company's reporting business costs rising year -on -year about 13 year -on -year by about 13 %.

Although the price of green vegetables has fallen this year, it is still a bit lagging in the cost. In the semi -annual report of 2022, Fuling mustard stated that the company's main raw materials in 2022 were affected by the market supply and demand, and the price fell by about 40%year -on -year. The vegetable heads acquired this year were successively put into May and June.

Where is the momentum of the net profit growth of Fuling mustard in the first half of this year? The Fuling mustard semi -annual report stated that it was mainly due to the year -on -year increase in company income, investment income and decreased sales expenses.

Specifically, the Fuling mustard received an investment income of 40.65 million yuan in the first half of 2022, and the revenue was 0 yuan in the same period last year. Regarding the increase in investment income, Fuling mustard stated that the reason for receiving banks and securities firms' wealth management products was increased year -on -year.

In addition, in the first half of 2022, the sales cost of Fuling mustard was 202 million yuan, a significant decrease of about 40.40%compared with the 339 million yuan in the same period last year. In this regard, the company stated that it is mainly to decrease the brand propaganda fee of the reporting period, and the reporting fee is included in the operating cost of the contract as a contract performed in accordance with the new income standards.

It is worth mentioning that on July 29, the stock price of Fuling mustard fell 2.77%.Compared with last year, as of July 29, the stock price of Fuling mustard has fallen by more than 20%this year.Cover picture source: Daily Economic News Liu Guomei Photo

Daily Economic News

- END -

[Endem the new journey to build a new era, innovation and hard work to fight for first -class] "Rukangjiayuan" entrusts the happy dream of disabled people

Walking in front of the new bureau | "Fate Beach" changed to "Happy Beach" in the new village of residents in the Yellow River Beach District, with new development

Editor's note:Keep in mind that the instructions will go in front, and the mission...