Kleadi IPO: Annual report is suspected of false statements for the relationship between the two shareholders

Author:Public Securities News Time:2022.07.29

For almost two years from the company's resignation, it is still indirectly held through the company's employee holding platform. This rare situation occurs in Guangzhou Kerrydi Medical Equipment Co., Ltd. (hereinafter referred to as "Kerrydi") Essence

A reporter from the Public Securities News Daily Mirror Financial Studio noticed that Wu Si, a departure employee of the Securities Regulatory Commission system who had a job and indirect shareholding company for a long time, was listed on the new company of the Securities Regulatory Commission of the company and the indirect shareholding company. After the third board, a company is also established, which will indirectly hold the company's shares "left hand and right hand", and then clear the position. It is worth noting that during the period of the period, the annual report of Klairi disclosed that there was no connection between the two companies controlled by Wu Si and suspected of false statements. Moreover, Wu Si, who resigned for almost two years from Kleadi, continues to be indirectly held through the company's employee holding platform.

Holding "left hand down and right hand"

Wu Si, the employee of the Securities Regulatory Commission system that was deeply intersected with Kleadi, was gradually listed on the New Third Board of Kerrydi, and gradually poured the indirect company shares to control the company's control enterprises.

In November 2016, when Kleadi was listed on the New Third Board, Xinyang Xuya controlled by Wu Si was also called Guangdong Xugan Asset Management Co., Ltd., holding a company of 1.764 million shares and a shareholding of 2.94%.

By April 2018, the top five ordinary shares disclosed by Klelei 2017 annual reports or shareholders holding 10%or more shares show that Xinyang Xuya holds a company's shares by 5880,000 to 1.176 million shares, and the proportion of shares will change. It is 1.96%.

And a company named Baibaoyou, that is, at that time, the company named Zhuhai Baibaoyou Investment Partnership (Limited Partnership) became the new shareholder in the list. The share ratio is 0.98%(see Figure 1).

Figure 1: Screenshot of Klairi 2017 annual report

Which god is Bai Baoyou?

Bai Baoyou is a company established by Wu Si's assault.

According to the industrial and commercial registration information of the enterprise inspection, the Baibaoyou's assault was established on March 31, 2017 shortly after the new third board of Klelei listed. During his duration, Wu Si always held 99.50%of the shares and always served as executive affairs Partner, another shareholder Wu Jianbo holds 0.50%(see Figure 2).

Figure 2: Screenshot of Bai Bao You You

Combined with the 2017 interim report of Kleadi showing that Xinyang Xuya's holdings have not changed, the shares held by Baibao Youyou should be transferred from July 2017 to the end of the year, and the Xinyang Xuya transferred. The income is just because Xinyang Xuya is not enough for changes in rights and interests, and it is not during the reporting period of the prospectus disclosed after Kleadi, so it is difficult to know the specific transfer time and price.

What is more noteworthy is that in the 2017 annual report of Klairi, "the top five or 10%or more shareholders of ordinary shares or shareholders", it is clearly stated that except for several shareholders' actual controller Zhan Deren and Li Li couple In addition to the control enterprises under the control, "the rest of the company's shareholders do not have a relationship" (see Figure 1).

In fact, from the information of the industrial and commercial registration showed by the enterprise, Xinyang Xuya is Guangdong Xugan Asset Management Co., Ltd., and Bai Baoyou has always belonged to the enterprise under Wu Si. It can be seen from the prospectus disclosed by Kleadi since December 2021 that Xinyang Xuya, Bai Baoyou, and Bai Anyou are all controlled by Wu Si (see Figure 3).

Figure 3: Screenshots of other affiliated parties in the latest prospectus of Kleadi

Wu Si later continued to pour the shares of Klelei, which was held by Xinyang Xuya to Bai Baoyou.

The prospectus disclosed by Claridi for the first time in December 2021 shows that "June 5, 2018 to June 8, 2018, Xinyang Xuya will hold it at a price of 2.538 million yuan through the national small and medium -sized enterprise shares transfer system. The transfer of 5260,000 shares of Kerrydi, the corresponding price per share is 4.76 yuan, of which: 5250,000 shares are given by its affiliated party Bai Bao, and 0.10 million shares are transferred by public investors. Baoyou bought the public investor to buy Kerraydi 0 1.10 million shares from the price of 9.52 yuan per share through the national SME shares transfer system. "After the transfer was completed, Bai Baoyou's holdings of 1.140 million shares, the shareholding ratio of 1.86 1.86 %, Xinyang Xuya holds 65 million shares and holds 1.08%.

Interestingly, when Xinyang Xuya was transferred, a public investor was transferred to 1,000 shares of Kerrydi shares at a price of 4.76 yuan/share. Bai Baoyou also spent double the price to buy back the 1,000 shares from his hand.

Wu Si later established a company to take over the remaining Kolaridi shares held by Xinyang Xuya.

According to the company's investigation, on January 14, 2020, Wu Si and Wu Jianbo established Bai Anyou (the full name is Nanping Yanping Bai Anyou Enterprise Management Partnership (Limited Partnership)). ——Wu Si holds 99.50%of the shares and is an executive partner, Wu Jianbo holds 0.50%of the shares, and no change has occurred during the duration of the company.

The company's latest prospectus shows that "On January 15, 2020, Xinyang Xuya and its affiliated party Bai Anyou signed the" Equity Transfer Contract ", which agreed to transfer 65 million Kerridi, which was transferred to Bai'an Young at a price of 1.3265 million yuan. Stocks, the price per share is 2.04 yuan. "

At this point, Xinyang Xuya completely withdrawn from Kerlayi, while Wu Si continued to hold the company through Bai Baoyou and Bai Anyou. After the hand is down, start the clearance

However, Wu Si, who held the shareholding from his left hand, immediately began to clear the shares of Klelei, which was indirectly held.

Wu Sixian was cleared by Kleydi's shares that had not yet "covered" Bai'an.

According to the company's prospectus, "On February 21, 2020, Tyntang, Bai Anyou and Times Bole signed the" Shares for Transfer Agreement ", agreed that Feikkang, at a price of 35.73 million yuan The transfer of ten thousand shares to the times Bole, Bai Anyou transferred 650 million shares held to Times Bole at a price of 5.9605 million yuan, and the price per share was 9.17 yuan. "

In other words, Bai Anyou's 650,000 shares of Kleledi shares from Xinyang Xuya were only about a month, and then cleared the position. Moreover, looking at Bai Anyou's short -term "life" -Steel was established on January 14, 2020, the next day was transferred to Xinyang Xuya to hold the shares, and the next month was transferred to all the shares. Specializing in Wu Si, a sense of vision that Wu Si fell down and sold some of the shareholding of Kerrydi.

Wu Si went on to deal with Kleadi shares held by Bai Baoyou.

According to the company's prospectus, "On August 24, 2020, Baibaoyou signed the" Equity Transfer Contract "with Yantang, which agreed to transfer 11.140 million shares held by Claridi, which was held at a price of 10.215,400 Tekang, the price per share is 9.17 yuan. "

After the clearance, Baibaoyou's final fate was soon like Bai Anyou -canceled on October 10, 2020.

However, Wu Si also passed the unanimous actor of the controlling shareholder of Kleadi (the company's employee holding platform, namely Zhuhai Huaxinghai Investment Partnership (Limited Partnership)), and Tatkang's indirect shareholding company.

As Wu Si resigned as a director, deputy general manager, secretary of the board of directors, chief financial officer, etc. from August 2020, Wu Si also studied ))quit. According to the information of the historical partner of the History History of the Enterprise Check, on October 16, 2020, Wu Si transferred the 5%contribution of the Tidang Titkang he held to the actual controller of Cleladi, and then he would no longer serve as the special. Kang executive partners (see Figure 4, Figure 5, Figure 6).

Figure 4: Screenshot of the historical partners of Stecker Kang

Figure 5: Screenshot of the actual controller of the company

Figure 6: Check the current business information about the current industrial and commercial information of the enterprise

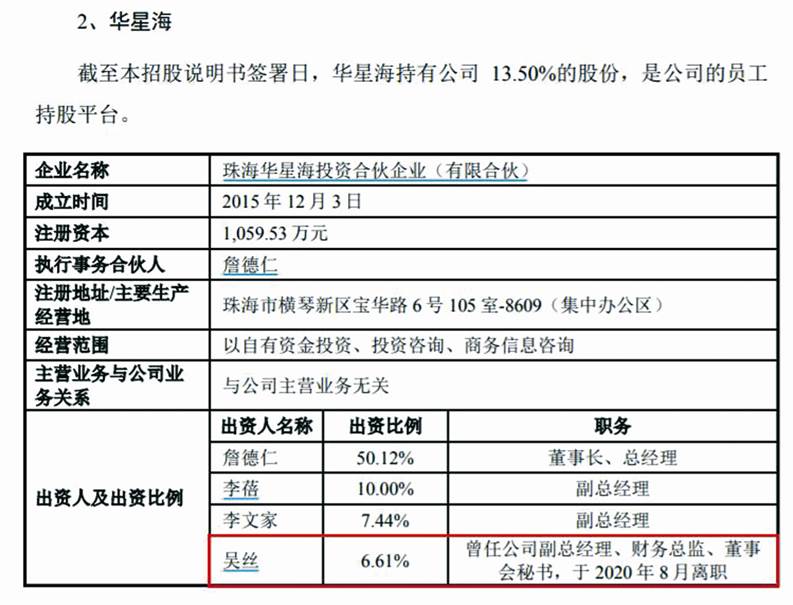

Two years of departure, still on the employee holding platform

Strangely, Wu Si, who resigned from all Kerrydi's position in August 2020, is still on the list of partners of Huaxinghai, a partner of Huaxinghai, the company's employee holding platform. (See Figure 7), this is very eye -catching in Huaxinghai, who is an executive and employees in other partners, is very eye -catching. As of the latest prospectus signing of Kleadi, Huaxinghai holds 13.50%of the shares of the company. Based on this calculation, Wu Si, who resign from the company for almost two years, still indirectly holds 0.89%of Klairidi through the employee holding platform. Stocks.

Figure 7: Screenshot of the latest prospectus of Klairi about Huaxinghai

The company describes the significance of the establishment of Huaxinghai and becoming a partner of Huaxinghai: "In order to enhance the company's cohesion, maintain the company's long -term stable development, and further promote the establishment of the company's establishment, improve the long -term incentive and restraint mechanism. In December 2015, the company established an employee holding platform Huaxinghai to implement equity incentives. Huaxinghai increased capital to the company. The main managers and backbone employees indirectly held the company's shares through Huaxinghai. The manner Zhan Daren implements the share of the company's employee to the company's employees to implement equity incentives. "

In fact, in terms of shares after leaving the employee of the holding platform, there are corresponding disclosure in the latest prospectus of Klairi: "According to the" Equity Incentive Agreement "signed by the company and the employee (Including active departure, being fired by the company, and resigning due to force majeure), the actual controller of the company will repurchase its incentive equity. After the service period expires, if the employee is motivated to leave, after the company's written consent, they can be able to perform in writing, and they can be able to perform written consent. Transfer the incentive equity it holds. "

According to previous reports, combined with Wu Si's resignation time in 2020, and Kleledi's past directors and supervisor's normal term of office for 3 years, the directors of Wu Si before resigning should be. Full. Wu Si, who has resigned for many years, has also been ranked among the Hingxinghai partner of Klelei employees. It is really remarkable.

It should be noted that Wusi, which was disclosed from the public transfer instructions from the New Third Board of Kleadi when it was listed on the New Third Board of Kleadi to the Guangdong Supervision Bureau of the China Securities Regulatory Commission from October 2006 to November 2011, is indirectly Most of the time when shares and holding companies shall be less than ten years of resigned from the SFC system. According to the relevant provisions of the Securities Regulatory Commission, the company's intended or listed enterprises shall be supervised.

IPO has clearly stated in the prospectus that there is no person to directly and indirect shareholders without the situation of resignation staff of the Securities Regulatory Commission.Although as of the latest prospectus signing date, Wu Si is no longer working on Kleadi and still indirectly through Huaxinghai's holding company.Once the employee of the CSRC's system has never mentioned.This newspaper will continue to pay attention to other situations and other situations such as Cleari core technology and patents.

Reporter Erdong

- END -

Help the company's rescue policy to realize the entire process of mobile application to declare the "High -tech Tong" of the Chengdu High -tech Zone to upgrade

Chengdu High -tech Zone Enterprise Service Network Picture Source: Chengdu High -t...

Jinjia Ling Street held the fifth "Jinjialing Cup" Tai Chi Cultural Exhibition and Community Fitness Path Mini Programming Ceremony

Luwang, June 17th, in order to vigorously promote the excellent traditional cultur...