After announced that it is planned to acquire lithium industry assets *ST's future stock price staged "10 days 9 boards"

Author:Public Securities News Time:2022.07.29

On the 29th,*ST's future (600532) daily limit. This is the ninth daily limit of the company's 10 trading days since July 18, with a cumulative increase of more than 60%.

Purchase of lithium mining industry assets for cross -border acquisition

On July 1,*ST disclosed in the future that the company intends to acquire 70%-100%of the Ruifu Lithium industry held by Ruifu Lithium, including Wang Mingyue, Liang Liang, and Jinan Junhua, And acquisition of 70%-100%equity in Xinjiang Dongli held by Hetian Ruifu. After the acquisition is completed, the company will control Ruifu Lithium and Xinjiang Dongli.

According to information, the Ruifu Lithium Industry is engaged in the development, production and sales of lithium carbonate and lithium hydroxide. The main products are lithium carbonate and lithium hydroxide. At present Lithium and annual output of 10,000 tons of battery -grade lithium hydroxide production lines. Xinjiang Dongli core assets hold the exploration and mining rights of "Xinjiang Aktas Lithium Mine". Aktas Lithium Mine is located in the Aksas area of Hetian County, Xinjiang. The total resource reserves are 5.806 million tons, and the transfer period is 19.76 years (including 1 year of infrastructure period). Underground mining, an annual output of 300,000 tons.

*ST said that the new lithium battery industry is in a rapid development stage. As the company's production capacity is gradually released, the investment will bring long -term profits to the company.

After the announcement was disclosed, the exchange immediately issued an inquiry letter to the company, asking the company to explain the source of funds acquired, the reasons and rationality of cross -border mergers and acquisitions.

The financial report "non -standard" is wearing a hat

According to the financial report, in 2021,*ST achieved revenue of 697 million yuan in the future, a year -on -year decrease of 83.72%; net profit loss was 172 million yuan, a year -on -year decrease of 1180.19%; the loss of non -net profit was 274 million yuan, a year -on -year decrease of 3355.62%. And due to major fraud in its currency funds, large -scale funds occupying large funds, and major errors in financial reports, audit institutions are based on "the company's internal control failure", "unable to account for accounting and expenditure cannot be verified" The company's financial report issued negative opinions. On July 1, the company's stock officially "wearing a hat".

However, the company said in the response to the inquiry letter that the transaction price will adopt a cash payment method. As of June 30, 2022, the balance of the company's monetary funds was approximately 1.29 billion yuan. The company's illegal guarantee matters have been completely lifted and the occupied funds have been returned.

Public information shows that the former Shanghai company's US Metropolitan Energy has planned to acquire the equity of Ruifu Lithium, and the consideration does not exceed 3.596 billion yuan. Later, it was terminated because the Ruifu Lithium did not reach its performance commitment. Its original management team repurchased.

In the response, the company stated that the current equity distribution of the target assets, whether there are restrictions on the rights of pledge and freezing, and other matters involved have not been checked.

In addition, the company also said that the company's exploration rights and mining rights of Xinjiang Dongli core assets "Xinjiang Aksas Lithium Mine" have not yet been verified.

Although the above -mentioned mergers and acquisitions have not yet been shrewd, the company's stock price began to skyrocket with the reply letter.

On July 7th, after "wearing a hat" and fell 4 trading days,*ST closed the daily limit in the future, and began to rise for 10 consecutive trading days on July 18. During the period, it harvested 9 daily limit boards, with a cumulative increase of 61.42%. The turnover was 1.329 billion yuan, and the transaction volume was 779,700 hands.

In terms of funds, on the 29th, the net inflow of the main funds of the stock was 14.77 million yuan, of which large orders inflow were 20.49 million yuan, the medium order inflow was 35.92 million yuan, and the small order inflow was 24.6 million yuan. Reporter Zhu Rong

- END -

Shouguang: Casting the city with sweat for a good tomorrow

Keep in mind that you will entrust your mission to open a new bureauRecently, the ...

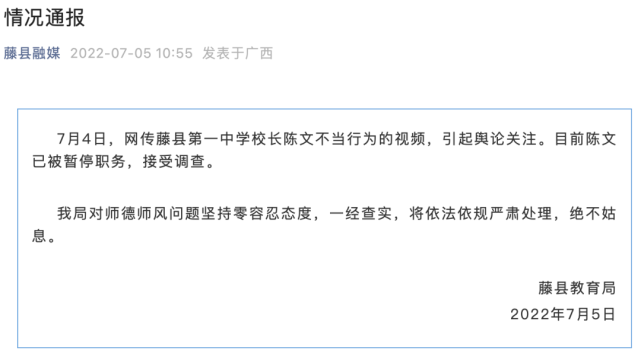

"Undead Video of the President of Ichigang County No. 1 Middle School", local notification

On July 5th, the public account of the WeChat public account of Fujian County, the...