The*ST lion with a market value of 100 billion yuan: crazy expansion of "indigestion", pour in the spring of the lithium battery industry

Author:Daily Economic News Time:2022.07.29

In this era of capital markets, a former giant bid farewell.

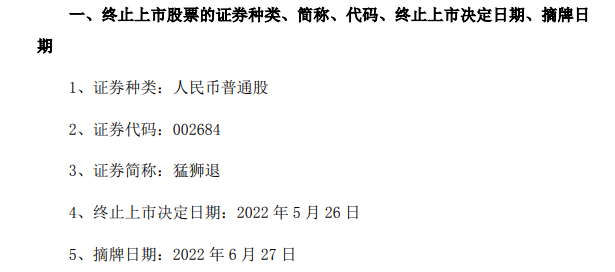

This delisting company that integrates the concept of lithium battery, energy storage and new energy is a lion New Energy Technology Co., Ltd. (hereinafter referred to as "Meng Lion Technology" or "*ST Meng Lion", SZ002684). On June 27, the*ST lion was terminated by the Shenzhen Stock Exchange and was delisted.

Image source: Announcement Screenshot

It was listed in June 2012 and delisted in June 2022. In ten years, the*ST lion did not achieve the goal of Chen Lewu's setting, and became a 100 billion lithium battery new energy enterprise, but fell in the spring of the lithium battery industry. Essence

"Second Generation" first exposed sharpness

After leading the company to win the leader, move towards the capital market

*The ST lion is a downright family business. Practical controlling people Chen Lewu and his father Chen Zaiyi and his mother Chen Yinqing.

The controlling shareholder of the company is Humei Battery Co., Ltd., Chenghai District, Shantou (hereinafter referred to as "Humei Company"). As of June 2022, Humei Company held 19.77%of the*ST lion.

The Humei Company was controlled by the couple of Chen Zaiyi and Chen Yinqing. The company's predecessor was the Humei Battery Factory in Chenghai County. The latter was the collective ownership company founded in February 1987.

Chen Zaiyi's picture source: video screenshot

Chen Zaiyi was a township entrepreneur in the late 1990s, and belonged to a group of people who eat "collective reform crabs" earlier. In May 1999, Humei Company successfully completed the restructuring and became a family enterprise. It mainly produced a lead -acid battery for motorcycles.

Data show that Chen Lewu was born in 1971. In 1993, after graduating from Sun Yat -sen University, the "rich second generation" went to the United States to study and graduated from Georgia State University three years later to obtain a master's degree in business management.

After returning to the home of famous American schools, after Chen Lewu returned to China, he quickly joined the operation of the family business and served as the executive director and general manager of the Shanghai -American Company.

As soon as Chen Lewu made his debut, he showed a sharp edge.

On January 12, 2001, Humei Company, Shenyang Battery Research Institute, Chen Lewu, and several other natural persons initiated the establishment of Guangdong Meng Lion Power Technology Co., Ltd. (*ST Meng Lion's predecessor, hereinafter referred to as "Guangdong Meng Lion").

In the year of the establishment of the Guangdong lion, China officially joined the World Trade Organization (WTO). Since this year, the Chinese economy has opened a new round of flying. The more open foreign trade market has allowed a group of young entrepreneurs to enjoy the open dividends.

The Guangdong lion is also the beneficiary of the tide of the times. By 2010, the company's motorcycle battery export sales ranked first in the country with revenue reached 336 million yuan and net profit of more than 37 million yuan.

In just a few years, Chen Lewu brought the Guangdong lion to the national leader in the segment of the motorcycle battery. In the past few years, Chen Lewu's debut has adhered to his father, Chen Zaoshi's "not seeking maximum, but seeking optimal", and the Guangdong lion has been developing and growing.

It seems logical to go from the leader in the field to the capital market. On June 12, 2012, the Guangdong lion successfully landed on the capital market. The issue price was 22 yuan, and the total amount of funds raised was about 290 million yuan.

However, the capital market is not optimistic about the development prospects of Mammoth technology on the segmentation of motorcycle batteries. On the day of listing, the lion technology broke. Although the closing price of 21.3 yuan was not a lot of the issue price of 22 yuan, it was grabbing at the new stock stock, and the glory of the A -share market that would make a stroke of the A -share market was During the years, the performance of the lion technology was surprising.

The same is not satisfactory, as well as the company's performance. From 2012 to 2014, the operating income of Meng Lion Technology was 485 million yuan, 288 million yuan, and 488 million yuan, respectively; while non-net profit was 37.905 million yuan, -44.2 million yuan, and 60.94 million yuan, respectively.

Sword refers to the market value of 100 billion

After listing, crazy mergers and acquisitions expand, three years of new subsidiaries exceed 60

The performance of the listing was mediocre. In 2015, the Lion Technology released the "2351" five -year strategic plan. That is, the two major market opportunities of "Energy Conversion" and "Belt and Road"; three major business segments: high -end battery manufacturing, new energy vehicle operation and clean power; advanced lead battery, high -end lithium battery, new energy vehicle, clean power, and e -commerce division ; "100 billion market value" in 2020.

In Chen Lewu's view, as the "new break -in" of the clean energy industry, in the face of a lot of competitors who are already at the forefront of the industry, if they do not get up, it will be difficult to stand out and get the space for survival and development Essence Participating in some technical enterprises with a certain basic foundation is a shortcut that the company has quickly obtained some important technologies or obtains strategic experience experience.

Source of Mamma Lion Technology Related Products: Screenshot of Fujian Meng Lion New Energy Technology Co., Ltd. official website

In the field of high-end battery manufacturing, in November 2016, Meng Lion Technology subscribed to the Lionano Inc.a-1 sequence preferred stock for $ 3 million. It is reported that Lionano Inc. is a company that develops and commercially applied high -performance lithium battery materials. The positive pole material developed by its development can greatly improve the multiple performance of the lithium battery for power. The completion of this subscription of Meng Lion Technology will undoubtedly help the company to give priority to obtaining advanced lithium battery orthopedic material technology to improve the performance of the company's dynamic use of lithium battery and improve the company's product competitiveness. In terms of new energy vehicles, Meng Lion Technology acquired 80%of Taizhou Taiying's equity in March 2016 for 60 million yuan in cash, filling the company's gap in the assembly and manufacturing part of the vehicle in the new energy vehicle industry chain.

In terms of cleaning power, the lion technology also expanded crazy and began to deploy photovoltaic power generation and energy storage equipment. In 2015 alone, the company acquired Shenzhen Hualit and Runfeng Electric Power, and increased its capital and controlled Jiangsu Fengguyuan Energy Storage Technology Research Institute Co., Ltd.

Through a series of capital operations, the lion technology under the control of Chen Lewu began to swell sharply. From 2015 to 2017, the company's funds used to increase capital and acquisitions reached 183 million, 1.889 billion, and 2.049 billion yuan, respectively, with more than 60 capital increases, mergers and acquisitions, and new subsidiaries in three years.

In April 2017, Meng Lion Technology issued an announcement on the progress of 51.01%equity of Shanghai Fuel Battery Automobile Power System Co., Ltd. It is reported that Shangliang Power is mainly engaged in scientific research and technical services for fuel cells and automotive power systems. Meng Lion Technology participated in this bidding, intending to improve the company's power system and control system in the new energy industry chain, and prepare for the technical route for new energy vehicles to enter the post -lithium battery era.

With the continuous buying and buying, the company's total assets have also increased. According to the financial report data, in 2015, the total assets of Meng Lion Technology were less than 1.6 billion yuan, but by 2017, it increased to 11 billion yuan.

Through a series of mergers and acquisitions, the net profit of Meng Lion Technology in 2016 reached nearly 100 million yuan, an increase of 3276.11%year -on -year, and the stock price also rose to 23 yuan per share, and the market value once exceeded 10 billion yuan.

Only one year after implementing a new strategy, the market value reached 10 billion yuan. Chen Lewu's 100 billion market value dream does not seem to be far away.

The Grand Proficiency Flower

The sequelae of the expansion are prominent, and the losses are wearing a hat

The good times are like a flash.

The sequelae of the rapid expansion of Meng Lion Technology also quickly appeared. Specific to financial data, it is a rapid conversion from profit to loss. According to the financial report data, from 2012 to 2016, the net profit of the shareholders attributable to listed companies was 131 million yuan. However, 134 million yuan in 2017 alone, losing the sum of the profit in the past few years.

After 2017, the loss continued. In 2018, the operating income of the lion technology narrowed to 1.1 billion yuan, a significant decrease of 71.83%compared with the 3.9 billion yuan in 2017. To make matters worse, losses have increased significantly, and the losses expanded to 2.77 billion yuan in that year.

Due to the two consecutive years of losses, the Shenzhen Stock Exchange has been treated with the "delisting risk warning" of the Guangdong lion since May 6, 2019, and the "lion technology" has been changed to "*ST lion".

Since then, Chen Lewu has begun to shrink the front.

Chen Lewu Picture Source: Video Screenshot

In a speech, he once said, "In 2018, the Lion will focus on the power battery industry chain, and some unrelated businesses, such as new energy vehicles, will cut off."

In December 2018,*ST Meng Lion has received three state -owned enterprises from Kaisheng Technology Group, Zhangzhou Transportation Group, and Fujian Zhe'anjin assets. Essence

In August of the following year, the*ST lion also jointly created the new energy industry base of the Sanmenxia Demonstration Zone with Sanmenxia Investment Group and Henan Gaochuang. Reach specific cooperation intentions.

In November 2019, Chen Lewu signed the "Strategic Cooperation Agreement" with Beijing Zhiyun and China Alliance Energy. Both state -owned enterprises have stated that they will participate, support, and assist the*ST lion to promote their debt reorganization and asset reorganization.

After more than a year of hard work, the*ST lion finally turned to profit. On June 20, 2020, the 2019 financial report released by the*ST lion showed that the net profit attributable to shareholders of listed companies was 151.7 million yuan, and net assets belonging to shareholders of listed companies were 80.42 million yuan.

Subsequently, the*ST lion submitted an application to the Shenzhen Stock Exchange on September 11, 2020, and was approved and approved.

Still difficult to escape the market

When the lithium battery and new energy circuit are the hottest, I departed the field when the hottest

Because the*ST lion's deduction of non -net profit in 2019 is still negative, in September 2020, although the "*ST lion" was successfully picked up and changed to a "ST lion", it did not "remove the hat".

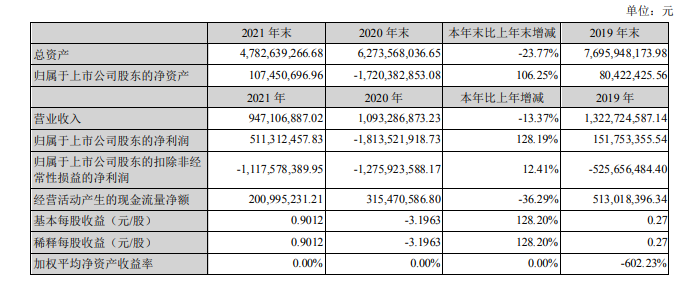

In fact, the early expansion in the early stage has long caused the lion technology to end greatly, and the debt ratio is high. According to the financial report, in 2015, the liability ratio of the lion technology assets was only 32.26%. However, in 2020, the debt ratio was as high as 128.32%, and in 2021, it was still 98.03%.

To make matters worse, according to the 2020 annual report data, the total assets of ST lion were 6.274 billion yuan, but they bear huge liabilities of 8.050 billion yuan, and their debts were not available.

In addition, some bank accounts of*ST Meng Lions have begun to be frozen, raised funds and fundraising accounts. Among the nine main subsidiaries including Taizhou Taiying Electric Automobile Co., Ltd. and Zhengzhou Dakar Automobile Leasing, there are Six are losing money.

In the third quarterly report of 2021, the*ST lion said that the company's current funds are extremely short, and many businesses cannot be carried out. At that time, the company's net profit was -926 million yuan, and its net assets were -2.645 billion yuan.

According to the delisting rules, if the*ST lion cannot significantly improve the operating performance in the fourth quarter of 2021 and turn the net assets into a positive value, it will face direct delisting.

At the last moment of the upcoming delisting, the*ST lion released the "big move". On the evening of January 6, 2022, the*ST lion disclosed the announcement that the "Removal Debt notice" issued by 12 creditors was exempted from 3.4 billion yuan in debt.

This huge debt exemption also attracted the gaze of the regulatory. From January 6 to April 19, 2022, a total of 9 follow -up letters were sent to the*ST lion.

Facing the serial questioning of the Shenzhen Stock Exchange, the*ST lion has repeatedly replied, and the explanation given is still doubtful. As of April 26, 110 days have passed by the first follow -up letter issued by the Shenzhen Stock Exchange on January 6, and the verification of the*ST lion's verification of 3.4 billion yuan in debt exemption has not been completed.

Photo Source: Screenshot of Meng Lion Technology 2021 Anniversary Report

On April 30, 2022, the*ST lion 2021 annual report was issued by the accounting firm that could not represent an audit report, which touched the termination of the listing specified by the Shenzhen Stock Exchange.

On the evening of May 29, the*ST lion announcement disclosed that the Shenzhen Stock Exchange decided that the company's shares were terminated. From June 6th, the company's stock entered the delisting period. It is expected that the final trading date is June 24.

Until June 27, the*ST lion was delisted on the Shenzhen Stock Exchange.

In recent years, lithium battery and new energy have become a trillion -level air outlet of the capital market. At the hottest time, the lion technology departed sadly. After the hematopoietic function of the capital market lacked the function of the capital market, the development of the lion technology was even more optimistic.

On July 21, "Daily Economic News" called Meng Lion Technology. Relevant personnel said that although the company has delisted, it does not affect the company's normal operation. At present, the company's management and employees are relatively stable to keep production as much as possible and maintain the company's operation. The company's main business in the future is still in terms of energy storage and photovoltaic.

------------------------------------------------------------------

Reporter's notes |

There is an old saying that you can't eat a fat man in a bite.

The fundamental reason behind the delisting of Meng Lion Technology is to want to eat "fat" in one breath, and eventually "choke" in the capital market.

At the beginning of the listing in 2012, only three subsidiaries including Liuzhou Power Bao Power Technology Co., Ltd. were only in the lion technology. By the end of 2017, through the acquisition, new establishment, etc., the company's holding and shareholding subsidiaries had 73.

In July 2015, Chen Lewu, chairman of Meng Lion Technology, first proposed the development strategy of the "2351" of the Meng Lion Technology, based on the manufacturing and leader of high -end batteries, and promoted the coordinated development of new energy vehicles and clean power industry chain. One of them is by 2020, and the company will develop into a market value of 100 billion market value. You know, the company's market value at that time was less than 10 billion.

It can be said that in the early years of listing, the lion technology was either on the way to acquisition or mergers and acquisitions. On the other hand, the company's main business and performance are not outstanding. From 2012 to 2016, the total profit was only 130 million yuan. But in 2017, all the total profit of the previous five years lost.

This is just the beginning. The company's multi -line operation, finance began to eat tight, and there is no solid foundation in the fields involved. Once the wind blows grass, it is easy to bring crisis to the company.

The lion technology can start from the segmentation of the motorcycle battery and achieve the lead in the industry. The company has previously adhered to the business philosophy of "not seeking the maximum, but seeking optimal".

However, the development concept after logging in to the capital market is blindly "bigger", but instead throw "doing excellence" behind. As a result, in the past ten years, from listing to delisting, it has become a passenger in the capital market.

To develop and grow, a company must be down -to -earth, lay a good foundation, and stabilize to be far away.

Daily Economic News

- END -

Heavy!Changsha's "Jian Gongqiang Provincial Capital Welcome Twenty Congress" large -scale network theme publicity activities launched!

/2022 is the beginning of Changsha's efforts to implement the strong provincial c...

Tianfu Nature calendar | "disappear" for more than a hundred years, and meet you again (July 11, 2022)

The edge of the leaves has spikes, and the petiole is close to the branches and st...