[Cai Zhi Toutiao] To the moment, the famous and innocent products were short, and they were accused of being reduced to the chairman's "money bag"

Author:China Well -off Time:2022.07.29

Picture source: network

On July 27, the Log in Hong Kong stocks less than half a month Mnso.us (9896.HK) was suspected of suspected the authenticity of the financial report by the short -selling agency and came to the cusp.

On July 26th local time, Blue ORCA Capital (hereinafter referred to as "Blue Whale Capital") released a report on famous and innocent products, pointing out the three major issues of Mingchuang Youpin:

The first is to have more than 5,000 stores. It has previously claimed that 99%of domestic stores were operated by franchisees independent of the company. However Personal names of executives or closely related to the company's chairman;

Second, Mingchuang Youpin is suspected of transporting interests to the chairman Ye Guofu. Famous Chuang Youpin and Ye Guofu set up a joint venture for the British Virgin Islands. The report speculates that Ye Guofu did not contribute to the joint venture. Pin only holds 20%of the equity, but uses 346 million yuan in deposits to buy land, but less than a year later, it acquired the remaining 80%of the company's company from Ye Guofu's hand for 695 million yuan;

The third is that Blue Whale Capital believes that Mingchuang Youpin is declining. In recent years, income atrophy, decline in franchise fees, and a large number of stores closed down. Together with the peak value of Mingchuang's revenue, the peak value before IPO decreased by 40%, and the franchise fee has fallen by 63%in the past two years, which proves this view.

On July 27, Mingchuang Youpin urgently issued an announcement in the Hong Kong Stock Exchange, saying that "the report has no basis and includes the misleading conclusions and interpretation of the company's information."

Picture source: Announcement of Mingchuang Youpin

However, this response did not stabilize the stock price of Mingchuang Youpin, and both Hong Kong stocks and US stocks were dived. As of the closing of July 27, Hong Kong stocks closed at HK $ 12.46/share, down 10.87%, with a total market value of HK $ 15.783 billion. In terms of U.S. stocks, Mingchuang Youpin closed at 5.66 US dollars per share on the 27th, down 7.67%.

Earlier, Mingchuang Youpin relied on the "crowdfunding" of consumers ten yuan and ten yuan to rush out among small commodity companies. It landed on the US New York Stock Exchange in October 2020 and in Hong Kong on July 13, 2022 The main board of the association is "double main listing".

Nowadays, the labels of the "pseudo -Japanese system" and "cottage" on Mingchuang Youpin have not been completely washed away, and they have been repeatedly entangled by negative information. In the past three years, the cumulative loss of nearly 2 billion yuan, the listing was short for half a month.

620 stores are secretly operated by company executives?

2018 is one of the most beautiful moments of Mingchuang Youpin. Not only did you hold JD.com, but also for nearly 800 stores in 33 cities across the country to go home to the home. It was also favored by Tencent and Gao Yan Capital, and received a strategic investment of 1 billion yuan.

At the 2018 Group Annual Conference, Ye Guofu announced his "100 million stores" plan: By 2022, Mingchuang Youpin will open 10,000 stores in 100 countries, including 7,000 overseas stores. Annual revenue reaches RMB 100 billion.

Ye Guofu Tu Source: Network: Network

As of September 2018, the newly opened stores in Mingchuang Youpin exceeded thousands, and the actual number of stores had exceeded 3,000. According to the latest data of the prospectus, as of December 31, 2021, the number of famous stores reached 5045, of which 3,168 domestic stores and 1,877 overseas stores.

However, whether the "100 billion stores" plan can be realized, it is unknown, but it has been accused by blue whale capital. Or personal secrets and operations closely related to the chairman. "

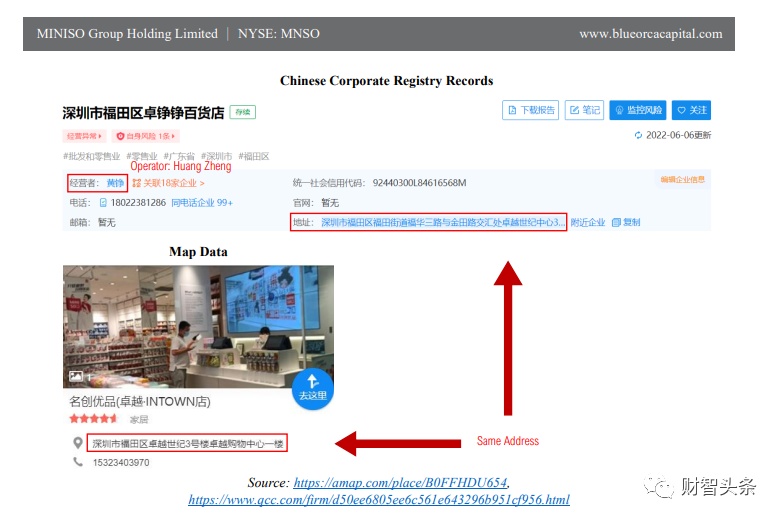

Blue Whale Capital pointed out that since November 2011, it cross -checking through corporate registry, online map and consumer data, and found that at least 620 stores are found to be independent of franchisees, but by Famous Chuangchuang, but by Mingchuang Chuangchuang The executives of Youpin or those who are closely related to the chairman are registered.

The report of the Blue Whale Capital pointed out that the 10 store addresses registered by the vice president of Mingchuang Youpin and the chief operating officer of Overseas Overseas, which are consistent with the store address of Mingchuang Youpin.

Picture source: Blue orca Capital Report

Not only that, Li Minxin, Executive Director and Executive Vice President of Mingchuang Youpin Group, was also found to be the registered owner of the 9 Mingyuyoupin physical stores by Blue Whale Capital. And in 2013, the establishment of the famous Chuang Youpin was established. The report believes that these stores are "formerly known as Chuangyou Stores" that have been closed for many years.

In this report, in addition to "Huang Yan" and "Li Minxin", Blue Whale Capital also pointed out that Zhou Hongxia, a subsidiary of Famous Chuang Youpin, Ye Tao, and the legal person Lin Zongyou all registered for many famous creators. The shop, including Ye Tao and Lin Zongyou and the chairman Ye Guofu or close the relationship.

Based on the investigation of this information, Blue Whale Capital called "In fact, Mingchuang Youpin is more like a declining physical operator."

Famous Chuang Youpin is reduced to Ye Guofu's "money bag"?

Not only was the business model of Famous Chuangyou, but the chairman Ye Guofu was also "bombarded".

In the report, Blue Whale Capital accused that shortly after the listing of famous and innocent products on the NYSE, Chairman Ye Guofu began to deceive investor funds through a series of improper transactions around the acquisition and construction headquarters, with a amount of hundreds of millions of dollars.

The famous "evidence" regarded by Blue Whale, which is regarded as blue whale, located in Guangzhou.

In October 2020, Mingchuang Youpin was listed on the New York Stock Exchange. Two months later, Mingchuang Youpin announced that the company and Ye Guofu set up a joint venture registered in the British Verjing Islands (BVI) and established it in China and established in China In the new headquarters, Ye Guofu holds 80%of the joint venture through his wholly -owned entity, and Mingchuang Youpin holds 20%. Blue Whale Capital believes that "this transaction is very suspicious." Ten months later, Mingchuang Youpin bought the remaining 80%of the shares from Ye Guofu for 695 million yuan. The next day, the income capital of this joint venture increased to nearly 1.8 billion yuan. In this regard, Blue Whale Capital stated in the report that "we believe this is the naked transfer of shareholders' wealth to the chairman."

At the same time, the report further pointed out that Ye Guofu also owns four other real estate development projects, and these projects are also accused of the same purpose by Blue Whale Capital -to send funds for Ye Guofu's personality.

Blue Whale Capital believes that "multiple real estate development projects are through complex BVI structures to allow the chairman to absorb funds from shareholders and transfer it to difficulty in overseas." The report even predicts that "similar situations will happen in the future."

Picture source: Blue orca Capital Report

Operations are in trouble: income atrophy, closed stores and reduction fees

"Mingchuang Youpin is a retailer who is going downhill." Blue Whale Capital also directly criticized the performance of Mingchuang Youpin.

Blue Whale Capital pointed out that in 2018, only 3,459 famous stores in the famous stores, in March 2022, this number increased to 5205. However, during the same period, the revenue of Mingchuang Youpin declined sharply. From the peak of 2018, the peak of 17 billion yuan shrank by more than 40%, and the franchised operating fee decreased by 63%in the past two years.

Public information shows that Mingchuang Youpin has continued to open stores in recent years, but the expansion rate has slowed down in the past two years. Data show that in 2020 and 2021, Mingchuang Youpin opened 497 and 527 new stores each year, while the number of new stores in recent years was as high as 700.

In terms of revenue, from 2019 to 2021, the revenue of Famous Chuang Youpin was 9.395 billion yuan, 8.979 billion yuan, and 9.072 billion yuan, respectively. Losses nearly 2 billion yuan.

In order to support the "decline" of Mingchuang Youpin, Blue Whale Capital pointed the spearhead to the sharp decline in the fame and Creative Terminal and franchise fees.

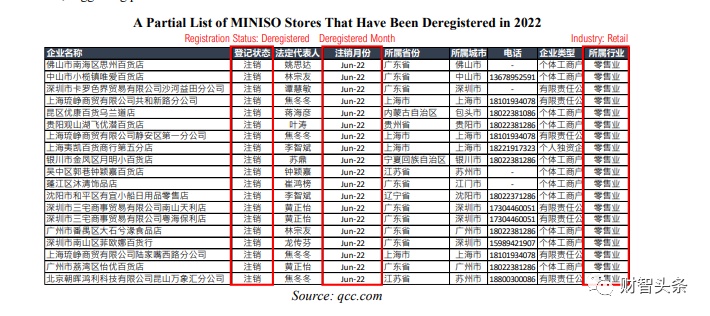

The report pointed out that after a trace of 620 domestic famous and TOP TOY, it was found that by July 2022, 120 stores were closed (about 20%of the samples), of which more than 110 were more than 110 of which Stores have revoked business licenses, which means permanently closed.

Picture source: Blue orca Capital Report

At the same time, Blue Whale Capital also believes that the decrease in franchise fees and product margins is also a powerful evidence for the dilemma of famous and innocent products.

In 2022, Mingchuang Youpin further reduced fees. Among them, the franchise costs of municipal stores fell to 29,800 yuan per year, and the product margin also dropped to 350,000 yuan; the county -level store franchise operating fee dropped to 19,800 yuan per year, and the product margin dropped to 250,000 yuan.

According to this, Blue Whale Capital believes that the significant reduction of franchise costs means that the brand value of Mingchuang Youpin has declined, and it also erodes the financial health of the retailer's future development. This company may lose hundreds of millions of yuan each year Income.

Blue Whale Capital has made many air stocks many times

Although the short report of Blue Whale Capital has triggered a strong response in the market, it remains to be questioned whether it can stand up to the market.

Public information shows that Blue Whale Capital is a radical short investment institution headquartered in Texas.

Its profit logic is very simple. Most of the cores of financial data of listed companies, related related transactions, high valuations, and executive behavior are used as breakthroughs. Out, the short -term investigation report exposed the company's operating problems, thereby suppressing the stock price stock indexes. After the company's stock price plummeted, the stock price was purchased at the low price.

The simple logic of making money has given a large room for short -to -short. The blue whale capital of the short -selling institution of this incident is called "killing whale" in the industry. In 2018, the institution became famous for its aesthetic settlement companies in the air -Hong Kong stocks. By accusing the company's poor governance, financial irrigation, and CEO academic falsification, the brilliance set the largest decline in six years and was forced to suspend trading.

It is worth mentioning that many Chinese companies include new oxygen, Chinese flying cranes, Data, and Pinduoduo. However, Blue Whale Capital can ultimately persuade the market.

Before Mingchuang Youpin, the blue whale capital was more well -known for Chinese flying cranes.

On July 8, 2020, Blue Whale Capital released a short report on Chinese Feihe. Subsequently, China Feihe strongly denied the relevant allegations of Blue Whale Capital and issued a pre -pre -pre -pre -pre -pre -pre -announced announcement in the announcement in the announcement. As of June 30, 2020, the income of China Feihe will increase significantly by more than 40%. It is mainly due to the significant increase in sales of high -end infant formula milk powder. China Feihe also said that the company reserved the right to take legal measures on the relevant matters related to the Blue Whale Capital Report.

At that time, the stock price of Feihe rose rapidly after a brief fluctuation of the day and closed at HK $ 16.96 per share. The stock price rose 7.21%on the day.In the end, Blue Whale Capital's short -term Chinese flying crane operation failed.

(WeChat public account "Cai Zhi Headou" comprehensive self: Yangguang.com, surging news, interface news, etc.)

Edit: Bai Jing

School pair: Yuan Kai

Review: Gong Zimo

- END -

Pu'er Meteorological Observatory issued a yellow warning of geological disasters [Class III/hea

Pu'er Meteorological Bureau and Pu'er Natural Resources and Planning Bureau June 10, 2022 jointly released the Grade III (yellow) warning of geological disaster meteorological risk at 8:30 on June 10,...

deal!In the future, every cultivated land will be guarded →

On the morning of July 20, the Sichuan Provincial Government News Office held a pr...