[Cai Zhi Toutiao] In the second half of the rate hike, the United States declined?

Author:China Well -off Time:2022.07.29

On July 27th local time, the Federal Reserve Commission announced that the federal fund interest rate target range raised 75 basis points to 2.25%to 2.5%, in line with market expectations. This is the second consecutive interest rate hike of the Federal Reserve.

At the same time, the Fed announced that it will accelerate the "shrinkage" from September, increase the monthly reduction limit of US Treasury bonds to US $ 60 billion, and increase the monthly reduction of the monthly reduction of the monthly reduction of institutional bonds and institutions mortgage loans (MBS) to 350 One hundred million U.S. dollars.

The Federal Reserve President Powell subsequently held a press conference that as interest rates tightened, slowing down interest rate hikes may be appropriate. His remarks clearly ignite the market enthusiasm. On Wednesday, the US stock market rose sharply. As of the closing, the Dow rose 436.05 points, an increase of 1.37%, to 32197.59 points, the NANPIPING rose 4.06%to 12032.42 points, and the S & P 500 index rose 2.62%to 4023.61 points.

On July 27, Powell, chairman of the Federal Reserve Committee, attended a press conference in Washington. Xinhua News Agency reporter Liu Jie

Powell: It does not think that the US economy has fallen into a decline

This is the fourth time the Federal Reserve has raised interest rates since this year. At this point, the Federal Reserve has raised interest rates of 225 basis points during the year: March 17, 25 basis points in interest rate hikes; May 5th, 50 basis points in interest rate hikes; on June 16th, rate hike 75 Base point; July 27, raise interest rates 75 base points.

Fed Chairman Powell said that although it has slowed down, the US economy has not fallen into a decline. "As the position of monetary policy is further tightened, when we evaluate the impact of accumulating policy adjustments on the economy and inflation, slowing down interest rate hikes may be appropriate." He said.

After the Federal Reserve's decision was announced, international gold prices bottomed out. After the market, the COMEX Gold Futures contract that the New York Commodity Exchange delivered in September was over $ 20 from a low level in the daily low. Currently, it is traded at $ 1733/ounce, up 0.90%. COMEX silver futures contract rose 2.8%, returned above $ 19, and now reported to $ 19.05/ounce.

International oil prices have reached a new high in the past week. WTI crude oil contracts have risen by 2.40%in recent months to $ 97.26/barrel. Brent crude oil contracts have risen 2.13%in recent months to $ 106.12/barrel.

The bank sector performed well, and Bank of China, Citi, JP Morgan Chase, and Goldman Sachs rose more than 1.5%. After the announcement of the interest rate hike, Morgan Chase, Citi, and Wells Fargo and other Wall Street institutions announced on the same day that they had raised the Prime Lending Rates 75 basis points to 5.5%, which came into effect from Thursday.

The chip sector rose, and the US Senate will advance a bill forward with 64 votes on the day before. It is expected that the House of Representatives is expected to vote this week. The bill not only provides US semiconductor production with about $ 52 billion in government subsidies, but also provides chip factories with an estimated $ 24 billion investment tax credit. Nvidia rose 7.2%, Texas instruments rose 6.6%, and Intel rose 3.1%.

Tesla rose 6.2%, and the company predicts that electric truck Cybertruck will be delivered in mid -2023.

Technology stocks led the market, Google rose 7.7%, and the financial report showed that the company's search business advertising revenue increased strongly. Microsoft rose 6.7%, and its revenue of Azure and cloud services increased by 40%. It is expected that revenue for annual annual revenue will maintain a double -digit growth rate. In addition, Amazon rose 5.3%, Apple rose 3.4%, and the two companies will announce their performance after on Thursday.

"There are still too many dynamic factors in the future to consider the future of UBS global wealth management analyst, said that the market will still be fluctuated after the FOMC meeting. As the market is expected to reach 3.3% by the end of the year, the federal fund interest rate will reach 3.3% by the end of the year. This means that after this week's meeting, by the end of December, the Fed may need to raise interest rate hikes about 100 basis points at the end of December. But the pace of interest rate hikes is still uncertain. "

GDP was announced in the second quarter

At 8:30 evening Beijing time, the United States will announce the GDP data in the second quarter.

The latest forecasts of the Egent Reserve Bank of the United States on the 27th show that the actual domestic product in the second quarter of this year will shrink by 1.2%by annual rate. According to data from the US Department of Commerce, the US economy shrinks 1.6%in the first quarter of this year. If Atlanta Fed's forecast becomes a reality, it means that the US economy falls into a technological recession.

Generally speaking, economic recession is defined as negative GDP growth for two consecutive quarters.

However, the Bayeng government is trying to cool the emotions. White House Chief Economic Adviser and Director of the National Economic Council, Brian Deese, said on the 26th that negative GDP growth for two consecutive quarters was not a formal definition standard for decline. In fact, due to the strong labor market and other factors, it is unlikely that the National Economic Research Agency (NBER), which judges the official institution of the US business cycle, immediately announced that the United States has entered an economic recession.

The Federal Reserve President Powell said at a press conference after the interest rate interest rate. After the 75 basis points of the interest rate hike, the federal fund interest rate target range was close to the neutral interest rate level. Although inflation data is still on the rise, the economy is likely to be in the period when the data has not fully reflected the tightening effect of the currency policy. He believes that the interest rate hike and "shrinkage" have actually produced the effect.

Powell said that the current Fed's shrinkage operation is operating well and will start at full speed of the table as planned in September. The model is expected to return to the "normal" of the Federal Reserve's balance sheet from 2 to 2.5. Dong Chengxi, a researcher at Zhixin Investment Research Institute, believes that this interest rate hike basically meets market expectations, but the Fed's attitude is more "pigeon" than market expectations. It may slow down the rhythm of interest rate hikes. Inhibitory inflation is still the first goal of the Federal Reserve. Although the inflection point of economic growth has appeared, the Fed still needs to continue to raise interest rates to avoid stagnation in the US economy.

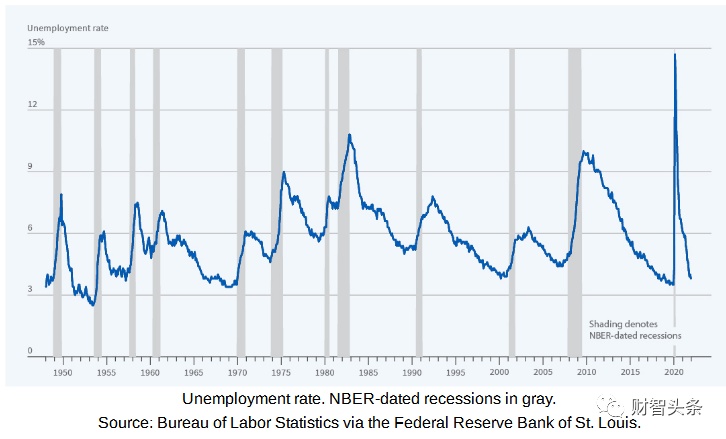

The relationship between the US economic recession and unemployment rate in the past 70 years (source: NBER)

Facing the highest inflation data in the past 41 years, the challenge may have just begun with the expected expected of economic slowdown and future policy tightening. The price of high fever and fever also makes many people start thinking that maybe only economic recession and higher unemployment rate can significantly alleviate price pressure.

Asian Central Bank tighten monetary policy

Faced with the Federal Reserve, which has been raising interest rates, the inflation rates in South Korea, Australia and Thailand have currently risen to the highest level in the twenty -three, twenty -one, and fourteen years, respectively. As the price of commodities rises and the supply chain is blocked to continue to increase the cost of import, the worst case may not end.

For a long time, the Asian Central Bank decision makers have adopted a pigeon position to support the country's economy to recover from the epidemic, but this has led to weak currency and capital outflow. In order to cope with the Federal Reserve's interest rate hikes and rising inflation, the Asian Central Bank finally began to take measures.

The Bank of Korea has unprecedentedly raised the benchmark interest rate to 50 basis points to 2.25%last Wednesday, the largest increase in 1999. The Singapore Monetary Authority raised the nominal valid exchange rate policy range of Singapore's nominal valid exchange rate last Thursday. The Philippine Central Bank announced on the same day that there were 75 basis points in non -cyclical interest rate hikes to 3.75%, and the interest rate hike was the largest in nearly 22 years.

Frederic Neumann, chief economist in HSBC Asia, said that the fluctuation exchange rate and the Federal Reserve's interest rate hikes are increasing the urgency of many Asian central banks to tighten monetary policy. As the central banks in South Korea, Singapore, Philippines, and the Philippines accidentally tighten monetary policy, central banks in Thailand and Indonesia may now speed up their reactions.

U.S. stocks are still hard to say

The institution generally predicts that the rhythm of interest rate hikes will be weakened in the fourth quarter. The Annual Meeting of the Global Central Bank of Jackson Hall will be held at the end of August, and investors will closely pay close attention to the central bank's forward -looking guidance.

THOMAS Costerg, a senior American economist in Patek Wealth Management, believes that the labor market may deteriorate before the end of the year. As the unemployment rate rises, wages and inflation should decrease significantly. Stop raising interest rates. A mild recession may occur in 2023, and the unemployment rate has risen, so the Fed will not raise interest rates further. "In fact, we think that the Fed will pay more attention to the growth indicators (and the rising risk of recession) and adopt a more forward -looking attitude to fight inflation. We expect the eagle speech to fade. Therefore, we believe that the Fed's actions in September It is a small interest rate hike 25bp. "

Destmond Rachman, an economist at the American Institute of Enterprise Research, told Xinhua News Agency that so far, the Fed's tightening monetary policy has had a significant impact on the financial market. In the first half of the year, the stock and bond markets had encountered a sharp decline. Growth began to slow down.

Under the expectations of profit recession, US stocks are still difficult to say. The institution believes that the profit of US stocks may still have 5%to 10%of space.

On July 28, a number of technology giants will release financial reports, and the prospects are not optimistic. For example, Wall Street predicts that cost increases the profit margin of Apple. The company may report sales growth rates at the lowest since the outbreak, and the quarter -quarter earnings per share have declined for the first time in the past two years. One of the reasons for the growth of operating income and the decline in profitability is the high threshold comparable performance, and another reason may be that the dollar is strong. In the same period last year, due to the outbreak of technical demand during the epidemic, Apple's quarterly income increased by more than doubled. More than half of Apple's sales occurred outside the United States, and the strength of the US dollar is a disadvantage. Many multinational companies have mentioned the adverse factors of the US dollar in recent weeks.

In the next few days, U.S. stock volatility may rise. Several traders pointed out that after the FOMC meeting, GDP will be announced later in the second quarter. The market is expected to gently grow by 0.5%in the second quarter. However, some data performance is weak, and two consecutive negative growth of GDP is possible, which is one of the technical standards that define decline.

The RMB exchange rate opens up

After the Fed's interest rate hike news was released, the exchange rate of the US dollar on the shore and offshore was higher. At the opening of the shore exchange rate, 35 basis points were pulled at 6.7534. At the same time, the offshore RMB rose to the 6.74 mark to the US dollar line, up to 6.7335, and then fell. As of 10:05, 6.7450 and 6.7444 were reported on the shore and offshore RMB.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said that the Federal Reserve policy has limited impact on domestic, mainly in China and the United States in different economic and policy cycles, and the one -country stock market will eventually return to its own economic fundamentals. From the perspective of trend, the prospects of domestic economic development, the market trend of the stock market is high, the correlation between RMB assets and other markets is not high, the RMB exchange rate trend is stable, and the pace of RMB internationalization is accelerated. Renminbi assets are expected to become global funds. Wang Chunying, director of the State Administration of Foreign Exchange and spokesman, stated at the State Council press conference last week that the elasticity of the RMB exchange rate in the first half of this year has increased and performed steadily globally. Since the beginning of this year, due to the multiple factors such as the Federal Reserve's interest rate hikes and geopolitical conflicts, the main line of changes in the international foreign exchange market is that the US dollar has strengthened, mainly non -US currency weakened. In this context, the exchange rate of the RMB to the US dollar has depreciated, but compared with major international currencies, the stability of the RMB value is relatively strong, and the depreciation is far less than the major US currencies such as euro, yen, and pounds.

Regarding the trend of the RMB exchange rate in the second half of the year, Wang Chunying believes that it will still be basically stable at a reasonable balance. She specifically pointed out the four aspects of support factors: First, China's economic stability and recovery, the main economic indicators are good, the industrial chain and supply chain remain stable, and will continue to play the fundamental role of supporting the RMB exchange rate. Second, China's foreign trade and foreign investment are strongly tough, and the funds at the real economic level such as trade investment will still be the basic disk of flowing, which will help the basic balance of supply and demand for the foreign exchange market. Third, the exchange rate of market entities is basically stable, maintaining a rational trading model of "buying foreign exchange and settlement at high exchange". In addition, China's foreign asset -liability structure is continuously optimized, the scale of foreign exchange reserves has remained overall stability, and it continues to ranks first in the world. It still plays the role of "stabilizers" and "compressor stones" that stabilize national economic and financial security.

(WeChat public account "Caizhi Headline" comprehensive from: Xinhuanet, China News Network, Beijing Youth Daily, First Finance, etc.)

Edit: Fenghua

School pair: Yuan Kai

Review: Gong Zimo

- END -

The China Electronic Energy Conservation Technology Association's Blue Carbon Professional Committee's preparation conference was held in Qingdao

On July 9th, the Preparatory Conference of the Blue Carbon Professional Committee ...

The American man rushed to the police with an ax and was killed directly

Jimu Journalist Hu XiuwenVideo editing Wang Peng