Experts interpret the issue of Yaoming Kangde's half -year report: the problem of "double high" doubts and powder profits cannot be ignored

Author:Cover news Time:2022.07.29

Cover reporter Meng Mei Ouyang Hongyu intern Shao Lijun

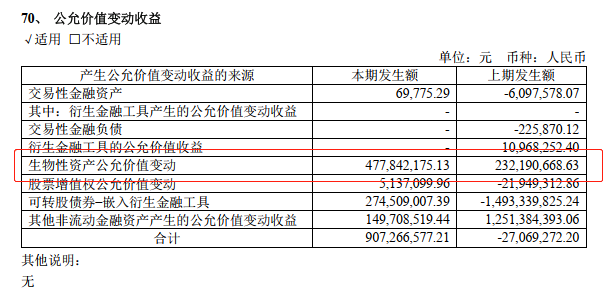

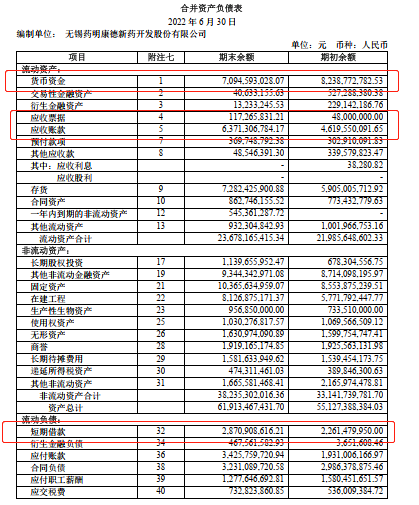

On July 27, Yaoming Kant released a 2022 interim. The report shows that Yaoming Kant's operating income was 1.7756 billion yuan, an increase of 68.5%year -on -year, and the net profit attributable to the mother was 4.636 billion yuan, an increase of 73.3%year -on -year, continuing the high growth trend. On the balance sheet, as of June 30, Yaoming Kangde's monetary funds were close to 7.1 billion yuan, of which nearly 7 billion were bank deposits, and at the same time, he held a short -term loan of 2.871 billion yuan; In terms of, it was divided into 6.371 billion yuan and 117 million yuan.

In this regard, Yu Qing, the founder of the study of the three -party research institution, interpreted that although the overall profit quality of Yaoming Kant was good, his performance may have certain moisture. "Especially the long -term existence of" dual -deposit and loan "and '" double high "are difficult to get reasonable explanations, which requires a special explanation of Yaoming Kant."

How to understand the two doubts: "Double High" and "receivable and pre -collection"? Kuang Yuqing introduced that the two -high deposit and loan high refers to the company's short -term deposits and long -term deposits on the banks, but on the other hand, they borrowed a lot of money from the bank; It is very strong in front of it. Customers are required to pay first and then ship the goods, causing the company's pre -collection (or contract liabilities) to be high, otherwise the pre -collection high.

Kuan Yuqing pointed out that the quasi -cash reserves on Yao Ming Kang's accounts were about 9.3 billion yuan, and in this case, she still borrowed from the bank. At the same time, the balance of accounts receivable and receivables also accounted for more than one -third of its revenue in the first half of the year.

Regarding the situation of "dual high deposit and loan high" of listed companies, the company is forced to borrow at high interest rates overseas or lacks strong control of subsidiaries. However, Yu Qing believes that because Most of the deposits of Yin Ming Kant are in China, and the equity of a few shareholders accounts for less than 1%of their net assets. Therefore, these two situations do not meet the actual situation of Yaoming Kant, and it is necessary to make further explanations.

In addition, Yin Kant also has suspicion of changes in fair value and expense capital powder. Guan Yuqing took the "company's confirmation of 478 million yuan of biological assets to bring fair value changes in the first half of this year" as an example that this value doubled compared to the same period last year, and the biological assets were extremely niche, and it was difficult to have fair value. It is difficult to have fair value. It is advisable to enter the account first, and then confirm the profit or loss at one time when it is realized.

"Overall, the quality of profitability of Yaoming Kangde is still very high." Kuan Yuqing said that most of the profits of Yao Ming Kangde come from the main business business, which can prove that it is an excellent company with a strong profitability and growth. In the context of the founding shareholder camp, these "doubts" should not be ignored.

- END -

Popularize the knowledge of air defense and disaster prevention knowledge to strengthen national defense awareness

Original title: Popularize the awareness of national defense and prevention of pre...

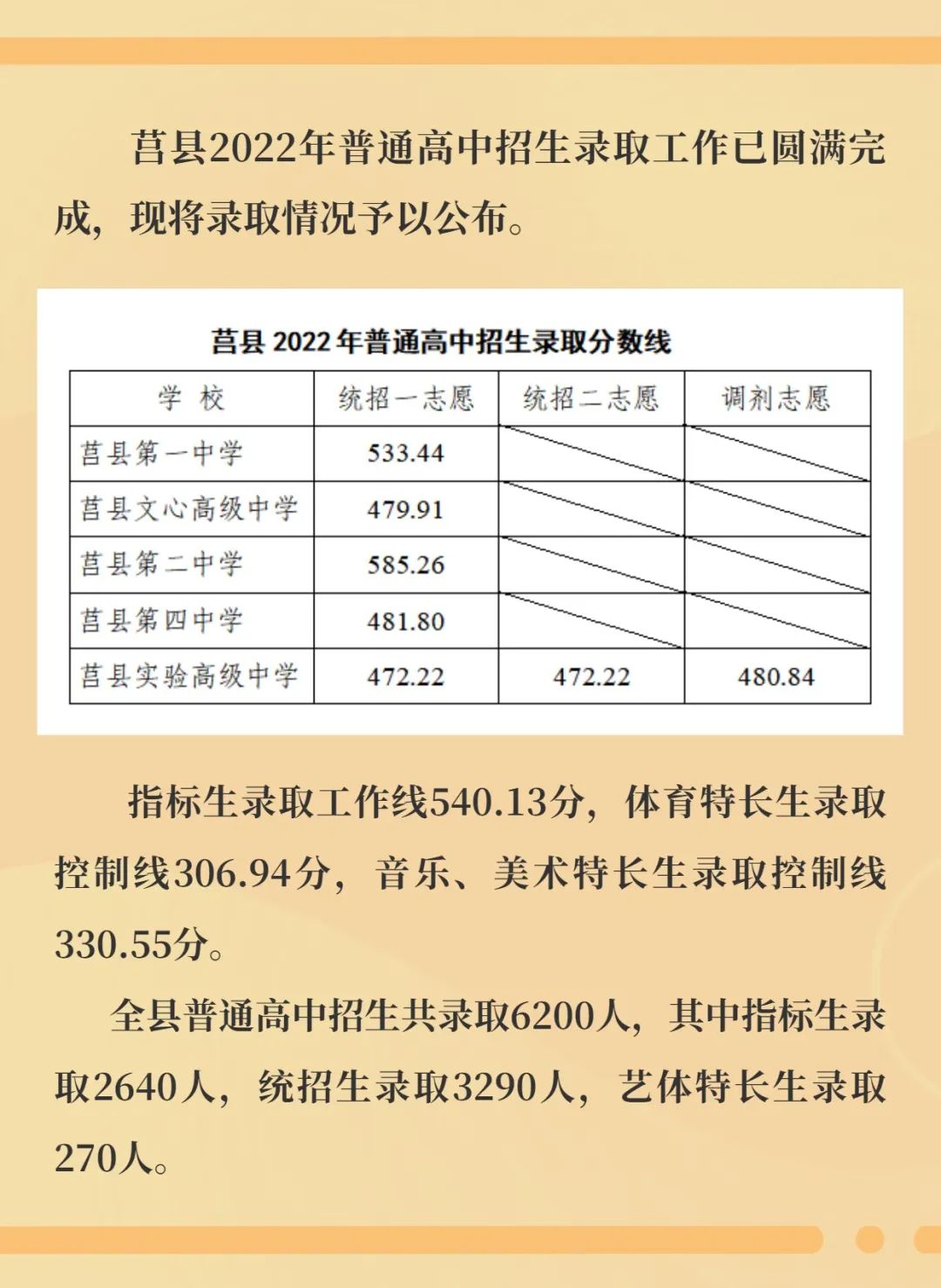

Look at it!Juxian and Wulian ordinary high school admission score lines are announced!

July 6thAfter a number of ordinary high school enrollment admission scores in the ...