The Federal Reserve ’s interest rate hike 75 basis points can affect the control of my country's monetary policy

Author:Securities daily Time:2022.07.29

In the early morning of July 28, Beijing time, the Fed announced the meeting statement of the Federal Public Marketing Committee (FOMC) in July. According to the statement, the Federal Reserve raised the federal fund interest rate target range of 75 basis points to between 2.25%-2.50%, in line with market expectations.

At this point, the Fed has raised interest rates 4 consecutive times for the year. From June to July, 75 basis points were raised twice in a row, and a total of 150 basis points were reached, the largest since the 1980s. In addition, the statement shows that the committee will continue the established process of shrinking the scale according to the "Plan for Reducing the Federal Reserve's Assets Liability Graduate" issued in May and is committed to the target of inflation to 2%.

The chief economist of CITIC Securities clearly said in an interview with the Securities Daily that although the Federal Reserve raised 75 basis points, the overall statement and outlook all revealed the signal of slowing interest rate hikes in the future. From the perspective of future interest rate hike paths, the operation of the Fed's monetary policy has little impact on my country's monetary policy and the RMB exchange rate, and it has a tendency to weaken margins.

"Securities Daily" reporter noticed that the wording of interest rate resolutions in July was basically the same as in June, but at the beginning of the statement, the Federal Reserve's words were obviously compared with the previous partial pigeons. Feeling weakness. "

Judging from recent data, the Fed's radical interest rate hike has indeed produced significant suppression of consumption and investment. In addition, according to the latest forecast of the Federal Reserve Bank of the U.S. Atlanta, the actual GDP in the second quarter of 2022 will shrink by 1.2%of the year -on -year calculation, which will grow negatively in two consecutive quarters, and fall into a "technical recession".

Wen Bin, chief economist of Minsheng Bank, said in an interview with the Securities Daily reporter that combined with the first rate hike in the European Central Bank in July, it started at 50 basis points in 11 years. Integration path. However, after the Federal Reserve raised 75 basis points on the benchmark interest rate, US policy interest rates have reached 2.25%-2.50%, which is at the level of "neutral interest rates" widely believed. At the end of this year or early next year, the viscosity of prices and the deterioration of economic data may adjust the Fed's policy goals and slow down the rhythm of interest rate hikes.

"Considering that the Federal Reserve has gradually entered the post -rate hikes, the interest rate environment has been further tightened. The Federal Reserve has a serious impact on the economic recovery through the appropriate slowing down the rhythm of interest rate hikes." Zhou Maohua, a macro researcher of the Financial Market Department of Everbright Bank, accepts " The Securities Daily said in an interview that the follow -up rate hike rhythm also needs to pay attention to future inflation data. If inflation in August exceeds expectations, it does not rule out 75 basis points or more raising interest rates in September.

After the interest rate hike landing, the US stock market increased significantly. As of the close of July 27 local time, the Dow Jones Index closed at 32197.59 points, an increase of 1.37%; the Nasdaq Index closed at 12032.42 points, an increase of 4.06%; the S & P 500 index closed at 4023.61 points, an increase of 2.62%. However, many analysts said that the trend of the US stocks is still cautious.

"75 basis points in the Federal Reserve interest rate hikes are in line with market expectations, because there were previous expectations of the 100 basis points of this interest rate hike, some investors regarded 75 basis points of interest rate hikes as 'benefits'. But after this rate hike, the risk asset market The outflow of funds will continue to occur, and the short rebound of US stocks is not sustainable. "Zheng Lei, chief economist of Samoyed Cloud Technology Group Holdings Co., Ltd., said in an interview with the Securities Daily reporter.

In the context of the Fed's continuation of interest rate hikes, the US dollar is expected to maintain a strong pattern. Several experts said that a strong dollar may fluctuate to the RMB, but it will not change the basic pattern of RMB stability, which will have a controllable impact on my country's monetary policy.

Zhou Maohua said that my country's economic fundamentals have long been better for a long time, and the international revenue and expenditure is basically balanced. In addition, my country's foreign trade has maintained toughness, RMB assets are attractive, cross -border capital flows in an orderly manner, the RMB exchange rate elasticity is significantly enhanced. one.

Xia Yan, a China interest rate strategy analyst of UBS Securities, believes that my country's monetary policy orientation is still mainly based on domestic macroeconomic situations. The changes in the Fed's monetary policy will not interfere with the tone of my country's monetary policy.

- END -

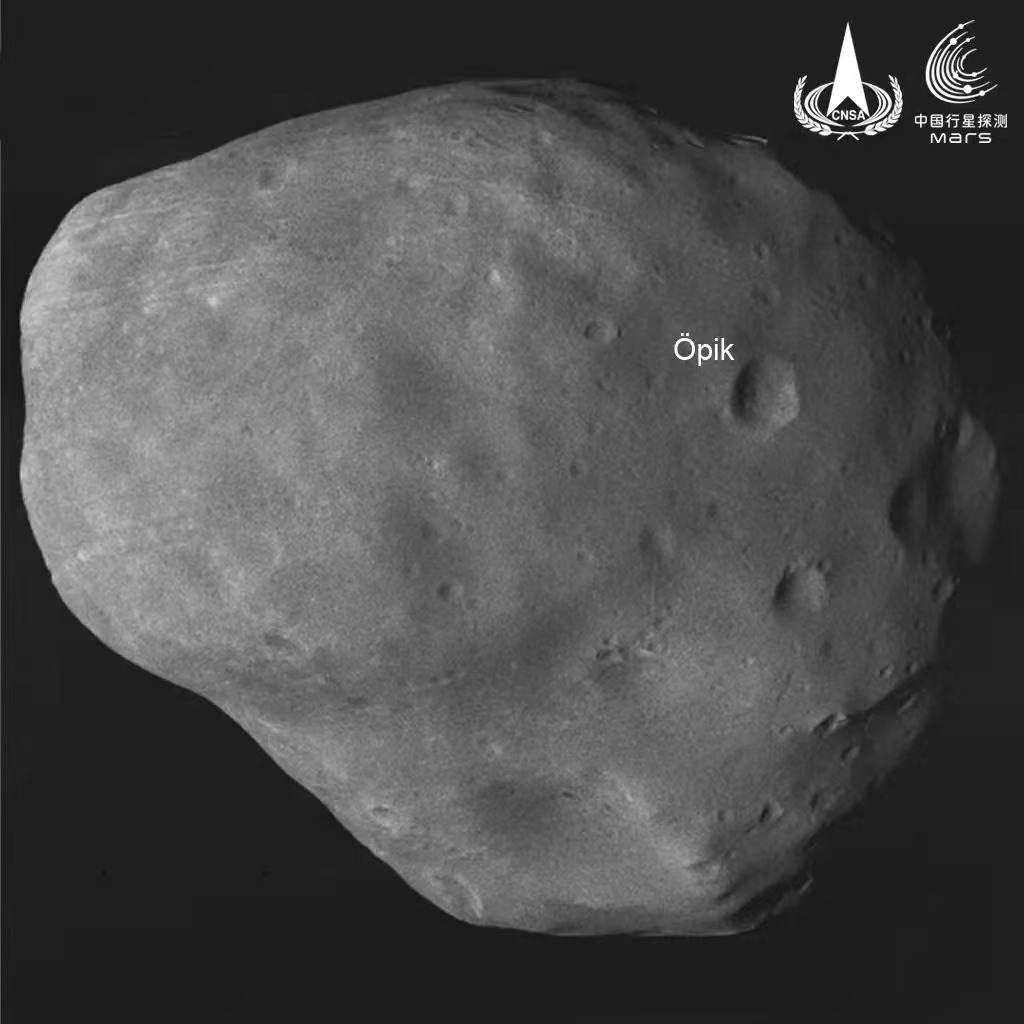

Tianwen No. 1 launch: Successful obtaining a high -definition image continued to carry out Mars global remote sensing detection

From Tianwen to Ask the sky. (Video source: 1 House of China Aerospace Science ...

The launching ceremony of the "Hope Hope · Love Companion" public welfare project was held in Zhuzhou

On July 10, 2022, the launching ceremony of the Hope Hope, Love with Children help...