In the second quarter, unexpectedly shrank 0.9%, the US economy was in a "technical decline", US stocks fell, and US debt yields fell more than 3%

Author:Daily Economic News Time:2022.07.28

Under the high inflation of the 40 -year record and a sharp interest rate hike in the Federal Reserve, the US economy has shrunk again in the second quarter and fell into a "technical recession."

Before the US stock market on July 28 local time, the US Department of Commerce announced the initial estimation of the annual annualized annualized annualized annualized annualized value of the United States in the second quarter. The first quarter decreased by 1.6%. As the biggest part of the US economy, the growth rate of personal consumption is 1%, which is slower than the previous quarter.

Earlier, economists surveyed by Bloomberg expect that the US GDP will increase slightly by 0.4%in the second quarter, and personal consumption will increase by 1.2%.

The report shows that high inflation has weakened the purchasing power of the United States, while the Fed's interest rate hikes weaken the fields of residential investment that is sensitive to interest rates.

It is reported that the GDP announced this time is based on incomplete or further revised data. The second quarter estimation of more complete data is announced on August 25.

The decline in GDP for two consecutive quarters is generally regarded as a technical recession, but the formal recession needs to be ruled by economists from the National Institute of Economics of the United States.

"I think we are in emotional recession, but we have not fallen into a real economic recession. Slowing growth is driven by inflation and price shock. As they fade in the short term, growth should accelerate," Financial economist ANeta Markowska said. She is expected to increase by 1.7%compared with the fourth quarter of last year.

After the opening of the U.S. stock market, the three major stock indexes of the US stocks rose slightly, and then fell across the board. As of press time, the Dow fell 0.24%to 32119.95 points; the S & P 500 fell 0.39%to 4008.04 points; the Nasi index fell 0.69%to 11949.89 points.

Image source: CNBC

As the new economic data reduces the possibility of continuing to raise interest rates sharply, the US 2 -year Treasury yield data that is sensitive to interest rates has plummeted by more than 10 basis points after the release of US 2 -year Treasury yield data. As of the release rate of 2.8642%, it fell 3.63%.

Image source: Yingwei Caiqing

The US dollar index has a short -term downward settlement of about 30 points to 106.61, and as of press time, it has recovered.

Image source: Yingwei Caiqing

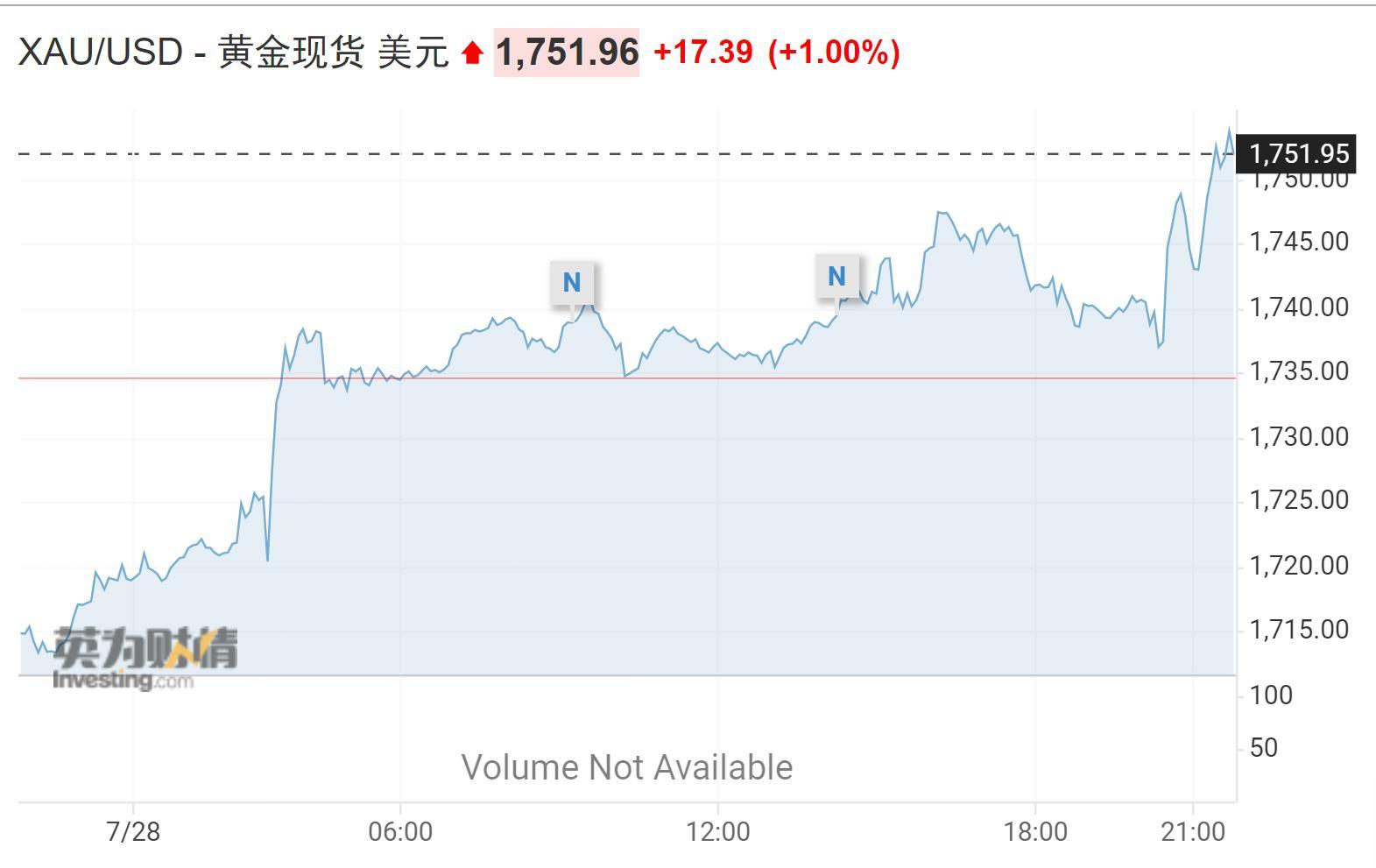

Spot gold continued to rise, as of the release of $ 1751.96/ounce, rose 17.39 US dollars.

Image source: Yingwei Caiqing

Daily Economic News

- END -

The front -line survey 丨 China -Vietnam trains have improved the operating efficiency of more than 4 times that they did it?

In Nanning in Guangxi, the operation time of the China -Vietnam trains has been ac...

Children's "home learning", the parent's mentality must be "stretched"!

Due to the epidemicChildren arranged to study online at schoolParents must not onl...