"SMIC" Shaoxing Zhongxin desires to go public, with 3.4 billion in three years, and 604 items of SMIC

Author:City world Time:2022.07.28

On July 27, 27 days after the prospectus was disclosed, the IPO status of Shaoxing Medica Integrated Circuit Manufacturing Co., Ltd. (referred to as "Shaoxing Zhongxin") was changed to "Inquiry", which means another " "SMIC" companies are one step closer to the capital market.

Like SMIC's 12.86%of the "Sealing and Testing First Share" Changdian Technology, Shaoxing SMIC is also a SMIC's joint venture. International has a significant impact on its financial and operating decisions.

The prospectus shows that SMIC's wholly -owned SMIC holds 19.57%of Shaoxing Zhongxin, and is the second largest shareholder of the latter. In addition, SMIC also uses companies such as Qingdao Juyuan Yinxin and other companies to indirectly holds Shaoxing Medica.

According to disclosure, SMIC has invested in a total of 15 associates so far. In addition to Changdian Technology and Shaoxing Zhongxin, another joint venture Chanxin Semiconductor has also planned to be listed. It has been listed in March 2021.

Some investors commented on this: "In the semiconductor industry, SMIC is the strongest angel investor."

01. Gailu CSI 604 items authorized

Shaoxing SMIC was established in 2018. According to the Chip Insights survey, in 2021, Shaoxing SMIC's operating income in only three years has ranked fifteen in the world and fifth in mainland China. after.

The rapid growth of Shaoxing SMIC has nothing to do with SMIC's support. According to the prospectus, Shaoxing SMIC has been authorized by SMIC since its establishment, and has a variety of business exchanges with the latter.

On March 21, 2018 and March 21, 2018, Shaoxing SMIC signed the "Intellectual Property Permit Agreement" with SMIC, SMIC, and SMIC. 573 patents and 31 non -patented technologies related to electromechanical (MEMS) and power devices.

The agreement stipulates that the period of relevant intellectual property permits is valid for a long time, and it is in a limited competition period before March 21, 2024.

The prospectus wrote that based on relevant technology authorization, Shaoxing SMIC established the first generation of technology platforms. If the relevant intellectual property permission is terminated, the production and sales of the company's first -generation products involved will be affected. In the short term It has a certain impact on profit.

However, Shaoxing SMIC has completely independently established core technologies and stable customer bases in the mid -to -high -end fields such as radio frequency MEMS, vehicle IGBT, high -voltage IGBT, and deep groove super knot MOSFET. Intellectual property rights used by international authorization.

As of December 31, 2021, the company had 57 original invention patents and 35 practical new patents.

During the reporting period, there were still related transactions between Shaoxing SMIC and SMIC and its subsidiaries.

Shaoxing Zhongxin has purchased raw materials such as SMIC International Shanghai, SMIC International Shenzhen, and commissioned SMIC International Shanghai and SMIC International Shenzhen for processing and manufacturing.

In 2019 and 2020, Shaoxing SMIC also sells products to SMIC and provides R & D services, selling materials to SMIC, and providing equipment rental services to SMIC.

02. Three -year loss is about 3.4 billion yuan

Although in the field of wafer foundry, Shaoxing SMIC and SMIC do not meet the specific business layout.

Shaoxing Zhongxin is mainly engaged in special process wafer foundry and module sealing and testing business such as MEMS (micro -electromechanical system) and power devices. Although SMIC has a distinctive process wafer foundry business, it focuses on characteristic process areas such as NAND (storage chip) and image sensors.

According to the prospectus, due to the rapid growth of the wafer foundry business, the Shaoxing medium -core revenue increased rapidly during the reporting period. In 2020, the revenue increased by 182.06%year -on -year to 739 million yuan; the revenue in 2021 increased by 173.883%year -on -year to 2.024 billion yuan Yuan.

However, Shaoxing SMIC is still in a state of losses. In 2019, 2020, and 2021, the net profit of home mother was -772 million yuan, -1.366 billion yuan, and -1236 billion yuan, respectively. The total loss of three years reached 3.374 billion yuan.

According to the prospectus, the reason why Shaoxing Zhongxin has not made up for the loss of losses is: "During the reporting period, the scale effect was not formed in a timely manner during the construction and expansion of the production line, and in the short term Investment continues to increase. "

From 2019 to 2021, Shaoxing SMIC's R & D costs were 63.87%, 35.46%, and 30.69%, respectively, higher than comparable companies.

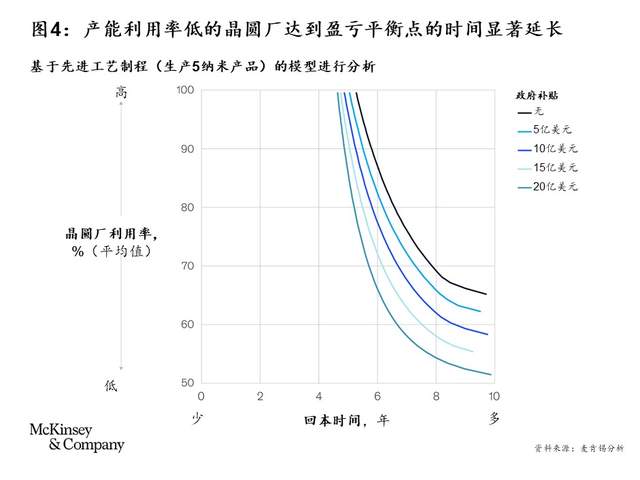

(Source: McKinsey)

Chip manufacturing is a typical heavy asset, high -R & D, and long -term industry. According to the prediction model of the management consulting company McKinsey: According to the most optimistic estimation, if the capacity utilization rate of the wafer plant is as high as 90%or more, its cash flow is expected to turn positive in about 5 years; when the capacity utilization rate continues to be lower than 55%~ At 65%, it takes about 10 years to see the return on investment.

In 2019, 2020, and 2021, Shaoxing SMIC's capacity utilization rate was 55.44%, 81.03%, and 93.36%, respectively.

- END -

The Discipline Inspection Commission of Changqing District organized the business ability enhancement class and district disciplinary committee theoretical study in 2022

From July 13th to 15th, 2022, the Changqing District Discipline Inspection Commiss...

Beijing City Auxiliary Middle Center realizes \"a picture of a global cities\"

\There are debris in the northwest corner of the No. 30 of Xinjie downhill, please handle it as soon as possible.\ Clean the scene and take less than 10 minutes throughout the process. The \Civili