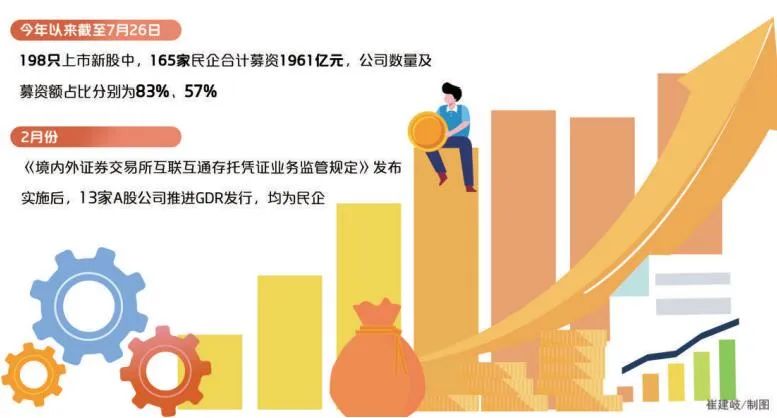

During the year, 165 new civic enterprises raised a total of 196.1 billion yuan of private enterprises' direct financing environment to continue to improve

Author:Securities daily Time:2022.07.27

27Jul

Since 2022, our reporter Xing Meng has issued a series of policies and measures to support direct financing of private enterprises. According to sorting out, in terms of equity financing, this year A -shares exceeded 80 % of new listed companies as private enterprises, with more than half of the fundraising amount; in terms of bond financing, private enterprise bond financing special support plans, scientific and technological innovation corporate bonds, transaction expenses and other measures have settled one after another. Essence "In general, the financing environment of private enterprises has improved. Supporting direct financing of private enterprises can not only solve the actual difficulties encountered by private enterprises, but also promote the better development of finance to serve the real economy." "Securities Daily" reporter said. Private enterprises are an important subject in the capital market. Vigorously supporting the development of private enterprises has always been an important task for regulatory authorities. "While the capital market continues to vigorously support the reform of state -owned enterprises, and strengthen the capital, it is unswervingly supporting private enterprises' innovation and transformation and healthy development. At present, the number of private listed companies has exceeded 3,000, and the number of families accounts 2/3, in recent years, newly listed companies have accounted for more than 80 % of private enterprises. "At the beginning of April this year, the Chairman of the CSRC said at the 3rd Member Congress of the Listed Companies Association. According to the Flush iFind data, as of July 26 this year, the total amount of funds for new shares listed on the 198 listed new shares was 343.2 billion yuan (including the launch of the starting listing and the listing of the Beijing Stock Exchange). The ratio of 83%and 57%, respectively. In addition, of the 165 companies, the number of (64) has the largest number of (64) in the GEM, and the science and technology board (47) will be secondary, with a total of 67%of the two. Home), electronics (25), and pharmaceutical creatures (19). "In the multi -level capital market, the GEM and the science and technology board are more suitable for small and medium -sized private enterprises. The two sectors are mainly positioned in service technology innovation and growth enterprises." Wang Xin, a global partner and president of Greater China, "Securities Daily "The reporter said. In terms of overseas financing, the regulatory authorities have also continued to broaden and optimize the financing channels of private enterprises. In February, the "Regulations on the Supervision Regulations on the Business Supervision of the Interoperability Exchange Credit Volleyball Team of the Stock Exchange". All private enterprises. "The financing of private enterprises still exists. Especially in terms of bond financing, private enterprise bonds have more defaults, and the qualified enterprises are difficult to issue bonds. Market confidence is still yet to be repaired." Gui Haoming said. Recently, the three departments such as the CSRC jointly issued the "Notice on Promoting the Bond Market to better support the reform and development of private enterprises", which aims to enhance the reform and development of private enterprises by strengthening financial services guidance, market supervision specifications, and departmental communication and cooperation. Quality and efficiency. "With a series of supporting private enterprise bond financing policies, the financing environment of private enterprises is gradually restoration, and it is expected to improve in the future." Wu Lina, Assistant to Fed's General Manager and General Manager of Bond Business Division, told the Securities Daily reporter that private enterprises Bond financing difficulties are formed by various complex factors for a long time. It requires government, financial institutions, enterprises and other multi -part -time force to jointly promote the solution.

Recommended reading

@, The "three consecutive declines" of oil prices are approaching, full box of 92 gasoline saving 12 yuan

Buddha -fire energy 4 consecutive boards, the real estate industry has the top list of the industry, institutions: increased performance or become an important driving force for the market

Picture | Production of Cui Jianqi of Securities Daily | Zhang Xin

- END -

How to deal with 6 consecutive rounds of heavy rainfall?After hitting the first line of flood prevention and disaster relief in Guangxi | After the flood disaster, there may be intestinal diseases, skin diseases, and prevent control!

Since June 2022, there have been 6 consecutive rounds of heavy rainfall and strong...

Lifan Metropolitan Meteorological Observatory to remove lightning yellow warning [Class III/heavier]

The Meteorological Observatory of Liyuan County, June 08, 2022, 20:25 on the thunderbolt warning signal at 20:25.