In the post -epidemic era, I found a new direction of wealth for a country

Author:Uncle blanket money Time:2022.07.27

In the post -epidemic era, what are you paying most attention to?

Undoubtedly it is to restore the economy and make money as soon as possible.

In the past two or three years, everyone has not been easy to live, and the three years of the epidemic have made us realize that only by the economic development and wallets, we have the confidence to talk to our family and friends to talk to life.

The recent chats with friends around me are inseparable from the important topic of "making money". What everyone cares about is what the country will have new measures in terms of economic aspects.

After all, the first priority to engage in money is to take the express train to economic development, so you must always pay attention to policy trends and follow the trend.

Many friends are also asking me, what is the general trend in the next five years? After studying carefully, I found that the country is in a new direction.

Yes, did you find it? Since last year, the country has begun to support the development of "specialized new" enterprises. Innovation and upgrading of small and medium -sized enterprises.

Picture source: Foresight Industry Research Institute

What is a "specialized new" enterprise?

It refers to those small and medium -sized enterprises with professionalism, refinement, characteristic, and novelty advantages. Although these companies are not large, they all have their own "unique skills" and have a certain right to speak in the industrial chain.

And these "specialized new" enterprises have established a competitive advantage in their respective segments, so they can effectively connect the "breakpoints" of the industrial chain and dredge the "blocking point" to help my country's industrial development core technology. To the extent solved the problem of "stuck neck".

At the same time, these companies can also absorb a large number of employment population to help the country grow steadily and protect people's livelihood.

In order to develop the "specialized new", in addition to industrial policies, the policy level has also increased support in the financial sector.

For example, financial institutions have increased their funding support for SMEs for "specialized in specialty". One of the goals established by the Beijing Stock Exchange is to further support the high -quality development of SMEs for SMEs.

Picture source: 21st century economic report

Another important financial support is the heavy incident of the financial circle in the past few days.

The subject target corresponding to these two derivatives is the CSI 1000 index.

What is the CSI 1000 index? It consists of all A -shares after excluding the CSI 800 Index's ingredients, with a small scale and 1,000 liquidity of 1,000 stocks, which comprehensively reflects the stock price performance of a group of small market value companies in the Chinese A -share market.

I carefully studied the CSI 1000 index and found a particularly interesting phenomenon.

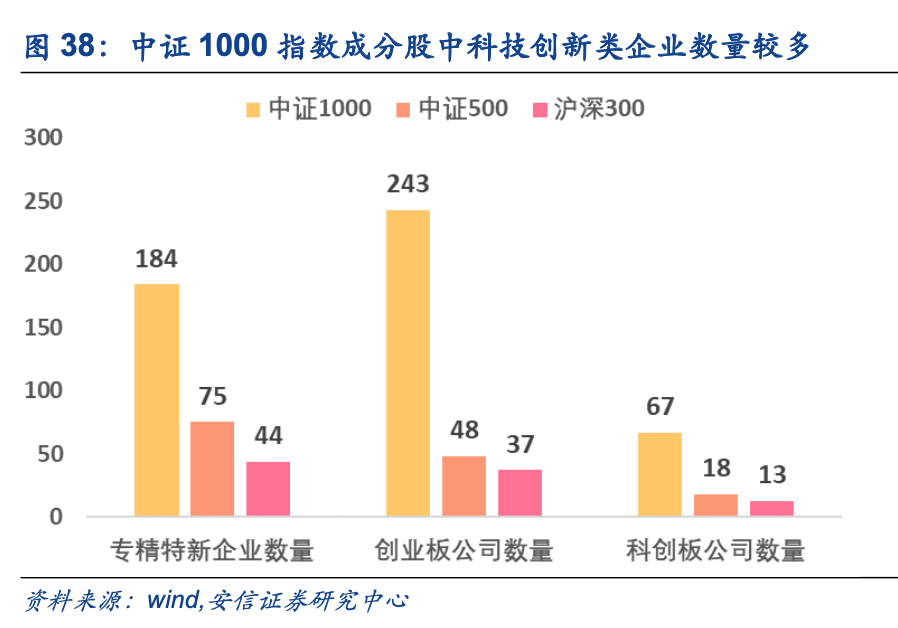

That is, it contains 184 special special stocks, 67 science and technology board stocks, and 243 GEM stocks. In contrast A lot less, it can be said that the CSI 1000 index is very prominent in the attributes of specialized and technological innovation.

Picture source: Wind, Anxin Securities Research Center

The above content sounds a bit high, and the focus is that the nature of the index of China C Securities 1000 is highly heavy with the direction of the national development of "specialized new", which closely follows the trend of the future.

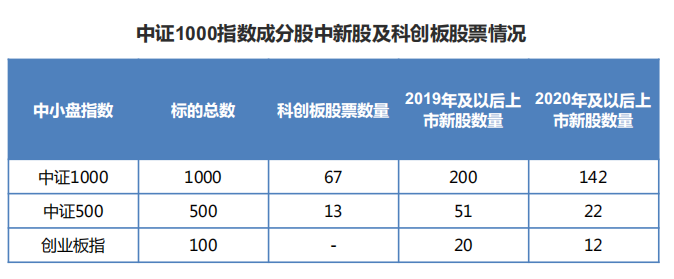

At the same time, the number of new shares listed in the CSI 1000 index after 2019 reached 200, which is 4 times that of the CSI 500 index, 10 times that of the GEM, and the characteristics of "younger" are very obvious.

Picture source: wind information, as of June 22, 2022

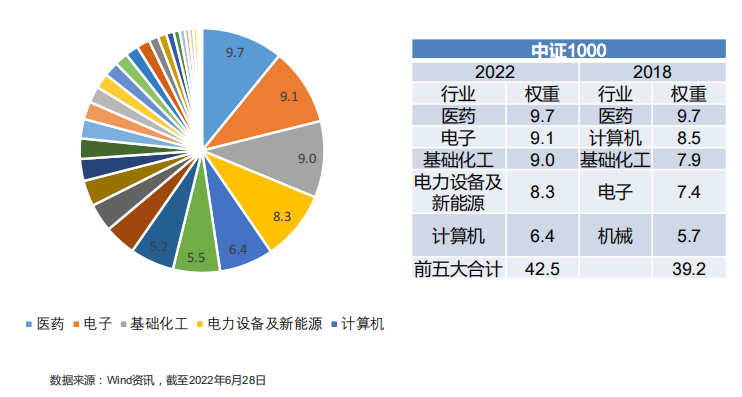

From the perspective of industry distribution, the CSI 1000 index focuses on high -tech industries such as new energy, medicine, and TMT. Among them, new energy, TMT and other sectors performed well in the rebound in the first half of the year. It has also grown particularly fast, which also gives the CSI 1000 index "high growth".

Picture source: wind information

Therefore, in summary, it is in line with the current general development, younger, and high growth. It sounds like the CSI 1000 index, as if the blind date has reached a high -quality "potential stock".

When encountering such an attractive "potential stock", don't let this opportunity easily.

As I continued to dig deeper, I found that the CSI 1000 index itself has a good investment value.

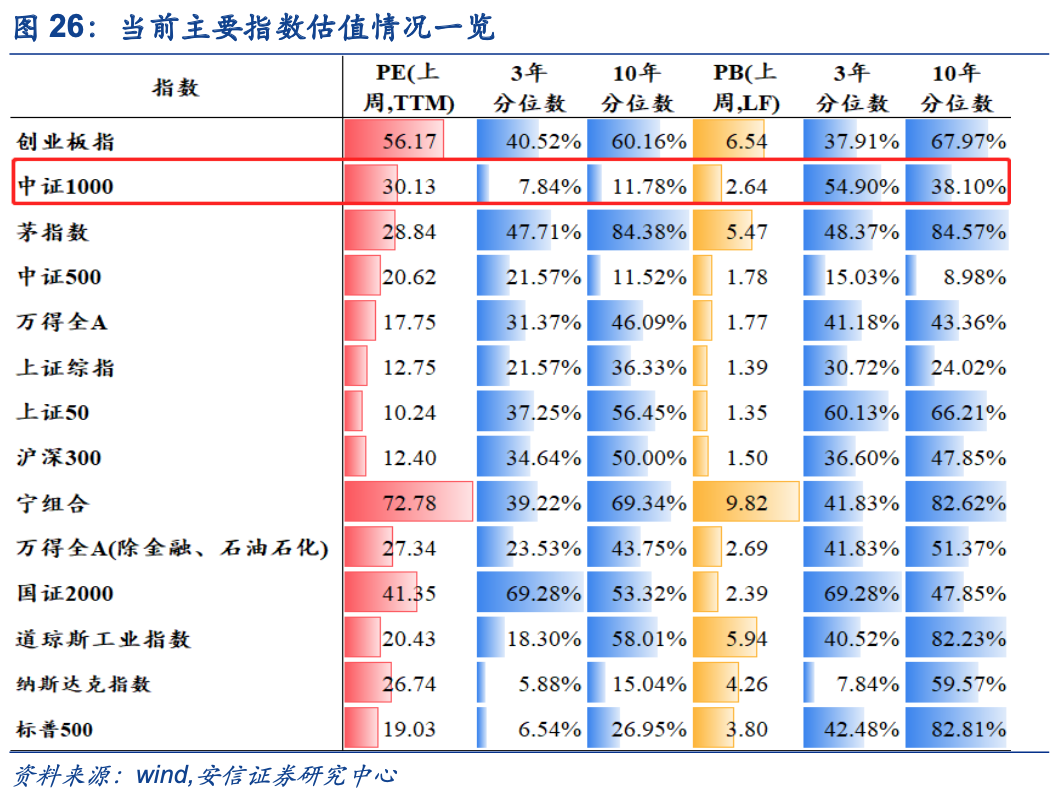

1. The valuation is in a lower position

In the past three years, CSI's P / E ratio has been only 7.84%in the past three years. In the past ten years, the number of price -earnings ratios of 11.78%is also at a low level. Compared with other mainstream broad -foundation indexes, such as CSI 300 and CSI 500, China CSI 500, China CSI 500, China CSI 500, China CSI 500, China CSI 500, China CSI 500, China CSI 500, and China CSI 500. The current valuation of 1000 is in a low range.

Picture source: Wind, Anxin Securities Research Center

History tells us more than once that in the underestimation area, it is very worthwhile to bring us the income.

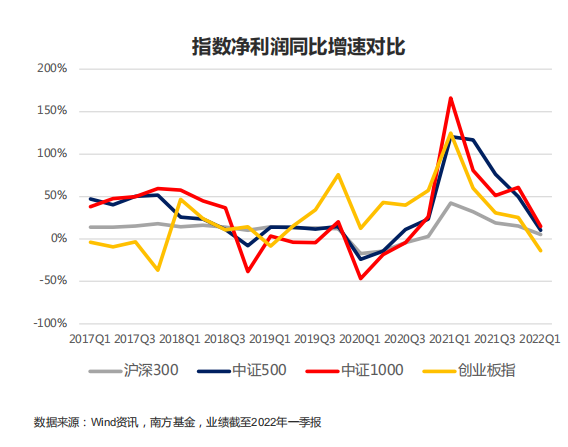

2. Small -cap stock companies are small, and the corresponding growth space is large

The CSI 1,000 "specialized new" content, strong growth attributes, high performance elasticity, and strong explosive power during the stage of performance growth. In the first quarter of 2022, the net profit of 213 ingredients in the index growth rate was greater than 50%.

Picture source: wind information

Judging from the income in recent years, the largest heavy weight stock Jiangte Electric has returned about 2.5 times in the past year. In the past three years, 6 stock returns have exceeded 5 times. The income exceeds 100%.

Picture source: former Oriental Securities Institute Wind Information

3. Focusing on the "specialty of specialization", a group of high -end manufacturing and technology industries represented by new energy vehicles, photovoltaic, military, and semiconductors have begun to rise in the recent years. The support of this policy indicates that the wave of focusing on the "specialty of specialization", focusing on industrial upgrading is coming, and the favorable measures at the future policy level are also expected to continue to launch.

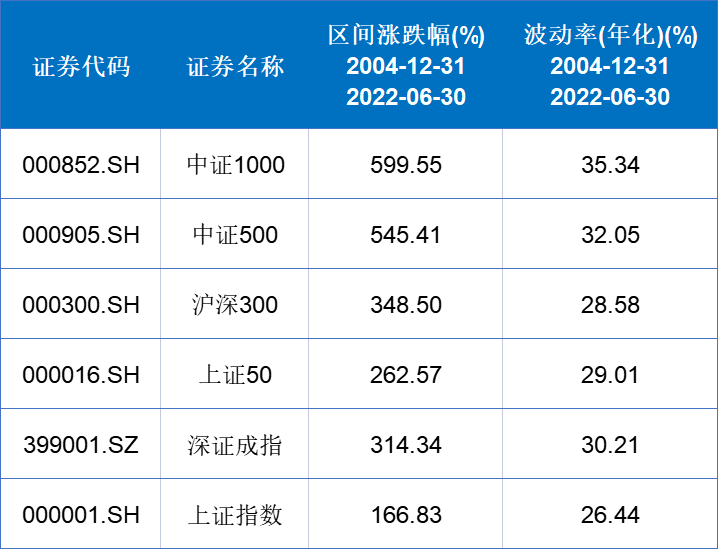

4. Historical trend performance excellent performance

The elasticity of the 1,000th benefits of CSI is relatively large. From 2005 to this year, the yield of 12.1%, the performance in the bull market is even more prominent. According to iFIND data, since the basic day on December 31, 2004, as of June 30, 2022, the CSI 1000 Index has increased by 599.55%, which has greatly won the Shanghai and Shenzhen 300 and Shanghai Stock Exchange Index.

Picture source: iFind; as of June 30, 2022

However, it can also be seen from the figure above that the annualized volatility of the CSI 1,000 is slightly higher than that of other broad -foundation indexes. Before participating, please be sure to do a good job of risk control and fund management.

Having said so much, the core is to tell you that the CSI 1000 index has a good investment value.

This index has the characteristics of high growth, the blessing of policies, and the key valuation is also very cheap. It has the characteristics of Buffett's "long slope, thick snow".

However, the 1,000 -stock index futures and options of the China Stock Exchange have a relatively high funding threshold and higher risks. Therefore, ordinary investors are more suitable to consider buying ETF and connecting funds.

ETF and connecting funds are low, and the risks are smaller and the procedures are more convenient.

At present, CSI 1000ETF is still a relatively new field. The total scale of the index fund is only one -tenth of the CSI 500 Index Fund. The number of CSI 1000ETF, which has been listed on the market, has a small number, and has a certain "scarcity".

I compared these products. If you want to participate, you can pay attention to the Southern CSI 1000ETF (512100).

First of all, this ETF is the longest -established ETF.

Southern CSI 1000ETF (512100) was established on September 29, 2016. It is the first ETF to track the CSI 1000 index in the market. Moreover, it has received more and more attention.

Since the announcement of the 1,000 -stock index futures and options of CSI, as of July 22, the Southern CSI 1000ETF (512100) has received net inflow of funds exceeding 273 million, 294 million, 537 million, 588 million, and 1656 million. Yuan, the net inflow amount of a week is as high as 3.45 billion yuan, leading the entire market ETF.

It is also the first and only one of the first and only one of the CSI 1000ETFs that include the financing margin margin, which can provide investors with a variety of investment solutions.

Secondly, the scale means good liquidity, active trading can reduce the generation of slippery points, and transactions can be carried out quickly.

In addition, Southern CSI 1000ETF (512100) has only 0.01%of the tracking error as of July 22, far lower than similar average, which also shows that fund managers have strong management capabilities.

Picture source: Tiantian Fund Network

I checked it. The current fund manager of this ETF is Ms. Cui Lei. She started to manage 1000ETF in July 2019. She has more than 7 years of quantitative research experience. Currently, 9 index funds are controlled, and the total size exceeds 10 billion. Product management has rich investment and research experience. At the company level, the Southern Fund has laid out the investment in the small and medium -sized disk index very early and has strong strength. Their CSI 500ETF has been ranked first in the "Index Taurus Fund" for 7 consecutive years, ranking first in the domestic index fund.

Therefore, based on the above points, make a simple summary, the CSI 1000 index has very good investment value, and investing in ETF is a good choice. Friends, may wish to pay more attention.

If you have a stock account, you can choose to choose the Southern CSI 1000ETF (512100). If the stock account is not opened, you can consider the connection fund outside the market (Class A 011860; Class C 011861).

*The content of this article does not constitute any investment advice or reference. Market risk, the investment need to be cautious. Readers are requested to make independent decisions based on personal investment goals, financial status and needs.

- END -

The dead bird "spread monkey acne virus"?rumor!

Recently, such a news spread on the Internet- From now on, whether it is in the co...

The four keywords show the city's charm of the Sichuan Meishan City Promotion Conference to enter Lhasa

Aerial MeishanCover reporter Wang Yuexin Li QingPregnant strange show is here, Yu ...